Auto claims ‘excellence’ in Allstate 2016 profitability playbook, but may take a backseat to ad cuts, rate increases

By onBusiness Practices | Insurance | Market Trends | Repair Operations

Allstate sees 2015’s higher collision severity and frequency rates continuing into 2016, and it will continue an auto profitability plan including greater “claims operational excellence” — which is probably code for trying to reduce what it pays shops and doctors.

However, while Allstate described this crackdown as one of its four main auto profitability tactics in 2015 and 2016 on a quarterly investors’ call Thursday, executives seemed to indicate that the other three — tightening standards for new policies, raising rates, and cutting ad spending — would carry greater weight for management.

That’s likely because they’re more controllable, ad cuts most of all. Allstate investor relations Vice President Pat Macellero described slashing non-claim expenses as something which could be done immediately during a tough quarter while the company awaited the returns or savings from the other three actions.

Still, with frequency and severity not expected to diminish as the economy and low gas prices induce Americans to drive more miles on newer, more advanced vehicles, Allstate will certainly be keeping an eye on claims.

“Maintaining claims operational excellence and precision also continue to be priorities given cost trends we and others in the industry are experiencing,” Macellero said.

And should profitability improve, Allstate wants to begin courting new customers, which could mean more ad spending and looser underwriting but not necessarily lower rates or looser claims handling.

