ICDP: ADAS could cut crashes 15% by 2030; repairers, insurers, fleets have recalibration ‘duty of care’

By onAssociations | Insurance | International | Market Trends | Repair Operations | Technology

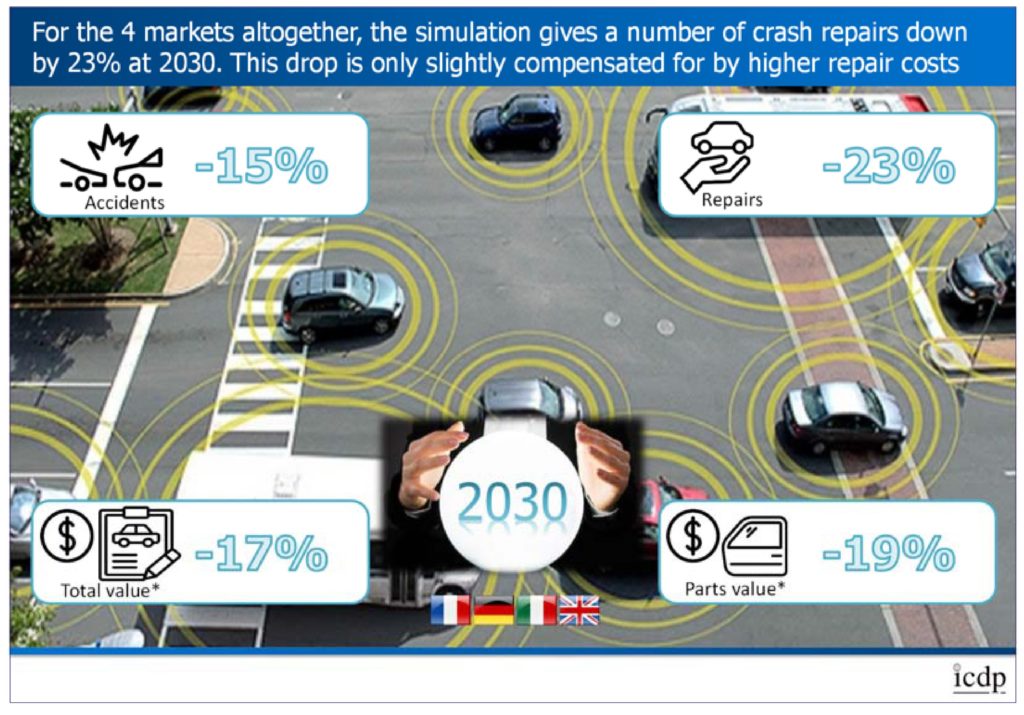

ICDP last month announced a simulation predicted a 15 percent decrease in crashes and a 23 percent decrease in repairs in “the four main European markets” by 2030.

The European collaborative aftermarket distribution researcher’s findings for France, Germany, Italy and the United Kingdom are similar to predictions by American consultants KPMG, for ICDP did predict repair costs would rise for the crashes that did make it into shops.

“Severe accident damage will be reduced, but write-offs will increase due to the higher cost of repairs and parts on more complex vehicles,” ICDP wrote, concluding the net effect would be a 17 percent decrease (€7 billion a year, which works out to $8.18 billion USD) in the “value of the repair market.”

The 23 percent reduction in collision repairs was “only slightly compensated for by higher repair costs,” ICDP wrote.

“For parts producers, including car manufacturers, the loss of profit will be significant – we estimate that across all parts and players, gross margins are around 40%,” ICDP wrote. This will affect car manufacturers the most as they will also be suffering during the same timeframe from the growing share of electrical vehicles which have a much lower service parts requirement. For bodyshops and insurers, the situation will vary widely by market as each national market has different characteristics in terms of the way that insurers influence the market and the profits that can be retained by the Bodyshop.”

