CDI: Some California shops may be paid up to 3.1% more by Allstate

By onInsurance | Legal

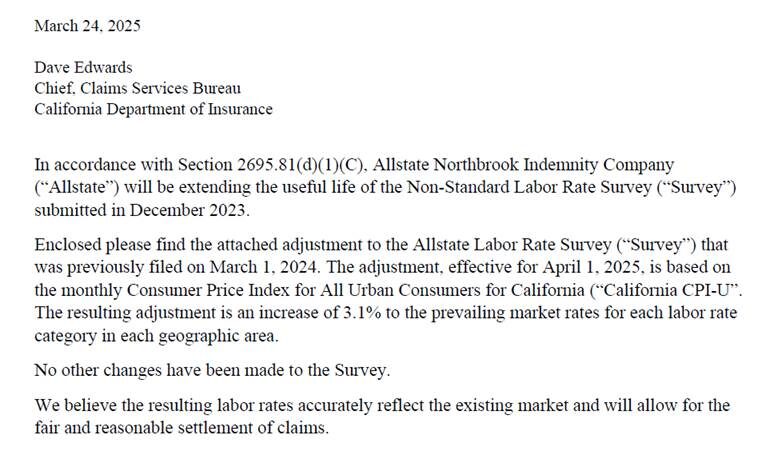

A letter from Allstate Insurance Group to the California Department of Insurance (CDI) that may have caused some confusion in the collision repair industry regarding rates has been clarified by the department.

In April, a reader contacted Repairer Driven News with a portion of the letter citing concerns about its legitimacy, as there was no signature.

CDI responded this week that the document is a cover letter to Allstate’s 2025 labor rate survey update, which is publicly available online via the CDI’s labor rate search portal.

After RDN contacted CDI, the department found an error in the letter that has since been corrected. CDI said Allstate had improperly cited Fair Claims Settlement Practices Regulations Section 2695.81(d)(1)(C), which only pertains to a standardized labor rate survey.

“For this reason, we required Allstate to correct this cover letter,” CDI told RDN. “Auto repair facilities would be aware of this information in the same manner that your reader became aware, by accessing the department’s labor rate search portal… Members of the public can access the portal to view current labor rate surveys that are used by insurers to assist in the settlement of automobile insurance claims. Our experience is that body shops are aware of this search portal and use it to review labor rate surveys used by individual insurers.

“Labor rate surveys reflect individual insurance companies’ review of the labor rates in local market areas. They are not intended to imply an amount that shops can use to raise their labor rates across the board. Body shops that participate in insurer labor rate surveys would provide their rates to insurers to be used in the survey.”

In answer to RDN’s questions about Allstate’s 3.1% rate referenced in the letter, CDI said the increase wouldn’t automatically mean that all shops can increase their rates by 3.1%.

“That would be a shop decision,” CDI said. “However, this means that shops can expect to be paid up to 3.1% more than they were paid previously, depending on what their rates are in relation to the new, increased rates. Insurers are not required to conduct a labor rate survey, and not all insurers do so. Body shops should work closely with individual adjusters in order to come to an agreement on claim settlement amounts on individual claims.”

During Allstate’s Q1 earnings call, Property-Liability President Mario Rizzo said the company’s auto insurance combined ratio was 91.3 in Q1 as average earned premium increases outpaced losses, driven by favorable physical damage loss cost trends. An Allstate press release states the combined ratio was 4.7 points below Q1 2024.

Tom Wilson, Allstate CEO, said there’s a trend in insurance companies reducing the rate of increases for auto insurance.

“I don’t see us moving into an aggressive rate reduction, particularly when you look going forward at the possible impact,” he said.

According to a press release from the company, Allstate’s auto rate increases resulted in an annualized premium impact of 1.4% in Q1.

Images

Featured image credit: Allstate