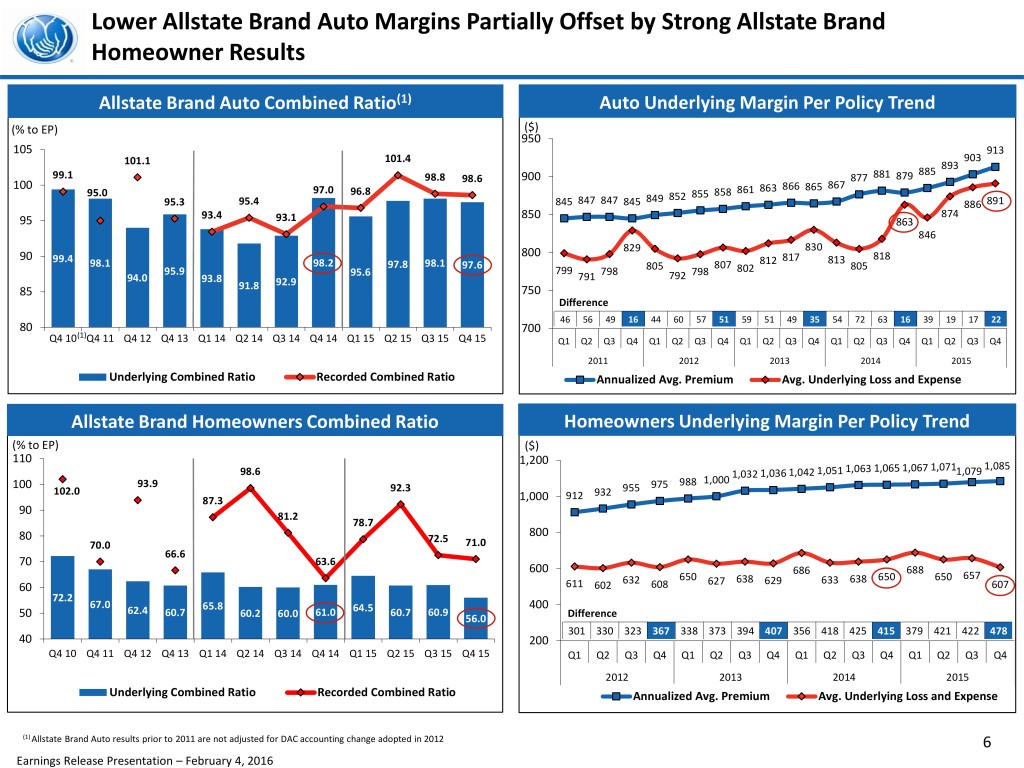

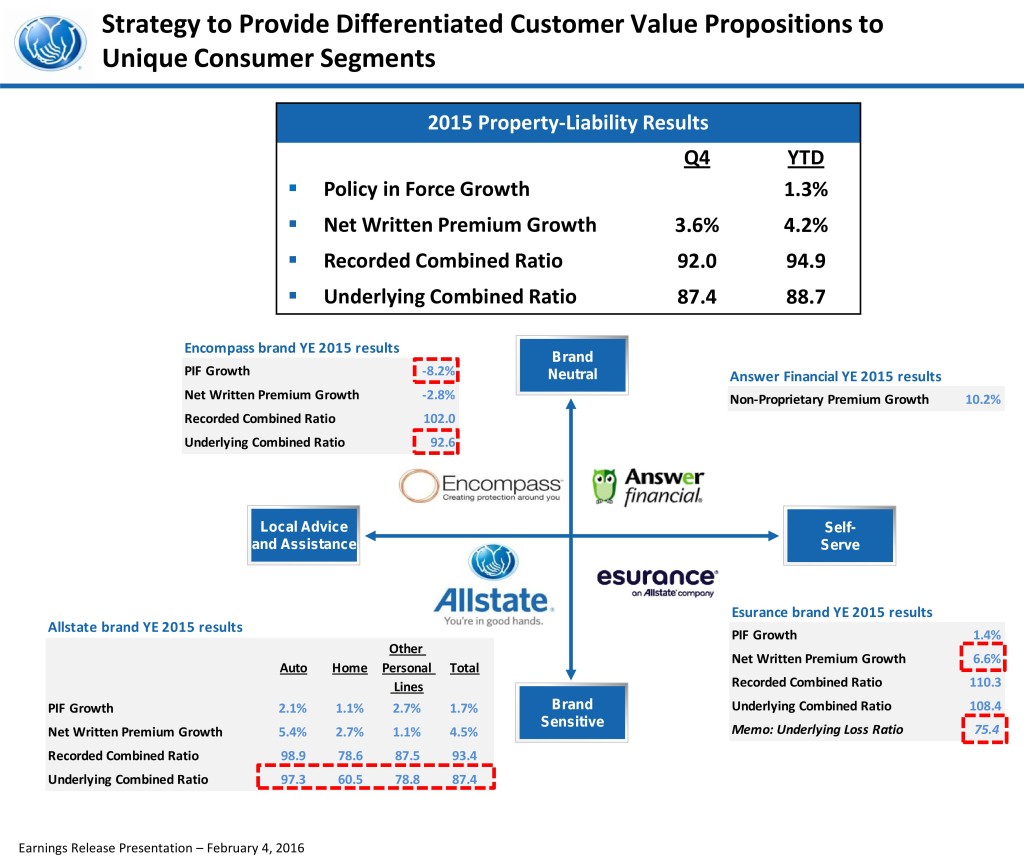

“The sooner we see a lower combined ratio, the sooner we will increase new business,” CEO Tom Wilson said, referring to a measure of insurer profitability. The closer a combined ratio is to 100, the less profitable the insurer. Exceed 100, and you’re in the red. The Allstate brand’s auto combined ratio in 2015 was 98.9; brandwide, it was 93.4.

That doesn’t necessarily mean every repairer across the country will see a crackdown. Wilson touted Allstate’s ability to be flexible and drop some or all of these profitability plans at any time, and Macellero stressed that use of those four strategies would depend on local conditions.

“We continue to evaluate and run our business on a local, market by market basis and continue to adjust our actions going forward,” he said. CEO Tom Wilson told an analyst rate increases in certain states would be his first step should profitability fall from higher craash frequencies and severities.

What else should repairers take away from the call?

Frequency and severity: Frequency and severity trends will be good for shop business, even if it makes Allstate (and other insurers) more of a stickler on claims. And for those of you who want to predict frequency at home, Allstate brand President Matt Winter had an interesting insight.

Though gas prices are frequently cited as fueling miles driven — one of the main variables affecting frequency — don’t count out unemployment rates, Winter said.

If you have to go to work, you’re going to go, even if gas is high, Winter said. Discretionary trips are what are affected. Plus, customers cease paying attention to the nuances of gas prices after a certain cost, he said.

“There is a point though, where it’s just plain cheap,” he said, and Allstate felt gas had reached that point.

Rates: The fact that Allstate has and will put so great an emphasis on rate increases helps repairers by reducing the need to control the somewhat uncontrollable repair bills.

It also provides great fodder for trying to justify your own higher rates to an insurer or small-claims court, not to mention supports the argument that insurers aren’t passing on savings from non-OEM parts to customers.

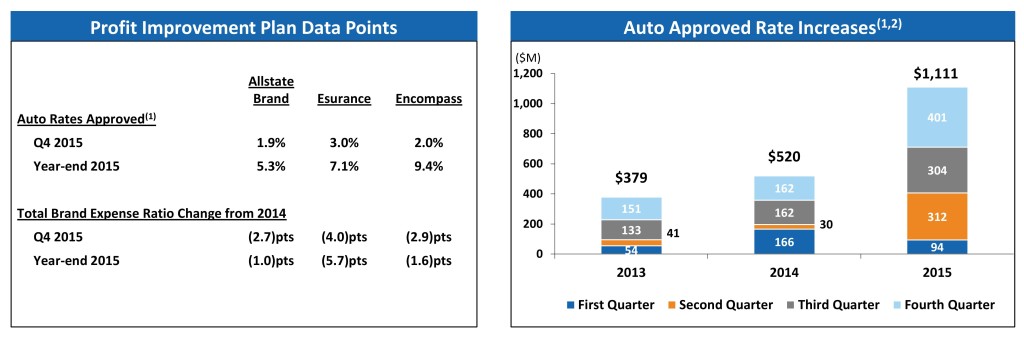

For the record, Allstate was granted $1.11 billion in rate increases from state regulators in 2015, though it only saw about 30 percent of that revenue in 2015. (Assuming policyholders renew with Allstate, Esurance and Encompass at the higher rates, the rest of the money will come in 2016-17.)

Macellero called it Allstate’s “highest amount of approved auto claims increases in over 10 years.”

The downside: The rates might not drive customers into the arms of another insurer, but they could lead that policyholder to drop some coverage, Macellero said. Still, he said insurance agents — something Allstate stresses — could be helpful in helping customers make smart decisions about coverage level, which hopefully was code for convincing clients not to drop things like collision or catastrophic.

More information:

“Q4 2015 The Allstate Corporation Earnings Conference Call”

Allstate, Feb. 4, 2016

Allstate fourth-quarter 2015 presentation

Allstate, February 2016

Images:

An Allstate insurance company sign is seen outside one of its stores Jan. 17, 2008, in Miami. (Joe Raedle/Getty Images News/Thinkstock file)

Data from Allstate’s fourth-quarter and year-end 2015 presentation to investors is shown. (Provided by Allstate)