FTC relays LKQ, ABPA, Safelite critiques of OEM collision practices in report to Congress

By onAnnouncements | Associations | Business Practices | Market Trends | Repair Operations | Technology

A Thursday Federal Trade Commission report to Congress on manufacturer control of product repairs highlights criticisms of auto industry practices relevant to the collision repair industry.

The FTC described LKQ attacking parts restricted to certified OEM repair networks and the potential for automakers to use telematics to “steer the consumer.” It also noted Safelite and the Auto Care Association opposition to automakers warning of risks from non-OEM parts.

Little rebuttal of these positions appears within the report. The FTC ultimately seemed skeptical about the cases for repairability restrictions advanced by various industries’ manufacturers.

“The report’s findings, including that ‘there is scant evidence to support manufacturers’ justifications for repair restrictions,’ are primarily based on responses to the Commission’s requests for public comments and empirical research issued in connection with its July 2019 workshop, ‘Nixing the Fix: A Workshop on Repair Restrictions,’” the FTC wrote in a news release Thursday.

Report history

Congress in 2020 told the FTC it was aware of its exploration of “how manufacturers—in particular mobile phone and car manufacturers—may limit repairs by consumers and repair shops, and how those limitations may increase costs, limit choice, and impact consumers’ rights under the Magnuson-Moss Warranty Act,” according to the agency.

The directive quoted by the FTC appears to have come out of the House Appropriations Committee in July 2020. It seems to have been approved by the full Congress as part of the the House Resolution 133 appropriations bill signed into law Dec. 27, 2020.

The Appropriations Committee told the agency to issue “a report on anticompetitive practices related to repair markets” with “recommendations on how to best address these problems” 120 days after an appropriations bill’s enactment.

The alternative auto parts advocates appear to have made an impression with comments submitted in 2019 ahead of the workshop. It doesn’t appear that automakers weighed in formally at the time. The FTC’s references to OEM and manufacturer counterarguments contained here use those terms generically and summarize arguments which could have come from unrelated sectors like appliance makers.

Reactions

“The FTC report is a clear signal that there should be federal legislation protecting consumer’s rights in the post-collision repair market,” Justin Rzepka, executive director of the CAR Coalition representing parties including CAPA, the American Property Casualty Insurance Association, Allstate and LKQ, said in a statement Thursday. “For far too long, the auto companies have dictated where and how consumers can repair their own vehicles. We concur with the FTC that consumers should be empowered to make choices when it comes to repairing products they repair and own, specifically their cars.”

Contacted for comment about the report, the Alliance for Automotive Innovation, which represents nearly all major OEMs, said in a statement Friday:

As we see from this report, automakers remain the gold standard when compared to any other industry. Consumers today have a broad spectrum of repair options, from authorized dealer networks, to national chain service facilities, to independent shops, to even fixing the car themselves. This is the result of automakers making parts and service information widely available across the repair community, as a means to support safe and quality repairs. Along those lines, Auto Innovators has been working hard to get state legislation passed that directs the use of OEM repair procedures in all insurance-funded, post-collision repairs. It should go without saying that such a policy position is only viable because repairers have all the information needed to diagnose and repair a vehicle… which they do today and will tomorrow.

SCG Management Consultants President Sean Carey, who has advocated OEM procedures and predicted a greater automaker role in the collision repair process, criticized the FTC’s methodology on Tuesday.

