Insurers set both premium and loss ratio records, report says

By onInsurance | Market Trends

Despite posting a historically poor loss ratio, private insurers wrote a record number of premiums during Q1, according to a newly-released S&P Global Market Intelligence report.

According to S&P’s analysis, premiums rose $7.4 billion during the timeframe to reach $76.3 billion, compared to the $68.83 billion of premiums written during Q1 2022.

It attributed the 10% premium increase to carriers producing “strong top-line growth” as they strove to recoup losses through rate increases.

The analysis showed that of the nation’s top 10 private auto insurers, only GEICO and Liberty Mutual incurred year-over-year premium declines.

Conversely, Progressive increased its premiums by 25% with $11.72 billion in direct premiums written, while State Farm saw a 22% boost after bringing in $13.62 billion.

Among the other insurers to observe a double-digit spike in premiums were Allstate, USAA, and American Family.

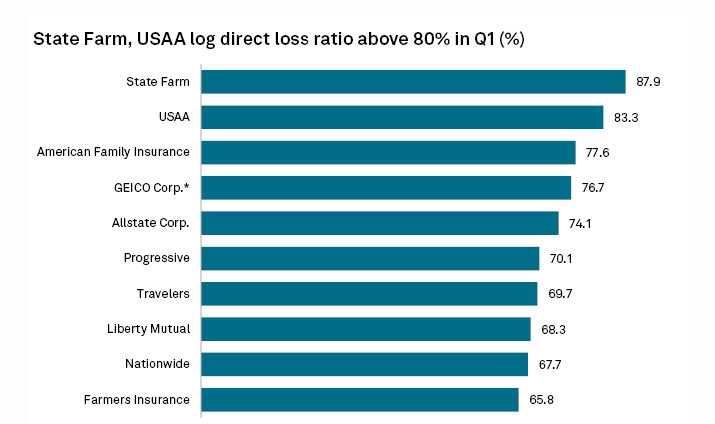

Despite most insurers writing more premiums during the first three months of the year, the overall loss ratio spiked, growing from 72.4% in Q1 2022 to 76.2% during Q3 2023.

“The first quarter was an unusually active period for natural catastrophes, which, in combination with ongoing inflation-related challenges in the private auto business, led to the highest personal lines direct incurred loss ratio for a first quarter since at least 2001,” the report said.

The latest loss ratio is a record high for a single quarter since at least 2001, the period S&P began analyzing the data. State Farm incurred the most significant loss ratio with 87.9%, a figure attributed to inflation and national catastrophes.

Among the private insurers featured in the analysis, just one saw its loss ratio improve.

“As first-quarter direct loss ratios hit new heights, the only top 10 insurer to see an improvement year over year was GEICO,” S&P said. “GEICO’s loss expenses for the first quarter of 2023 decreased $552 million compared to the first quarter of 2022, according to its May Form 10-Q.

“The insurer attributed this improved loss ratio to higher average premiums, favorable reserve development for prior accident years, the reduction in policies-in-force and lower claims frequencies.”

Nevertheless, GEICO still saw a 77% loss ratio for Q1.

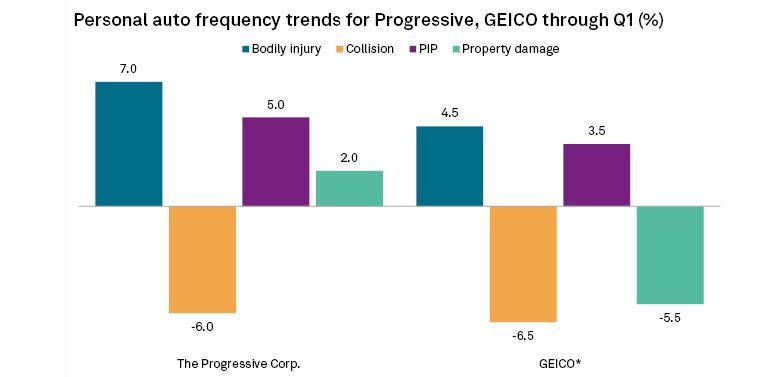

Both GEICO and Progressive experienced increases in claims severity. Progressive in a recent filing attributing its increase in bodily injury, personal injury protection, and property claims partially to the “impact of inflation, which continues to increase the valuation of used vehicles and total loss, repair, and medical costs,” S&P said.

The report also highlighted commentary from Travelers Co. CEO Michael F. Klein, who attributed changes to claims severity to weather and economics during an April earnings call.

“One consistent trend we see underneath everything is parts and labor costs continuing to rise,” Klein said. “That’s been fairly steady for a long time.”

A separate SwissRE report released Wednesday indicated that while premium growth remains strong, “natural catastrophe losses and persistent inflation weighed on underwriting results” during Q1.

However, it said that despite a rough start to the year, it expects to see improvement in property and casualty insurance return on equity both this year and next.

“…We expect other factors to support continuation of positive momentum: the peak impact of inflation on property and auto claims costs is likely past, rate increases are supporting premium growth and investment gains from higher interest rates are accruing,” the report said.

“Downside risks to our forecast include a prospect of more severe than expected recession in the second half of this year, financial stresses causing credit downgrades and higher capital requirements, unexpected natural catastrophe activity, and a slow return to target inflation.”

SwissRe said that while personal auto insurance has reached an “inflection point,” there are signs that the situation is improving.

“In 2022 the personal auto combined ratio exceeded 112%, the worst result since at least 1975,” it said. “The line has a long way to go before it returns to profitability, but the worst might be over. The personal auto 1Q23 loss ratio of 76% was the highest first-quarter loss ratio in at least 20 years but still represented an improvement from last year’s overall result (80%), and rate increases are exceeding most indicators of claims severities.”

Images

Featured image credit: Bill Oxford/iStock

Secondary images courtesy of S&P Global Market Intelligence report

More information:

Allstate announces $885M single-month losses, further raises rates