IHS: Auto sales to level off but stay high; expect more CUVs to hit shops

By onBusiness Practices | Education | Market Trends | Repair Operations

OEMs and repairers should expect crossover CUVs to continue taking U.S. sales share from cars for the next few years, an IHS Markit expert advised Wednesday.

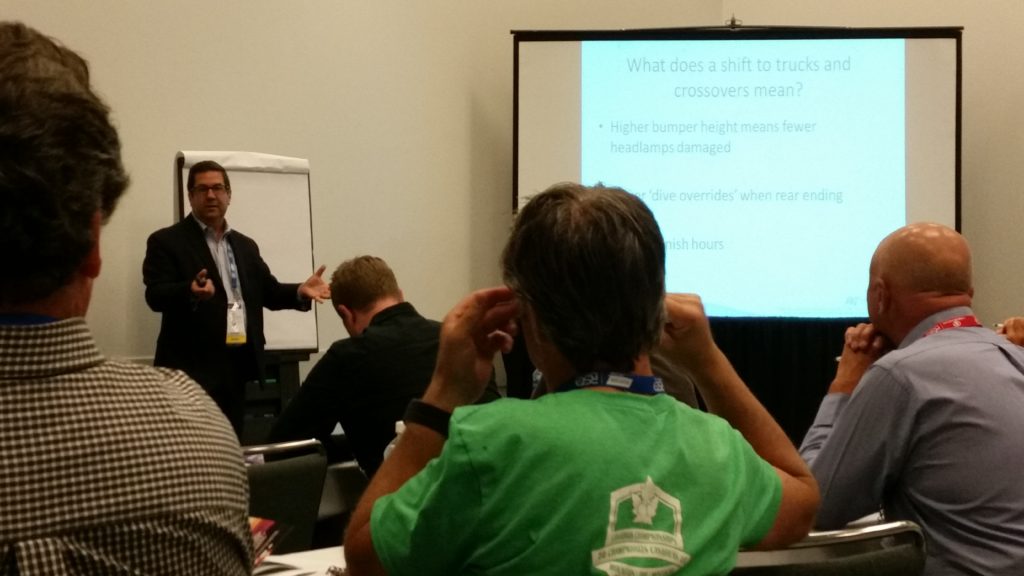

U.S. sales overall should level off but still remain at a high volume above 17 million, IHS global aftermarket practice leader Mark Seng predicted during an Auto Care Association webinar.

Both trends have an impact upon collision repair, dictating not only the severity and types of body work to expect in the near term but also the likelihood of encountering newer cars.

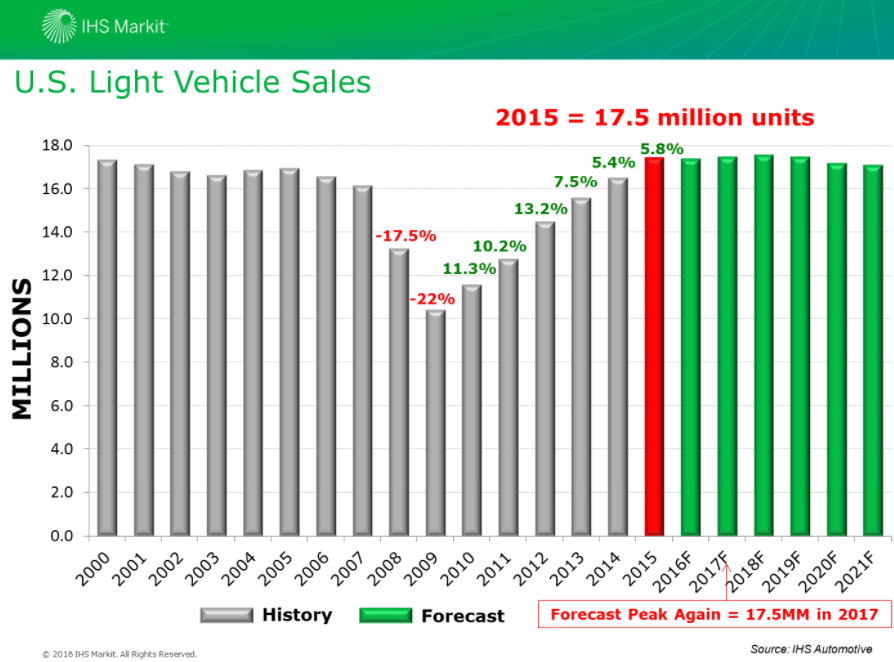

Seng observed that new U.S. vehicle sales seemed to have peaked in 2015 at 17.5 million units, the first time OEMs broke 17 million since 2001. However, sales would level off starting with this year — but “keep in mind, it’s all relative,” he said.