“It’s a worse level of reduction than when we looked at the service and maintenance sector 10 years ago and hopefully it acts as a wake up call for the industry,” ICDP managing director Steve Young told the International Bodyshop Industry Symposium last month, according to IBIS/bodyshop magazine. “The collision repair industry is going to be a fascinating space in the coming years.”

IBIS also reported:

Looking at the impact of ADAS, Steve suggested that in principle, ADAS systems should reduce the accident rate, but he pointed out, this will depend on penetration into the vehicle parc as a whole. He highlighted how feedback has been mixed and one OEM interviewee response to the research programme stated: ‘We’ve not seen any change yet in accident rates, though when we looked in detail we found that front end damage was being replaced by rear end.’ Another, respondent, a premium brand bodyshop, suggested it would see a 50% reduction in structural repairs in the next five years.

The four major Western Europe markets obviously are collectively a different customer base, car parc and technology level than the U.S., but they’re not so different that American repairers should ignore the conclusions. As mentioned above, KPMG predicted increased severity, lower frequency, and an overall net decline in collision business by 2030.

It also predicted OEM operating profits could fall 4-9 percent by 2030 and 6-13 percent by 2040 from the reduction in collision parts business, though unlike ICDP, it felt fewer vehicles would be totaled.

“In our projection, crash involvement rates could decline by over 60 percent by 2030 (that’s just 13 years from today) and over 80 percent by 2040,” KPMG wrote in a May 2017 white paper.

“While there may be transitional spikes as new technologies shift from low-take options to high-volume applications, based on the evolving mix of vehicles, we estimate that the average cost of repairs will increase (in real dollars) about 10 percent by 2030 and almost 20 percent by 2040.

“Nevertheless, by combining the crash rate and cost per repair estimate, we could see a roughly 50 percent decline in the overall collision repair market by 2030 and around a 75 percent decline by 2040.”

Honda and CCC research has found average frequency and severity declining with the introduction of ADAS (in CCC’s case, this only applied for front-impact crashes), indicating that the net effect might already be a decrease in collision business.

The ICDP report is also noteworthy in that it imparts responsibility for proper calibration of ADAS to fleet operators and body shops — but also insurers.

An additional concern that emerges from the research is that the quality of repairs may be compromised where these include replacement of parts that incorporate some form of ADAS functionality. These include many of the parts that feature most heavily in accident repair such as bumpers, headlights, windscreens and mirrors. All of these parts on ADAS equipped cars will typically have radars, cameras or other sensor technology that when replaced or removed and refitted needs to be recalibrated in order to ensure the safe working of the car. We are aware that this need for recalibration in the best case results in longer repair times, particularly for independent bodyshops who may not have their own calibration equipment, but in the worst case results in the ADAS function being degraded or disabled due to incorrect or missed calibration. Drivers may be unaware of this, or ignore its significance, with the result that the car is no longer able to assist in avoiding or reducing the severity of accidents. We suggest that insurers, repairers and fleet operators have a duty of care to ensure that recalibration is done correctly in order to avoid potential claims by drivers and third parties in the event of a subsequent accident involving the repaired car. (Emphasis ours.)

In an off-topic but important aside, the ICDP continues by warning of the risk of shops improperly repairing a car’s bones as well as its eyes and brain.

Similar risks and liabilities apply to structural repairs where, due to the increased complexity of body construction and jointing techniques, a repair which does not recognise the different materials and methods required may result in the future crash performance of the car being compromised.

Get even more information by reading the entire June 12 IBIS/bodyshop coverage of Young’s presentation here.

More information:

ICDP, June 27, 2018

“ICDP PREDICTS CHANGING FUTURE”

International Bodyshop Industry Symposium/bodyshop, June 12, 2018

KPMG, May 17, 2017

“Will autonomous vehicles put the brakes on the collision parts business?”

KPMG, May 17, 2017

Images:

Volvo’s City Safety auto-braking technology is indicated in this image. (Provided by Volvo)

ICDP last month announced a simulation predicted a 15 percent decrease in crashes and a 23 percent decrease in repairs in “the four main European markets” by 2030. (Provided by ICDP)