Gerber Collision parent company, Romans offer perspective on collision repair consolidation

By onBusiness Practices | Education | Market Trends

Collision industry consolidation has slowed, but it hasn’t stopped, industry analyst Vincent Romans said Aug. 9, and a day later, the CEO of one of the nation’s largest consolidators told investors a “healthy pipeline of targets” remained.

Boyd Group CEO Brock Bulbuck, whose firm owns Gerber Collision and the Canadian MSOs Boyd Autobody and Assured Automotive, told analysts on an Aug. 10 quarterly earnings call that Gerber had spread to 24 states. He said the recent additions of Wisconsin and Alabama shops gave the company two more states and made sense because of Gerber’s nearby regional concentration. (The shops will be managed out of the Chicago and Atlanta markets, respectively, where Gerber already has a presence, Bulbuck said.)

Asked about the competition for deals today compared to 2017, Bulbuck said there was no real difference except for maybe a “slightly heightened competitiveness” since ABRA had returned to pursuing growth. He said the most meaningful trend he could comment upon was the existence of numerous growing regional MSOs.

Financial consulting firm FOCUS offered a similar assessment in a July report.

“Many of the next 150 largest MSOs in have been rapidly growing on their own, most often by picking up the single shops in their respective markets,” FOCUS wrote.

Bulbuck said the growing regional MSOs could be opportunities for some acquisitions, and many of those regional players had 10-15 shops, or even 15-20 locations.

