CCC Crash Report outlines vehicle, claim trends

By onAnnouncements | Insurance | Market Trends

The average new vehicle APR was 7.1% for new vehicles and 11.4% for used in July 2024, reaching points not seen since the Great Recession, according to a CCC Crash Course Report.

About 17.8% of new auto loans have a monthly payment of $1,000 or more, the report says. This increased from 17.3% in Q1.

As of Q2, auto loans made up 9.1% of total household debt and total auto loan debt now exceeds $1.6 trillion, according to the report.

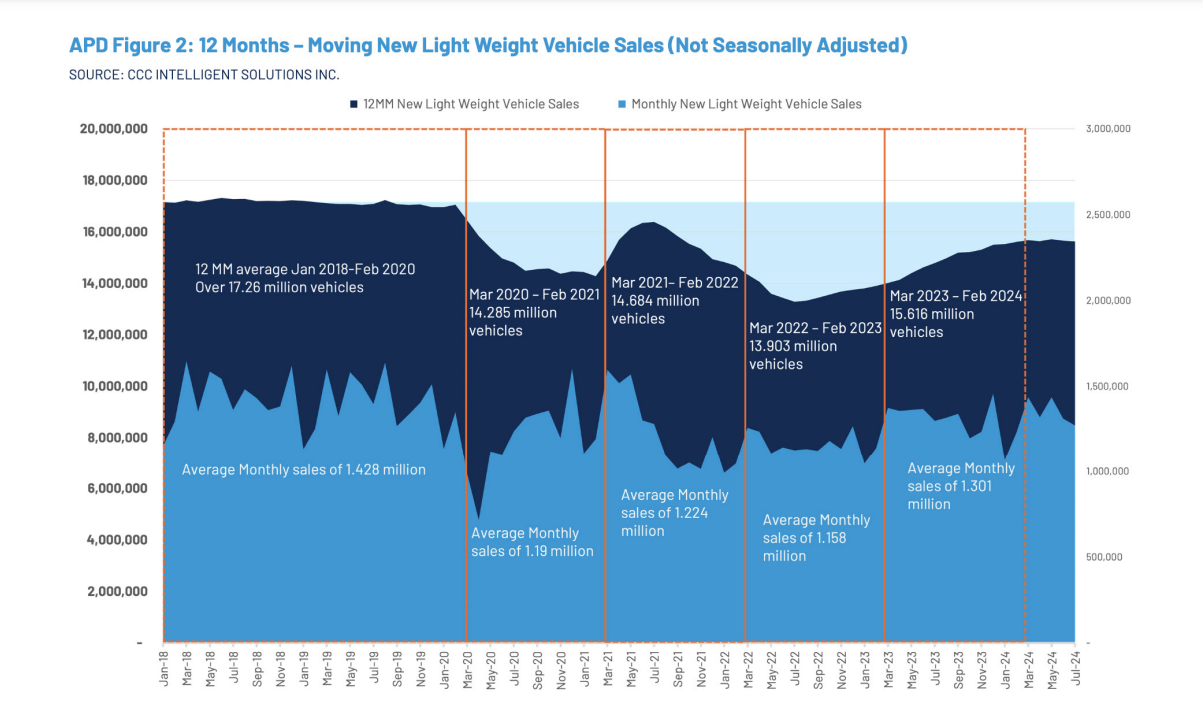

New and lightweight vehicle sales remain below 16 million on a 12-month moving basis through July at 15.63, the report says. The average from 2015-2020 has been 17.26 million.

The report says the supply of new vehicles is up 35 days year-over-year; however, consumers are currently facing continued elevated new vehicle prices, financing costs, and general economic woes due to inflation.

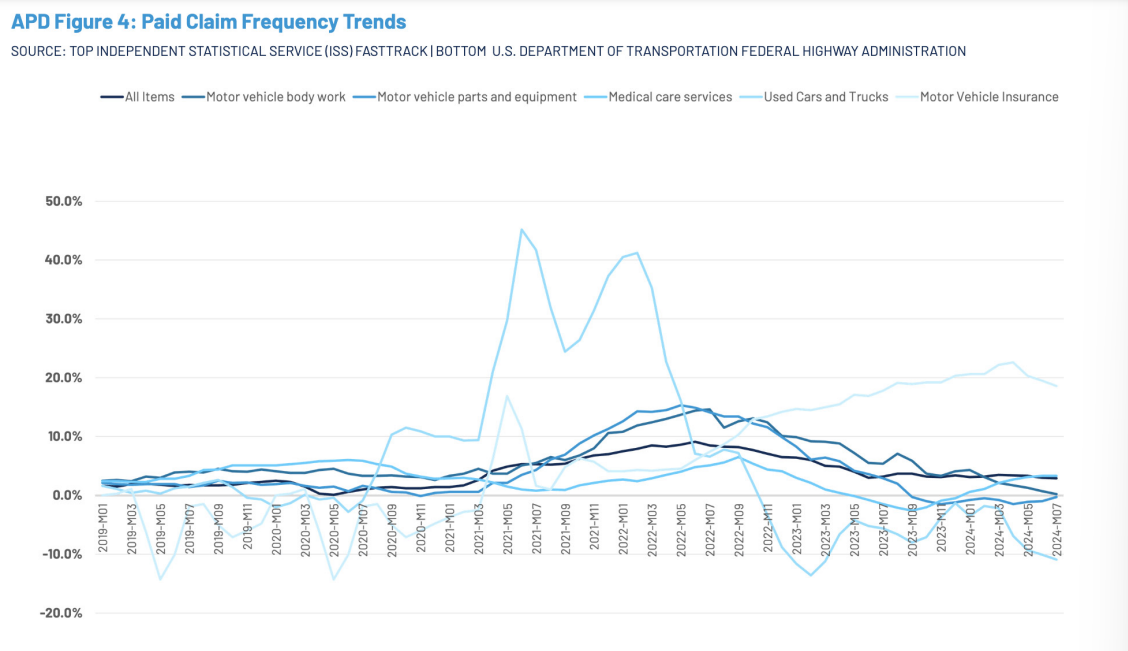

Paid claim frequency trends through Q1 show that 12-month moving auto collision frequency continues to slowly decline, the report says. This includes liability claims frequency flattening over recent quarters, remaining below historic norms.

Comprehensive paid frequency remains at or near historic levels, the report says. It has declined slightly in recent quarters.

The report says the number of total loss vehicles increased by 1.8% in 2024, primarily due to the continued erosion of used vehicle values and an increasingly mature vehicle pool. It notes that 73% of valuations across all loss categories are for vehicles seven years or older.

“An increased total loss frequency will, conversely, decrease the ratio of repairable vehicles,” the report says. “Higher severity losses, which might have been repaired a year ago, are more likely now to be totaled, increasing shop capacity and lowering overall cycle times.”

Images

Photo courtesy of nigelcarse/iStock