LexisNexis: High claim severity due to litigation, parts and labor shortages

By onInsurance

LexisNexis Risk Solutions found in its 2024 U.S Auto Insurance Trends Report that high claim severity continues due to parts and labor shortages and rising attorney involvement.

According to the report, 93% of claimants who sought legal counsel were likely to retain services in the future. LexisNexis also found that consumer dissatisfaction around total loss because of lengthy claims processes remains high at 46%.

The report aggregates annual market data about consumer driving patterns, auto insurance shopping trends, claim frequency and severity, and consumer responses to rate increases.

LexisNexis concluded from its findings that claim severities “show no signs of abating.”

Auto insurance policyholders are switching providers because of high premium increases shown by an increase in new policies by 6.2% in 2023, according to the report. Consumer retention rates dropped from 83% to 80%. LexisNexis says those changes indicate insurers should consider focusing on their existing portfolios and take steps to update their underwriting practices this year.

“Auto insurers are navigating a dynamic and challenging market environment in 2024,” said Adam Pichon, LexisNexis Risk Solutions insurance senior vice president of global analytics, in a news release. “For their part, consumers are displaying more unpredictable driving and policy shopping behavior, and increasingly switching carriers to find better rates,” “It is crucial for insurers to balance market acquisition and retention with rate adequacy and utilize data-driven insights to help manage risk and maintain profitability to be set up for continued success as the market begins to soften.”

Compared to 2020, bodily injury has risen by 20%, along with severity as material damage has increased by 47%, according to the report. LexisNexis says rising bodily injury numbers raise serious concerns about the adequacy of minimum coverage limits for many drivers.

LexisNexis says attorney involvement has contributed to the rise in claims costs because 51% of claimants who hired one received a higher settlement amount. Attorney involvement is most prevalent after auto accidents with 85% of claimants being approached by one attorney and 60% by more than one, according to the report.

The time required to settle a claim is the highest determinant of customer satisfaction, followed by the number of people and touches needed to resolve the claim, LexisNexis said.

Last year, 27% of collision claims were deemed total losses, according to the report. Forty percent of those survey respondents for LexisNexis’ report said it took a month or longer to receive final payment. Twenty-three percent said it took less than two weeks.

In response to the record-setting rate increases of 9% in 2022 followed by 14% in 2023 traditionally stable consumers are now shopping for better rates.

Forty-one percent shopped at least once for a new policy. Overall, shopping increased 4.7% last year, with many consumers switching carriers, driving new policies up 6.2% in the same period.

Over 2022-2023, the number of drivers within a policy increased by 5%, “pointing to changing risk profiles that may be overlooked during renewal periods and potentially indicating consolidation in households,” LexisNexis said.

The report also found:

-

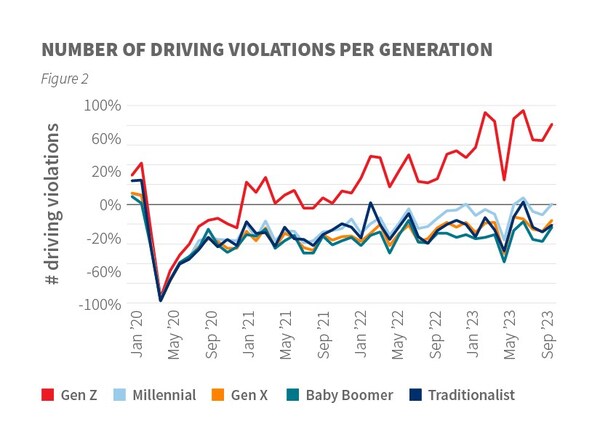

- Distracted driving violations by Gen Z increased 24% from 2022 and 66% compared to 2019.

- Auto insurers are “taking an aggressive approach to profitability challenges” with a 14% year-over-year rate increase in 2023, improving the combined loss ratio by seven points to 105% over 2022.

- Claim frequency and severity for EVs were 17% and 34% higher, respectively, than internal combustion engine (ICE) vehicles.

Major speeding violations are up 10% from 2022-2023 and 36% since 2019. Minor speeding violations are up 16% from 2022-2023 and 15% since 2019.

Distracted driving is more prevalent among younger drivers, especially Gen Z. From 2022-2023, violations for the age group increased by 24% and, compared to 2019 figures, have risen 66%.

EV sales last year grew 54% compared to light duty vehicles of 13%. The total number of EVs insured grew by 40% to 3.9 million in 2023, while the number of private passenger vehicles insured grew by 1.2% during the same period to 265 million, according to LexisNexis.

Twenty-four percent of new EV buyers shopped around for lower rates on their auto insurance policies in 2023, significantly higher than the 19% of new private passenger buyers that shopped for coverage last year.

Images

Featured image credit: D. Lentz/iStock

Graph provided by LexisNexis