Biden details next EV plan steps, Mitchell concludes EVs ‘not going away’ as sales & claims continue to climb

By onMarket Trends

The Biden-Harris administration announced on Wednesday the next steps in establishing minimum standards for federally-funded electric vehicle (EV) infrastructure and implementation — a car parc that Mitchell International isn’t going away.

“This is a major step toward a world where every EV user will be able to find safe, reliable charging stations anywhere in the country,” said U.S. Transportation Secretary Pete Buttigieg. “We’re establishing common, universal standards for EV charging stations just like the ones for gas stations so that recharging an EV away from home will be as predictable and accessible as filling up a gas tank.”

While discussing Mitchell’s inaugural quarterly “Plugged-In: EV Collision Insights” report with Repairer Driven News, Director of Claims Performance Ryan Mandell says it will serve as a necessary resource for collision repairers and insurers as the EV parc increases.

“We started seeing the data… mature a lot more and seeing a wider variety of EV models that were coming into the marketplace,” he said, referring to Q4 2022. “We felt this was a great opportunity at the start of the year to really say, ‘Listen, this is a trend that is not going away. This is something where we feel this is important for repairers and insurers; both in terms of understanding the impact that this new propulsion type is going to have on the industry and now seeing that it’s picked up traction.'”

The timing of the new report also coincides with Mitchell’s development of “forward-looking” software to be compatible with EV estimate writing, he added.

In 2022, EV sales “hit a tipping point,” representing 5.6% of all new vehicles sold, according to Kelley Blue Book. Mitchell noted that as consumer adoption has increased so has the number of vehicle manufacturers, including Audi, General Motors, and Volvo, who pledge to go all-electric in the future thus putting more of these automobiles on the road and, potentially, in a collision repair shop. Ford, Toyota, and Nissan plan to reach carbon neutrality by 2050.

Along with the increasing number of EVs hitting the road has come a rise in the number of EV claims. New vehicle sales have decreased by 15% overall throughout the COVID-19 pandemic but gross EV sales increased 5%, according to data Mandell has tracked. That’s an indication, he said, that EV trends aren’t following the same trends as internal combustion engine (ICE) vehicles.

While there’s the theory that increasing EV sales have to do with increasing fuel prices, Mandell said there has still been growth in EV sales even as gas prices have come back down, which he believes to be because EV models have become more diversified to “appeal to larger segments of society” from sedans to pickup trucks and the functionalities they offer.

“We’re seeing the infrastructure improve and you’re seeing a wider availability of charging points,” he said. “That is going to mean that you’re just reducing that range anxiety for people.

“Some people are going to have that green push to want to own an EV and there’s still some people that think they’re cool and it’s a new thing. It’s a new technology and they want to be a part of that. There’s less barriers to entry for a consumer now than there used to be as far as price, where you can charge, and also just what the vehicles look like.”

Biden’s federal action includes finalizing the “Build America, Buy America” implementation plan for EV charging equipment and opening the application window for the first round of $2.5 billion in competitive grants to build EV charging stations in communities across the country.

U.S. Secretary of Energy Jennifer M. Granholm said the plans will “address challenges to widespread EV adoption by clearing the path for a nationwide network of chargers that is even more accessible and affordable than traditional gas stations.”

“This historic undertaking will spur economic growth powered by American workers who will deliver on President Biden’s goals for America to lead the world in EV manufacturing and adoption,” she said.

The minimum standards will help ensure that chargers operated by different networks will operate similarly and provide the traveling public with a predictable EV charging experience, including consistent plug types and charging speeds, common payment systems, and availability regardless of vehicle model or the state the charger is located in, according to the U.S. Department of Transportation (USDOT).

Based on data from Q4 2022, Mitchell’s EV report documents:

