LendingTree: More than half of policyholders are not shopping for better rates at time of renewal

By onInsurance

A new LendingTree survey shows that, of those who renewed their policies, 54% didn’t seek additional quotes at renewal, and 81% of those who considered switching by getting at least one quote ultimately decided to stick with their current carrier.

Seventy-nine percent of those who switched said their main reason was to save money, and 92% said they did save. Sixty-three percent saved at least $100 annually. Twenty-two percent of those who switched said they saved at least $200 annually and 28% saved between $100 and $149.

The survey was conducted online from Feb. 20-21, to which nearly 2,000 consumers responded.

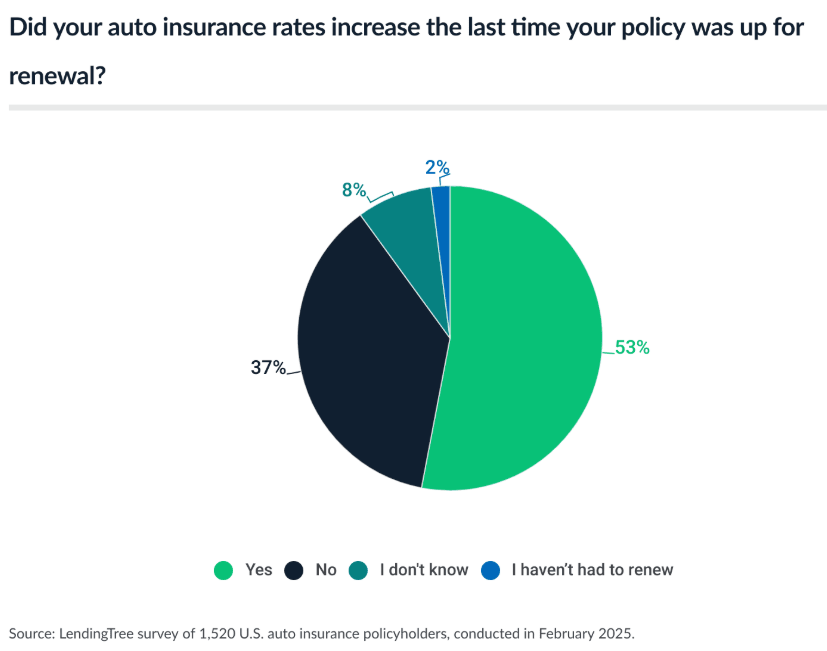

Fifty-three percent of respondents said their rates increased at their last renewal — significantly impacting 61% who reported they’re “somewhat” or “completely” struggling to afford their auto insurance premiums, particularly Gen Zers (76%), those earning less than $30,000 a year (73%), and Millennials (68%).

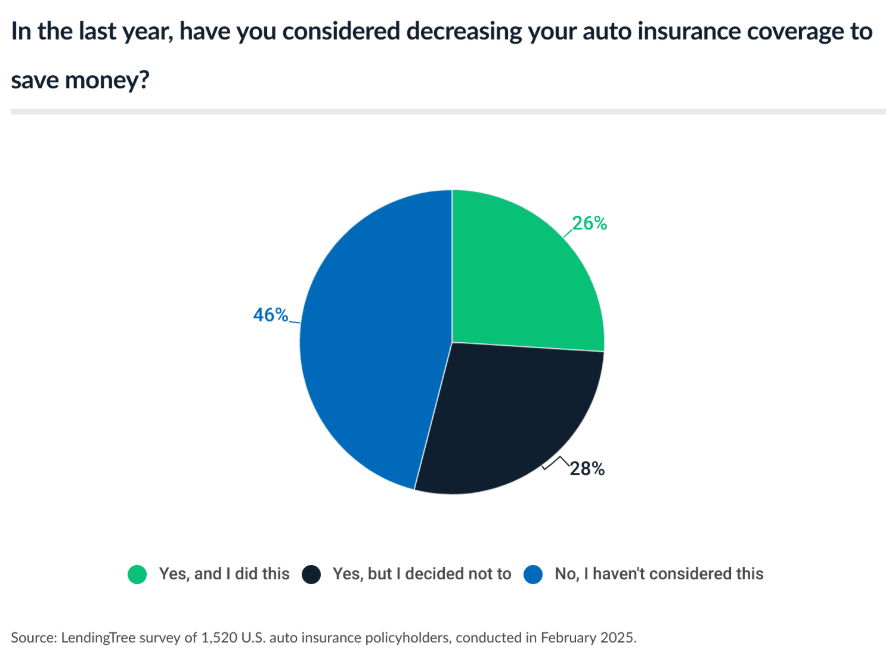

Fifty-four percent of respondents said they’ve considered decreasing their insurance coverage to save money, with 26% doing so. Younger generations are more likely to consider downgrading coverage including 73% of Gen Zers and 66% of Millennials.

“After a few years of sharp rate increases, many insurance companies are trying to win back customers by lowering rates a little,” said Rob Bhatt, of LendingTree auto insurance and a licensed insurance agent, in a LendingTree article about the survey results.

“A company that quoted you a higher rate before may give you a cheaper rate today. Finding a way to save money is always wise but cheaper rates aren’t the only factor to consider when choosing an insurance company.”

For example, LendingTree noted that if had a good claims experience in the past without your rates shooting up, it may be best to stick with the same insurer. Conversely, if your company isn’t treating you well and charges a high rate, it could be a great time to shop around, the article states.

LendingTree found that Gen Zers ages 18 to 28 are more likely to shop around (59%) as well as 54% of Millennials ages 29 to 44.

Full-coverage car insurance is projected to increase by 8% by the end of 2025, from $2,313 to $2,502 on average, according to Insurify.

Last month, California Insurance Commissioner Ricardo Lara approved provisional emergency interim home insurance rate increases to State Farm policies following the January wildfires while raising questions about the company’s financial stability.

The proposed rate increases are 21.8% for homeowners, 15% for renters, 15% for condominium unit owners, and 38% for rental dwellings.

The CDI said in a press release Friday that “unprecedented times call for decisive action,” and the increase is necessary to “safeguard Californians during the ongoing insurance crisis and stabilize the market.”

State Farm must justify the increase with data during an April 8 public hearing.

Ahead of the hearing, the Center for Climate Integrity has released a report that says the average California State Farm policyholder will pay $841 more for homeowners insurance in 2025 than they did in 2023.

“The insurance crisis is a direct result of the climate crisis that Big Oil has caused. Before insurers raise rates, they should stand up for their policyholders and fight to recover damages from the fossil fuel corporations whose climate pollution, obstruction, and disinformation are driving up costs for Californians,” said Richard Wiles, president of the Center for Climate Integrity, in a press release.

The largest percentage and dollar increases between 2023 and 2025 occurred in zip codes along the Sierra Nevadas where wildfire risk is higher and in Southern California where there is a higher risk of wildfires and rising seas.

Images

Featured image credit: Yuliya Taba/iStock