New types of claims management ‘insurtech’ could disrupt auto body industry

By onBusiness Practices | Insurance | Market Trends | Repair Operations | Technology

Developments in “insurtech” could radically change how collision repairers interact with insurers and customers in the next few years — and the nature of that disruption will depend how automated and “touchless” a claims managment method the carrier chooses.

We encountered at least three accident management models at TU-Automotive’s Connected Car Insurance USA 2017 last week. It’s possible your customers will encounter any of these (or potentially a blend of them) depending on their carrier’s strategy and budget. At least one scenario is also an option for OEMs to influence the collision repair shop selection process, creating another potential external market condition to which shops must adapt.

One framework involved detecting a collision through telematics and getting the claims process started immediately from the moment of loss. One involved photo-estimating artificial intelligence. Another was simply a means of reporting a claim through video chat — sort of a combination of a call center and photo estimating.

The appeal to an insurer varies depending on the product, and a benefit suggested by one insurtech provider might extend to a competing product.

Carrier benefits mentioned included reducing the lag until a policyholder actually reports the collision — shrinking it from days to seconds — and appearing heroic or high-tech to customers.

With a connected car product that detects an impact and immediately alerts an insurer to a loss, the carrier has a chance to reach out to a customer “when he’s most vulnerable,” said CCC OEM Group general manager and Senior Vice President Andreas Hecht, whose company already sells a telematics service capable of facilitating this.

“In those first crucial moments, you can help,” Hecht said.

The ability to steer to OEM and DRP shops (and insurer-affiliated tow trucks) and to kick total-loss vehicles immediately to the salvage yard also were mentioned Wednesday and Thursday.

Verisk claims Internet of Things and telematics Assistant Vice President Dawn Mortimer said her company had an artificial intelligence engine trained to detect total losses with 91 percent accuracy.

“That’s happening already” in Europe, she said.

Other applications included cutting fraud and leakage, giving the shop a jump on parts ordering and diagnostics, cutting the cost of physical appraisals, and replacing subjective analyses with vehicle and on-scene crash data and artificial intelligence predictive models. (The latter carries concerns about the quality and neutrality of the model, but we’ll address that in other coverage.)

Here’s a look at the three models we saw. Collision repairers need to consider the ramifications of these systems and prepare accordingly, for this technology is coming fast. In fact, all of these products appear to be in use today or market-ready.

Accident data

Attendees CCC, Verisk, Metromile, Octo and Redtail Telematics all have a model where an artificial intelligence studies data gleaned from a smartphone, OBD-II port “dongle,” another gadget or the vehicle’s own electronics to detect a collision by noticing variables like the change in vehicle velocity (“delta-V”) and direction.

Generally, the closer one gets to the actual car, the better the data, CCC and Verisk both told us. (But phones are improving, and some OEMs yield better data quality than others, experts told us.) LexisNexis, which is selling a telematics data exchange and working on a pilot driving behavior program with Mitsubishi, humorously observed during the conference that phone-based telematics can erroneously read a cell signal drop as a sudden acceleration.

The car, dongle, device or phone registers a collision and the relevant information from that crash. Depending on the program, this information might immediately be shared with an insurer, OEM or emergency services. Mortimer, whose company partners with General Motors and Ford to offer such a capability, described a system activated by collisions over 5 mph.

OnStar and BMW’s telematics offerings will call the owner and see if he or she needs medical assistance, according to Strategy Analytics automotive connected mobility director Roger Lanctot and Mortimer. Ford cuts right to the chase and calls emergency responders, Lanctot indicated.

Hecht said CCC already was deciphering crash pulses (and scoring driving behavior) today for insurer clients, and it was in the proof of concept and discussion phase with OEMs on the idea of the cars themselves transmitting crash data to CCC for such electronic first notice of loss uses by other CCC clients.

Luke Harris, director of claims for Metromile, said that while the solely usage-based insurer was “not currently” dispatching police or an ambulance, but it can validate that a loss occurred.

“I’d say down the road” these capabilities could develop, he said.

