J.D. Power and ValuePenguin expect continued insurance rate increases; 2025 could see UBI uptick

By onInsurance

J.D. Power expects auto insurance policyholders to continue shopping for lower rates this year and perhaps an uptick in usage-based insurance (UBI) adoption.

Last year, insurance costs hit record levels. The average annual premium was $2,543, up 26% from 2023, according to J.D. Power.

ValuePenguin predicts drivers will pay an average of 7.5% more this year for auto insurance as the new year kicked off with an average nationwide monthly premium of $175 for full coverage. Nevada, Florida, and Michigan premiums are the highest at more than $250 a month, according to ValuePenguin’s “State of Auto Insurance in 2025” report.

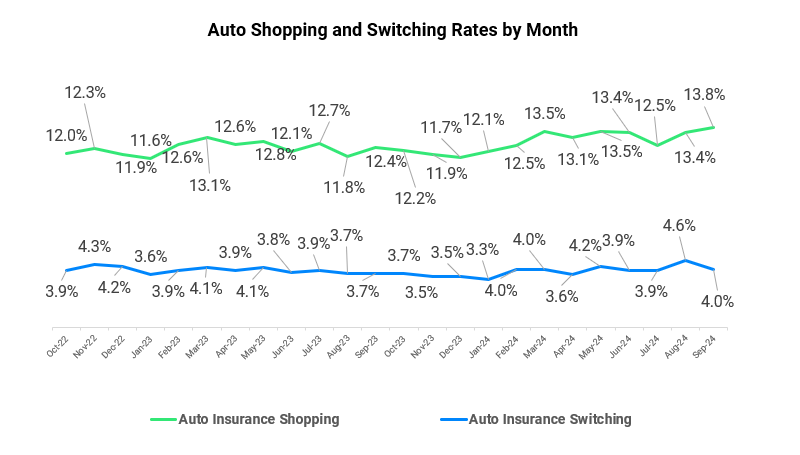

By May 2024, 49% of auto insurance customers said they were shopping for a new plan, and by Q3, shopping rates had reached a record high, according to J.D. Power.

“However, with virtually every carrier increasing rates, all those shoppers had very few alternatives and many stayed put. Now, that’s all about to change,” states J.D. Power’s latest “Insurance Intelligence Report.”

“After the past three years spent shoring up their operations and scaling back growth initiatives, insurers are going to be on the hunt for new customers in 2025 and all indications are that customers will be more than willing to comparison shop their policies and jump ship for a better rate. According to our quarterly LIST Report for Q3 of 2024, policy shopping activity hit a record high of 13.8% in September. Since then, shopping rates have stayed elevated, hitting 13.8% again in October and dipping slightly to 13.6% in November. Switch rates also increased, peaking at 4.6% in August. As more competition starts to heat up between carriers, switch rates may increase further in 2025.”

According to ValuePenguin, insurance price increases vary a lot by state.

“New Jersey, Washington, and California drivers can expect to see the biggest jumps the next time they renew,” states ValuePenguin’s report. “New Jersey and Washington have estimated increases of 17.2%, while California residents will see a 16.2% increase, on average. Only one state — North Carolina — has an expected rate drop in 2025 (0.1%). That means North Carolina drivers are the most likely to see no change, or even a slight drop, in their insurance rates.”

J.D. Power expects there will also be widespread adoption of UBI policies, which offer discounts for safe driving and fewer miles driven according to vehicle telematics tracking.

“On average, overall satisfaction among new customers participating in a UBI program is 64 points higher (on a 1,000-point scale) than new customers who choose not to participate in UBI programs,” J.D. Power wrote. “The bump in customer satisfaction that’s coming from UBI combined with a surge in rate-driven shopping and switching activity and continued interest among insurers in courting new customers have set the stage for a significant jump in UBI adoption.

“Investments in mobile apps, particularly in the claim reporting process, are paying off as claims reported through this channel have higher satisfaction than any other method, even surpassing agents and call centers… For auto repair claims filed in 2024, the average repair cycle time has improved by five full days, driven in part by higher usage rates of photos and continued improvement in shop backlog.”

J.D. Power concludes in the report that 2025 will be a year of relief for customers and volatile for insurers due to remaining high costs and customers “consistently demanding more.”

“Those insurers who keep improving their offerings, make it easier for their customers to work with them, and consistently demonstrate their value to customers will be those who are in the best position to weather this volatility,” the report states. “Winning in the current environment is about combining the highest possible degree of operational efficiency with the most engaged, personalized, and supportive customer-facing front end.”

ValuePenguin notes in its report that inflation fell 3% during the last half of 2024 and financing options are improving. Both mean insurance rates might continue to slow and the overall cost of insuring a new car might go down but tariffs could also raise rates, the report states.

“About 60% of replacement car parts are imported from other countries. Higher parts costs mean higher repair prices, which would likely result in higher premiums,” the report says.

Images

Featured image credit: filo/iStock

Graphs provided by J.D. Power