J.D. Power: Insurance shopping still up, carrier focus shifting to traditional rate approaches

By onInsurance

The latest Loyalty Indicator & Shopping Trends (LIST) report from J.D. Power and TransUnion shows that auto insurance shopping remains elevated and switching is flat.

According to the Q1 report, the shopping rate was 14.1% in Q1, up 0.8 points quarter-over-quarter and 1.3 points year-over-year.

The switching rate was 4.1%, down 0.1 points quarter-over-quarter and up 0.2 points year-over-year.

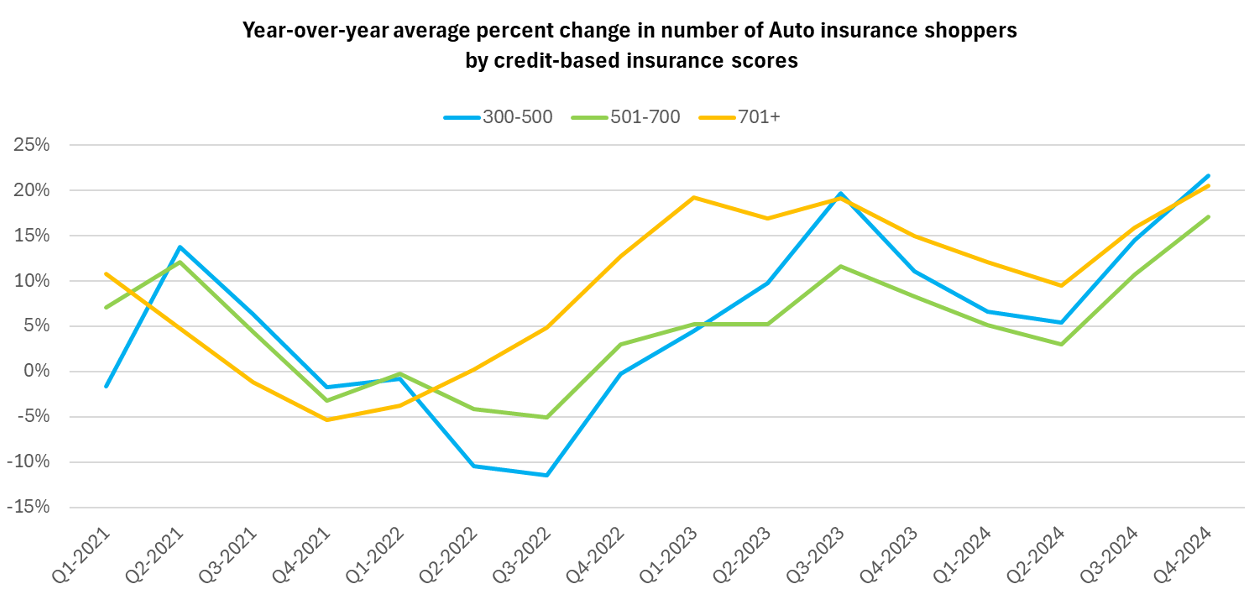

“Shopping rates steadily increased throughout 2024, ending Q4 at 20% above the prior year for both auto and property [insurance],” the report states. “For auto, focus is shifting toward increasing policy growth and returning to traditional rate approaches, higher premiums assessed to higher risks.”

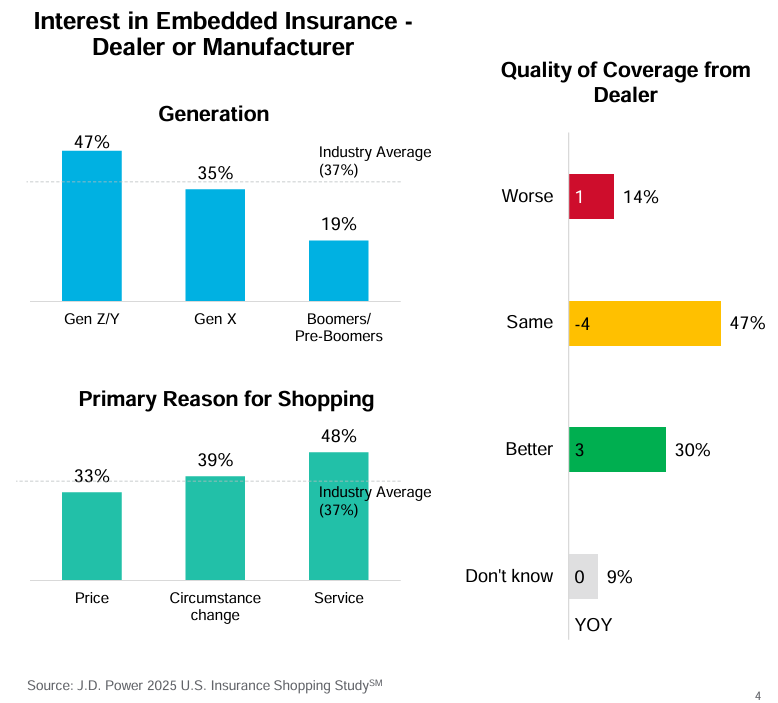

Based on J.D. Power’s 2025 U.S. Insurance Shopping Study, 37% of customers say they are interested in embedded insurance either from the dealer or manufacturer.

In December, J.D. Power predicted auto insurance policyholders would continue shopping for lower rates this year and a possible uptick in usage-based insurance (UBI) adoption.

Interest in embedded insurance is particularly high among the Gen Z/Y group (47%) and among those who say they are shopping primarily for service reasons (48%).

However, while customers are most likely to believe the service and quality from embedded insurance purchased through a dealer will be the same or better than traditional channels, 37% think the cost will be higher, according to the LIST report.

A new LendingTree survey shows that of those who renewed their policies, 54% didn’t seek additional quotes at renewal, and 81% of those who considered switching by getting at least one quote ultimately decided to stick with their current carrier.

Seventy-nine percent of those who switched said their main reason was to save money, and 92% said they did save. Sixty-three percent saved at least $100 annually. Twenty-two percent of those who switched said they saved at least $200 annually and 28% saved between $100 and $149.

A recent report from Finance Buzz found that many consumers don’t have confidence in their understanding of their current auto insurance coverage.

Overall, 39% of consumers said they are somewhat confident (37%) or are a little confident (12%) in their understanding of their coverage, according to the 2025 Auto Insurance Statistics and Consumer Report.

The report also found that auto insurance premiums have increased by 45% since 2019, with insurance rates ranging anywhere from $1,230 (in Wyoming) to $4,312 (in Washington D.C.) annually.

Images

Featured image credit: AsiaVision/iStock

Graphs from J.D. Power/TransUnion Q1 2025 LIST report