Romans: ‘Scale matters’; leveraging advantage can be strategy for all sizes of auto body shop

By onBusiness Practices | Education | Market Trends

Collision repair financial consultant Vincent Romans earlier this month encouraged body shops to find their “scale,” a concept he defined broadly to include a competitive advantage.

Romans, founder of the Romans Group, told the NACE MSO Symposium Aug. 9 that “scale matters.”

He also encouraged shops to find partners and said there were opportunities from everyone from single-shop operations to MSO chains. Those partnerships can produce their own scale, one of his slides stated.

Romans’ presentation encouraged the repairers in the room not to be a “microscopic cog in some one else’s catastrophic plan.” Instead, determine your company’s “scale advantage” and “Manage and leverage your individual business scale whatever the size.”

He said that when a repairer reached a “semi-mature” and consolidated industry (it was unclear if he was suggesting the market had done so already), a shop had to look at how it could better differentiate itself or diversify. If it couldn’t do either, the owner might want to consider “exiting the business,” Romans said.

Romans presented a list of companies he said were examples of scale. They included the Big 4 consolidators and CARSTAR, but also the single-location Harry’s Auto Collision Center, which had 90,000 square feet and focuses on high-end vehicles.

“He’s got scale,” Romans said of Harry’s Auto.

A different playbook will work too, Romans said — the large footprint and a high-end clientele was simply how Harry’s Auto found its scale. “There’s lot of opportunity out there,” Romans said.

In the Chicago area, the seven-location Crash Champions does about $30 million in revenue, according to Romans. “They have scale,” he said.

The chain is a successful operation, and it also has diversified into high-risk towing, with about 40 trucks in the competitive marketplace, according to Romans.

“Scale comes in all sizes, all shapes,” he said.

A “scale” edge could be inventory (think Enterprise Rent-A-Car, Romans said), a customer base, revenue or industry segment market share, number of locations or providers, geographic spread, a database (think CCC or Verisk) or supplier base (PartsTrader).

Romans told the NACE MSO Symposium that the multi-location companies doing $20 million a year or more in sales went from 9.1 percent of the $30 billion billion collision industry revenue in 2006 to 26.9 percent of the $36.2 billion market in 2017. He said this was starting to sound like scale.

We found it noteworthy that these operations have nearly doubled in number as well — from 57 in 2006 to 96 by the end of 2017, based on Romans’ estimate. (It was the highest number of $20 million businesses ever for the industry, he said.) That would seem to reinforce the notion that opportunity certainly exists for companies to prosper despite the increasing competition from huge, national MSOs.

According to Romans, while the top four MSOs held 1,813 facilities as of early August, that was a mere 5.6 percent of the locations that his company considered “relevant.” (This appeared to be a reference to the U.S. market.)

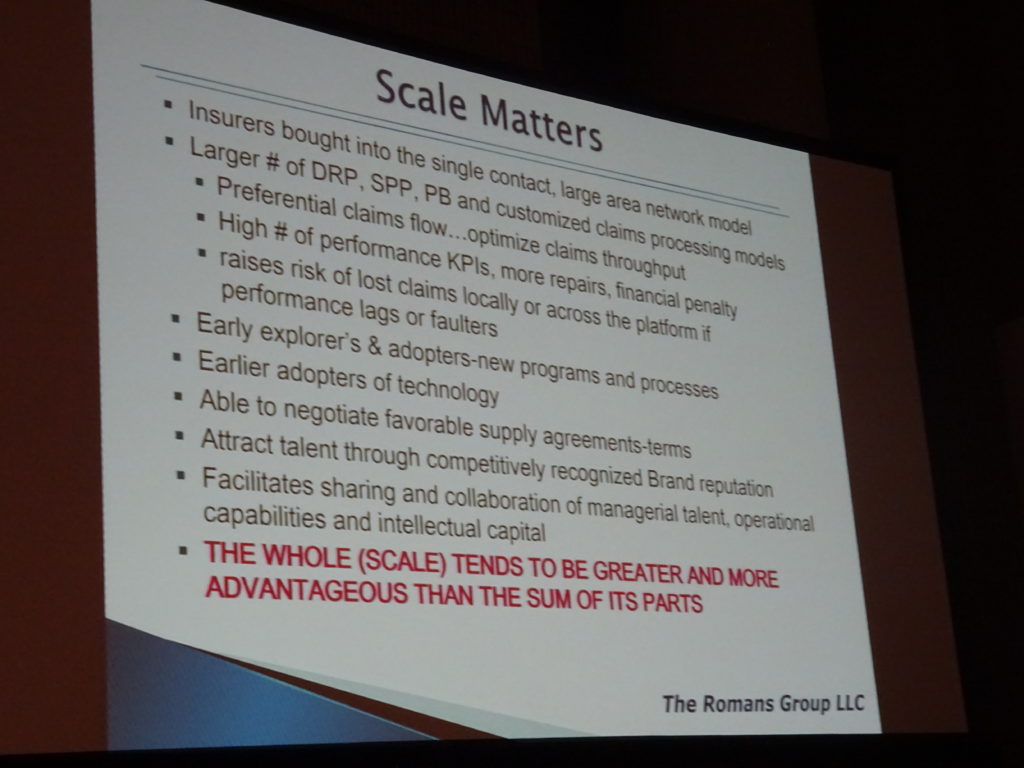

Romans offered a series of reasons why scale matters:

- Insurers like the “single contact, large area network model.”

- Favorable supply terms are available.

- A brand reputation attracts talent

- The shop can share “managerial talent, operational capabilities and intellectual capital.”

- “THE WHOLE (SCALE) TENDS TO BE GREATER AND MORE ADVANTAGEOUS THAN THE SUM OF ITS PARTS.” (Emphasis Romans’.)

Romans also said companies with scale tend to be early adopters of new technology and processes.

Featured image: Collision repair industry financial consultant Vincent Romans of the Romans Group at the Aug. 9, 2018, NACE MSO Symposium encouraged body shops to find their “scale,” a concept he defined broadly to include a competitive advantage. (John Huetter/Repairer Driven News)