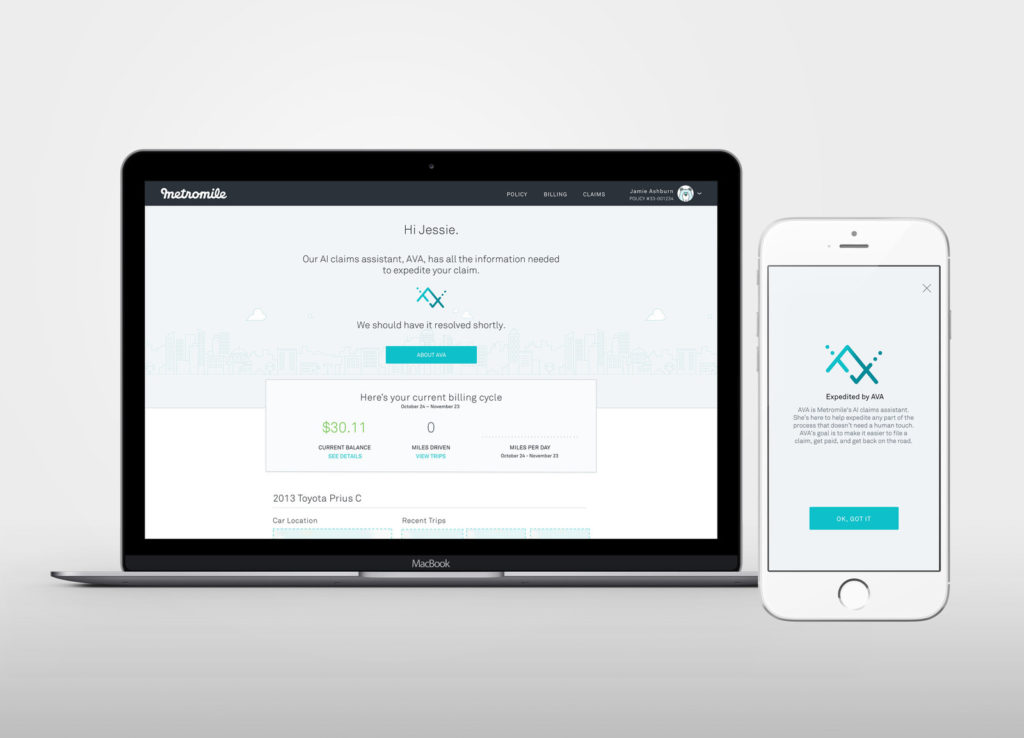

Metromile in June announced AVA, an “AI claims assistant” which helped get claims paid faster. “AVA can also use opt-in sensor data from the Metromile Pulse device to reconstruct the accident scene, expediting the approval process,” the company wrote. “For certain claim types, this enables the claim to be instantly approved.”

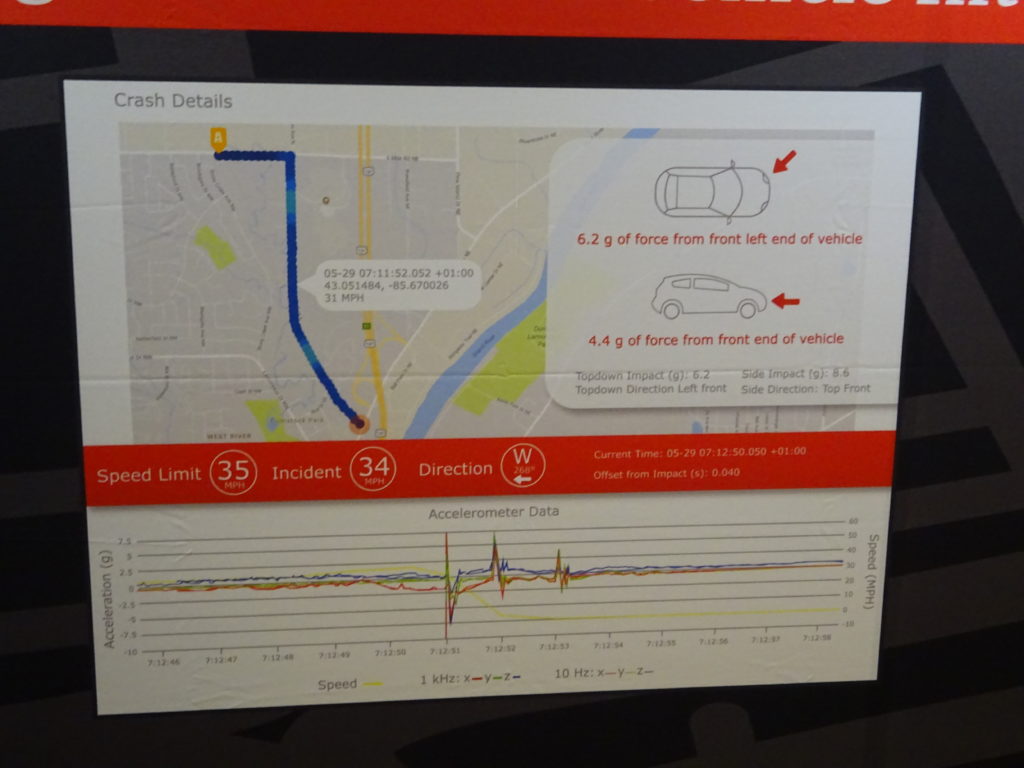

RedTail Telematics in its booth and on its website described a system which not only alerts an insurer that there’s been a collision but also reconstructs the accident.

