Overall length of rental down to 16.7 days, collision industry may have found ‘new normal’

By onMarket Trends

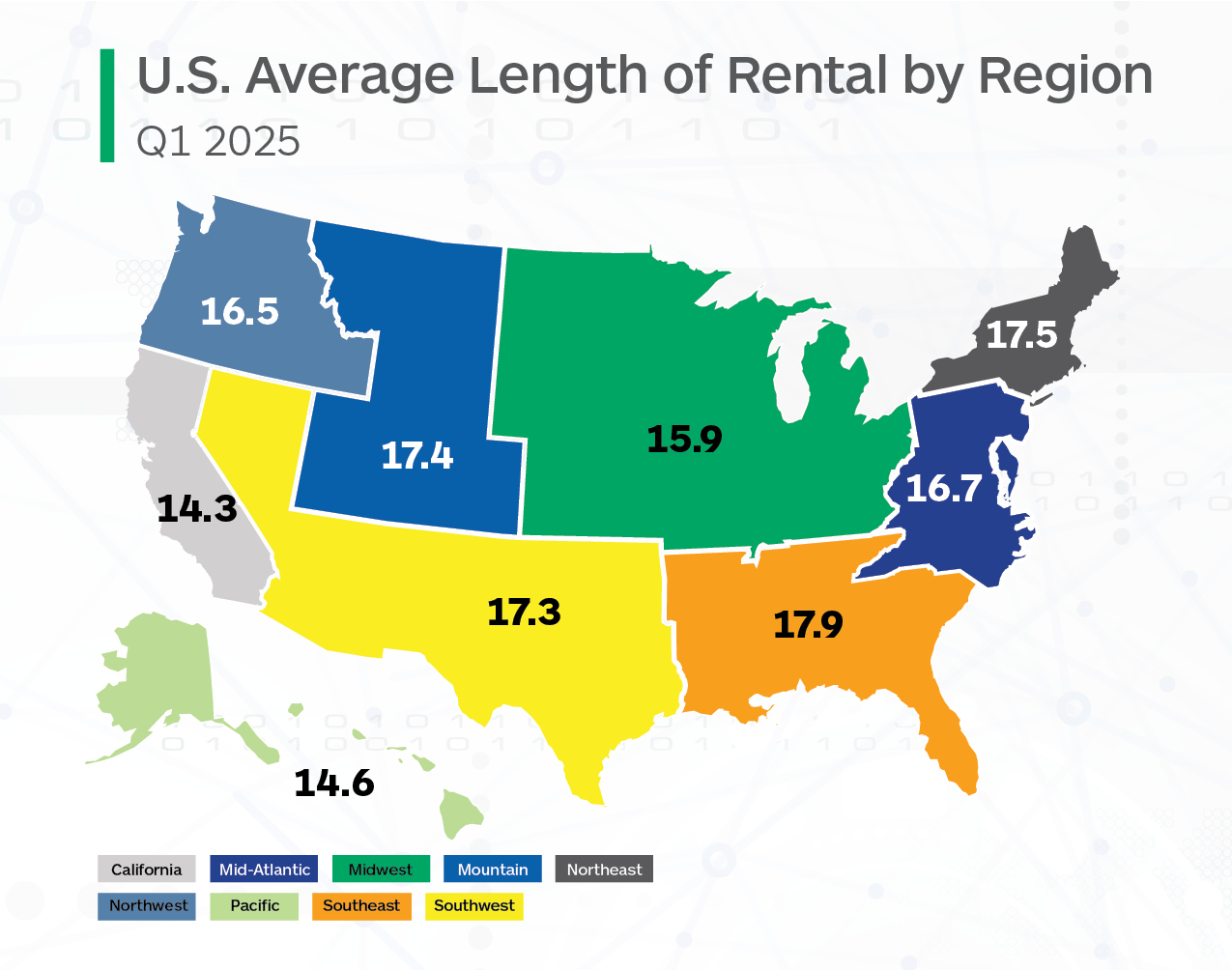

Enterprise Mobility reports that for Q1 2025, the overall length of rental (LOR) was down to 16.7 days compared to Q1 2024.

The rate declined by less than one (0.9) day, while by this time last year, it had declined by 1.1 days from Q1 2023, when overall LOR was 18.7 days.

“We have previously discussed the outsized impact on LOR in 2022 and 2023, given the post-COVID effects of vehicle production and supply chain issues,” the Q1 2025 LOR report states. “When we compare Q1 2025 to Q1 of 2020, overall LOR is currently 3.5 days higher; LOR in Q1 2020 was 13.2 days. And in Q1 2019, overall LOR was even lower at 12.8 days.”

