U.S. property and casualty net combined ratio lowest in over a decade, insurance shopping highest on record

By onInsurance

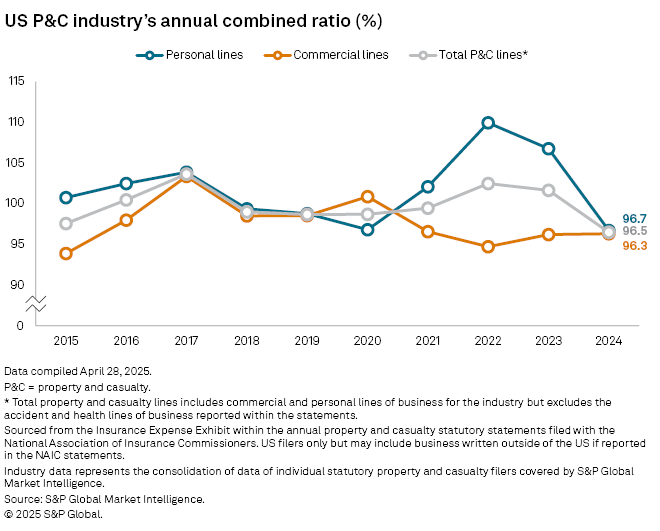

According to S&P Global Market Intelligence, the net combined ratio for the U.S. property and casualty (P&C) industry reached its lowest level in over a decade last year.

The industry’s aggregated P&C lines posted a net combined ratio of 96.5%, marking the best annual performance since 2013, when it was 96.2%, the study found. S&P Global says the figure represents a significant improvement from the previous year’s net combined ratio of 101.6%.

“The drastic improvement can be attributed to better underwriting results in personal lines of business, which include private auto, homeowners, and farmowners insurance,” the study states. “The net combined ratio for personal business lines was 96.7% in 2024, reflecting a year-over-year improvement of approximately 10 percentage points.”

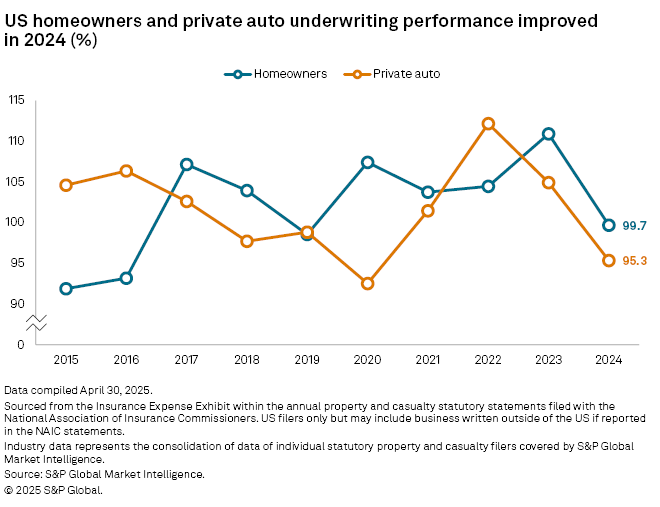

The U.S. private auto insurance sector continues to recover significantly from historically poor underwriting performance in 2022, according to S&P Global.

“Substantial rate increases have helped push the net combined ratio for private auto insurance to 95.3% in 2024, marking a decrease of nearly 17 percentage points from its peak of 112.2% in 2022,” the study states.

In February, the Bureau of Labor Statistics reported that auto insurance rose 11.1% year-over-year — a statistic that SambaSafety says is due to vehicle complexity increasing costs, nuclear verdicts, dangerous driving behaviors, higher crash severity, and medical inflation.

The U.S. Homeland Security & Governmental Affairs Subcommittee on Disaster Management, District of Columbia, and Census held its first hearing on May 13 to examine the insurance industry’s claims practices following recent natural disasters.

Repair costs have also increased, and are expected to go up more this summer following tariffs on imported car parts, which are likely to further increase insurance premiums.

“When you get into an accident, your insurer often has to pay to replace the auto part, and if auto parts were more expensive because it comes from out of the country, then those costs often get passed on to consumers,” said Matt Brannon, Insurify data journalist, according to Fox Business. “The average popular new car would see about a 15% increase because of tariffs, and in terms of insurance, it would go up about 6% year-over-year on top of what it was already going to go up.”

Fifty-seven percent of auto insurance customers have actively shopped for a new policy in the past year — the highest shopping rate ever recorded by J.D. Power, primarily through digital channels.

According to the 2025 U.S. Insurance Digital Experience Study, 47% of shoppers purchase their policies digitally.

“Some insurers are doing this much better than others. Particularly in quoting new policies and comparing prices and coverages, the data shows a stark divide between top and bottom performers, which could have serious effects on new business growth during this period of heightened shopping activity,” said Eric McCready, J.D. Power’s director of digital solutions, in a press release.

According to SambaSafety, a cloud-based driver risk management solutions company, the average number of replacement parts involved in a repair job has grown 15% over the past five years, adding up to half of the total repair cost.

SambaSafety’s report also mentions that tariffs are expected to compound increasing costs, as more than $84 billion in auto parts are imported annually, the report states.

According to the report, the greatest contributing factors to the total cost of repair have been labor and miscellaneous costs, including diagnostics. SambaSafety notes that even minor collisions necessitate the recalibration of sensors and camera systems.

Images

Featured image credit: Mohamad Faizal Bin Ramli/iStock

More information

Automakers announce adjustments due to tariffs, Trump now allowing import adjustment offset