“The INR platform enables detailed observation of incidents by sampling data at an extremely high frequency leading up to and during the event,” Redtail wrote. “Its data outstrips what can be provided by GPS alone and includes forensic detail relating to the impact, the accelerations and forces involved, together with evidence of any harsh braking immediately before and during the incident.

“This intelligence replaces potentially unreliable human recollection of events with precise facts, which in turn enables timely and accurate assessments of liability and claim costs.”

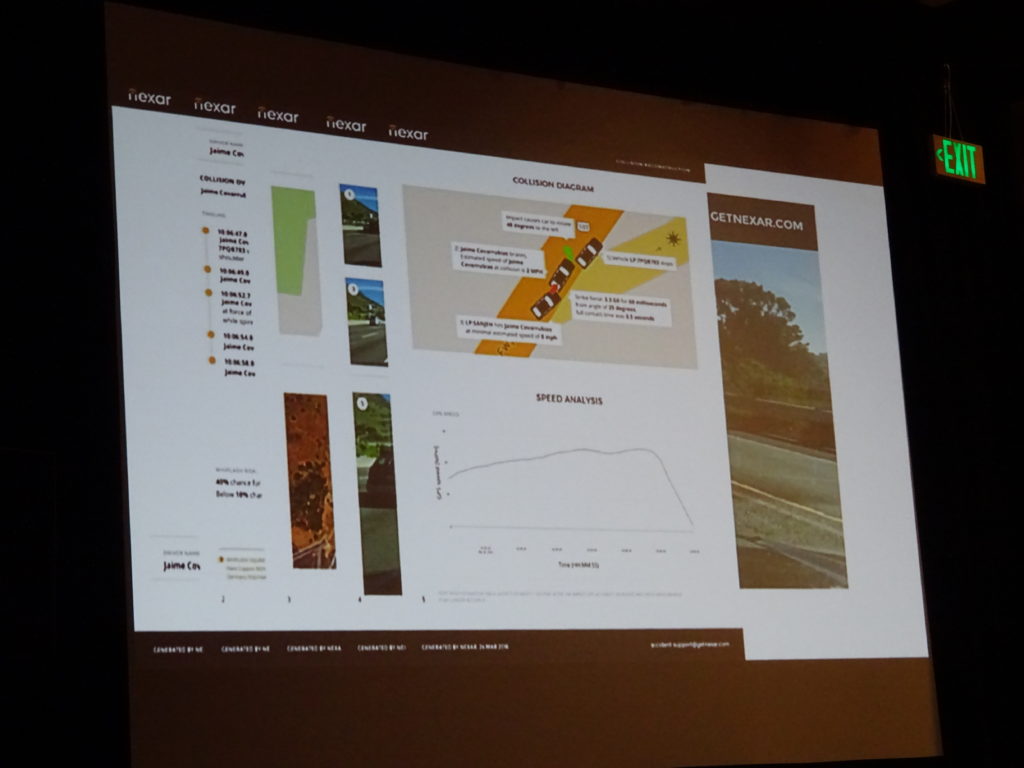

Nexar, one of the startups competing in a semi-formal audience-judged competition during the Connected Car Insurance event, offers an insurer similar crash data and analysis as its competitors but pairs it with photos from the scene.

The company’s fleet drivers — who can receive an attractive commercial insurance discount for allowing Nexar to score their driving and study their collisions — mount a smartphone with the Nexar app to their windshield. In addition to spitting out traditional driver-rating and collision metrics, the app transmits images of the collision event back to the insurer.

