Finance Buzz finds large percent of consumers are not confident in their understanding of auto insurance policies

By onInsurance

Many consumers don’t have confidence in their understanding of their current auto insurance coverage, according to a new report from Finance Buzz.

Overall 39% of consumers said they are somewhat confident (37%) or are a little confident (12%) in their understanding of their coverage, the 2025 Auto Insurance Statistics and Consumer Report says.

Yet, more than half of 1,000 adults surveyed said they are mostly (37%) or completely (23%) confident in their understanding, the report says.

The report also found that auto insurance premiums have increased by 45% since 2019 with insurance rates ranging anywhere from $1,230 (in Wyoming) to $4,312 (in Washington D.C.) annually.

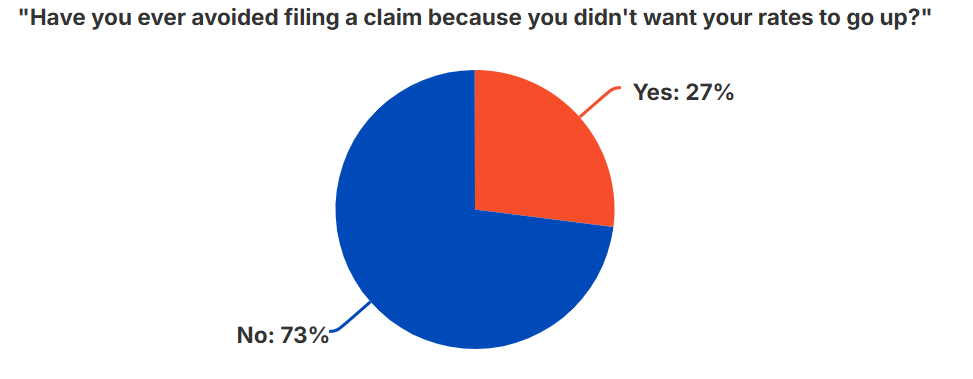

About 1 in 10 Americans have said they’ve skipped a car insurance payment due to high costs, the report says, and more than a quarter of drivers have avoided filing a claim because they did not want their insurance rates to go up.

“When a customer files a claim with their insurance company, it can and often does increase the amount they’re charged for their premiums in the future,” the report says. “For instance, when the accident in question caused minor or superficial damage, drivers could potentially choose not to file an otherwise legitimate claim because they do not want their rates to increase.”

Finance Buzz found that monthly premiums are, on average, 43% more expensive for drivers with an accident on their record compared to the overall average premium cost.

IMAGES

Feature image courtesy of bymuratdeniz/iStock

Graph courtesy of Finance Buzz