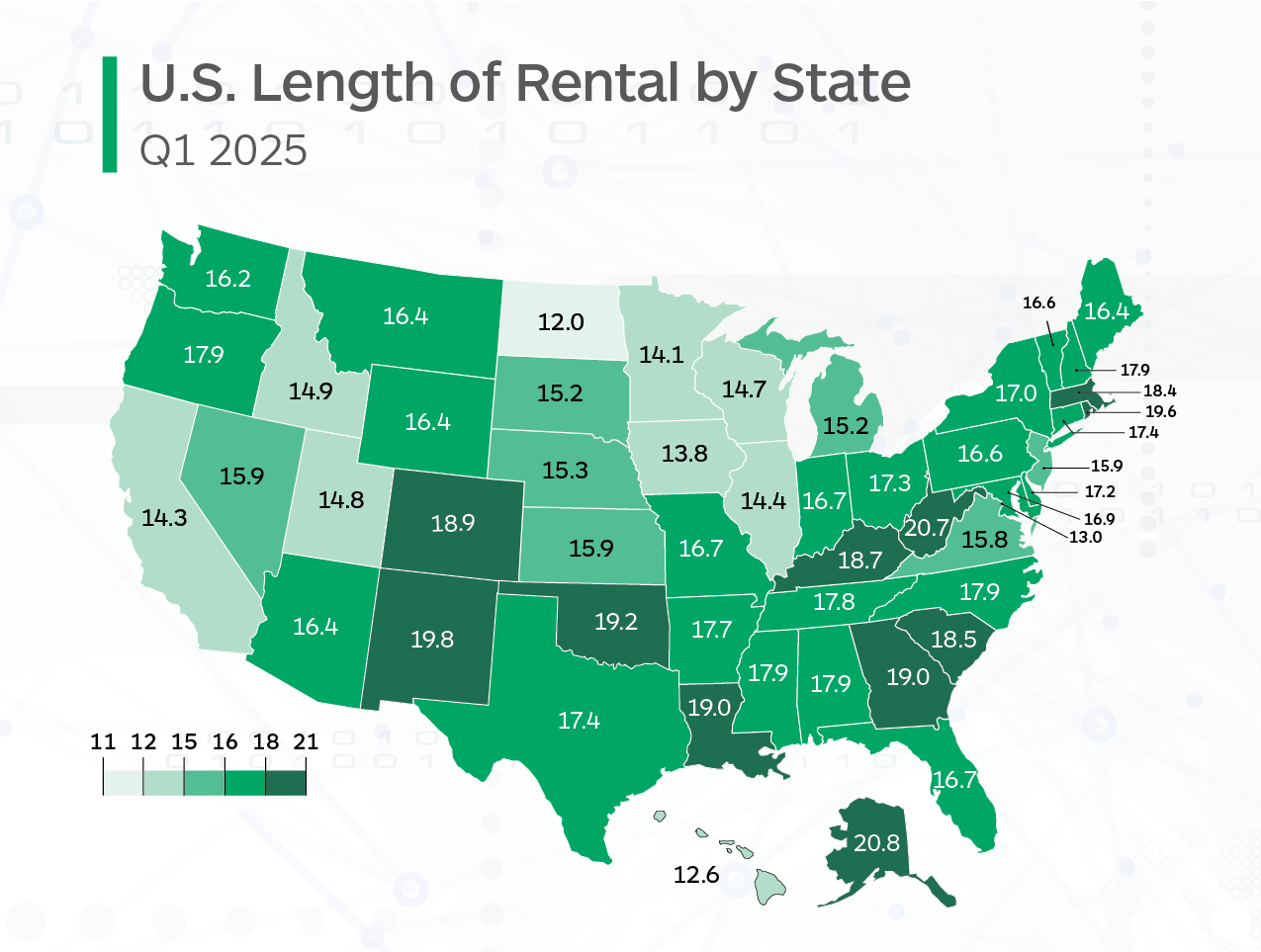

Alaska recorded the highest LOR at 20.8 days, a 0.1-day increase from Q1 2024. West Virginia had the next-highest LOR at 20.7 days, followed by New Mexico at 19.8 days.

North Dakota had the lowest LOR at 12.0 days, a 1.1-day decline from Q1 2024. Hawaii followed with 12.6 days, ahead of the District of Columbia at 13 days.

Nebraska and Vermont had the highest LOR increases at 0.6 days; Iowa, New Hampshire, and Arkansas recorded higher LOR in Q1 versus

Q1 2024.

Montana has the largest LOR decrease, down 2.6 days from Q1 2024, followed by Idaho (-2.5 days), with Nevada and Colorado down 2.2 days.

