GEICO sees Q1 increase in premiums earned, Warren Buffett to retire and board names successor

By onAnnouncements | Insurance

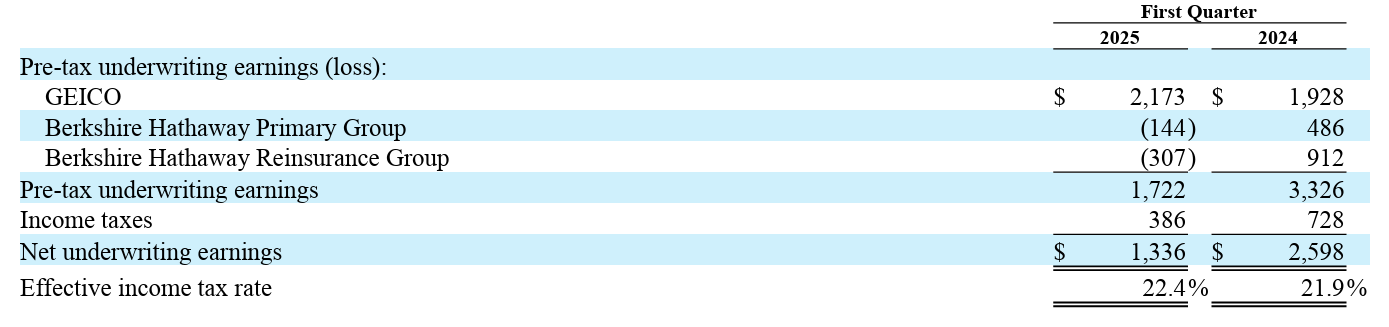

Berkshire Hathaway, parent company to GEICO, reports a nearly $1.3 billion decrease in net insurance underwriting earnings in Q1 2025, down by half compared to $2.6 billion in Q1 2024; however, GEICO saw an increase of $518 million in premiums earned during the quarter.

Berkshire attributes its net insurance underwriting earnings decrease to $860 million in losses from the Southern California wildfires in January.

The following chart summarizes GEICO’s underwriting results (dollars in millions):

Berkshire noted in its quarterly report to the SEC that periodic operating results may be impacted in the future by ongoing macroeconomic and geopolitical events, including international trade policies and tariffs, which have accelerated this year.

“Considerable uncertainty remains as to the ultimate outcome of these events,” the report states. “We are currently unable to reliably predict the potential impact on our businesses, whether through changes in product costs, supply chain costs and efficiency, and customer demand for our products and services. It is reasonably possible there could be adverse consequences on most, if not all, of our operating businesses, as well as on our investments in equity securities, which could significantly affect our future results.”

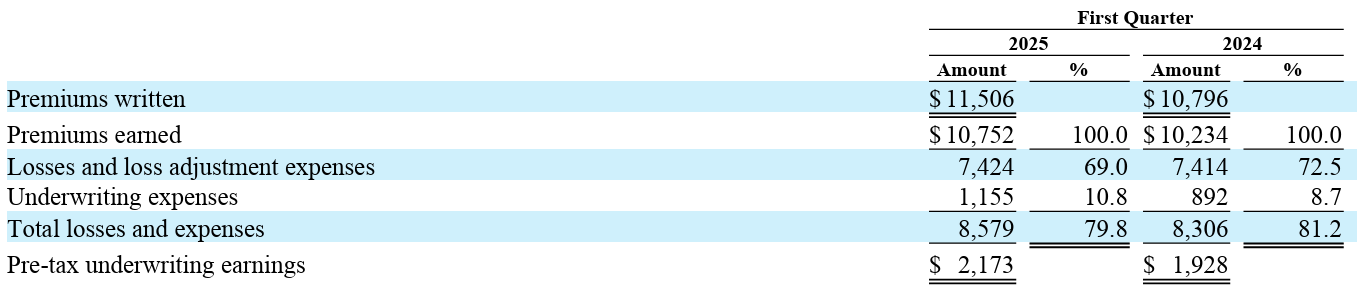

Specific to GEICO, Berkshire wrote that premiums written increased $710 million (6.6%) in Q1 compared to Q1 2024, reflecting an increase in policies-in-force and higher average premiums per policy.

Premiums earned increased $518 million (5.1%) in Q1 compared to Q1 2024, and losses and loss adjustment expenses increased $10 million (0.1%).

GEICO’s loss ratio (losses and loss adjustment expenses to premiums earned) was 69% in Q1, a decrease of 3.5 percentage points compared to 2024.

“The loss ratio decline reflected the impact of higher average premiums per auto policy and lower claims frequencies, partially offset by increases in average claims severities and less favorable development of prior accident years’ claims estimates,” the report states. “Private passenger automobile claims frequencies declined in the first quarter of 2025 versus 2024 for property damage and collision coverages (6-9% range), with bodily injury coverage down slightly.

“Average auto claims severities increased in the first quarter of 2025 for property damage and collision coverages (1-3% range) and bodily injury coverage (6-8% range) compared to 2024. Losses and loss adjustment expenses included reductions in the ultimate loss estimates for prior accident years’ claims of $45 million in the first quarter of 2025, compared to $155 million in 2024. Underwriting expenses increased $263 million in the first quarter of 2025 compared to 2024.”

GEICO’s expense ratio (underwriting expense to premiums earned) was 10.8% in Q1, an increase of 2.1 percentage points compared to 2024, which Berkshire attributes to increased policy acquisition-related expenses, partially offset by increased operating leverage.

Also, during a Q&A session before Berkshire’s May 3 annual shareholders meeting, CEO and Chairman Warren Buffett announced that he planned to recommend to the Board of Directors that Greg Abel, Berkshire’s non-insurance operations vice chairman, succeed him as CEO, effective Jan. 1, 2026. On May 4, the board unanimously appointed Abel. Buffett, 94, will remain chairman of the board.

The Associated Press reports that the Abel, 62, will also have the assistance of fellow Vice Chairman Ajit Jain, who has held responsibility for the insurance companies, including GEICO, since 2018, and two investment managers — Ted Weschler and Todd Combs, plus the CEOs of Berkshire’s several subsidiaries to handle all day-to-day operations.

Berkshire Class B shares fell more than 5% on Monday in response to the news after hitting an all-time high Friday, but many investors praised the plan, according to the AP.

During the shareholders meeting, Buffett said he doesn’t see many bargains to invest Berkshire’s $348 billion in cash, not even the company’s own stock, but assured some of the estimated 40,000 attendees that one day the company would be “bombarded with opportunities,” the article states.

According to Reuters, Jain said GEICO has made “rapid strides in telematics” and is now “as good as anyone.”

“All this has allowed GEICO to become a more focused competitor,” Jain said, according to Reuters.

He added that it’s too soon to say “mission accomplished,” and that the company has achieved a lot, but “we have to do a lot more,” the article says.

According to Reuters, Jain also praised Combs for reducing the company’s workforce; 2,300 jobs were cut last year.

Bloomberg reports that Jain said GEICO cut 30,000 jobs down to a total of 20,000 but didn’t specify the time period of the reductions.

Images

Featured image: Warren Buffett, Berkshire Hathaway chairman and CEO (Mario Tama/Getty Images News/Thinkstock file)