CCC predicts continued costlier hail and hurricane damage repairs this year

By onMarket Trends

There were significant increases in repair times and costs due to storm-related damages in 2023 and it’s bound to get worse this year, according to CCC Intelligent Solutions’ Crash Course Q2 2024 report.

The Q2 edition focuses on how severe weather events, particularly hurricanes and convective storms, impact the auto insurance and collision repair industries. It’s based on information from 300 million claims-related transactions and millions of bodily injury and personal injury protection/medical payments (MedPay) casualty claims processed by CCC customers.

Hail-related auto claims rose to 11.8% of all comprehensive claims last year, up from 9% in 2020, with average repair costs for vehicles increasing by 15% over the past three years.

Hail claims are, on average, 21.7% more costly to repair than the average comprehensive claim and 25.6% more expensive than the average repairable claim.

In 2023, 19.4% of comprehensive claims included paintless dent repair, and 80% of claims identified as “hail” included PDR. Throughout 2023 — a year rife with hail damage claims — PDR was included on 19%-35% of repairable comprehensive estimates.

Comprehensive claims that include paintless dent repair have an average total cost of repair (TCOR) 28% higher than non-PDR claims, an average of $1,282 dollars in the 12 months ending in March 2024. Labor costs for PDR are also, on average, 159% higher.

“CCC data shows that hail claims are, on average, 21.7% (+889) more costly to repair than the average comprehensive claim and 25.6% (+1,020) costlier than the average repairable claim, exacerbating these increases in storm frequency and risk,” the report states.

“Extreme weather events are increasing in severity, becoming major disruptors in the auto claims and repair industry,” said Crash Course co-author and CCC Industry Analytics Director Kyle Krumlauf, in a news release. “Our Q2 report delivers critical insights, showing that the frequency and severity of storms are not just a seasonal issue but a persistent challenge that demands strategic planning and swift adaptation from industry players.”

Key findings from the report include:

-

- “Record storms and increased costs: The surge in billion-dollar weather events has led to higher claims costs and longer repair times.

- “Geographic shifts: The migration of populations to hurricane and hail-prone areas like Florida, Colorado, and Texas has intensified the impact on insurers and repair shops leading to higher claims volumes and stressing the existing repair infrastructure.

- “Vehicle repair costs rising: The average TCOR increased 3.3% in Q1 2024 compared to Q1 2023, with labor rates and parts costs contributing to the rise. Q1 2024 saw significant improvements in repair cycle times, with vehicles entering repair shops six days sooner compared to Q4 2023.

- “Electric vehicle (EV) repairable claims growing: EVs accounted for 2.4% of all repairable claims in Q1 2024, up from 1.6% in Q1 2023. The average repair cost for EVs is 46.9% higher than for non-EVs, primarily due to higher labor costs. For vehicles three years and newer, the average repair cost for EVs is 19.5% more than non-EVs.

- “Casualty and medical costs continue to rise: Medical treatment costs for auto claims are rising, with high-dollar procedures experiencing significant inflation. Additionally, uninsured and underinsured motorist (UM/UIM) injury claims increased by 44%, rising from 9.4% in Q1 2023 to 13.5% in Q1 2024, as households struggle with rising auto insurance premiums.

- “Subrogation trends: High turnover among adjusters hinders subrogation efforts, leading to a 16% decrease in referrals. Carriers are increasingly using technology to streamline subrogation processes and improve recovery rates.”

CCC notes in the report that initial forecasts from Colorado State University predict 11 hurricanes this year, with five categorized as major. Comparatively, that would not only represent a significant spike from 2023, but it also hints at challenges reminiscent of the tumultuous 2021 season, CCC said.

In February 2024, the National Centers for Environmental Information (NCEI) reported 28 events recorded in 2023 that caused $1 billion or more in damage, compared to 18 in 2022.

A case study in the report highlights Hurricane Ian’s impact in 2022, where comprehensive estimates tripled in affected states and increased nearly sevenfold in Florida.

When Hurricane Ian hit, it caused $116 billion in damages. CCC data shows independent appraisals increased from around 8% to 18.5% and insurance company staff appraisals from around 58% to 65%. Appraisals conducted at DRP shops decreased from around 21% to 6%.

