Axalta sees Q1 year-over-year sales decrease and expects tariff impact of $25 million this year

By onAnnouncements

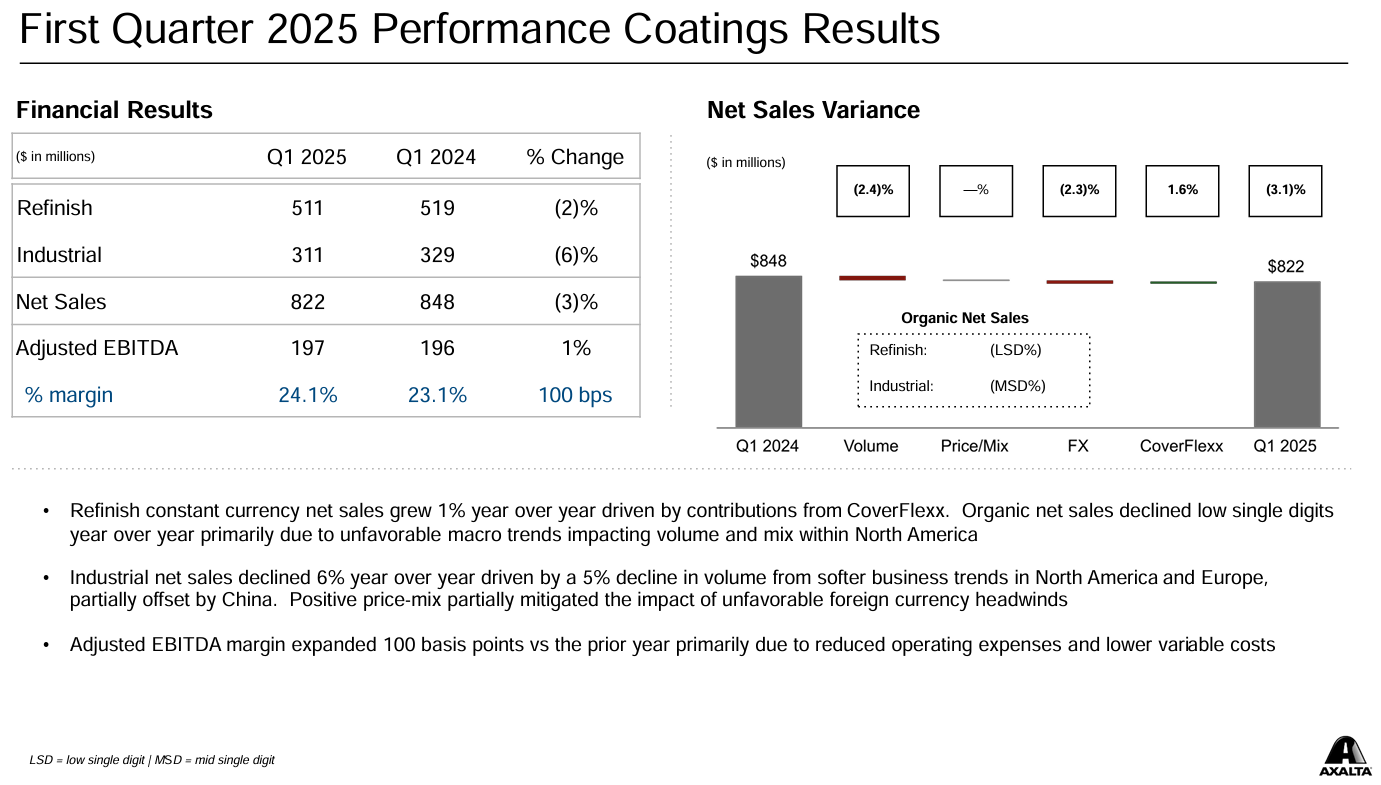

Axalta reported to investors Wednesday that its Q1 net sales decreased 3% year-over-year (YoY) to $1.26 billion, including a 2% decline in Refinish to $511 million, as the company expects tariffs will cost $25 million by year-end and $50 million annually.

