Mitchell: Claims frequency for repairable, collision damaged BEVs increased in Q1

By onMarket Trends

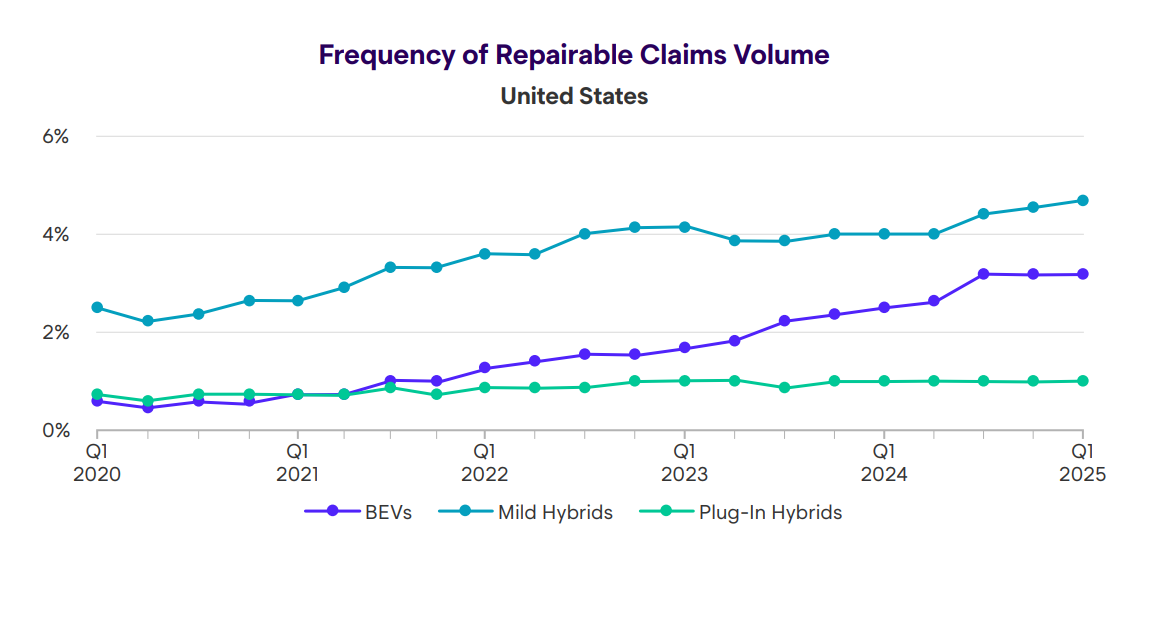

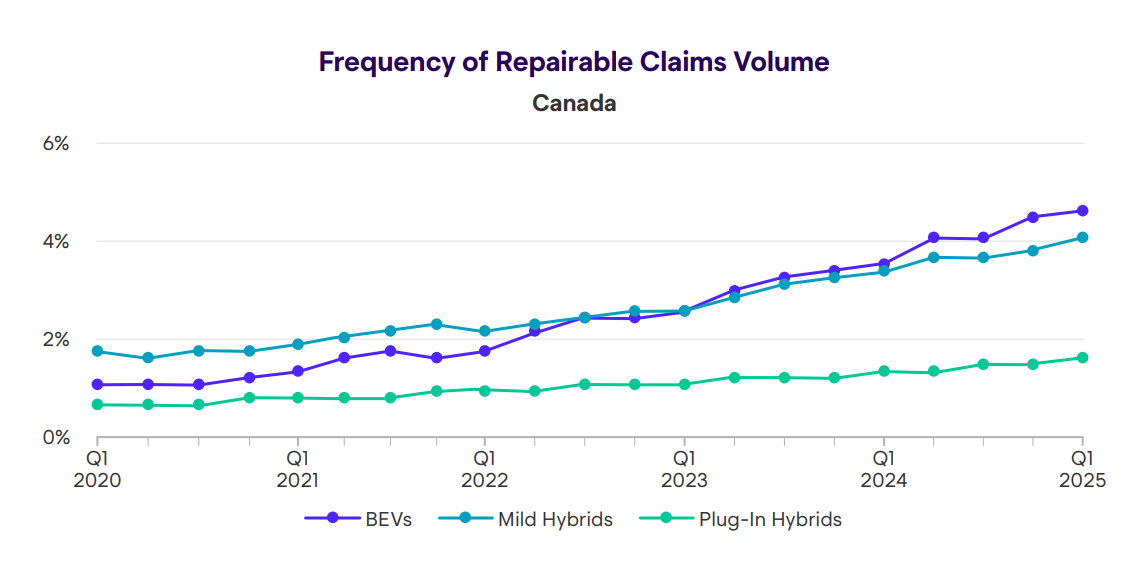

Claims frequency for repairable, collision-damaged battery electric vehicles (BEVs) increased to 3.12% in the U.S. and 4.48% in Canada in the first quarter of 2025, according to a new Mitchell Plugged-In report.

