In-vehicle subscriptions: Consumer interest remains low & skeptical of data security

By onTechnology

Based on recent Cox Automotive and Dialexa research, the success of in-vehicle subscriptions, also known as Features on Demand (FoD), depends on usefulness, pricing, and data security measures.

Cox Automotive’s consumer research study “Software Monetization: The Emergence of Vehicle Features on Demand,” released earlier this month, suggests automakers may face challenges if they expect to generate significant FoD revenue.

More than 2,000 in-market vehicle shoppers were surveyed by Cox Automotive for the study in late December 2022 and early January 2023 to determine their interest in vehicle features through subscription services. The company also looked at FoD consumer benefits and barriers.

“Our initial research indicates that the transition to Features on Demand will be an uphill battle for many automakers,” said Vanessa Ton, Cox Automotive senior manager of market and customer research. “In the market right now, there is low consumer awareness and some skepticism on the part of shoppers. To gain consumer acceptance, automakers must ensure consumers perceive subscription-based features as a good value and not just a money-grab.”

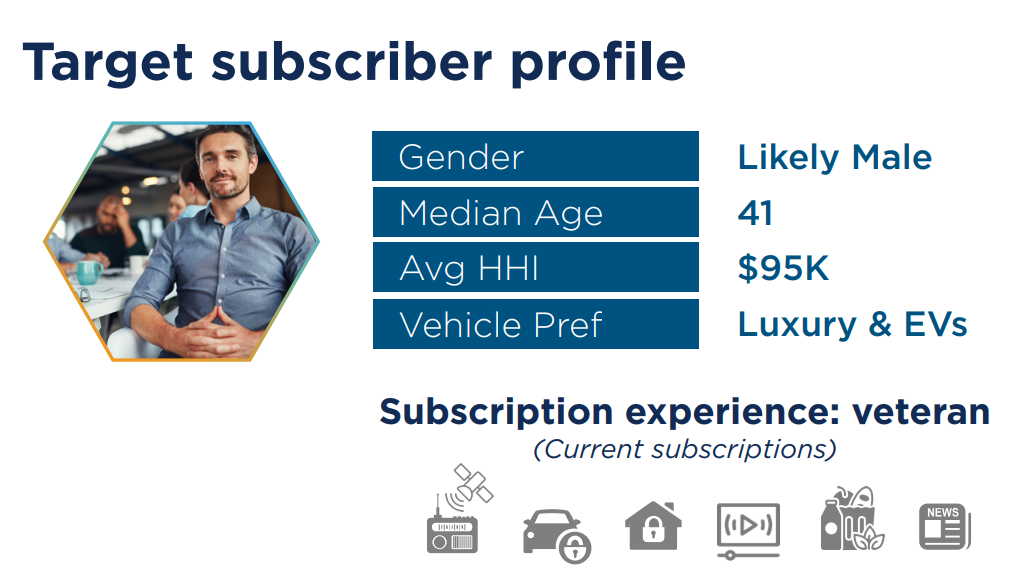

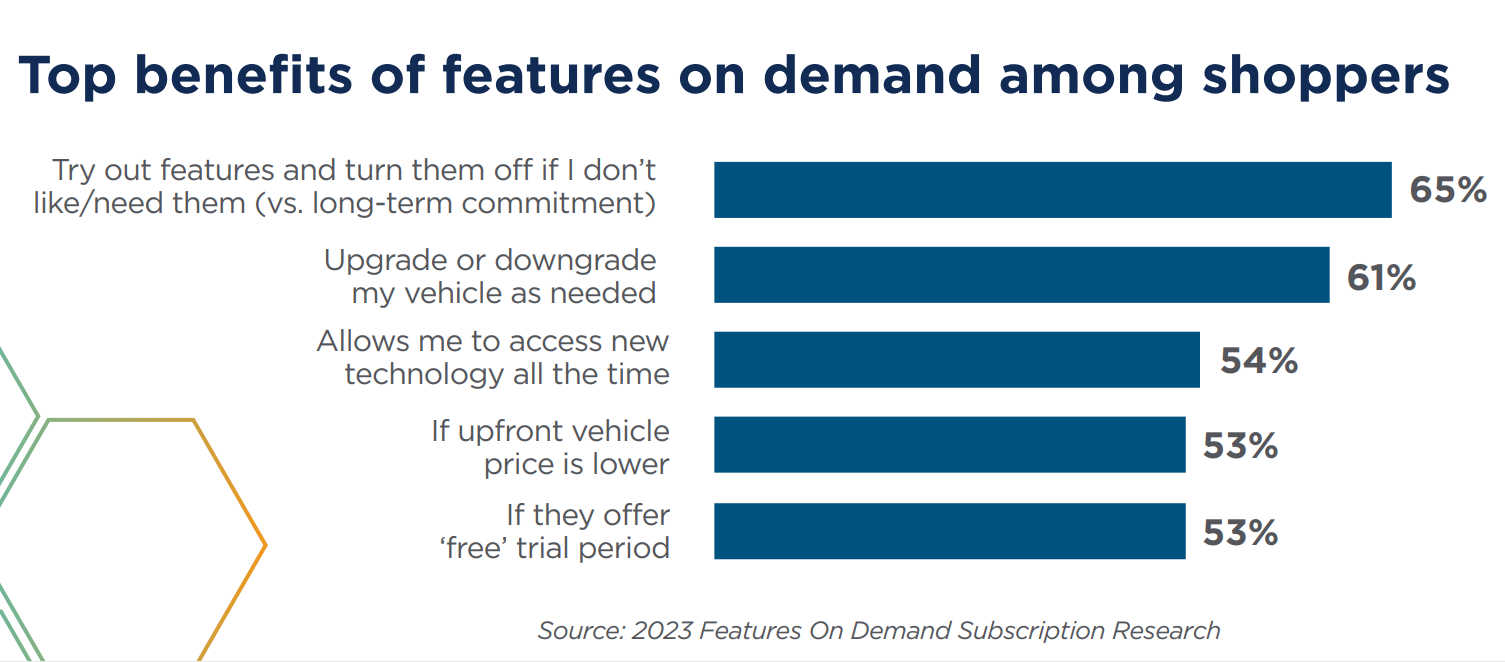

According to the study, FoD consumer awareness is very low with only 21% of in-market shoppers familiar with the concept. However, 41% said they are interested in FoD, with the majority saying they see some benefit in the features, especially the opportunity to try out the tech and upgrade their vehicles without a long-term commitment.

Most shoppers believe a top benefit of FoD would be a lower vehicle starting price. Fifty-eight percent said they expect FoD to be too expensive and have concerns about data security and privacy.

Chris Ripley, partner at Dialexa, an IBM Company, says for in-vehicle subscriptions and vehicles as a subscription to be a viable, revenue-producing market, OEMs have to offer subscriptions that stand out.

In a recent blog post, he wrote, “For some time, we have been experiencing a revolution in the monetization of platforms and applications, especially in the automotive industry. And the viability of this marketplace (both in-vehicle and vehicle as a subscription) is in serious question… To date, the in-vehicle subscription economy (and to a lesser extent automotive subscriptions) has consistently failed to prove industry-wide viability.”

According to Ripley, “bad bets” on vehicle subscriptions include:

-

- BMW’s rollback in 2019 of its $80 per year Apple CarPlay subscription;

- BMW’s rollback in 2022 of its $18 per month subscription for heated seats;

- General Motors’ rollback of its $1,500 per three-year OnStar subscription as a standard item; and

- To date, only two automotive manufacturers in the U.S. promote an all-inclusive car subscription platform: Care by Volvo and Porsche Drive.

While digital membership subscription cancellations have outpaced new subscriptions, Ripley noted that inflation has added pressure on subscription viability.

Citing a 2022 study from Cox Automotive, Ripley wrote that consumers believe the following should come standard in new vehicles:

-

- 92% say heated and cooling seats

- 89% say remote start

- 89% say lane-keeping assist

- 87% say automatic emergency braking

