Rising costs of health insurance challenging U.S. small businesses ability to provide competitive offerings

By onBusiness Practices | Insurance

The rapidly rising cost of health insurance is “crippling” U.S. small businesses, according to a new report from the National Federation of Independent Business (NFIB).

Participation in the small group market, where most small businesses purchase coverage, is in a “death spiral,” the report says. It says the number of participants has declined sharply in recent years, with a decrease of 7.4% from 2022 to 2023.

“The market ended the year in 2023 with 8.5 million participants, compared to nearly 15 million in 2014,” the report says. “In addition, issuer participation has declined from an average of 13 in 2015 to only five in 2020 and continues to fall.”

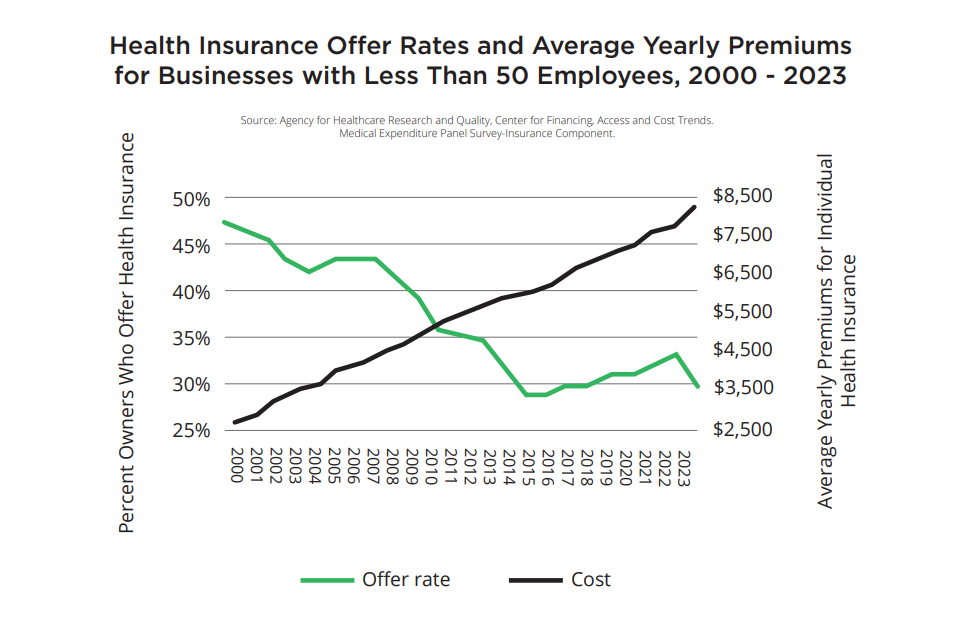

According to the report, the average cost of an individual health insurance plan has increased by 120% for firms with less than 50 employees and average family premiums have increased by 129% in the last 20 years.

Ninety-eight percent of small businesses report they are concerned about whether they’ll be able to afford health insurance in the next five years due to the pace of rising premiums and shrinking coverage choices, the report says.

Yet, small businesses continue to see the value in offering health benefits, the report says.

“Sixty-three percent of all employers believe that providing health insurance to recruit and retain employees is very important,” the report says. “However, almost all (94%) of small employers find it challenging, to some degree, to manage the cost of providing employer-sponsored health insurance.”

The median health insurance payroll burden for small firms with less than $600,000 in annual revenues is nearly 12% compared to just 7% for firms with revenues over $2.4 million, the report says.

Forty-nine percent of small employers say they are absorbing some of the cost increases through lower profits, while 46% report they are raising prices to absorb higher insurance costs, further reducing their market competitiveness.

“The inability of small employers to provide affordable health insurance and compete with their larger counterparts will have severe consequences for the broader economy, federal spending, and the overall health of the small business economy,” the report said. “If not dealt with, the current crisis will lead to increased employee turnover and difficulty attracting talent. The broader economic impact includes reduced innovation, job creation, and economic dynamism.”

Congress should take steps to provide a solution to small businesses, the report says.

The report recommends:

-

- Protection of employer-sponsored insurance

- Supporting small businesses with targeted health insurance tax credits

- Expanding individual coverage health reimbursement arrangements (ICHRAs)

- Employer pooling arrangements

- Expanding access to health savings accounts (HSAs)

- Protecting small business access to stop-loss insurance

- Expanding affordable coverage options

- Eliminating one-size-fits-all mandates that drive up premium costs and limit competition

- Promoting price transparency and price certainty

- Discouraging hospital consolidation

- Reducing prescription drug prices through innovation

“The rising cost of health insurance continues to strain small businesses, disproportionately burdening them with unsustainable premiums and red tape, particularly compared to their larger counterparts,” the report says. “Without targeted policy reforms, the few coverage options available, such as those sold in the small group market, will continue to decline. Millions may lose access to affordable employer-sponsored health coverage, which most Americans prefer over other options.”

Benefits of one example product offered in the association program include:

-

- $0 deductibles and employees choose their out-of-pocket maximum, which ranges from $3,000-$7,000;

- No-cost services for visiting primary care physicians, specialists, urgent care, labs, or having X-rays;

- Free generic prescriptions and mental health services; and

- Aetna and Cigna networks.

Details about the plans offered can be found in the SCRS benefits center.

IMAGES

Photo courtesy of BrianAJackson/iStock

Embedded graphic courtesy of NFIB