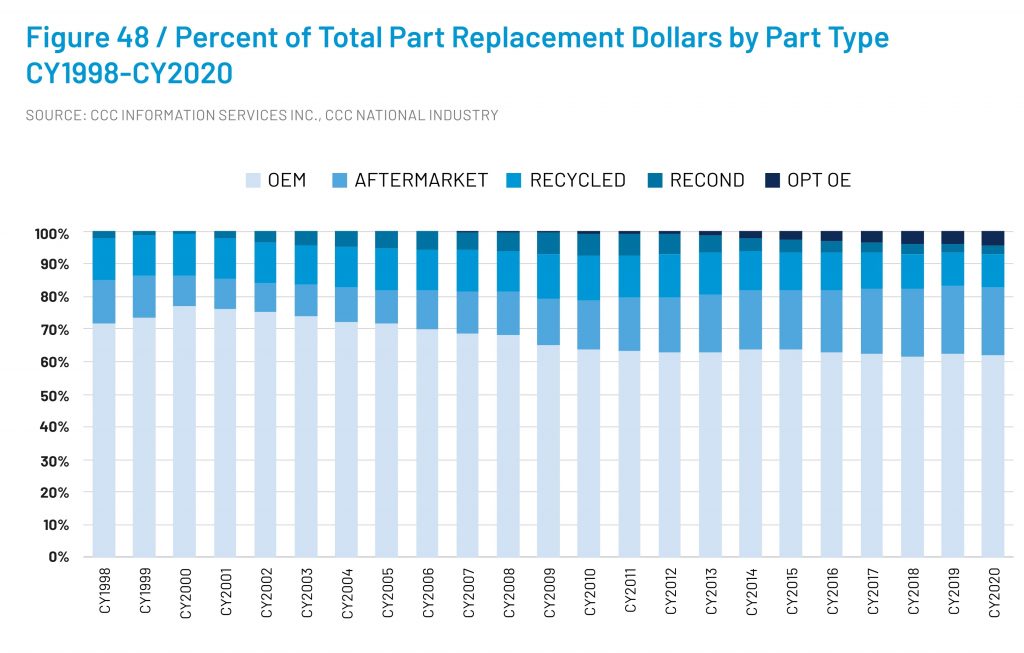

“This is a difficult read,” he said in a statement. “There are so many mixed messages and examples drawn randomly from differing sources that have no connection. It would benefit the consumer far more if the FTC stuck to the facts such as despite the growth in alternative parts used in the collision segment (which the report alludes will save consumers money) growing to 38.3% of total parts (CCC’s Crash Course) the cost of insurance premiums has risen by 52.2% (III 2021 fact book) during the same timeframe. If alternative parts are a cost saving then why haven’t premiums gone down? The consumer deserves a far more balanced and broader perspective than the one provided in this report.”

Restricted parts

Some automakers restrict the sale of structural components to the certified independent and dealership collision repairers deemed qualified to install them. LKQ doesn’t like this, and the FTC apparently didn’t either.

“Some manufacturers make parts available only to their authorized repair networks,” the FTC wrote in its “Nixing the Fix” report to Congress, citing research from LKQ. “For example, LKQ Corporation (‘LKQ Corp.’) stated that in the automobile industry, where replacement parts have been generally available outside of manufacturers’ repair networks, several manufacturers, such as Volvo, limit the availability of key replacement parts to only their authorized repair networks.”

LKQ argued in its comments to the FTC that Volvo could have restricted parts but “pursued an accreditation program open to all members of the repair community and not the select few that join the loyalty club.”

According to the FTC, manufacturers “argue that authorized repair facilities provide superior service compared to the service provided by independent repair facilities. Most of the support for this argument is anecdotal and relates to concerns about independent repair facilities that do not meet safety standards and do not conduct repairs properly.”

The agency said companies also “argue that repair restrictions protect repair workers and consumers from injuries that could result from fixing a product or using an improperly repaired product. According to manufacturers, safety risks are mitigated when repairs are performed by authorized repair persons …

“Manufacturers further assert that unauthorized repair presents a safety risk for a device’s user, not just its repairer.”

The manufacturers also told the FTC they risked liability and their brands could suffer if independent repairers fixed their products incorrectly.

VIN burning

The FTC also devoted report space to LKQ’s criticism of OEM technology barring the reuse of parts.

The FTC said LKQ had reported the existence of “‘VIN burning’—the practice of limiting a control module to function with a single vehicle identification number. With VIN burning, a manufacturer can constrain a part to function with only a single car. Using the part on another vehicle would be blocked by the vehicle’s embedded software. This practice is reportedly being used by General Motors as well as a number of European luxury brands.”

According to the FTC, automakers didn’t offer an explanation for VIN burning.

“(W)e note this practice may have benefits (such as reducing the marketability of stolen airbags and other components),” the FTC wrote. “However, any such benefits could likely be achieved without imposing a substantial burden on independent repair.”