During the earnings call, President and CEO Chris Villavarayan said the company is continuing the second year of its plan to improve safety metrics, optimize its supply chain, and open more shops, including 900 during the quarter.

“We’re on track to achieve four of our five financial objectives a full year ahead of schedule, and the teams are executing well across all pillars,” he said. “While the macro environment remains uncertain, the strategic actions we have taken enable us to be more stable and resilient through the cycles. We have consistently demonstrated our competence for strong execution, meaningful cost actions, and margin expansion.”

The company’s net income also increased 154% YoY in Q1 to $99 million, and adjusted EBITDA was $270 million, representing a 4% increase YoY.

According to Villavarayan, Refinish organic net sales performance was above industry trends compared to the same period last year, and organic net sales decreased by 1% while the industry was down mid-single digits. Refinish is expected to outpace industry trends and deliver strong adjusted EBITDA again this year.

“Despite wage inflation, operating expenses decreased by 4% from last year due to savings from our transformation initiative introduced in 2024,” Villavarayan said during the earnings call. “Capital expenditures have nearly doubled compared to Q1 of 2024.

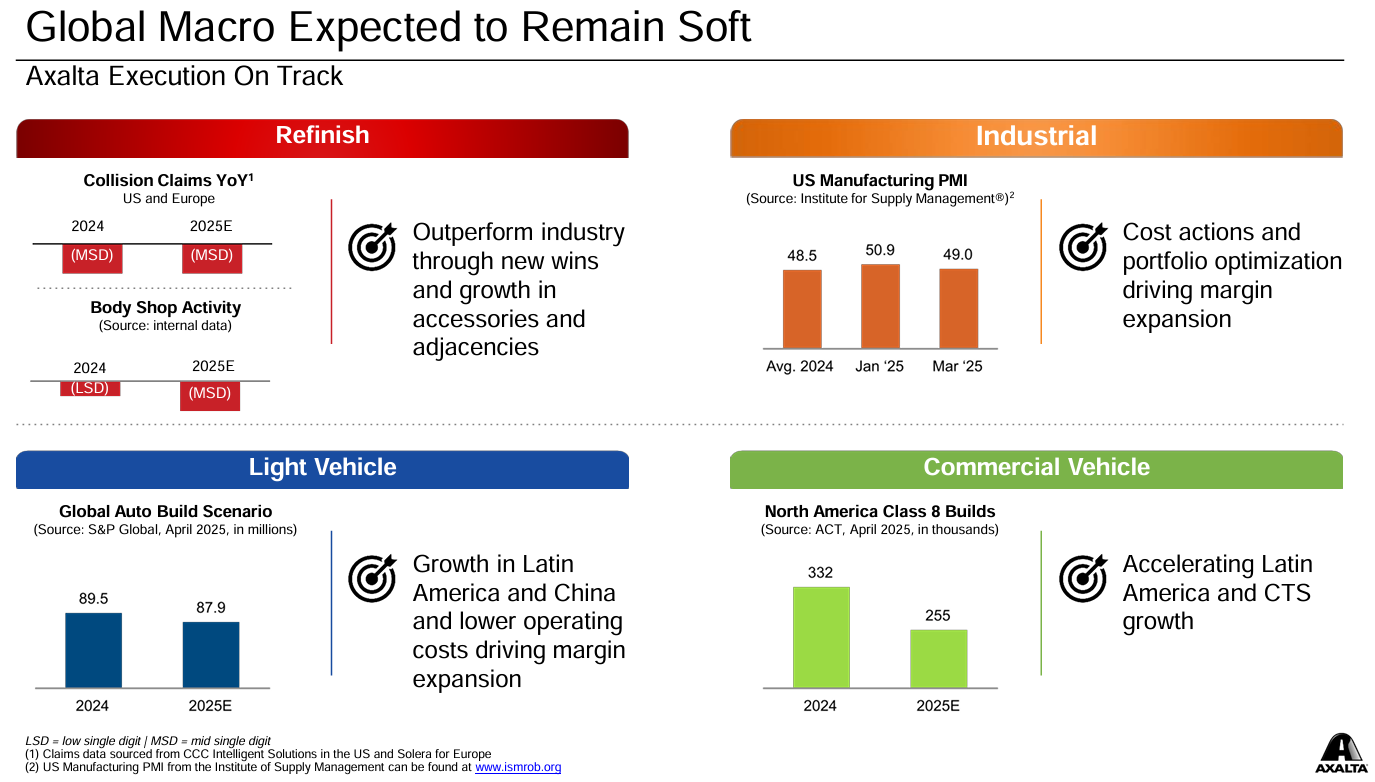

“Based on industry metrics that we track, the external demand pressures experienced in 2024 continue to affect collision claims and body shop repair activity in the first quarter. These factors are driven by insurance premium inflation, increasing repair costs, and waning consumer confidence. Irrespective of the industry dynamics, we were able to add approximately 900 net new body shops, growing adjacencies, and expand further in the economy segment.”

Carl Anderson, senior vice president and chief financial officer, added that Axalta believes raw material costs will be flat, excluding the direct impact of tariffs.

“Our productivity pipeline remains strong and we expect it to drive sustained improvements to our operating model going forward,” Anderson said. “Based on the current economic environment, we are updating our market expectations for the year. Uncertainty persists, and recent industry data is coming in softer than we were forecasting at the beginning of the year.

