Need techs? See how your workplace stacks up to peers as CREF, I-CAR release 2019 data

By onAnnouncements | Associations | Business Practices | Education | Market Trends

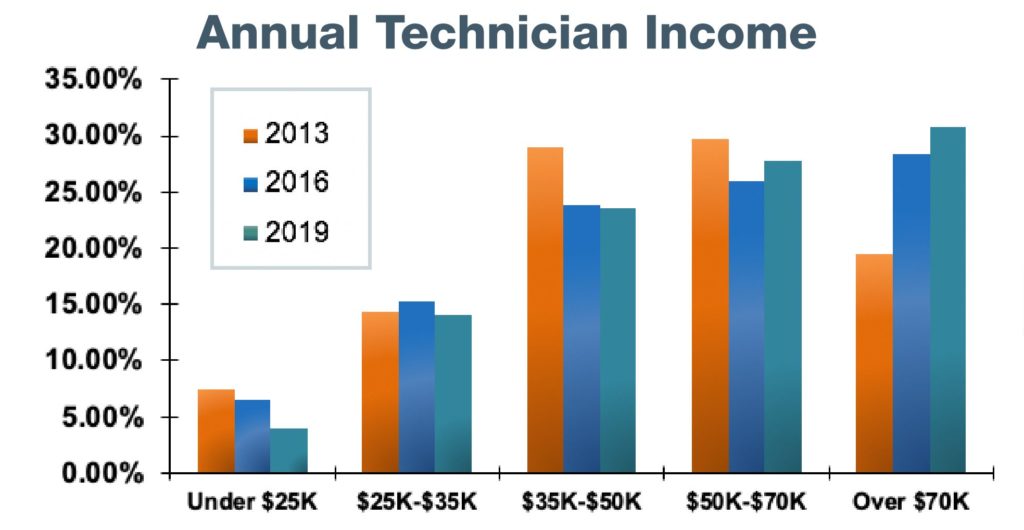

A body shop will need to pay the average production technician $54,842, and nearly one in third of staffers $70,000 or more to compete with the market, the latest Collision Repair Education Foundation and I-CAR joint survey suggests.

CREF and I-CAR conduct the study every three years. The executive summary released Thursday provides a valuable benchmark and resource for shops looking to hire and retain technicians by showing what strategies and compensation your competitors use. (It’s also a good resource for trade schools curious to know how shops view their programs and what skills shops want in graduates.)

The latest online survey was advertised to the industry and drew responses from more than 675 collision repair companies employing more than 4,500 technicians. Given that methodology, it’s possible that the results could be skewed to reflect more engaged collision repairers, who might be playing at a higher level than the true industry average shop. But even if that’s true, your shop shouldn’t dismiss the data as irrelevant — after all, you’ve still got to beat out those kind of repairers to recruit and retain techs.

CREF found the average shop had 13.1 technicians and support, up from 12.7 in 2016 and 11.1 in 2013. More than six techs could be found at 57.5 percent of shops.

The average shop grew to 15,114 square feet, way up from 13,843 square feet in 2016. At the same time, the number of collision businesses actually grew 1.6 percent between 2016 and 2019, based on CollisionWeek data cited by CREF and I-CAR. However, the percentage of small shops declined.

Average years in business also increased from 32.2 in 2016 to 33.9 years in 2019.

Taken together, this seems to suggest the average shop is getting bigger rather than newcomers rushing in with big facilities.

“The percentage of small shops (with annual sales under $300,000) has steadily declined since 1995, while the share of large shops (over $1 million) continues to increase,” CREF and I-CAR wrote. (Inflation only takes $300,000 in 1995 dollars to around $500,000 today, so there does to appear to be a true market shift.)

The average technician age rose to more than 41 years, up from younger than 41 back in 2016. Repairers need on average 0.7 technicians to fill open entry-level slots and 1.2 experienced techs for vacant positions. These stats were better than the 0.9 technicians worth of entry-level vacancies and 1.7 experienced technicians needed in 2016, but it still leaves repairers three warm bodies short.

“The research clearly shows the collision repair industry’s urgent need to build its skilled workforce development efforts,” CREF Chairwoman Jeanne Silver (CARSTAR Mundelein) said in a statement. “The Snapshot Survey of the Collision Industry results provides a detailed view of the challenges facing the collision industry’s workforce and clearly identifies the path, opportunities and solid financial rewards available to people seeking to train for a career in the industry. We urge the industry to help the Foundation deliver these solutions.”

About 7.1 percent of technicians left the collision industry altogether, though some of this sectorwide attrition includes retirees and employees bailing for another automotive business. But 2.8 percent appear to have taken a job completely out of the automotive sector.

But the task of filling your vacancies isn’t insurmountable. 56.4 percent of shops hired at least one entry-level tech within the past year.

On the other hand, they might be obtaining that tech from your shop. While down from 2013’s 61 percent, hiring workers from another body shop was “still the largest source of technician hiring (52%),” according to the summary.