Leveling off in this case meant a decline to 17.4 million vehicles predicted for 2016 — hardly a plunge, particularly as IHS predicts sales to peak again at 17.5 in 2017 and remain in the 17 million-a-year range through around 2021.

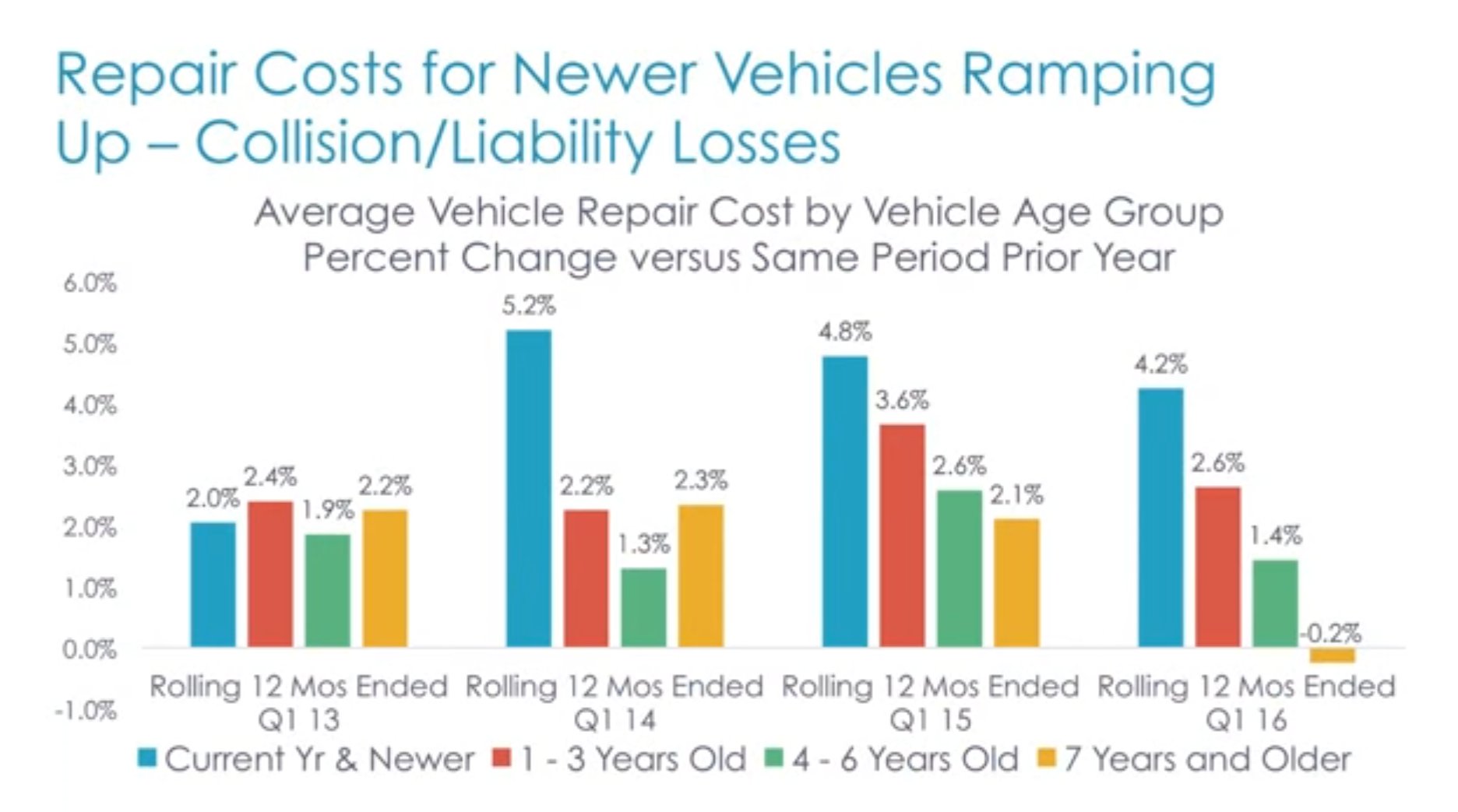

As CCC director and industry analyst Susanna Gotsch observed in the June edition of “CCC Trends,” higher new-car sales mean collision repair and insurer customers will be bringing newer vehicles into repair bays.