The agency did note that manufacturers view technological protection measures as “necessary to protect proprietary hardware and copyrighted technologies.”

“With increasing frequency, vehicle manufacturers embed software restricting the reuse, repair and remanufacturing of an electronic control module or computer. This limits repair options to new OEM replacement parts only,” the FTC quoted LKQ.

“… Within the aftermarket industry, dealer prices for OEM parts are almost always the highest. Alternative parts, including remanufactured or salvage control modules, sell at a fraction of dealer prices.”

The FTC said it received no comments that “rebuts the right to repair advocates’ argument that repair restrictions increase the price consumers pay for repairs.”

The agency also mentioned LKQ’s view that VIN burning leads to more electronic waste.

OEM criticism of aftermarket parts

The FTC quoted Safelite and Auto Care Association complaints over automaker comments regarding aftermarket parts.

“According to right to repair advocates, another tactic used to restrict independent repair is OEM efforts to promote their own parts and affiliate repair networks,” the FTC wrote. “A number of commenters also raised concerns about OEMs disparaging the quality of aftermarket parts and independent repairs. The record most strongly reflects this with respect to the automobile industry. For example, the Auto Care Association cited a bulletin released by Honda ‘disparaging the use of non-original equipment (OE) parts’ and a bulletin from Kia ‘that warned against the use of an aftermarket oil filter.’ Safelite AutoGlass, the ‘nations [sic] largest purchaser of Original Equipment Equivalent (OEE) replacement vehicle glass,’ reported that vehicle manufacturers have cast ‘any OEE products or non-dealership repair services as dangerous for the driver,’ and that individual vehicle owners ‘will turn away from the aftermarket and head to the new vehicle dealer to ensure that their warranty and safety not be jeopardized.'”

The FTC doesn’t mention a BodyShop Business 2019 industry study it also received as a public comment — a document which would seem to support automaker warnings about aftermarket part quality. The document was submitted to the agency in December 2019, missing the September 2019 deadline the agency had set for “Nixing the Fix” comments but prior to Congress ordering the FTC to prepare a report on the issue.

Repairers told BodyShop Business that 90 percent of OEM parts “provide an acceptable fit” compared to 73 percent of recycled parts, 51 percent of certified aftermarket parts and just 29 percent of uncertified aftermarket parts. The repairers said they return 11 percent of OEM parts, 42 percent of certified aftermarket parts and 56 percent of uncertified parts to vendors.

Shops also told the magazine they prefer used parts to aftermarket parts by a 56-44 percent margin.

The study found 71 percent of shops buy aftermarket parts because they “feel pressured by insurance companies.” The next most popular answer was “customer request,” at 32 percent.

Speaking of consumer choice, 28 percent of shops said most insurers pay for OEM components “if a customer objects to aftermarket crash parts.”

“In some situations, after Safelite installed an OEE windshield, having learned of the scare tactics of the dealer and/or the vehicle manufacturer, the customer demanded OEM glass be installed,” Safelite strategic initiatives Vice President Edward Springler wrote to the FTC on Sept. 17, 2019. “So, we unnecessarily had to remove a perfectly good piece of OEE glass, wait for the delivery of OEM glass and then reinstall – all at Safelite’s cost. Not fair to the customer, nor Safelite or any other service provider qualified to perform ADAS recalibration services. This unfortunate but recurring problem is increasing in frequency, as most new vehicles are equipped with ADAS.”

Under the original 2014 right to repair agreement, Safelite is permitted to buy all the same calibration tools and access the same repair instructions available to dealerships. Based on Springler’s comments to the FTC, the company uses aftermarket calibration equipment from Bosch.

“Over the past eighteen months, using state of the art equipment manufactured by Bosch, Safelite has successfully performed 400,000 front camera ADAS recalibrations on vehicles representing twenty eight vehicle makes from Audi to Volvo,” Safelite wrote. “These recalibrations have been successfully performed on OEM and OEE windshields. We are confident this volume of experience qualifies us as not only vehicle glass repair and replacement specialists, but also ADAS recalibration specialists. In fact, as part of a multi-national company our dedicated technical innovation team exists for the sole purpose of developing the best technologies to serve our customers. Our commitment to ADAS recalibration across all vehicle makes, models and years is unmatched in the VGRR industry, investing millions of dollars in ADAS recalibration technology in the past five years.”

