North Carolina shop owner charged with parts fraud, tips to prevent fraud at your business

By onBusiness Practices | Legal

Body shop owner Christopher Mark Rogers, 51, of Dallas, North Carolina has been charged with felonious insurance fraud.

Rogers allegedly didn’t use new parts to repair a vehicle in May 2023 when he had been paid for new parts by National General Insurance Co., according to a news release from the North Carolina Department of Insurance.

“Insurance fraud is not a victimless crime,” said Insurance Commissioner Mike Causey, in the release. “It hits all of us in the pocket through higher premiums.”

Insurance fraud can be reported anonymously by calling the N.C. Department of Insurance Criminal Investigations Division at 919-807-6840 or toll-free from anywhere in North Carolina at 888-680-7684.

While all employees hope to be able to trust their business owners and owners of their employees, it’s not a bad idea for shops to have safeguards in place just in case.

The National Automobile Dealers Association (NADA) previously shared some useful tips on how to prevent or catch fraud during a webinar.

Lewis R. Fisher, Moss Adams CPA and automotive and dealer services partner, said fraud more often occurs in parts and services departments and is “very basic on the surface.”

For example, if parts inventory isn’t integrated into the general ledger and management system, accurate numbers aren’t reconciled. That gives employees the opportunity to sell inventory that isn’t tracked online, sometimes even from their own website using their employer’s FedEx and/or UPS accounts to ship the parts, he said.

“There’s opportunities to prevent this,” Fisher said. “You can have annual physical counts – you should have annual physical counts. You can have monthly cycle counts where the accounting department is doing bin counts.”

He added that owners should know what access to parts inventory employees have and what manual adjustments they could be making.

It’s also important to pay attention to inventory reconciliation trends on a month-to-month basis, Fisher said.

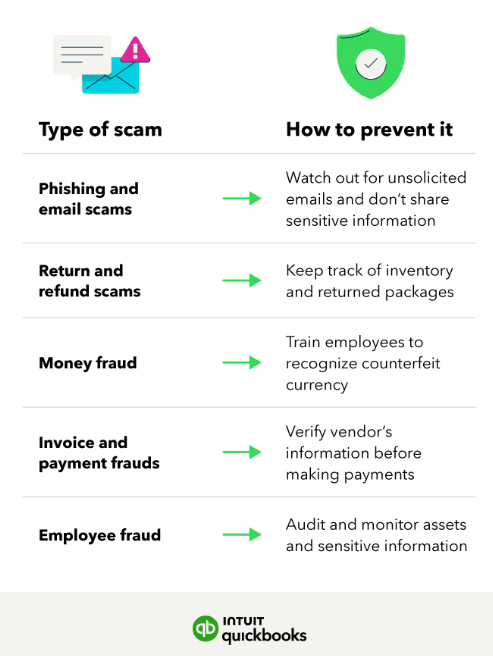

Intuit Quickbooks also recently provided some fraud mitigation tips for businesses regarding:

Intuit Quickbooks says employers should do the following to prevent each type of fraudulent act:

-

- “Educate employees and yourself to recognize phishing attempts. Be careful with unsolicited emails, and don’t share sensitive information. You can use email filtering and authentication tools to detect and block phishing emails and websites;

- “Establish clear return policies, including issuing a refund if the customer hasn’t used the product and inspecting returned items carefully. Use technology to track returned packages and keep track of inventory to know what your business shipped to the customer;

- “Train your team to recognize counterfeit currency and establish clear procedures for handling cash and check transactions;

- “Verify your supplier and vendor’s information before paying and implement secure payment methods with two-step identification for any financial transaction. Monitor transactions to spot unusual or unauthorized activity; and

- “Regularly audit and monitor assets and sensitive information. Establish internal controls and conduct background checks on employees handling sensitive information. Build trust in leaders and a culture of full transparency.”

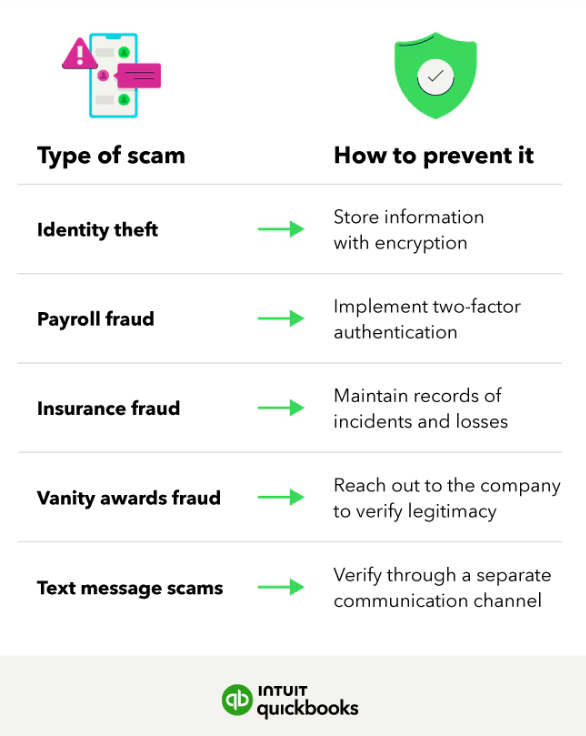

Other types of possible fraud include:

Prevention tips given by Intuit Quickbooks are:

-

- “Store customer data with encryption and secure storage practices, such as using identity verification services. Monitor credit reports and financial records for suspicious activity;

- “Implement two-factor authentication for payroll software and employee records. Regularly review payroll records and time tracking to ensure there aren’t discrepancies;

- “Maintain detailed records of incidents and losses and report any suspicious claims to your business’s insurance provider;

- “Be careful with unsolicited award notifications, especially if they request a fee or sensitive information. When in doubt, contact the organization to verify if it’s legit; and

- “Have employees save phone numbers and clarify how you will communicate with them. Instruct them to verify through a separate communication channel and not provide any sensitive information.”

Images

Featured image credit: NicoElNino/iStock