-

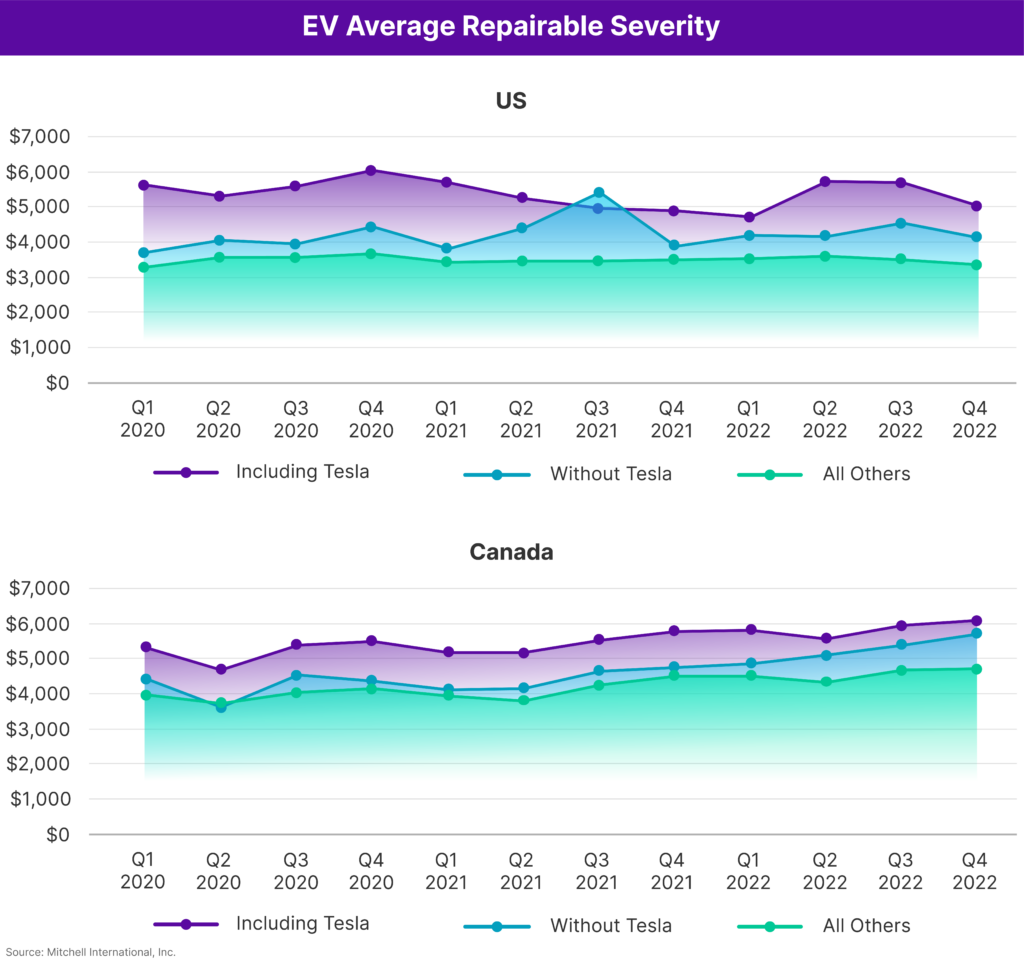

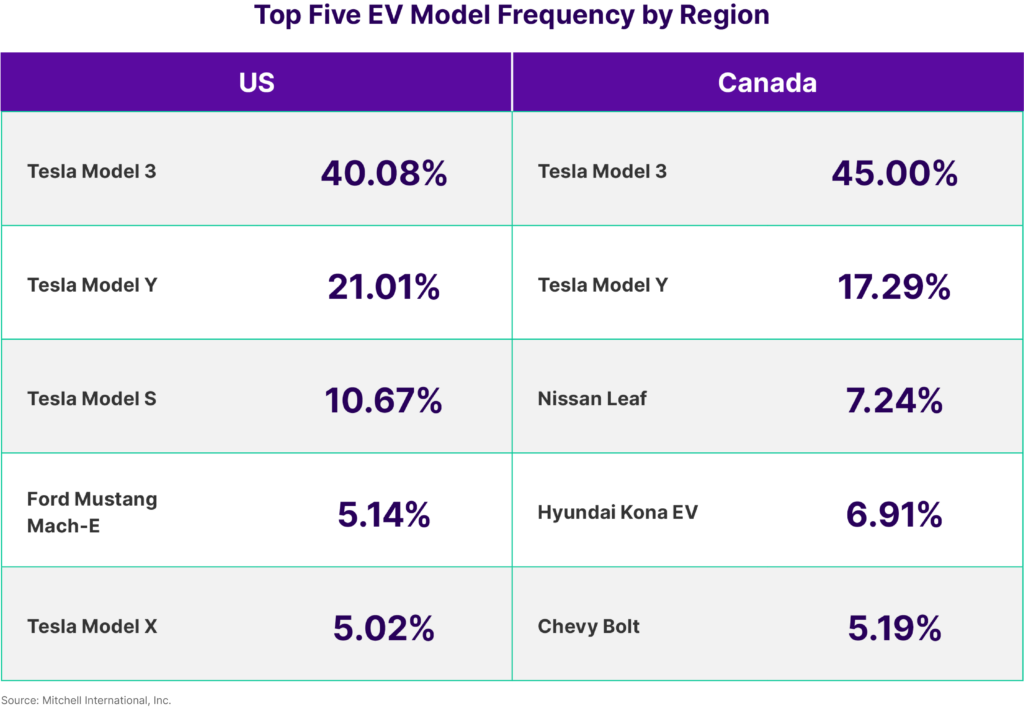

- EV repairable claims increased slightly to 1.1% in the U.S. and 2.26% in Canada while Tesla continues to dominate, holding more than 70% of the market in both;

- The average percentage of EV parts repaired increased from 11.05% in Q3 2022 to 12.16% “suggesting that repair facilities may be improving their capabilities to repair lighter weight substrates;” and

- The average number of mechanical EV labor hours still outpaces ICE vehicle labor hours by 1.7 hours.

“I was surprised that the percentage of parts repaired was increasing slightly,” Mandell said. “I think that is indicative of the investments that shops are making. I would say that as we move forward in time, these are going to be the vehicles that are on the cutting edge of the use of new types of materials — aluminum and carbon fiber and those kinds of things. But when you look at some of these studies that have been done over the past few years, there’s really going to be, I think, this new suite of materials that we start to see in the industry.

“So, for collision repairs to stay on top of those trends, working on EVs gives you foresight into where I think the rest of the industry is going to go when it comes to those types of materials and being able to work on those types of materials, whether it’s welding or any sort of repair work.”

He suggested shops that have never worked on EVs should start by looking at the car parc in their market — are there enough that aren’t required to be repaired at OEM-certified shops that could make it to your shop? Those that decide they should step into the EV repair world could then start out with training their technicians through I-CAR, Mandell said.

However, Mandell writes in the report that a portion of the increase in parts repaired could have to do with ongoing supply chain disruptions and the lack of replacement parts available. EV part repair frequency continued to lag behind ICE vehicles during Q4, ending the quarter at 19.18% compared to 18.83% by the end of Q3.

“The way some vehicles are designed, you have to replace a part,” Mandell said. “Oftentimes, that’s prohibitive and can actually create a total loss outcome. In order to capture as much business as possible, I think repairers need to be aware of how to be able to process these vehicles in an efficient manner and affect repairs on them — be able and repair certain parts — so that they can keep more of that business in their shop without having to total vehicles.”