“In the current landscape, when measured against increasing price pressure on the customer in the new vehicle market, the lack of visionary thinking as applied to the in-vehicle platforms/applications space, and the clear lack of interest by U.S. consumers to pay for in-vehicle subscriptions, it seems fairly obvious a dynamic shift in how companies approach this area of the market is necessary,” Ripley said. “…they must start seeking more viable solutions – and that starts with empathy for their customers. How can I make their life better and how can we differentiate from a saturated digital market currently owned by Apple, Google, and Samsung?”

Specific to the collision repair industry, Ripley noted to Repairer Driven News that while in-vehicle subscription revenue is mostly aimed at infotainment and the in-vehicle experience there is an approach to drive revenue for repairers.

“I think there is a huge revenue opportunity here and also a huge opportunity for manufacturers to really connect with their customers and really build brand loyalty,” he said.

“Perhaps the collision centers are going to be a part of the subscription model as well because they’re getting valuable information from the vehicle before the vehicle ever arrives to them. It’s valuable information about the consumer, about the damage to the vehicle, about the vehicle’s performance [and also] is this car back to the standard that it needs to be from a functioning perspective?”

Consumer skepticism was apparent in Cox Automotive’s research, with three out of four respondents choosing to agree with the statement, “Features on Demand will allow automakers to make more money.” Sixty-nine percent of respondents said if certain features were only available with a subscription, they would likely shop elsewhere.

“As consumer familiarity is low, automakers will have to be careful in how they present an FoD strategy and make sure not to turn off shoppers from the start,” Ton said. “Our research suggests that free trial periods might be one way to approach the issue.”

Sixty-five percent of respondents suggested that a free trial of an on-demand subscription would be a positive selling point and make them more likely to consider a brand. Nearly half of the respondents said FoD features would be a reason to keep a vehicle longer since new capabilities or options could be added long after the time of purchase. Shoppers of Tesla, Jeep, Dodge, and Ford were more likely to consider vehicles equipped with FoD, according to the study.

Cox Automotive found that the greatest revenue opportunity for automakers through FoD is through stolen vehicle location and recovery systems, parking-assist features, smartphone app digital keys, and in-vehicle Wi-Fi. The best longer-term revenue opportunities would be through streaming services, virtual assistants, and driver monitoring or self-driving capabilities.

“As with everything in the auto business, the value proposition has to be front-and-center for the consumer,” Ton said. “Automakers will need to steer away from mandates and instead ease consumers into features they can access by offering free trials on safety and convenience options.”

From the safety perspective, Ripley said a huge challenge for the industry will be the protection of personally identifiable information (PII) and cyber security on all data collected.

“We continue to see individuals — bad actors — breaking into systems all of the time to get data,” he said. “I don’t know that that idea has been properly thought through… it is a tightrope that these companies are going to have to walk. They are going to have to assure their customers that the applications that they build are safe and secure. They are going to have to assure their customers that the applications are collecting only the data that they have authorized.”

Images

Featured image credit: dusanpetkovic/iStock

Chris Ripley headshot provided by Dialexa

Data graphs provided by Cox Automotive