According to the report this is an increase of about 31% in both the U.S. and Canada over Q1 2024 and 2% and 4% increase over the last quarter.

BEV sales are more than 9% of new vehicle sales in the U.S. and 10% in Canada as of March 2025.

“However, consumer adoption of these electrified alternatives is now being threatened by tariffs and the anticipated impact to manufacturing costs and, ultimately, the MSRP of new BEVs as well as the supply of used BEVs,” the report says.

Vehicles imported from outside North America have been subject to a 25% tariff since April 3. BEV automakers that are dependent on European and Asian manufacturing centers will likely have to increase prices to cover the increased costs, such as Hyundai, Kia, Mercedes-Benz, and Nissan, the report says.

Manufacturers who rely on manufacturing in Mexico may avoid additional tariff expenses because, as of now, vehicles and components that are compliant with the U.S.-Mexico-Canada Agreement (USMCA) have no new import taxes. However, OEMs may still make price adjustments.

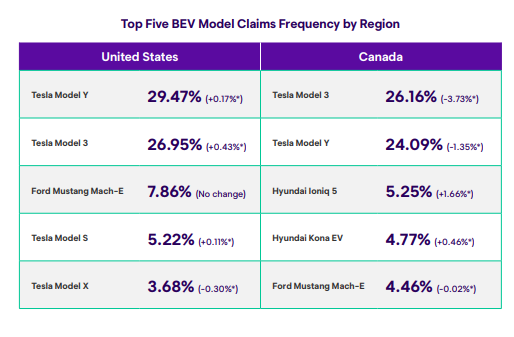

Those dependent on Mexico include the Ford Mustang Mach-E, Volkswagen ID.4, and Tesla models, the report says.

There are also import taxes on raw materials, such as steel and aluminum, and auto parts, the report says. However, an amendment to the original White House Proclamation in April eliminates the compounding of raw material and auto part tariffs as part of the whole vehicle assembly applications.

The amendment also allows all manufacturers that assemble vehicles in the U.S. to temporarily offset a portion of the tariff cost on parts used in the production of new vehicles, according to the report.

“While sheet metal and other cosmetic and structural vehicle parts appear to be immune from the tariffs, other segments of the vehicle, like electrical components, are not,” the report says. “These components include headlamps and tail lamps, which are common to all vehicles.”

BEVs and plug-in hybrid electric vehicles (PHEVs) are more reliant on electrical components than internal combustion engine (ICE) vehicles, the report says. For example, high-voltage batteries and electric motors are two parts that are included in the electric component category, it says.

“As a result, a steep rise in the price of BEVs and PHEVs is expected for those that use imported batteries and motors from outside of North America,” the report says.

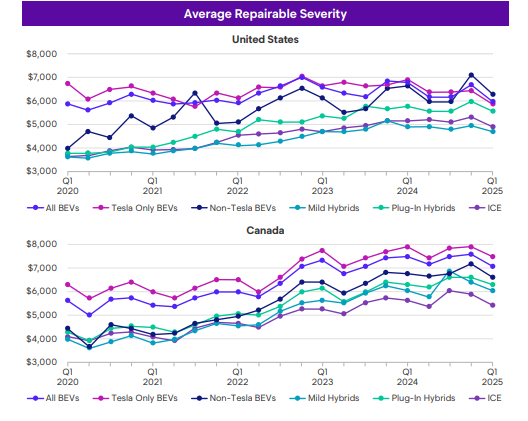

BEVs continue to have the highest claims severity when compared to other vehicle types in Q1, the report says. The average severity was $5,927 for BEVs in the U.S., $5,526 for PHEVs, $4,644 for mild hybrid EVs, and $4,857 for ICE-powered options.

In Canada, the average claims severity was $7,026 CAD for BEVs, $6,253 CAD for PHEVs, $5,972 CAD for MHEVs, and $5,345 CAD for ICE vehicles.

IMAGES

Feature photo courtesy of colony ro/iStock. Embedded graphics courtesy of Mitchell.