“We now expect the industry to be down low-single to mid-single digits on a year-over-year basis compared to flat to down low-single digits previously. Insurance claims data continues to post declines in both North America and Europe. Repair costs have increased by over 10% since 2022, and the average age of the car parc is approaching 13 years in North America. These industry drivers, along with higher distribution inventory levels in North America, are expected to offset an increase in miles driven. Our strategy remains unchanged as we continue to add new body shops, expand further into the economy segment, accelerate accessory growth, and look to add bolt-on M&A as evidenced by our execution during the quarter.”

In answer to an investor’s question about how Axalta is handling a downturn in Refinish business, which the questioner noted has historically been a “fairly steady industry,” Villavarayan said there has been a low- to mid-single digit claims decline for at least nine quarters. He said the cost of repairs and total loss write-offs have primarily been the cause of the declines.

“Another aspect of this is insurance premiums, if you look from a 2023 to 2024 basis, have gone up about 20%,” he said. “There’s been a lot of factors that have driven the decline. If you break it down to consumer confidence, one of the things you notice is folks have been pulling collision off their claims, and a lot of it is also related to folks cashing in claims just based on where the economy is.

“Insurance claims are starting to flatline, used car pricing is coming up, which helps, and miles driven is still continuing to go up — we see a 1% increase… I do believe there’s an opportunity for this to become, at least, more stable.”

Villavarayan assured investors that, while there is the risk that inflation will stay up for a bit longer, there are opportunities for that to break. He used shop backlogs of 12-16 weeks caused by the COVID-19 pandemic as an example.

“That is starting to come down, and what you can see is with the reduced backlogs, there’s an opportunity there for repair costs to also go down over time, which will drive more business back into the body shops,” he said.

“Another element of this is with where the tariffs and new car pricing is being driven. Used car pricing going up also creates an opportunity where you have more folks putting cars into the repair bay. And the final aspect of this is the car parc continues to increase. So again, I do believe that there are opportunities for this marketplace to improve — we’re not counting on that… I see the strength of our performance in Q1 as a good sign of market share wins.”

