Nearly half of policyholders polled shopped for insurance in the last year

By onInsurance

J.D. Power says notable auto insurance premium increases and “lackluster” customer satisfaction scores have led 49% of more than 10,000 consumers to shop for new policies in the past year.

According to J.D. Power’s 2024 U.S. Insurance Shopping Study, 29% of those shoppers switched carriers. Switch rates were highest among Gen Z policyholders.

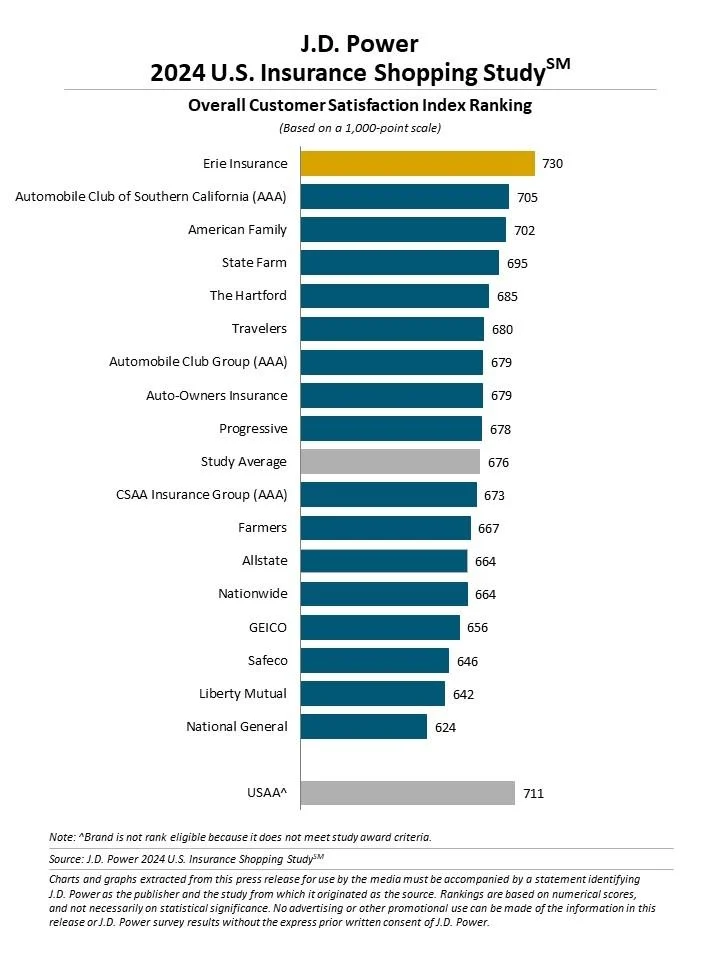

The average overall satisfaction score among auto insurance shoppers was 676 on a 1,000-point scale.

“After the past few years of steady auto insurance premium increases, customers are no longer passively keeping an eye out for a better deal,” said Stephen Crewdson, J.D. Power insurance business intelligence senior director, in a news release. “Instead, they are actively seeking new carriers to offset these rising costs. However, with rising premiums across the country and fewer insurers explicitly offering usage-based insurance, or UBI plans, during the quoting process insurance shoppers are not finding many alternatives.”

Auto insurance increased by 2.6% in March from February and a 22% increase from a year ago. Auto repair costs increased 1.7%, up 8.2% in a year. Gasoline costs also increased 1.7% in March with an annual increase of 1.3%.

Yahoo Finance reported in April that auto insurance’s 22.2% annual increase is the largest since December 1976 when prices increased 22.4%.

“While the magnitude of rate increases is likely to ease somewhat, after several years of double-digit increases, some lingering claim cost inflation and adverse claim severity and frequency will likely lead to a ‘higher for longer’ auto rate environment,” CFRA analyst Cathy Seifert told Yahoo Finance.

UBI programs, which use telematics software to monitor driving style and assign rates based on safety and mileage metrics, were offered to 15% of insurance shoppers this year, down from 22% a year ago and 20% in 2022, according to the study.

Customers who enrolled in UBI programs showed a 6-point increase in price satisfaction in 2024, which is down from a 32-point difference in 2023, the study says.

Thirty-five percent of auto insurance customers said they are interested in embedded insurance — auto insurance provided directly through vehicle dealers or OEMs.

The study also found that electric vehicle (EV) owners are less satisfied with their insurance purchase experience than customers who insure gasoline-powered vehicles. The average purchase experience satisfaction score among EV owners is 663, which is 16 points lower than that of gas-powered vehicle owners.

J.D. Power says the gap is attributable to lower satisfaction with the quote process and price of the policy because EVs are typically more expensive to insure.

State Farm and Progressive are bringing in more customers while GEICO is losing some of theirs, according to the study. As a result, State Farm and Progressive have shown gains in market share while GEICO’s share is down.

Erie Insurance ranked highest in the study among large auto insurers in providing a satisfying purchase experience with a score of 730. Automobile Club of Southern California (AAA) ranked second at 705 followed by American Family at 702.

J.D. Power’s study results are based on responses from 10,003 insurance customers who requested an auto insurance price quote from at least one competitive insurer in the previous six months. The study was conducted from March 2023 through January 2024.

Images

Featured image credit: Pattarisara Suvichanarakul/iStock

Insurance Shopping Study graph provided for use by J.D. Power