Tractable: AI in claims processing, what it does and doesn’t do

By onTechnology

As the widespread use of artificial intelligence (AI) grows, from obvious uses to those that we may not think about like populating our news feeds and music playlists, collision repairers and insurers are often seemingly on two fronts with its use in claims.

Some repairers see AI as a waste of time because it isn’t the same as an educated collision repair professional, as expressed last week during a “TechTalk360” webinar held by AirPro Diagnostics. Insurers on the other hand have talked about the benefits from faster claims cycles overall to quicker responses to claimants.

Jimmy Spears, Tractable head of automotive and property, shared during the webinar how he believes repairers can begin their AI engagement journey.

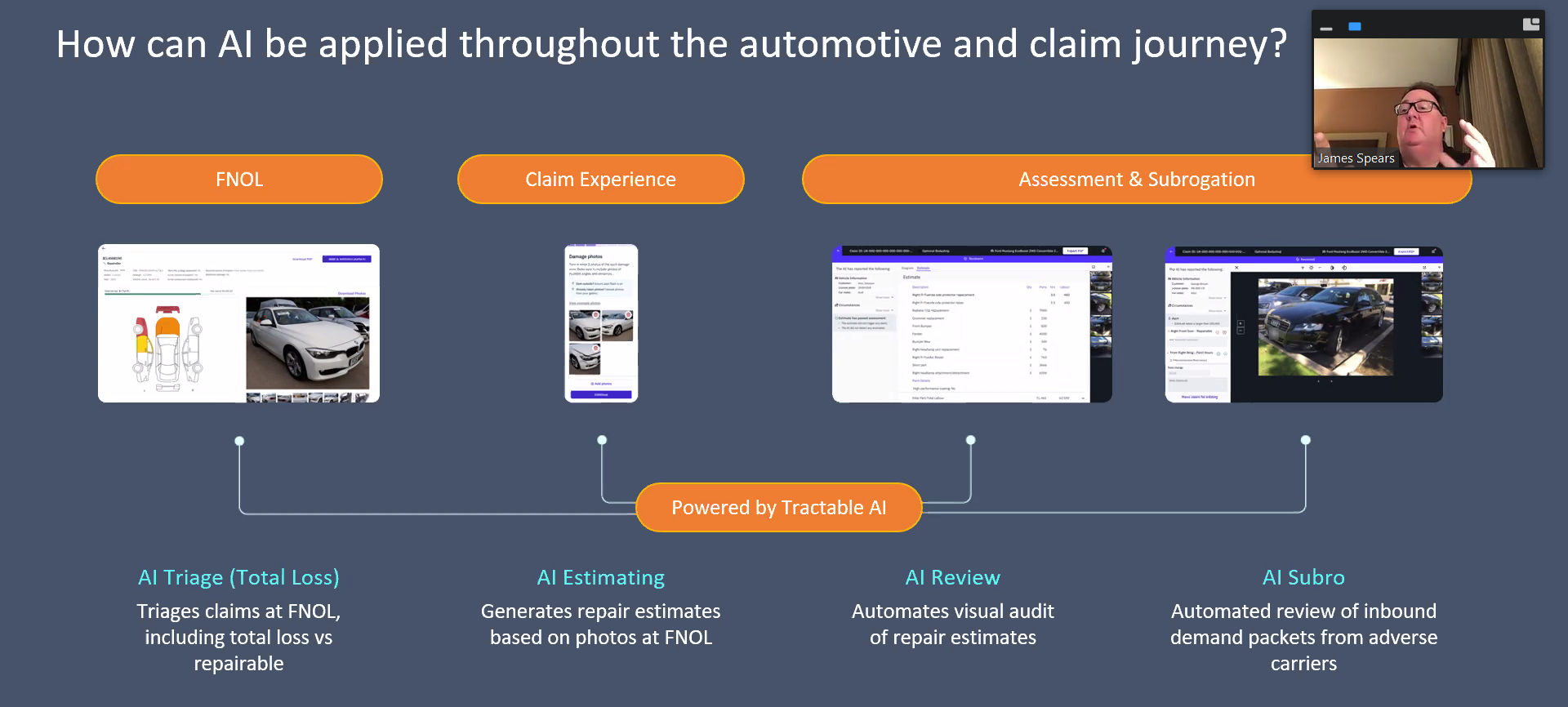

“When you buy this technology, you’re buying decisions that hopefully you don’t have to have someone else engaged with because they are rather simple,” Spears said. “There is a lot of complexity behind it. When we talk about first notice of loss, is the car repairable or do we believe it’s going to be a total loss? That becomes such an important question and it affects every one of us within the ecosystem. We really want to make sure that we start this vehicle out right on its journey and so many do not.”