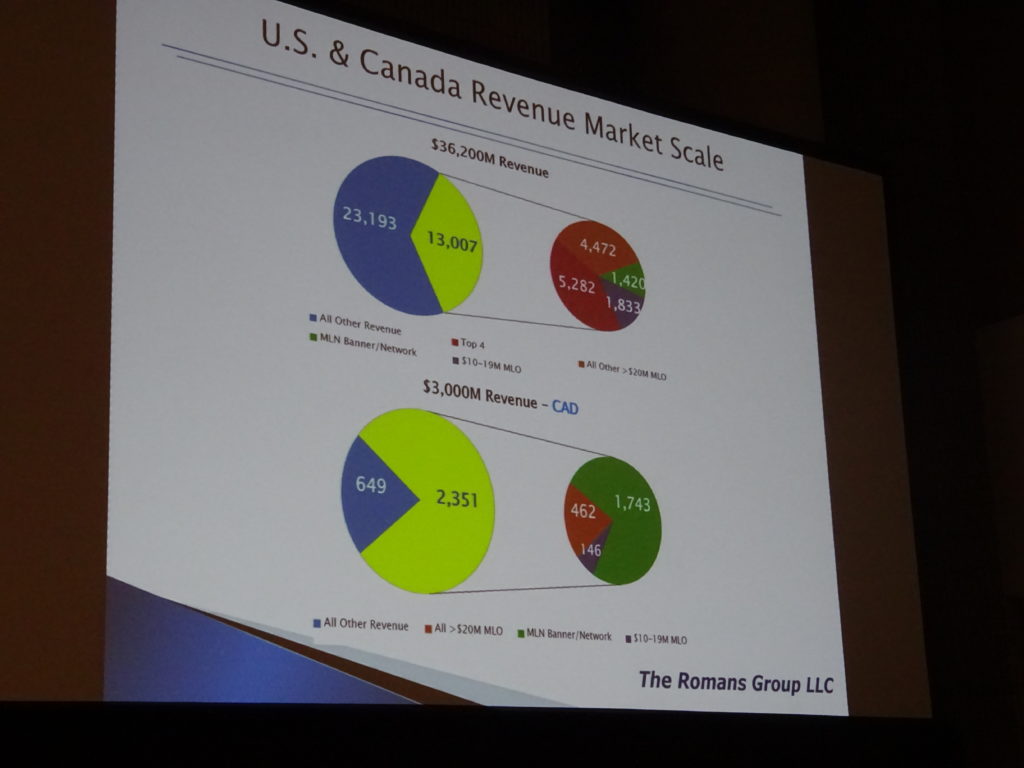

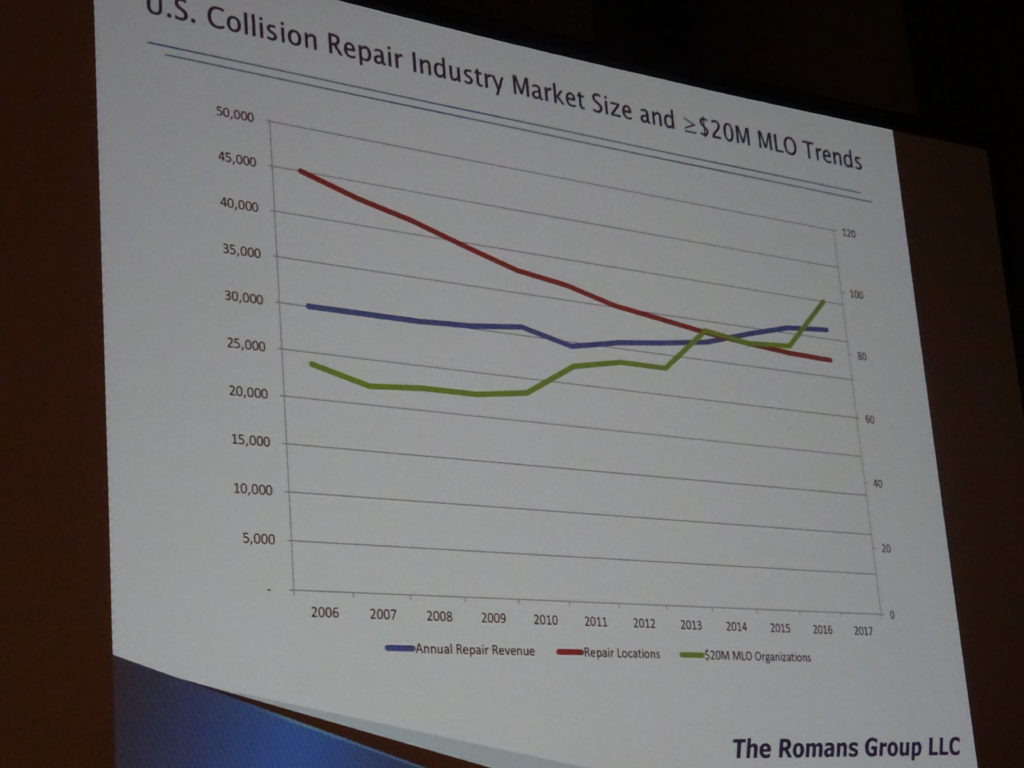

Romans, founder of the Romans Group, told the NACE MSO Symposium that the multi-location companies doing $20 million a year or more in sales went from 9.1 percent of the $30 billion collision industry revenue in 2006 to 26.9 percent of the $36.2 billion market in 2017.

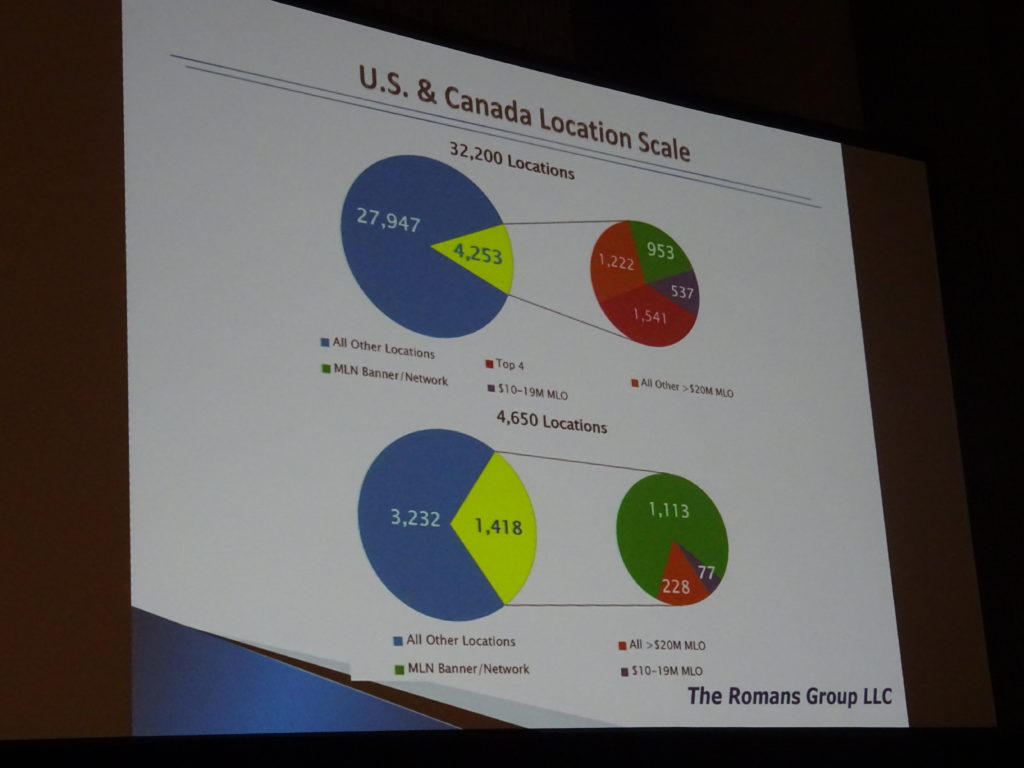

Those operations had nearly doubled in number during that time, from 57 in 2006 to 96 by the end of 2017, based on Romans’ estimate. (It was the highest number of $20 million businesses ever for the industry, he said.) They represented around 2,763 shops out of the 32,200 U.S. market.

