Calif. insurance trade groups misquote Repairer Driven News ‘excerpt’ in message to CDI

By onAssociations | Business Practices | Insurance | Legal

A Tuesday message to the California Department of Insurance by several insurance trade organizations on a proposed antisteering regulation misquotes a September Repairer Driven News article to make the insurers’ point.

For the record, here’s what we published:

‘Any other statement’

Another interesting proposed change involves rewording the description of prohibited unsubstantiated comments from “has a record of poor service or poor repair quality, or of other similar allegations against the repair shop” to “has a record of poor service or poor repair quality, or making any other statement to the claimant with respect to the chosen repair shop.”

This is interesting because one could sort of read it as barring misleading positive speech that an insurer makes about its own DRP shop selected by a customer.

Our point was simple: The proposed regulation implies that an insurer couldn’t mislead a customer through praise. For example, by complimenting a selected DRP shop that the insurer knew to have quality control issues or a number of complaints.

Here’s how the Association of California Insurance Companies, American Insurance Association, Pacific Insurance of Domestic Insurance Companies, Personal Insurance Federation of California, National Association of Mutual Insurance Companies and the California Chamber of Commerce represented it Tuesday in their public comments, a copy of which were provided by the California Autobody Association.

For the sake of clarity, we’ve added minor formatting changes like indents and applying red, underlined type to differences.

Section 2695.8 subdivision (e) (3) The proposed revision inserts the following standard: “if the statement is known to be, or should by the exercise of reasonable care be known to be, untrue, deceptive or misleading.” This appears to be a legal standard that will not be easily understood by people directly affected by it. What does exercise of reasonable care be known to be, untrue, deceptive or misleading mean? Will word of mouth satisfy such a standard?

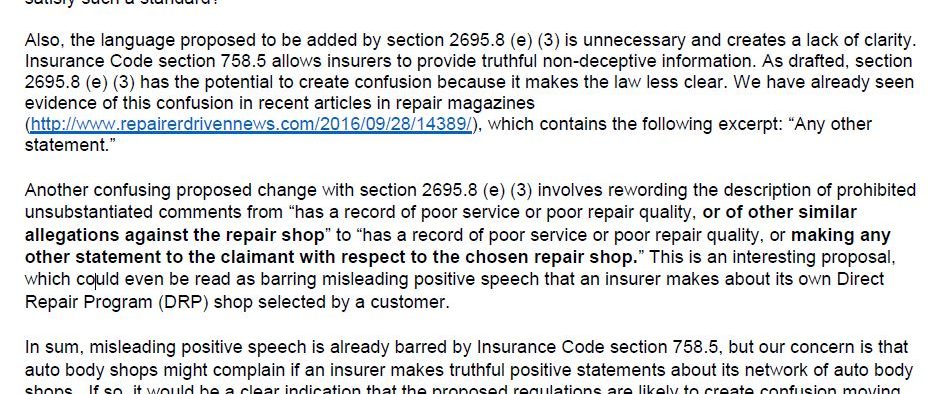

Also, the language proposed to be added by section 2695.8 (e) (3) is unnecessary and creates a lack of clarity. Insurance Code section 758.5 allows insurers to provide truthful non-deceptive information. As drafted, section 2695.8 (e) (3) has the potential to create confusion because it makes the law less clear. We have already seen evidence of this confusion in recent articles in repair magazines (http://www.repairerdrivennews.com/2016/09/28/14389/), which contains the following excerpt:

“Any other statement.”

Another confusing proposed change with section 2695.8 (e) (3) involves rewording the description of prohibited unsubstantiated comments from “has a record of poor service or poor repair quality, or of other similar allegations against the repair shop” to “has a record of poor service or poor repair quality, or making any other statement to the claimant with respect to the chosen repair shop.”

This is an interesting proposal, which could even be read as barring misleading positive speech that an insurer makes about its own Direct Repair Program (DRP) shop selected by a customer.

Images of the originals can be seen below.

The “excerpt” in the trade groups’ message alters the original wording in a few minor places, and then most egregiously at the start. Changing “interesting” to “confusing” not only misquotes us, it alters the entire sentence’s meaning. The two words have completely different definitions and connotations. The word “confusion” does not appear in the article.

It’s ironic insurers have misrepresented something while opposing a regulation designed to deter their industry from alleged misrepresentations.

The groups appear to use that misquote to reinforce their conclusion:

In sum, misleading positive speech is already barred by Insurance Code section 758.5, but our concern is that auto body shops might complain if an insurer makes truthful positive statements about its network of auto body shops. If so, it would be a clear indication that the proposed regulations are likely to create confusion moving forward.

The proposed regulation doesn’t prohibit truthful statements, positive or negative. It prohibits any statement “known to be, or should by the exercise of reasonable care be known to be, untrue, deceptive or misleading.” These are not necessarily mutually exclusive.

For an example of where a shop — or state — might criticize a truthful statement as misleading, see the dispute between Minnesota and Safelite regarding what the state called its alleged practices on behalf of AAA.

The spring version of the CDI regulation document was stricter but less subjective. It bars false or misleading statements “without clear documentation in the claim file supporting these statements.”

More information:

Insurance trade group comments to California Department of Insurance

California Department of Insurance, copy provided by California Autobody Association, Oct. 11, 2016

“Proposed Calif. ‘anti-steering’ regulation softens on documentation, adds third-party claim rule”

Repairer Driven News, Sept. 28, 2016

Featured image: A Tuesday message to the California Department of Insurance by several insurance trade organizations on a proposed antisteering regulation misquotes a September Repairer Driven News article to make the insurers’ point. (Public comment to CDI provided by California Autobody Association)