Telematics and OEM repair networks

Apparently not realizing that smartphone and connected OBD-II dongle technology offer insurers a similar opportunity, the FTC report highlighted the ability for automakers to control the repair process after detecting a crash.

“Many modern vehicles come equipped with telematics that monitor the status of the car and relay that information to a central location,” the FTC wrote. “Numerous commenters asserted that these telematics systems serve as a relatively new way of limiting independent repair access and consumer choice in the auto repair industry. As LKQ Corp. and MEMA described in their submissions, telematics systems, which ‘provide remote, real-time communications between a vehicle and a remote third party,’ are currently only accessible by the vehicle manufacturers. This exclusive possession of information by manufacturers, LKQ Corp. asserted, limits consumers and independent repair shops because:

“Vehicle manufacturers retain exclusive insight in vehicle operations and diagnostics systems[, v]ehicle manufacturers control the telematics system for marketing purposes. Information and advertisements sent by the vehicle manufacturer can appear on the information display[, and f]ollowing an accident, vehicle manufacturers can steer the consumer, perhaps unwittingly and at the time when they are most vulnerable, to a dealership or loyal repair facility…”

The FTC did acknowledge, “Telematics enable manufacturers to provide beneficial services to consumers such as, parking assist, vehicle maintenance warnings, and navigation and emergency support.” Again, a connected OBD-II plug-in or smartphone app could permit aftermarket repairers and insurers features like this as well, though potentially with less accuracy and convenience.

However, a new Massachusetts “right to repair” ballot initiative passed in 2020 demands the automotive aftermarket in that state receives access to vehicle telematics if the customer consents. The law is on hold pending the outcome of a legal challenge by automakers.

“Manufacturers also assert that repair restrictions protect consumers from cybersecurity risks,” the FTC wrote.

Secure gateways

OEM cybersecurity measures could require automaker approval of a scan tool or OBD-II dongle to access vehicle data, and companies such as Nissan and Stellantis have already initiated such precautions.

The Massachusetts “right to repair” ballot initiative — again, assuming it survives the legal challenge — would let OEMs institute such “secure gateways,” but the process for receiving approval must be standardized.

“The Auto Care Association also asserted that if every manufacturer creates a unique system for accessing telematics vehicle repair data, ‘it will be difficult for aftermarket tools to navigate the system and repair shops could have difficulty cost effectively providing service for their customers,'” the FTC wrote.

“ABPA argued in its comment that ‘car companies are trying to create a product monopoly by leveraging new technological advantages gained through telematics from the cars and software partnerships with large industry players to eliminate parts competition. The result is higher parts pricing – leading to increase in repair costs….,” the FTC wrote.

“At least one manufacturer has also adopted a cybersecurity gateway to reduce the risk of vehicle hacking, but repair advocates argue the manufacturer has implemented the gateway in a manner that prevents legitimate third party repairs.”

LKQ in April 2019 told the FTC how it sold an aftermarket calibration kit to a repair facility without realizing “due to the FCA cybersecurity barrier, the new tools would not repair late model vehicles” from that OEM.

Be heard: The FTC can be reached here. Lawmaker contact information can be found here.

More information:

Federal Trade Commission, May 6, 2021

“Nixing the Fix: An FTC Report to Congress on Repair Restrictions”

FTC, May 2021

2014 “Right to Repair” Memorandum of Understanding

Comments submitted to FTC in 2019 for “Nixing the Fix” request for input

“CAR Coalition Applauds FTC Report Urging Expanded Consumer Access to Auto Repair Options”

CAR Coalition, May 6, 2021

Images:

The Federal Trade Commission headquarters is shown. (bpperry/iStock)

The Federal Trade Commission headquarters is seen July 19, 2019. (P_Wei/iStock)

Data from CCC’s 2021 “Crash Course” shows the proportions of various parts types found on estimates. (Provided by CCC)

An OBD-II port is shown. (gargantiopa/iStock)