PPG sees sales price and volume improvements, discusses tariff impact mitigation strategies

By onMarket Trends

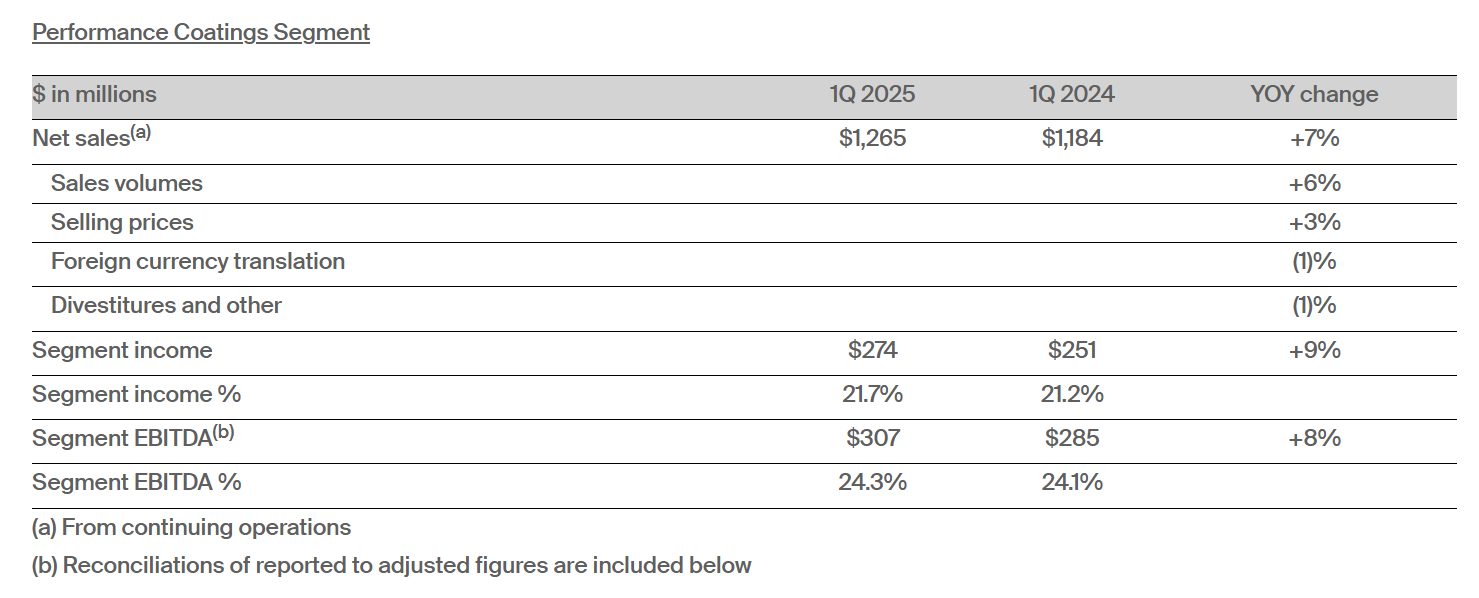

PPG reports that its Performance Coatings segment Q1 organic sales increased by 9% with price and sales volume improvements.

Chairman and CEO Tim Kenevich said during the company’s Q1 earnings call on April 30 that, overall, PPG’s sales for the quarter were $3.7 billion — a decrease of 4% compared to Q1 2024, primarily due to unfavorable foreign currency translation and the impact from business divestitures, including silicas business.

“In automotive refinish, global organic sales increased a low single-digit percentage versus the prior year,” Kenevich said. “In the U.S., sales volumes improved a mid-single-digit percentage with benefits from customer order patterns and share gains offsetting lower industry collision claims. Segment sales volumes also decreased 1% as strength in Industrial Coatings and Packaging Coatings was offset by soft automotive industry builds.”

Kenevich added that from a business unit perspective, automotive OEM industry production was lower year over year in the U.S. during Q1.

Regarding the recent automotive tariffs, Kenevich said PPG isn’t largely affected because its raw materials and finished goods are primarily bought, made, and sold locally.

“We have a balanced global business portfolio without reliance on any single country, region, or end market,” he said. “We are flexible batch process manufacturers, which results in an asset-light footprint that is easily adaptable to volume shifts. We have a highly variable cost structure that allows us to adjust our conversion costs according to demand.

“Historically, we have been successful in adjusting our selling prices, including through surcharges, to account for any changes in our delivered cost of raw materials… Like all companies, we have potential downsides if overall demand significantly weakens, and we are diligently monitoring these conditions… if and when there is a direct impact to us, we’ll work with our customers on pricing, surcharges, reformulations, substitutions, things like that. So the third bucket of potential impact for us is demand.”

Kenevich added that PPG is executing contingency plans and working with suppliers on alternative sourcing of supply chain materials. He said PPG is also making volume deals with suppliers and working with customers on formulation tweaks and adjustments.

“We always have in our toolbox pricing surcharges if necessary,” he said.

“We have not experienced any significant change to our raw material pricing as our suppliers continue to favor volume over pricing. We are monitoring this situation and we will react accordingly with pricing actions and or self-help cost actions to mitigate any impacts. While auto OEM industry demand forecasts were slightly reduced, our share gains are beginning to yield benefits, and we expect to outperform the market beginning in the third quarter.”

So far this year, collision repair customers have seen weighted average paint and material (P&M) costs increase by an average of 7.4%, according to company announcements from the five major refinish brands.

Letters sent out by industry P&M companies between October and December 2024 and March of this year attribute the cost increases to the challenging economic climate, sustained cost increases, inflationary pressures, and labor, operating, and shipping costs.

Kenevich said he doesn’t anticipate auto OEM paint lines will become idle, though staffing and output may have to be decreased.

“We’ll flex but we don’t have to idle any factories,” he said. “I can’t really say when any customer would decide to significantly change their production plans. We are positioned virtually everywhere in the world, so wherever they decide to go, we can make coatings for them.”

Unrelated to tariffs, Kenevich said going forward, he expects PPG will gain more leverage through “significant rightsizing” by shuttering some facilities over the next three years. He didn’t share how many are planned to close.

In answer to an investor’s question during the call regarding seemingly “volatile” Refinish earnings, Kenevich said that despite the “lumpiness” in sales numbers, Refinish earnings aren’t affected.

“We’ve demonstrated that year-over-year, over year, over year, despite this lumpiness,” he said. “The reason for that is the strength of our total value proposition around customer body shop productivity, where the actual cost of the paint is only a fraction of the cost of the total process, and our productivity solutions help that total process… this business has always had a bit of lumpiness because of the two step distribution model.”

Kenevich concluded that PPG’s automotive sales customer mix and overall performance will continue to improve, especially beginning in Q3 when “we expect to be outperforming the industry,” as a result of ongoing work to rebalance customer mix in a couple of regions.

Images

Featured image provided by PPG