However, Mitchell hasn’t seen an increase in the number of EVs that are totaled due to repair complexity, parts availability, and/or cost because they retain a higher actual cash value (ACV) than ICE vehicles, he added.

“There’s more of a salvage value and the repairs are costlier but that ACV simply outweighs those other factors,” he said.

Mandell also found that 90.11% of EV repairs used OEM parts. He attributes that not only to OEMs restricting their parts to OE-certified shops but also to there not being alternative aftermarket parts due to patents held by automakers and a small pool of salvaged EVs available to recyclers.

“I think that number is going to change over time,” he said. “I think we will see a reduction in the percentage in the OEM percent of parts use it simply as more alternatives start to hit the market.”

Collision repairers aren’t the only ones in the auto industry that Mandell says need to adjust their business practices and thinking to EVs. Insurance carriers also need to evaluate their underwriting practices specifically for EVs rather than matching repair cost estimates to EV versions of ICE vehicles to their ICE counterparts.

“It’s essentially treated as a different trim package, almost,” he said. “It actually is a challenge that insurance companies need to understand and create a process and a strategy around how do we properly price these vehicles moving forward?”

In the report, Mandell notes that the average EV supplement delta, meaning the percentage of the final cost of the repair estimate that comes from supplements, was 27.45% in Q4.

“You have a greater supplement delta with EVs, which means that when you’re writing the estimate and you’re committing that original estimate, there’s just more unknowns before you get into it because I think the repair procedures are more complex and more detailed and when you’re looking at the backlogs in collision repair right now, estimates are being written five to six weeks before the repairs can get started. You’re committing that initial estimate and you don’t have the opportunity to tear it down during the course of the initial estimate unless the vehicle is non-drivable.”

To access the report and subscribe to future issues, visit www.mitchell.com/plugged-in.

Images

Featured image credit: Daisy-Daisy/iStock