Video estimating

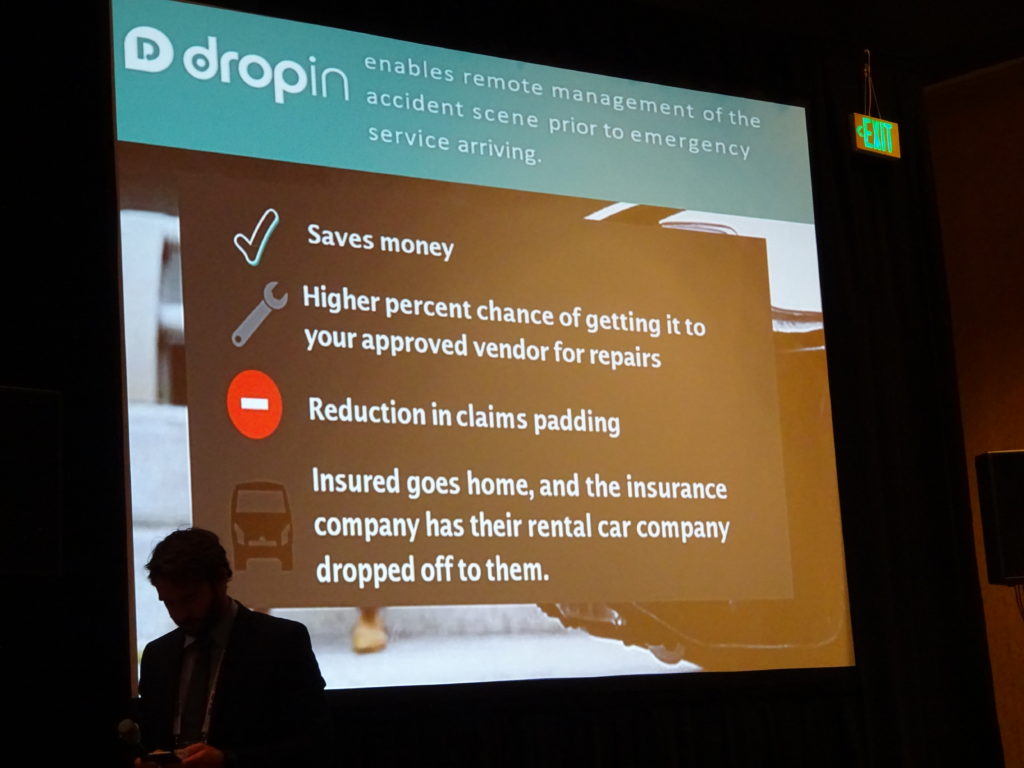

DropIn should probably feel the most familiar to customers, shops and insurers. The startup offers insurers a first notice of loss piece of software — which mostly involves live-streaming video chat — which can be integrated into a carrier’s app.

This “gives the power to the carrier,” DropIn CEO Louis Ziskin said during the startup competition. The customer can be directed to produce the images an adjuster would need, he said.

“It compresses admin costs,” Ziskin said.

The insurer can start taking cost-cutting steps like picking the towing company, instead of emergency services calling a tow, Ziskin said.

“The car’s on your hook,” he said, noting there’s a better chance of getting it to a DRP shop.

Ziskin said customers could be directed to use the software for claims as a condition of a premium discount up-front, and the ability to knock out the entire claim immediately might be attractive to a policyholder.

Photo estimating AI

Tractable is a little different than the others in that it doesn’t have a crash reporting feature. Rather, the company uses artificial intelligence to identify parts of a car and the damage to those parts based on photos of the vehicle. It trained the computer using what CEO Alexandre Dalyac characterized as a “gold mine” of hundreds of millions of insurance industry estimates and accompanying photos.

“We are making sense of the vehicle,” Dalyac said during the startup competition (Tractable beat out Nexar by a hair). The AI can estimate if parts are likely to be repaired or replaced and estimate the overall cost, he said.

He said that insurance experts typically see an agreement rate of 75-80 percent, but Tractable’s AI is usually 2-3 percentage points higher. He said the AI is only uncertain in about 8 percent of cases — and that number is dropping, he said.

Overall, the company can generate $40 in value per claim for a potential billion dollars in value to insurers in the U.S., he said. It has deals with Mitchell and half of the top 10 insurers in the U.S., and No. 3 United Kingdom insurer Ageas announced in May it’d use the company on every claim.

Dalyac predicted that next year, the industry would see entire estimates generated by artificial intelligence, and the innovation departments of its partner carriers had a goal of “touchless claims.”

For information on the 2018 Connected Car Insurance USA, email Andy Pym at andy@tu-auto.com.

More information:

Connected Car Insurance USA website

Images:

Tractable uses artificial intelligence to identify parts of a car and the damage to those parts based on photos of the vehicle. It trained the computer using what CEO Alexandre Dalyac characterized Sept. 6, 2017, at Connected Car Insurance USA as a “gold mine” of hundreds of millions of insurance industry estimates and accompanying photos. (John Huetter/Repairer Driven News)

CCC OEM Group general manager and Senior Vice President Andreas Hecht speaks during Connected Car Insurance USA 2017. (John Huetter/Repairer Driven News)

Metromile in 2017 announced its claims artificial intelligence AVA. (Metromile/PRNewsfoto)

RedTail Telematics in its booth at Connected Car USA 2017 described a system which not only alerts an insurer that there’s been a collision but also reconstructs the accident. (John Huetter/Repairer Driven News)

Nexar, one of the startups competing in a semi-formal audience-judged competition during Connected Car Insurance USA 2017, offers an insurer similar immediate telematics crash data and analysis as its competitors but pairs it with photos from the scene. (John Huetter/Repairer Driven News)

The startup DropIn offers insurers a first notice of loss piece of software — which mostly involves live-streaming video chat — which can be integrated into a carrier’s app. According to CEO Louis Ziskin and a slide during Connected Car Insurance USA on Sept. 6, 2017, the appeal for an insurer includes a greater chance of getting the vehicle into a direct repair program auto body shop. (John Huetter/Repairer Driven News)