Progressive to hire 12,000 employees due to YoY revenue uptick, Chubb reports Q1 revenue decline

By onInsurance

Progressive says it plans to hire more than 12,000 employees this year, including adjusters, due to its continued year-over-year growth.

The insurance company is the second largest in the country. According to a press release, other positions in Progressive’s claims, customer care, IT, analyst, legal, and corporate departments will be filled.

In claims, Progressive plans to fill entry-level roles such as claims adjuster trainee and a new opportunity, field adjuster trainee, as well as experienced roles like claims specialist and claims adjuster auto damage.

While most roles are remote, there are some hybrid and in-person opportunities in Massachusetts, Florida, Texas, New York, and South Carolina.

There are also several call center positions available nationwide, including Spanish bilingual representatives and licensed insurance agents.

In 2024, Progressive added just over 5 million policies in force and grew net premiums written by 21% to $74.4 billion, according to the release.

Progressive’s Q1 profit increased by 10% over Q1 2024, reaching nearly $2.6 billion in net income and a 43-cent increase per share, as of March 31.

Specific to auto insurance, revenue from direct personal lines was up by 25%, or nearly $14.8 billion, compared to almost $11.9 billion brought in during Q1 2024.

Progressive’s combined ratio was 86%, down 0.1% from a year ago. When the combined ratio is below 100%, that shows more revenue was made from premiums than spent on paying claims. Premiums earned increased by 20% compared to Q1 2024.

“The company has continued its growth in the new calendar year by adding 1.3 million policies in force during the first quarter,” the release states. “To support these continued positive trends, market share gain, and growing customer base, Progressive has continued to increase its workforce, and this year is no different, as the company is actively seeking qualified candidates to fill a multitude of roles.”

The roles will be a mix of remote, in-office, and hybrid. The company currently employs more than 66,000.

“By having a flexible workplace approach, it not only allows us to meet the needs of our current employees but to also reach job seekers where they are,” said Neil Lenane, Progressive’s talent acquisition business leader, in the release.

Progressive says it provides extensive training and career development opportunities, including Career Central, an internal career development hub with learning tools for leadership development and mentorship “to support and encourage employees to grow and advance their careers within the company,” the release states.

Also this week, Chubb Limited reported a significant decline in Q1 net revenue. P&C underwriting income was down 68.5% compared to Q1 2024, according to a press release. However, the company’s combined ratio increased to 95.7% versus 86% in Q1 2024. Net premiums written were up 3.2% to nearly $11 billion.

Net income and core operating income were $1.3 billion and nearly $1.5 billion, respectively, versus $2.1 billion and nearly $2.2 billion last year.

Evan G. Greenberg, Chubb’s chairman and CEO, said in the release that the company had a good first quarter “overshadowed by the significant catastrophe losses we incurred from the California wildfires.”

“As I observed at the beginning of the year, about 80% of our global P&C business, commercial and consumer, and our life business have very good growth prospects,” he said. “There is a lot of opportunity, though we are mindful of the external environment. There is currently a great deal of uncertainty and confusion surrounding our government’s approach to trade, and it’s impacting business and consumer confidence as well as our image abroad.

“The odds of recession have risen substantially, and higher inflation appears all but certain; to what degree is an open question. We have competing priorities between our stated trade, economic, and fiscal objectives, and coherence of policy has yet to emerge. I hope we can reach agreements on trade, reduce or eliminate tariffs, and reconcile our priorities quickly. Certainty and predictability are jacks to open for confidence, growth, and the image of our country as a leader, a reliable partner, and a place to do business. In sum, I have confidence in what we can control…”

According to J.D. Power’s 2025 U.S. Insurance Shopping Study, the rate at which auto insurance premiums increased in 2024 declined to less than 2% at year-end from 13% at the beginning of the year. However, the percentage of customers shopping for insurance year over year jumped to 57% from 49%.

Fifty-seven percent of auto insurance customers have actively shopped for a new policy in the past year — the highest shopping rate ever recorded in the 19-year history of the study, J.D. Power said.

Shopping rates were higher in Q1 2024, in line with record highs in insurance rates. As price increases slowed throughout the year, shopping rates increased.

Thirty-three percent of customers actively shopping for an auto policy seek to bundle their auto policy with a homeowner’s policy, according to the study.

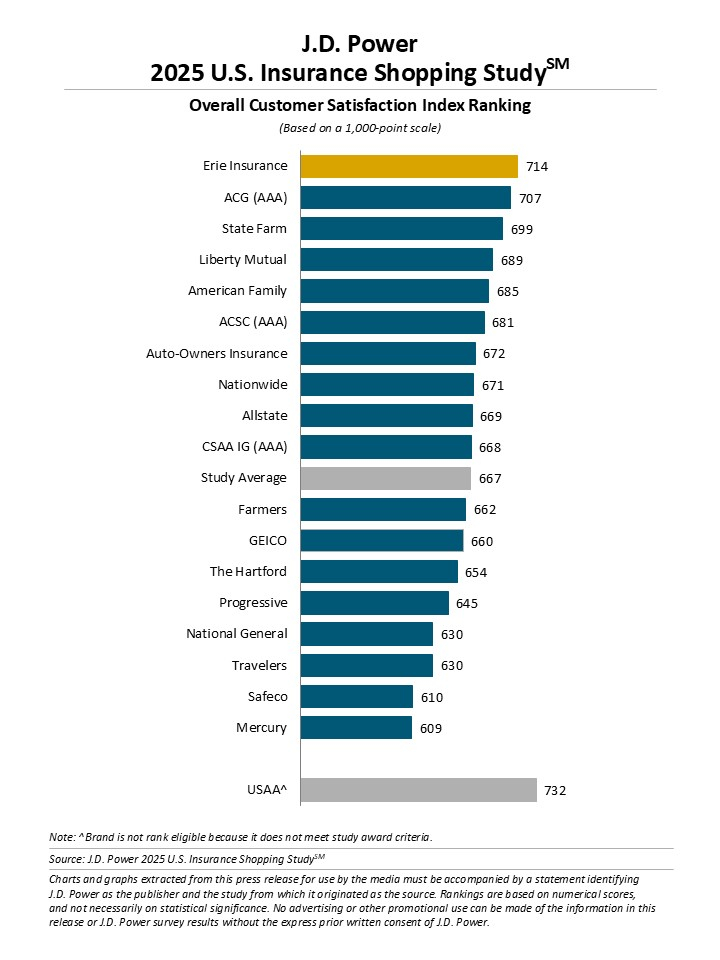

Erie Insurance ranked highest among large auto insurers in providing a satisfying purchase experience for the second consecutive year, with a score of 714, according to the study. ACG (AAA) (707) ranked second, followed by State Farm (699).

Thirty-seven percent of auto insurance customers said they’re interested in embedded insurance sold through auto dealers or OEMs.

Interest is highest among Generations Y/Z1 (47%), and among those who say their primary reason for shopping their auto policy is service (48%).

Usage-based insurance (UBI) also saw a small resurgence. This year, 17% offered UBI programs to shoppers, up from 15% in 2024 but down from 22% in 2023.

Images

Featured image provided by Progressive