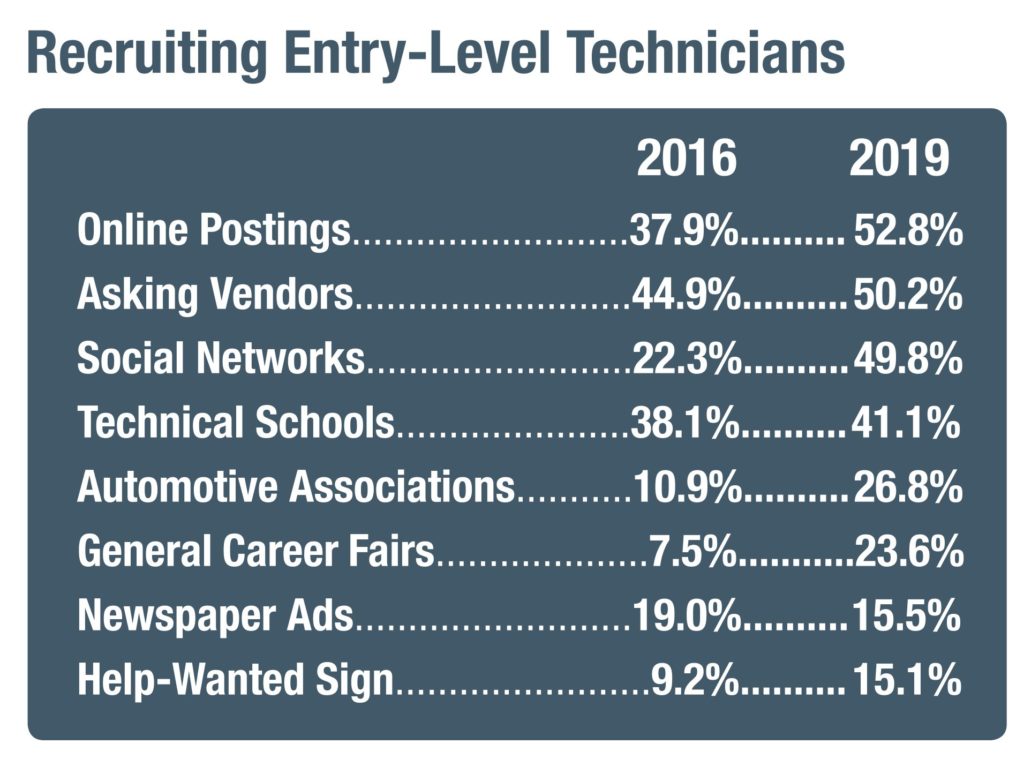

Online job postings were seen as the most effective recruiting technique for entry-level techs.

But don’t forget the personal touch. Career fairs are proving much more effective than in 2016, though that might be somewhat attributable to CREF’s aggressive job fair expansion introducing events where none had existed. (SEMA added one as well in 2017.)

“The most effective recruitment method reported is now online postings, followed closely by social media,” the summary states. “Career fairs showed improved effectiveness as ranked by respondents.”

As noted above, you’re going to have to pay well to keep or hire techs.

“Although there is a wide distribution, annual income tends to increase with shop sales volume. Income figures shown are for production technicians over 20 years old.

“According to survey respondents, average income for production technicians rose from $52,997 in 2013 and $53,857 in 2016 to $54,842 in 2019. This is competitive with similar skilled trades and higher than most.

“Almost 31 percent reported earnings of $70,000 or higher, showing an attractive earning potential as a collision repair technician.”

(On the other hand, the increased pay isn’t keeping pace with inflation. $53,857 in June 2016 dollars would have been $57,237 in June 2019. $52,997 in June 2013 would be $58,135 in 2019. So owners are catching a little bit of a break there.)

“We are pleased to again work with the Collision Repair Education Foundation in conducting this important industry survey,” I-CAR CEO John Van Alstyne said in a statement. “The survey verifies the critical need for well-trained collision repair technicians – both today and in the future – and it also confirms the outstanding professional and financial opportunities that are available in the industry. Today’s rapidly changing vehicle technologies and materials require technicians who have the training and ability to utilize information, knowledge and skills to repair damaged vehicles correctly. There has never been a better time to consider a rewarding career in the collision repair industry.”

What’s interesting here is how techs are making their money. CREF and I-CAR reported that flat-rate compensation fell again.

“Flat rate (commission) compensation plans have again decreased to just over two of five technicians (43%), now almost equal to hourly/salary plans (40%),” CREF and I-CAR wrote in the summary.

Back in 2007, CREF and I-CAR found flat-rate used in 54.3 percent of shops. Only 35.4 percent paid “Hourly Only,” and hourly-with-a-bonus was used 8.5 percent of the time. A team plan made up the other 1.8 percent in 2007.

Pride Collision Centers President Randy Stabler told the International Bodyshop Industry Symposium in February that flat-rate was a mistake. It creates a workforce of individual employees running their “own little business” within your company, he said. The system fosters “very short-term thinking” and doesn’t incentivize employees to protect the company, he said.

