Washington workshop to explore ‘historic’ auto insurance complaints

By onAnnouncements | Business Practices | Insurance

Washington Insurance Commissioner Mike Kreidler revealed this week that he’ll host a workshop to address a “historic volume” of complaints that have been pouring in since 2021.

The Office of the Insurance Commissioner (IOC) said its advocacy program received 467 complaints in April, up 63% from the historic average of 287 per month.

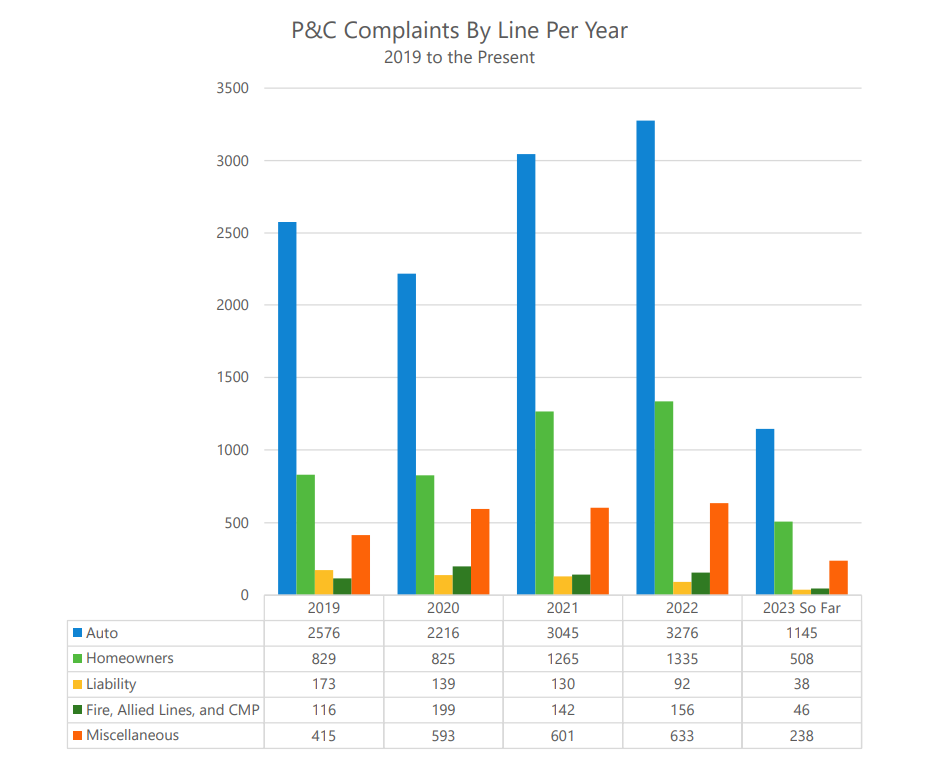

Throughout the two-year period from 2020 to 2022, complaints rose 48% from 2,216 in 2020 to 3,276 last year, according to the IOC.

“Most of the time, the claims process works as intended when insureds and claimants alike are made whole,” Kreidler said. “But when there are disputes, the industry needs to step up and do more to help resolve them in a timely, accurate manner.”

According to the IOC, auto insurance-related complaints accounted for the bulk of the overall rise in P&C complaints. Most concerns related to how, and how fast, claims are handled, it added.

As of May 15, 2023, claim handling issues are cited in more than 80% of complaints, the IOC said of the record figure.

The IOC also shared several consumer complaint stories, laying out some of the major pain points drivers are facing.

One area of contention relates to how heavier reliance on photo app-based repair estimates are causing estimates to be “significantly lower” than expected, the IOC said.

It gave an example of a Seattle man whose insurance company requested he use an app to photograph damage to his Porsche, which he had brought to a local shop for repairs. The insurer used photos submitted through the app to prepare an initial estimate of $2,816, the IOC said, adding it refused to conduct an in-person inspection.

In another case, it said a Tesla owner was asked by their insurer to use their app estimator, which generated an initial repair estimate of $6,481.28, compared to the final repair invoice of $19,779.33.

“The company disputed the repair shop’s labor rates but the rates/cost approved by the insurance company to repair the Tesla was still $13,000 more than their app estimate,” the IOC said.

Untimely communication and delays, and unreasonable explanations in settlements, were among other issues noted as being commonly faced by policyholders. According to IOC data:

-

- “Claim delays, unsatisfactory settlement offers, and claim denials are consistently the top three reason codes cited in auto insurance claims handling related complaints;

- “Adjuster handling issues are growing exponentially, with 2023 already surpassing the previous high point in 2022 just five months into the year;

- “Claim delays, in particular, have reached concerning levels, with this one reason surpassing virtually all other reasons combined in the last year.”

Insurance rate hikes were not among the top complaints, despite the fact that many insurance companies have consistently raised rates in recent years as a response to inflation, the rising cost of repairs, and supply chain challenges.

Kreidler’s office is hosting a virtual workshop on July 17 to gather information from the insurance, auto repair, and restoration contractor industries as well as claims experts and consumers to determine how they’ll address the issue.

More details about the meeting, including an agenda and information on how to testify, will be shared a week ahead of the event. It will be held via Zoom from 11 a.m. to 1 p.m., and the video will be posted online later in July.

Images

Featured image credit: Bill Oxford/iStock

Secondary image courtesy of Washington’s Office of the Insurance Commissioner