J.D. Power: Slightly over half of policyholders don’t trust insurance company, more likely to switch with rising costs

By onAnnouncements | Insurance

Customers aren’t concerned by the rising cost of auto insurance premiums, if they trust their insurer, according to J.D. Power’s 2024 U.S. Auto Insurance Study.

However, the study found 51% of policyholders have little trust in their insurance company, a J.D. Power press release says.

“Auto insurers are in a tough position right now,” said Breanne Armstrong, J.D. Power director of global insurance intelligence in the release. “With repair costs still rising — and with more than 20% of vehicles involved in collisions now considered total write-offs — insurers are still losing money, despite passing along huge price increases to their customers. What’s interesting in J.D. Power data is that even though high premiums negatively affect customer satisfaction, those negative influences can be offset by high levels of trust that insurers will come through when they are needed.”

Auto insurance rates are up 11.2% on average in the past year but insurance companies are losing an average of 5 cents on every dollar of premium they collect, the release said.

The U.S. Bureau of Labor Statistics (BLS) recently reported the motor vehicle insurance index rose 1.8% in April following a 2.6% increase in March. Auto insurance was mentioned as an item that notably increased by 22.6% over the past year.

Multiple media agencies have reported it as the largest annual increase for auto insurance since 1979.

As insurers raise premiums, collision repair shops have simultaneously noted an increase in consumer responsibility for out-of-pocket expenses due to short payments.

It’s possible consumers are also noticing concerns in their coverage, as only 15% of J.D. Power respondents reported having a high level of trust with their insurance company. Thirty-four percent answered their trust was mid-level.

Only 30% of those in the low-trust category were likely to renew their policy with the same insurance company, the report found. Those in the high-trust category were 90% more likely to renew their policy.

A J.D. Power and TransUnion report released in April found about 12.8% of consumers were shopping for new insurance in Q1, compared to 12% in Q4. The switch rate rose from 3.6% to 3.9% during the same period.

On a 1,000-point scale, the average overall satisfaction score was 917 among policyholders with the highest level of trust in their insurance company, the new insurance study says. The score is 426 points higher than those who had the lowest level of trust in their insurer.

“The average trust score among customers who experience an insurer-initiated increase — but who fully understand the reasons for that increase and expect the increase — is 735,” J.D. Power says. “That is just one point lower than the average trust score among customers who experienced an insurer-initiated rate decrease (736).”

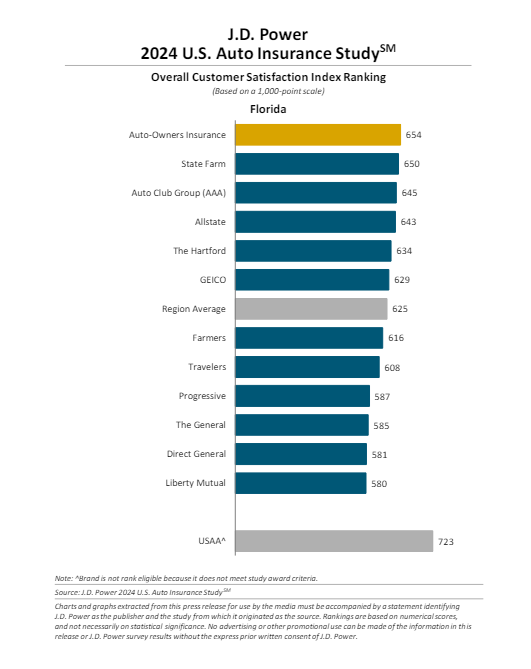

The study also found trust varied by region, with Florida having the lowest trust scores out of the 11 geographic regions studied.

“Florida, where the incidence of rate increases is highest, also has the highest percentage of customers (55%) with low levels of trust,” the report says.

The highest-ranked insurance companies by region are as follows:

-

- California: Auto Club of Southern CA (AAA) (684)

- Central: Shelter (677), for a fourth consecutive year

- Florida: Auto-Owners Insurance (654)

- Mid-Atlantic: Erie Insurance (713), for a third consecutive year

- New England: Amica (709)

- New York: Travelers (667)

- North Central: Erie Insurance (710), for a fourth consecutive year

- Northwest: PEMCO Insurance (666)

- Southeast: Alfa Insurance (693)

- Southwest: CSAA Insurance Group (AAA) (683)

- Texas: Texas Farm Bureau (686)

- Usage-Based Insurance (UBI): Nationwide (842)

This year’s study was based on responses from 41,242 auto insurance customers and was fielded from August 2023 through April 2024, according to the release.

IMAGES

Photo courtesy of utah778/iStock. Inside graph courtesy of J.D. Powers.