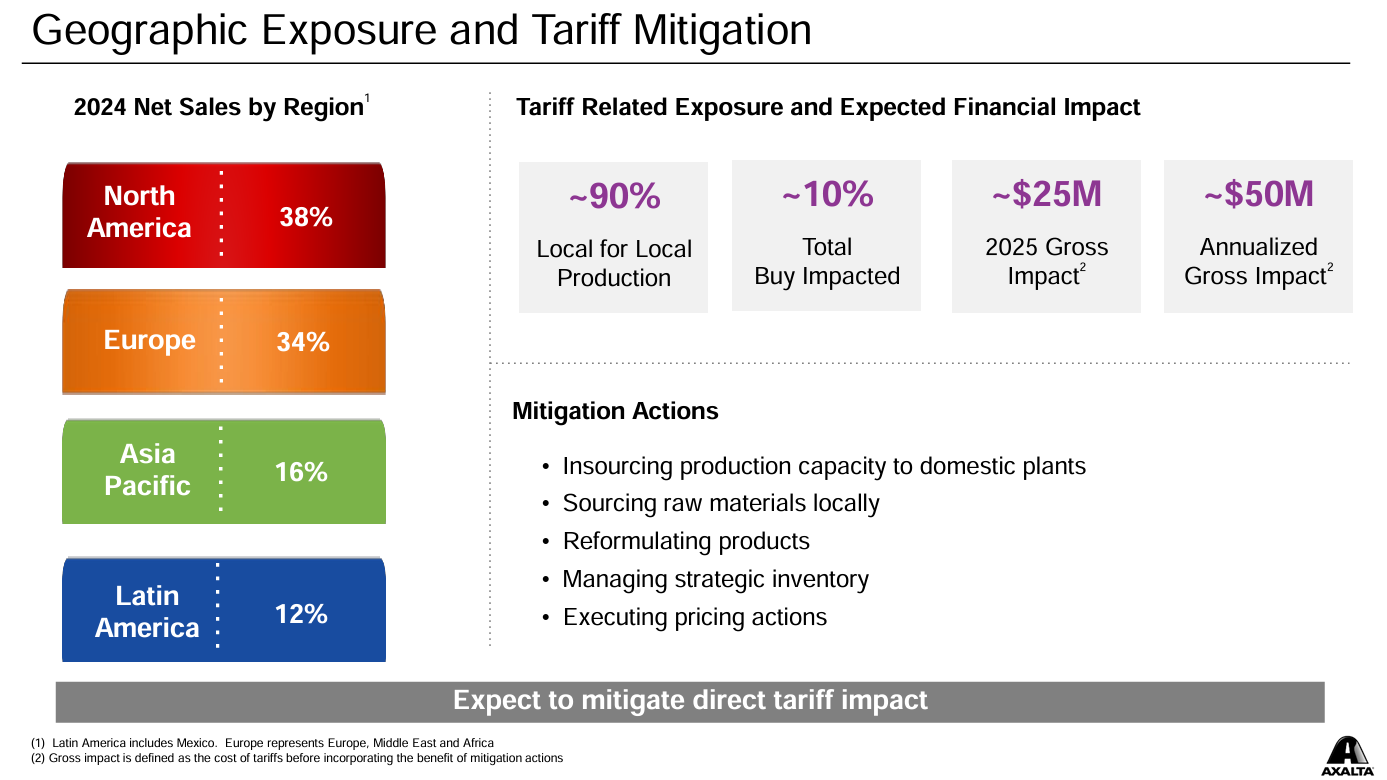

Regarding the impact of tariffs, Villavarayan said there are “four or five levers” that Axalta can pull before increasing prices. He added that the company proactively implemented a 7% price increase ahead of the implementation of the tariffs.

So far this year, collision repair customers have seen weighted average paint and material (P&M) costs increase by an average of 7.4%, according to company announcements from the five major refinish brands.

Letters sent out by industry P&M companies between October and December 2024 and March of this year attribute the cost increases to the challenging economic climate, sustained cost increases, inflationary pressures, and labor, operating, and shipping costs.

If necessary to offset costs, Villavarayan said Wednesday that Axalta could increase manufacturing in North American facilities since there is available capacity. He noted that 90% of Axalta’s products are manufactured and sold within the same region.

In U.S. Refinish, Villavarayan said the company is already working with its engineering teams to reformulate products using supplies available in North America and encouraging distributors to use up inventory until there is more clarity on tariffs.

“We are very confident in offsetting the $25 million tariff impact this year,” he said. “It might take us probably a quarter but we’ll certainly get it done this year.”

Images

Logo and presentation slides provided by Axalta