John Yoswick, editor of the weekly CRASH Network newsletter, added that some trends suggest there might not be significant drops to LOR moving forward this year if the claims count doesn’t decrease further.

“Two years of decline in the average shop backlog of work came to an end in the first quarter of this year,” he said. “The ‘Who Pays for What?’ survey conducted in January by Collision Advice and CRASH Network found that among more than 750 responding shops, the average backlog of work was 2.6 weeks, up half a week compared to the prior quarter.

“An increase in backlog between the fourth and first quarter is not unusual but this increase was slightly larger than typical, perhaps an indication that the industry is finding its new ‘normal’ range after eight consecutive quarters of backlog declines.”

LOR for rentals associated with drivable claims was 15.2 days in Q1, down 0.6 days from Q1 2024’s 15.8 days, according to the report.

Alaska had the highest drivable LOR at 18.5 days, a 0.9-day increase from Q1 2024. Rhode Island followed at 18.4 days; however, the state’s rate fell by over half a day (0.9).

Georgia (18.1 days) and Oklahoma (18.0 days) rounded out the top states with the highest drivable LOR. North Dakota had the lowest drivable LOR at 10.1 days, followed by D.C. (11.1 days) and Hawaii (11.2 days).

Eleven states saw drivable increases, including Tennessee with the highest at 1.9 days, as well as Indiana and Nevada at 1.8 days. Nebraska and Vermont each saw an increase of one day.

Greg Horn, PartsTrader’s chief industry relations officer, states in the report that quarter-over-quarter LOR reductions align with PartsTrader’s median delivery days (plus two standard deviations), which improved in Q1 compared to Q1 2024.

“A lower claim frequency seen by many of PartsTrader’s clients has also resulted in quicker shop throughput, which reduces cycle time,” he said.

Ryan Mandell, Mitchell International’s director of claims performance, added that the frequency of diagnostic operations in the U.S. rose to 87.4% in Q1, up from 84.3% in Q1 2024 while calibration frequency increased to 25.3%, up from 23.4% in Q1 2024.

“The average number of calibrations per estimate (when calibrations are present) also increased to 1.46 per estimate in Q1 2025, compared to 1.38 in Q1 2024,” he said. “We expect the frequency number of 25.25% to increase above 30% once the data is fully mature, as calibration operations are often added as supplemental items and are not reflected on original estimates. The calibration frequency number for Q4 2024 ended at 29.4%.”

LOR for non-drivable vehicles was 22.8 days, a 2.2-day decline from Q1 2024.

Alaska had the highest non-drivable LOR at 29.6 days, followed by West Virginia (29.4 days) and New Mexico (28.6 days).

Iowa had the lowest non-drivable LOR at 19.2 days, followed by California and D.C. at 19.8 days.

All states, plus D.C. and Puerto Rico, had declines in non-drivable LOR.

Total loss LOR was 14.9 days, a 1.5-day decline from Q1 2024. All states and D.C. saw total loss decreases during the quarter.

West Virginia has the highest total loss LOR at 19.4 days, followed by Alaska (18.4 days) and Kentucky (18.3 days). North Dakota had the lowest LOR at 12.5 days, and closely behind, Minnesota at 12.6 days, followed by Idaho (13.0 days) and South Dakota (13.1 days).

Idaho had the largest total loss decrease, down four days from Q1 2024, followed by Minnesota (-3.5 days) and Connecticut (-3.2 days).

Mandell said moving forward, it’s likely total loss frequency will continue to increase due to the older age of vehicles on the road, meaning improved cycle times.

“U.S. total loss frequency rose to 22.4% in Q1 2025, up from 21.1% in Q1 2024. The biggest increase came with older vehicles (10-plus years old), which saw an increase of 0.95 percentage points, followed by vehicles aged zero to three years old, which saw an increase of 0.87 percentage points,” he said. “An increase in total loss frequency means there are less borderline vehicles that are ending up as repairable and thus preventing a segment of larger, lengthier repairs from entering shop workflows, thereby reducing bottlenecks and improving cycle times.

“We expect that severity, once the data is fully mature, will not increase as much as in previous quarters as a result of some of these higher dollar repairs being written off.”

However, Yoswick noted there may be fewer claims overall depending on the economy.

Perhaps the biggest unknown is the larger economy,” he said. “Should it falter, vehicle miles traveled (which has rebounded to above pre-pandemic levels) could decline, further lowering claims count, and overall financial uncertainty may lead more drivers with moderate vehicle damage to forego having it repaired.”

Images

Featured image credit: coffeekai/iStock

Maps provided by Enterprise Mobility