Survey: OEMs are ‘confident’ in overcoming future supply chain issues

By onMarket Trends

Automakers feel more confident in addressing future supply chain disruptions after the most recent one prompted them to rethink their approach, according to a new survey.

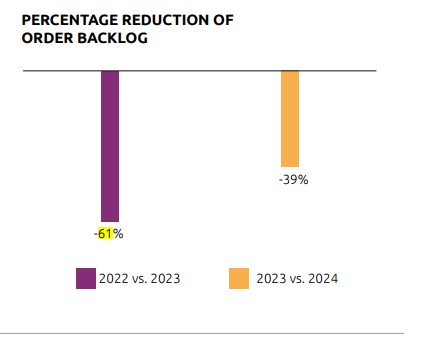

Capgemini’s survey of more than 1,000 global automotive senior executives found that 61% of auto organizations have slashed their backlog orders by 61%, while an additional 34% reduction is expected within the next year.

“Reasons for this reduction include reshoring, logistical improvements, and the removal of some bottlenecks — as well as increased inventory levels,” Capgemini said in its report. “Most organizations (especially OEMs) are now better prepared for long delivery lead times and have built enough inventory to reduce their order backlogs substantially. Suppliers, in contrast, are still feeling the backlash. Our data supports this hypothesis: OEMs report a 70% reduction in order backlog, compared to a reduction of only 33% for suppliers.”

The report found that half of OEMs are certain they would be able to avoid 60% of the revenue loss they suffered in 2022 under the same set of circumstances, including the semiconductor shortage if they happened again.

However, many automotive organizations now recognize that building inventory is a short-term solution, saying that relying on working capital is a “risky strategy.”

“Automotive organizations have been over-reliant on increasing their inventories to ride out the volatility of the past few years,” Capgemini said in its report. “They are now taking longer-term measures to rectify this reliance: three out of five suppliers, and a little less than half of OEM respondents, are working on monitoring-based solutions to increase their understanding of the risk and constraints to which their organizations are subject. Many, too, are venturing out into the open market to purchase from new suppliers.”

The report added that both suppliers and OEMs have adopted strategies based on additional operational investment and working capital to build inventories, but warned there is danger in doing so.

“This is led by the building of inventories, which 81% of suppliers and 44% of OEMs have implemented,” Capgemini said. “However, it’s clear that this is unsustainable in the long-term as holding excessive inventory risks a variety of negative effects on the operational and financial wellbeing of automotive organizations.”

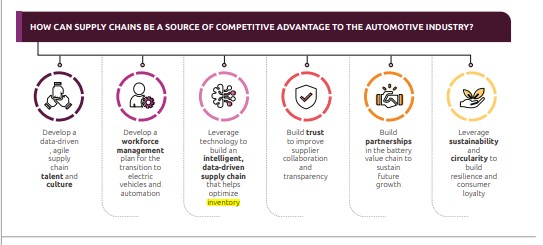

According to Capgemini, organizations seeking to further improve their supply chains to gain a competitive edge should lean into technology to:

-

- “Build an intelligent, data-driven supply chain to help optimize inventory;”

- “Build trust to foster transparency and more effective supplier collaboration;”

- “Create strong partnerships throughout the battery value chain to sustain future growth;”

- “Implement a comprehensive workforce management plan, focusing on automation and transition to EVs;”

- “Develop a data-driven and agile supply chain culture, and the talent to support it;” and

- “Harness sustainability and circularity to build resilience and consumer loyalty.”

The report also detailed how supply chain disruptions have caused sustainability efforts to lag within the industry.

Among survey respondents, just 37% said issues like carbon footprint management and environmental risk influenced their supply chain decision-making. While OEMs’ investment in supply chain sustainability is about the same year-over-year, the survey found that suppliers’ annual investment has dropped by 17%.

“While sustainability and circularity are key components for building a more resilient supply chain and to future-proof operations, the scaling of circular-economy initiatives has been delayed due to a shortage of suppliers of recycled materials (and of the materials themselves),” Capgemini said. “Automotive organizations need to balance sustainability and circular economy with factors like cost and affordability.”

It cited two examples of how sustainability has proven benefifical for automakers.

In the first, it noted how Renault is replacing its traditional auto manufacturing plant in with recycling and reconditioning activities. The program is expected to decrease a used car’s prep time for resale from 21 to eight days.

In its second example, it citied BMW’s Dingolfing plant, which plans to use heat produced from regional biomass and its own waste wood to meet about half of its processes’ hot-water requirements, beginning in 2025.

The report also detailed how integrating sustainability and circularity into supply chain strategies can benefit businesses by helping them build more resilient and future-proof operations. More than 56% of its survey responded reporting having improved operational efficiency from recycling auto parts.

“Agility is important because success is not about being better than the competition but about being faster than the competition,” George Kurian, vice president of Michelin North America’s supply chain, said in the report.

“And that’s vital because no one truly knows where we’re going.”

Images

Main image: RainerPlendl/iStock

Secondary graphics courtesy of Capgemini