Spears added that when shops purchase AI to assess damage they need to ensure that it’s customized to the way they do business and that the tools they’re using have a human in the loop (HIL).

He said, “If anyone attempts to sell you any of this technology and if they do a road map or a process map, make sure that you understand… where is the human going to be in this loop? Where will AI do its work? And then where will the humans actually assist it?”

When asked what’s different with AI now compared to automated processes insurers have used before, Spears said AI gives shops the ability to run an assessment of the appraisal either as it’s being written or afterward.

For example, when assessing damage to a quarter panel AI with computer vision can assess the image and see that the shop wrote nine hours of labor on a previous estimate. “If it’s calibrated to nine hours that one goes through so that’s really your biggest thing is that you can think about it and treat it like an employee that would be looking at an appraisal with their eyes,” Spears said. “It doesn’t kick out just because a rule says something.”

Spears was also asked if AI can be used to decipher disparity in the number of labor hours estimated for a repair and how long it should or does take according to OEM repair procedures.

Spears added that the goal is for companies like OE Connection, for example, to work with AI companies on including OEM repair procedures in the AI’s overall general database.

“Some of the easier procedures, they’re in there, but the more complicated ones… particularly when it calls out maybe certain adhesives or certain things like that, that’s where the AI starts to lose it,” he said. “That’s the type of data that it needs.”

AI can also assist in shop marketing and streamlining the customer experience, according to Spears. For example, a shop could put the option on its website homepage for potential customers to send in pictures of their damaged vehicles and within seconds they would be told if the shop can complete the repairs.

“They’re able to tell them, ‘Yeah, the car is repairable…’ Or to be able to say, ‘At this point in time, it looks like there’s a lot more damage on the car,'” Spears said. “What you’re answering is that basic human need of ‘be my advocate.'”

QR codes can be used similarly on the outside of shops to scoop up potential customers after hours, he added.

“It sends a link to their phone, you’re now engaging with them,” Spears said. “You’re being much more of a [consumer] advocate.”

“The risk is not training your people,” he said. “Have AI as a tool and let that be an investment for the easier type of interactions… when the consumer does interact with you, at that point in time, that’s where you need to have invested your time.

Leadership does need to know that this computer vision AI machine learning can take care of these tasks but at the end of the day, once it fouls out, you need a person that you’ve invested time and training into to really know how to understand and how to answer a person’s question much better.”

Spears noted that he hasn’t seen an AI tool that has reduced supplement amounts because AI is only visually assessing the damage before teardown.

In December, CCC Intelligent Solutions said the use of AI in shops to carry out initial damage inspections is predicted to increase this year as a means to save time, but also on administrative tasks. From appointment scheduling and inventory management to customer communications, AI can be used on the front end to give administrative staff more time to focus on complex and strategic aspects of their roles, CCC wrote.

However, CCC noted that AI shouldn’t be left completely in charge of tasks.

Last week, CCC launched CCC Inbound Subrogation, which uses AI, to “help carriers assess inbound demands in minutes and determine what they owe” and “streamline the claims review process, improving cycle time and reducing manual intervention.”

“Reviewing inbound subrogation demand packages, some as long as 200 pages, can be a painstakingly slow and manual process prone to inconsistencies, which can lead to inaccurate payments and unnecessary delays,” said Jeff To, CCC senior vice president of subrogation at CCC, in a news release.

“To address this challenge, CCC designed an inbound subrogation solution that streamlines this process and uses AI to extract data and reduce errors for all parties involved. Leading carriers have run demands through the new solution, including several of the top 10 auto carriers.”

A survey held in January by Insurity on American consumers’ attitudes toward AI in the property and casualty (P&C) insurance sector has revealed a significant shift in perception following direct experience with AI-enabled services, according to a news release from the company.

Initial reservations about AI diminished significantly following firsthand experience with AI-enabled services in routine P&C insurance operations, according to the findings. Forty-two percent of consumers say they are less likely to purchase a policy from an insurance provider that publicly states it uses AI.

However, while this could cause insurers to reconsider their AI strategy, Insurity found that this sentiment is largely driven by consumers who haven’t interacted with AI. Of the respondents who have interacted with AI through their insurance company, 63% said the experience was positive.

“The findings suggest that the negative sentiment towards AI in insurance is largely driven by a lack of understanding or direct experience with the technology,” Insurity said. “Insurity’s report calls on the insurance industry to proactively address consumer concerns and to highlight successful AI interactions that enhance the policyholder experience, from personalized policy recommendations to efficient claims processing.

“By doing so, insurers can not only alleviate fears but also showcase the value AI brings to the insurance ecosystem. Policyholder acceptance increases once the efficiencies, accuracy improvements, and customer service enhancements provided by AI are understood and experienced.”

Images

Featured image credit: BlackJack3D/iStock