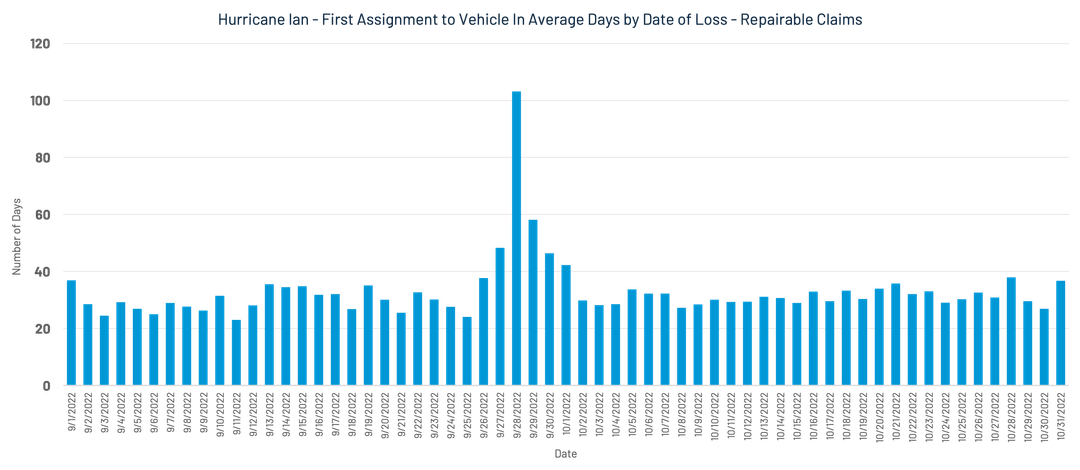

“After Hurricane Ian, there was a significant increase in the time it took for vehicles needing repairs to actually start the repair process after initial claims were assigned to a shop,” the report says.

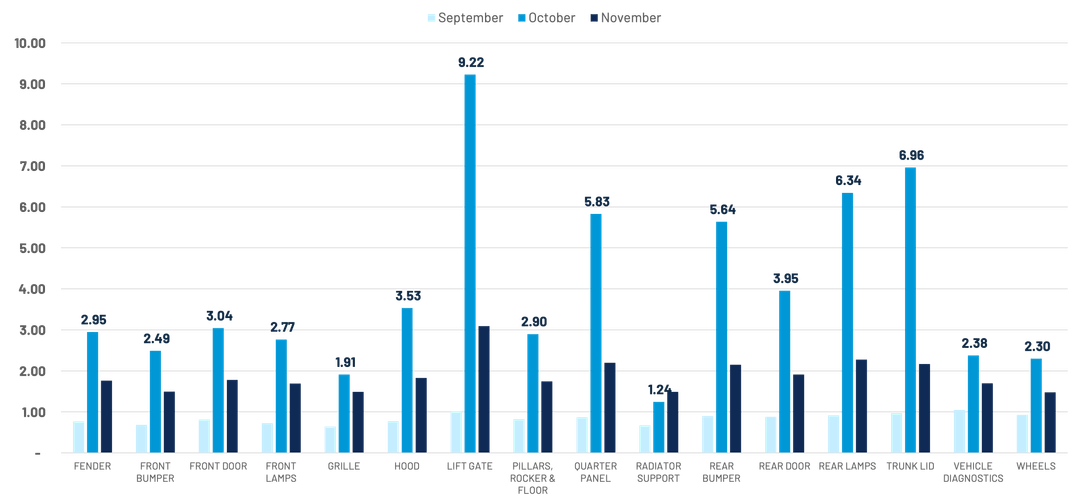

CCC found that, in Florida, which bore the brunt of Hurricane Ian-related damages, part demand increased almost 20 times for trunk lids and liftgates while demand for many others increased 10 times.

Nearly 52% of claims were deemed total losses in the three hardest-hit states — Florida, Georgia, and South Carolina. Nearly 51% of claims in Florida alone were total losses, according to the report.

The 2024 hurricane season looms large, and while major hurricanes garner significantly more attention for their dramatic impacts, evidence suggests that even the smaller storms can critically strain auto claims and repair industry resources,” the report states. “Preparing with robust strategies and technologies is crucial to weathering the storm ahead, as is adjusting strategies based on new intelligence.”

Previously published annually, Crash Course is being released quarterly in 2024 to provide more frequent updates on key trends and insights.

Images

Featured image credit: Luca Piccini Basile/iStock

Graphs provided by CCC