The MLOs doing between $10 million and $20 million were another $1.42 billion in revenue and controlled 537 more locations in 2017.

Altogether, all of the businesses doing $10 million or more represented 35.9 percent of the $36.2 billion US. market at the end of 2017.

According to Romans, while the top four MSOs held 1,813 facilities as of early August, that was a mere 5.6 percent of the locations that his company considered “relevant.”

He said they had 14.6-15 percent of the U.S. market share from a revenue perspective, which worked out to about $2.93 million a shop.

Romans also observed that the “banner” organizations like Certified Collision Group were starting to see growth, though that business model wasn’t as dominant as in Canada. He thought he’d include them in Romans’ 2018 analysis. “They are making progress,” he said.

Consolidation was down from 2014, when nearly $1 billion in revenue and 291 locations were purchased (and this data didn’t include single-shop purchases, only the sale of other MLOs), according to Romans. He estimated that as of July 31, about 39 locations and $132 million in revenue had been purchased this year.

However, Romans said that more private equity money entering the industry and the need for shops to invest in equipment to achieve certification could accelerate the decline in total U.S. shop count, dropping it below 30,000. The 32,200 locations in existence today were in Romans’ opinion “too many shops.”

Romans also directed the crowd to a couple of private equity consolidator names that might have flown under the radar.

Carousel Capital, which owns Joe Hudson’s Collision Center, has helped grow that company past the $100 million mark, according to Romans. He estimated Joe Hudson’s ranked No. 8 among non-dealership auto body chains and said it is aggressively buying shops. Pro Care Automotive and Collision, backed by Kinderhook Industries, also has topped $100 million in sales, Romans said.

Four private equity companies are also building networks of Maaco shops, in some cases rolling up 40-50 locations, according to Romans. (Which is ironic, for the franchisor itself is owned by private equity outfit Roark Capital).

“This is all pretty new stuff,” he said.

When all repairers are considered, Caliber was No. 1 in 2017 U.S. revenue, followed by Service King, ABRA, Gerber and CARSTAR, according to Romans’ estimates. The remainder of the Top 10 in the U.S. were Maaco, AutoNation, Fix Auto, Hendrick Automotive and Berkshire Hathaway Automotive, according to Romans.

If you look at combined U.S. and Canadian revenue, Caliber still is No. 1, followed by Service King, Gerber/Boyd, ABRA and CARSTAR, according to Romans. Fix Auto USA/Fix Auto Canada, Maaco, Collision Solutions Network, Auto Nation and Hendrick round out the remainder. As noted above, Romans’ analysis did not include U.S. banners, only Canadian ones.

Romans said he would think dealerships would be poised to thrive with the opportunity of OEM certification, but 2017 was “pretty flat” in that regard. Some dealerships want to grow, but it’s “few and far between,” he said. Looking purely at U.S. dealerships’ collision operations, AutoNation was “far ahead” of the others, he said.

More information:

“Boyd Group Income Fund Reports Second Quarter 2018 Results”

Boyd Group, Aug. 10, 2018

Boyd group second-quarter 2018 earnings call

Boyd Group, Aug. 10, 2018

Boyd Group second-quarter 2018 report

Boyd Group, Aug. 10, 2018

Images:

Consolidation was down from 2014, when nearly $1 billion in revenue and 291 locations were purchased (and this data didn’t include single-shop purchases, only the sale of other MLOs), according to Romans Group founder Vincent Romans. He estimated that as of July 31, about 39 locations and $132 million in revenue had been purchased this year. (Simon Carter Peter Crowther/iStock)

Collision industry consolidation has slowed, but it hasn’t stopped, industry analyst Vince Romans of the Romans Group said Aug. 9, 2018, at the NACE MSO Symposium. (Slide by the Romans Group; John Huetter/Repairer Driven News)

When all repairers are considered, Caliber was No. 1 in 2017 U.S. revenue, followed by Service King, ABRA, Gerber and CARSTAR, according to Romans Group founder Vincent Romans’ estimates. The remainder of the Top 10 in the U.S. were Maaco, AutoNation, Fix Auto, Hendrick Automotive and Berkshire Hathaway Automotive, according to Romans. (John Huetter/Repairer Driven News)