As the cars are newer — equipped with more advanced technology and more likely to demand OEM parts — repair costs grow.

“Both industries (auto body and auto insurance) are now starting to see more of the younger vehicles within the claims mix,” she said. “This is starting to raise repair costs, which had already started to rise coming out of the recession, following upon two very difficult winters in 2014 and 2015. …

“Total loss claims are also experiencing a shift to a slightly newer vehicle mix after numerous years where the vehicle mix saw growth primarily in the oldest segment.”

Though some decline in total loss values had been seen in the first quarter of 2016, Gotsch said it was unclear if the trend would continue through the rest of the year.

Like IHS, Gotsch also predicted the newer-vehicle sales trend would continue for the next 3-5 years.

High new vehicle sales also ensure a greater supply of recycled parts — which also curtails used parts price inflation, former Mitchell industry relations Vice President Greg Horn pointed out in August.

Sales mix

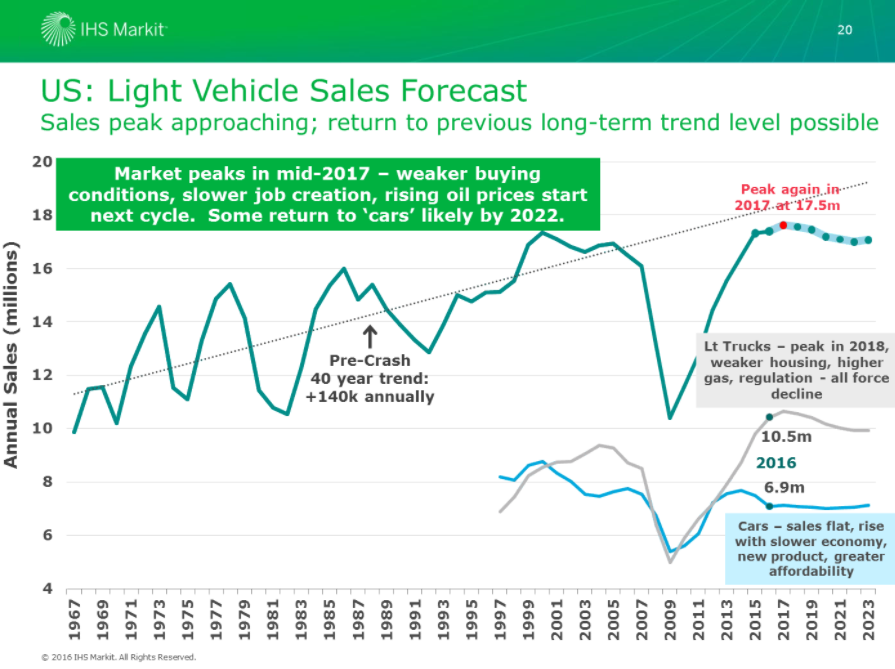

With gas prices low and crossovers providing a happy medium between sedans and true SUVs, IHS has found a “major falloff in car sales” in favor of customers buying trucks and SUVs.

“Cars” are down 8.2 percent, while “light trucks” are up 7.7 percent, according to IHS.

“That’s a 15 percent swing between cars and light trucks,” Seng said, describing it as largely driven by the SUV segment — particularly the smaller CUVs. IHS predicts “cars” would see greater interest by 2022 as gas prices rose, and “light trucks” would peak in 2018 and flatten out.

“Again, flattening out is pretty relative,” Seng said.