If you agree with Stabler’s assessment, it appears that offering a plan other than flat-rate won’t be the deal-breaker with a prospective hire that it might have been more than a decade ago.

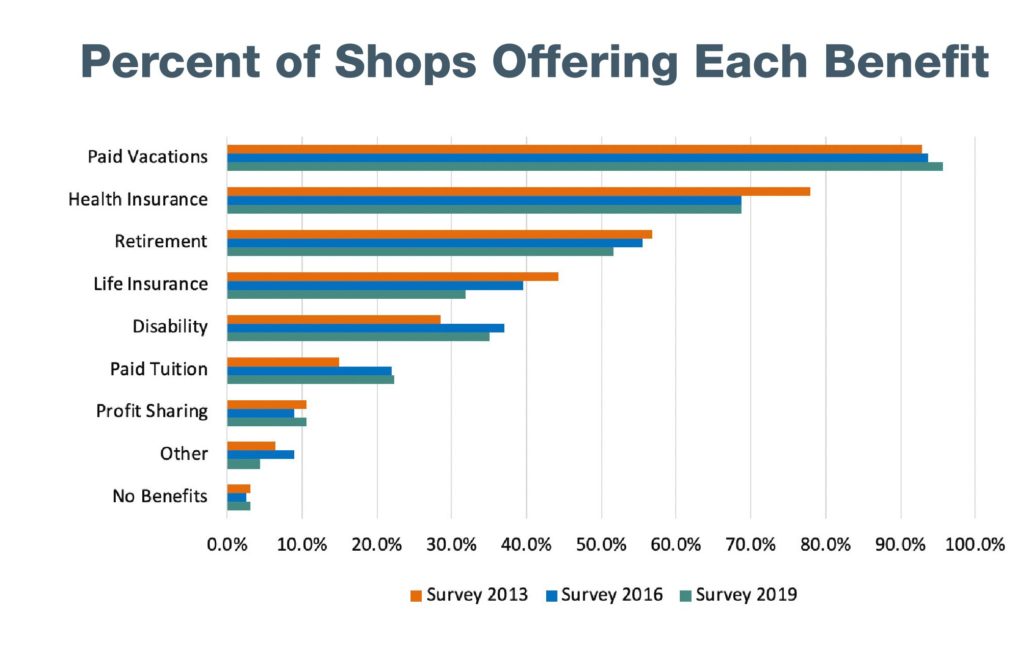

Pay is only part of the recruitment or retention process. If you’re in the less than 3 percent of the industry not offering any benefits — down from 19 percent in 1995 — you’re probably going to have a hard time finding staff.

“Benefit packages offered to today’s collision repair technician workforce show slight increases in Paid Vacations and Tuition Reimbursement. Health Insurance remains steady from 2016, but lower than 2013,” the CREF and I-CAR summary states. “Both Retirement Plans and Life Insurance show declines.”

If competitors aren’t offering them, retirement benefits could be a huge differentiator for a employer. Gerber Collision already has said a benefits initiative including an improved 401(k) program has helped with a persistent tech shortage.

The Boyd Group, which owns Boyd Autobody, Gerber Collision and Assured Automotive, in 2018 put half of its projected $11 million CAD savings from U.S. tax cuts into better benefits for its technicians. It increased vacation and holiday pay for commissioned repairers, and it doubled its employer match and shortened vesting on repairers’ 401(k)s.

“We’re not out of the woods” on the tech shortage, but the Boyd Group made enough progress to post the kind of sales results it did in the fourth quarter, CEO Brock Bulbuck told analysts earlier this year.

Some employers argue that they just pay employees more instead of offering a retirement account, according to Eric Frazer, senior business development for HR services firm and Society of Collision Repair Specialists 401(k) partner Decisely. “That’s taxable money,” he said.

In a group 401(k), the employer can deduct the company’s contributions, and the employee’s contributions aren’t counted as taxable income, according to Frazer. (Of course, the employee will eventually see their 401(k) withdrawals taxed during retirement.)

A plan like SCRS’ 401(k) for members “could be a net win” for employee and employer in this regard, Frazer said.

Find out more about the SCRS 401(k) plan, which can save companies more money than trying to go it alone, on www.scrsbenefitscenter.com or with this webinar.

More information:

Collision Repair Education Foundation, Aug. 1, 2019

Executive summary of 2019 CREF, I-CAR study

CREF, Aug. 1, 2019

Images:

A Pittsburgh, Pa., Collision Repair Education Foundation job fair in 2017 is shown. (John Huetter/Repairer Driven News)

The 2017 SEMA job fair is shown. (John Huetter/Repairer Driven News)

Job fairs were more effective for shops recruiting technicians in 2019 than in 2016, according to a Collision Repair Education Foundation and I-CAR study. (Provided by CREF)

Nearly a third of production technicians made at least $70,000 in 2019, according to a Collision Repair Education Foundation and I-CAR study. (Provided by CREF)

A smaller percentage of shops reported offering life insurance and retirement in 2019 than in 2016, according to a Collision Repair Education Foundation and I-CAR study. (Provided by CREF)