Bill aims to repeal CTA, small business advocates speak at Congressional hearing

By onLegal

The U.S. House Committee on Small Business heard multiple testimonies last week from small business advocates who said the Corporate Transparency Act’s (CTA) confusing requirements are overly burdensome on Main Street businesses.

Rep. Warren Davidson (R-Ohio) introduced HR8147 to repeal the CTA a day before the hearing. More than 100 trade associations, including the Society of Collision Repair Specialists, sent a letter to Davidson expressing their support of the bill.

“By way of background, the CTA took effect this year and requires small businesses and other covered entities to report the personal information of their owners and managers to the Financial Crimes Enforcement Network at the Treasury Department (FinCEN),” a release from the S-Corporation Association says. “As we’ve written extensively, the CTA saddles law-abiding business owners with compliance headaches and criminal penalties while doing little or nothing to combat illicit activity. The letter signed by NFIB, The Real Estate Roundtable, the National Association of Wholesaler-Distributors, and dozens of other groups, makes clear that CTA is poor policy that needs to be reconsidered.”

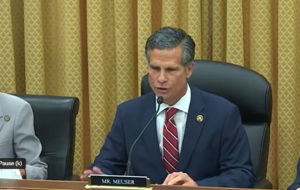

Rep. Dan Meuser, (R-Pennsylvania) led the CTA discussion during the April 30 Committee hearing.

“Congress passed the Corporate Transparency Act to detect illegal funds moving through the financial system. If you can better detect and prevent illicit funds from entering the financial system, it should reduce overall criminal behavior. For example, FinCEN’s beneficial ownership rule is meant to show who is profiting from business activity and reduce the number of shell companies used by criminals,” Meuser said. “This requires some businesses with less than 20 employees to disclose ownership information of anyone with a 25% stake in the company. This information is saved to a database for law enforcement and financial institutions to help detect criminals that have previously been hidden by LLCs or other companies.”

Meuser said FinCEN’s implementation and regulations have been overly broad and burdensome on small businesses.

“Nearly half of small business owners said they had no idea what the Corporate Transparency Act is and had never heard of the government agency FinCEN; suddenly they are getting something in the mail asking for personal information with the threat of massive fines if they do not comply,” Meuser said. “When some businesses have received these notices they’ve turned to their lawyers or accountants or Congressional offices for help to fulfill these requirements. However, we are hearing that the rules are written in a way that makes these trained professionals hesitant or unwilling to take on this task. This is a telltale sign that something has gone wrong in implementing this law.”

Meuser said small businesses also have privacy concerns, as it’s known that financial information has previously been leaked from FinCEN by an employee in the past.

“Business owners are rightfully concerned that their data could be leaked, stolen, or used against them,” Meuser said. “Biden administration’s implementation of this law fails to strike the balance in detecting illicit activities in our financial system and burdening all small businesses with expensive new mandates. I hope this hearing shed some light on the many challenges that our nation’s job creators are facing and will begin to work on correcting some of these issues coming out of FinCEN.”

Carol Roth, a small business owner and advocate for small businesses, told the committee that the act is an overreach of the federal government.

“While preventing financial crimes is a worthwhile endeavor your methods cannot do so in a way that infringes upon Americans’ natural rights or assumes that they are guilty without due process,” Roth said. “Asking small businesses and their owners to report sensitive personal information and identification to an organization involved in monitoring financial crimes unfortunately does just that.

“It’s not only an invasion of privacy but it also creates additional burdens and challenges for small business owners and, once again, by exempting big businesses from this reporting rule, it specifically and unfairly targets and penalizes small business owners with a different standard and set of rules. Small businesses, overall, are not shell companies. They’re the backbone of the economy. If FinCEN has concerns about money laundering, cartel activity or otherwise they should be using the courts to receive information on those specific cases and entities.”

Roger Harris, President of Padgett Business Services, says his clients have asked his company for help in complying with the act. However, the confusing regulations make it difficult for his company to offer assistance.

“This isn’t going to work as it’s currently structured. It’s going to cause massive non-compliance in the small business community,” Harris said. “The non-compliance is not going to be because these businesses are laundering money. It’s because they’re not filing a form. So we need to find a way, if we’re going to have this rule, to make it work. So we think that there are some common sense things that we can do to see if we can make this work.”

Harris said this includes putting the implementation on hold until all lawsuits have been settled and then giving government a year to fix any issues.

Earlier this year, an Alabama U.S. District Court judge ruled the CTA unconstitutional, according to a Reuters article. It says the government is expected to appeal the finding.

“The government says that the CTA is within Congress’s broad powers to regulate commerce, oversee foreign affairs and national security, and impose taxes and related regulations,” the article says Judge Liles C. Burke wrote in the ruling, issued March 1. “The government’s arguments are not supported by precedent. Because the CTA exceeds the Constitution’s limits on the legislative branch and lacks a sufficient nexus to any enumerated power to be a necessary or proper means of achieving Congress policy goals.”

Burke’s decision protects members of the National Small Business Association (NSBA), which brought the suit. However, 32 million other small businesses in the nation are still at risk of being required to meet the filing requirements.

Harris went on to say, during the hearing, that businesses need further guidance and third-party verification tools similar to the Internal Revenue Service’s.

He told the committee he’s been to two FinCEN meetings regarding the act.

“I have asked for guidance on the role of the spouse,” Harris said. “Could they be deemed to have substantial control, even if they didn’t own anything in the business?”

Harris said he never received an answer.

Timothy Opstinick, Technology Concepts & Designs executive vice president and general counsel, represented the NSBA during the meeting. He told the committee he didn’t think the act could be resolved with fixes but needed to be completely repealed.

“I’d like to draw your attention to FinCEN’s 57-page small entity compliance guide as well as the 45-page FAQ,” Opstinick said. “A first-time entrepreneur looking to open a coffee shop, for example, must push through 102 pages of explanatory language to understand the reporting burden given, permitting, and other delays. It’s entirely possible that our aspiring barista would have to act on all of this before a single cup of coffee was served to a customer all under the threat of criminal sanctions.”

He also raised similar concerns to Harris regarding confusion on who is deemed an owner.

“In determining who must be a beneficial owner, the filer must determine not only who is an owner but must list those with substantial control over the business,” Opstinick said. “Lawyers do not understand the meaning of substantial control let alone the barista I mentioned. The term would make for good law school discussion.”

Gary Kalman, Transparency International executive director, took the opposite opinion of the small business advocates. The organization claims to work at ending world corruption.

“CTA is a historic anti-money laundering measure that Congress correctly understood would strengthen the ability of law enforcement in the U.S. National Security Community to curtail the use of anonymous entities to commit crimes,” Kalman said. “Moreover the CTA’s reporting requirements are neither unusual nor unprecedented for everyday Americans. Most states collect more information when granting public library cards than is required under the CTA and the CTA benefits small business owners, by among other things, protecting them from unfair and fraudulent competition.”

Kalman also said he didn’t believe businesses would be found guilty of violating the law if they mistakenly failed to file or made errors in their reporting.

Alex Ford, S-Corporation Association executive director, said Monday that the hearing was positive overall.

“The three witnesses opposing the CTA did a great job of articulating the many challenges posed to small businesses by this reporting regime,” Ford said. “The one witness in support had a main selling point that boiled down to, ‘Don’t worry, we won’t throw you in jail.’ Not very comforting given the many millions of entities that will be non-compliant come year-end simply because they’d never heard of the CTA.”

IMAGES

Rep. Dan Meuser (R-Pennsylvania) speaks on Corporate Transparency Act (CTA) concerns during a U.S. House Committee on Small Business meeting.