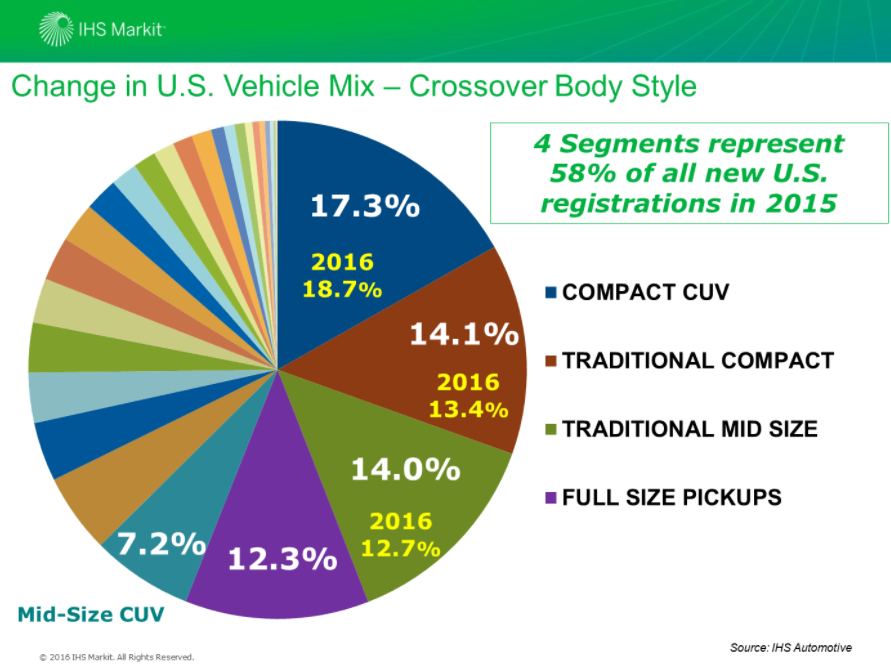

IHS tracks around 30 vehicle segments, but the compact CUV, compact car, midsize car, and pickup segments represented 58 percent of all 2015 new U.S. registrations. 2016 forecasts show similar dominance — but with a different mix within the four segments.

“We’ve seen a huge shift” to compact crossover SUVs, Seng said.

Trucks tend to sit at around 12-12.5 percent of the vehicle fleet, and would continue to do so. But between 2015 and 2016, compact CUVs are expected to grow from 17.3 percent of the market to 18.7 percent of the market — at the expense of traditional compact and midsize cars.

Horn in August noted the U.S. fondness for trucks, SUVs and CUVs over cars and offered some perspective into how this affects repairs. The larger the vehicle, the more lightweight it needs to be. Trucks, he predicted then, would be the first segment to make major use of aluminum.

The same would seem to follow for SUVs, even CUVs — shifting to lighter body panels and/or using more higher-strength steel or aluminum in the body-in-white to save weight and preserve crashworthiness.

A shift to trucks and crossovers produces higher bumper heights — leading to fewer broken headlamps — and fewer “dive overrides” in a rear-end crash, according to Horn’s presentation at NACE.

However, refinish hours grow, according to Horn — the vehicles are just bigger, after all. More lightweight parts also tend to cost more and require greater replacement; they can’t always be repaired like milder steels.

Gotsch said more light trucks and non-domestic vehicles (another growing U.S. trend, according to IHS) also “tend to have more expensive vehicle features and safety items,” including OEM-dominated advanced driver assistance system components. That raises severity as well.

More information:

“Five Trends in Five Minutes: Trends Affecting the Aftermarket Environment”

IHS Markit via Auto Care Association, Nov. 9, 2016

“Industry Trends with Susanna Gotsch – June 2016”

CCC, June 2, 2016

Images:

U.S. sales overall should level off but still remain at a high volume above 17 million, IHS global aftermarket practice leader Mark Seng predicted during an Auto Care Association webinar. (Provided by IHS Markit via Auto Care Association)

OEMs and repairers should expect crossover CUVs to continue taking U.S. sales share from cars for the next few years, an IHS Markit expert advised Wednesday. (Provided by IHS Markit via Auto Care Association)

As CCC director and industry analyst Susanna Gotsch observed in the June edition of “CCC Trends,” higher new-car sales mean collision repair and insurer customers will be bringing newer — and more expensive to fix — vehicles into repair bays. (Screenshot of CCC video on YouTube)

OEMs and repairers should expect crossover CUVs to continue taking U.S. sales share from cars for the next few years, an IHS Markit expert advised Wednesday. (Provided by IHS Markit via Auto Care Association)

Former Mitchell industry relations Vice President Greg Horn in August noted the U.S. fondness for trucks, SUVs and CUVs over cars and offered some perspective into how this affects repairs. (John Huetter/Repairer Driven News)