EVs pose more repair problems and sales are up, reports find

By onMarket Trends

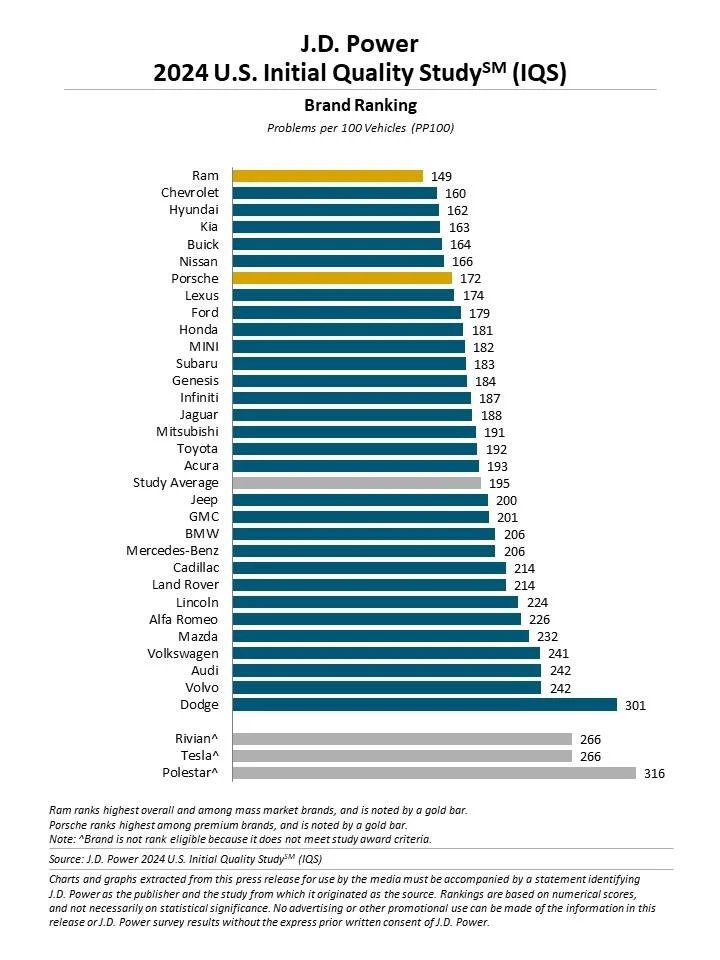

According to J.D. Power’s most recent U.S. Initial Quality Study (IQS), there are, on average, 195 problems per 100 (PP100) 2024 model year vehicles within franchise dealership repair visits, and even more issues with premium brands including electric vehicles (EVs).

Proponents of battery electric vehicles (BEVs) often state that the vehicles should be less problematic and require fewer repairs than gas-powered vehicles since they have fewer parts and systems, a J.D. Power news release states.

However, J.D. Power found with newly incorporated repair data that BEVs and plug-in hybrid electric vehicles (PHEVs) require more repairs than gas-powered vehicles in all repair categories.

“Owners of cutting edge, tech-filled BEVs and PHEVs are experiencing problems that are of a severity level high enough for them to take their new vehicle into the dealership at a rate three times higher than that of gas-powered vehicle owners,” said Frank Hanley, J.D. Power senior director of auto benchmarking, in the release.

Mass market brands, with a combined average of 181 PP100, outperform the industry average while premium brands — often including more complicated systems and reliance on connectivity — average 232 PP100, according to the report. A lower score reflects higher vehicle quality.

“It is not surprising that the introduction of new technology has challenged manufacturers to maintain vehicle quality,” Hanley said. “However, the industry can take solace in the fact that some problem areas such as voice recognition and parking cameras are seen as less problematic now than they were a year ago.”

Gas- and diesel-powered vehicles average 180 PP100 this year while BEVs are 86 points higher at 266 PP100.

“While there are no notable improvements in BEV quality this year, the gap between Tesla’s BEV quality and that of traditional OEMs’ BEV quality has closed, with both at 266 PP100,” J.D. Power said. “In the past, Tesla has performed better, but that is not the case this year and the removal of traditional feature controls, such as turn signals and wiper stalks, has not been well received by Tesla customers.”

The study found that frustration is rising from false warnings and drivers not understanding what warnings mean. Rear seat reminder technology contributes 1.7 PP100 across the industry. Some mistakenly perceive it as a warning that a seat belt is unbuckled, or the warning goes off when no one is in the rear seat.

Advanced driver assistance systems are irritating vehicle owners with inaccurate and annoying alerts from rear cross-traffic warning and reverse automatic emergency braking features, a newly added feature to the survey this year, J.D. Power said.

Problems with Android Auto and Apple CarPlay persist as the feature remains one of the top 10 problems. Customers most frequently experience difficulties connecting to their vehicle or losing connection.

More than 50% of Apple users and 42% of Samsung users access their respective features every time they drive, illustrating that customers want their smartphone experience brought into the vehicle and want the feature to be integrated wirelessly, according to the study.

Features, controls, and displays are the second most problematic category in the study, slightly better than only the notoriously issue-prone infotainment category, J.D. Power said.

From seemingly simple functions like windshield wipers and rear-view mirrors to the more intricate operation of an OEM smartphone application, the category is particularly troublesome in EVs. PP100 in this category is more than 30% higher in EVs than in gas-powered vehicles and is exacerbated by Tesla’s recent switch to steering wheel-mounted buttons for horn and turn signal functions, according to the study. The change hasn’t been well received by owners, J.D. Power said.

Unpleasant interior smell is another issue that has worsened the most compared to 2023 with every brand except Kia and Nissan seeing an increase, the study states.

Vehicle owners say problem odors seem to come from heating, ventilating, and air conditioning systems.

The IQS, now in its 38th year, is based this year on responses from 99,144 purchasers and lessees of new 2024 model-year vehicles who were surveyed after 90 days of ownership.

For the first time, the study also incorporates repair visit data based on hundreds of thousands of real-world events reported to franchised new vehicle dealers, J.D. Power said.

The methodology for this year’s IQS was enhanced to unite newly acquired, state-of-the-art vehicle repair data with traditional J.D. Power Voice of the Consumer data while fielding continuously year-round.

The study is based on 227 VOC questions plus relevant repair data, all of which is organized into 10 vehicle categories: infotainment; features, controls, and displays; exterior; driving assistance; interior; powertrain; seats; driving experience; climate; and unspecified (unique to repair).

The study was fielded from July 2023 through May 2024.

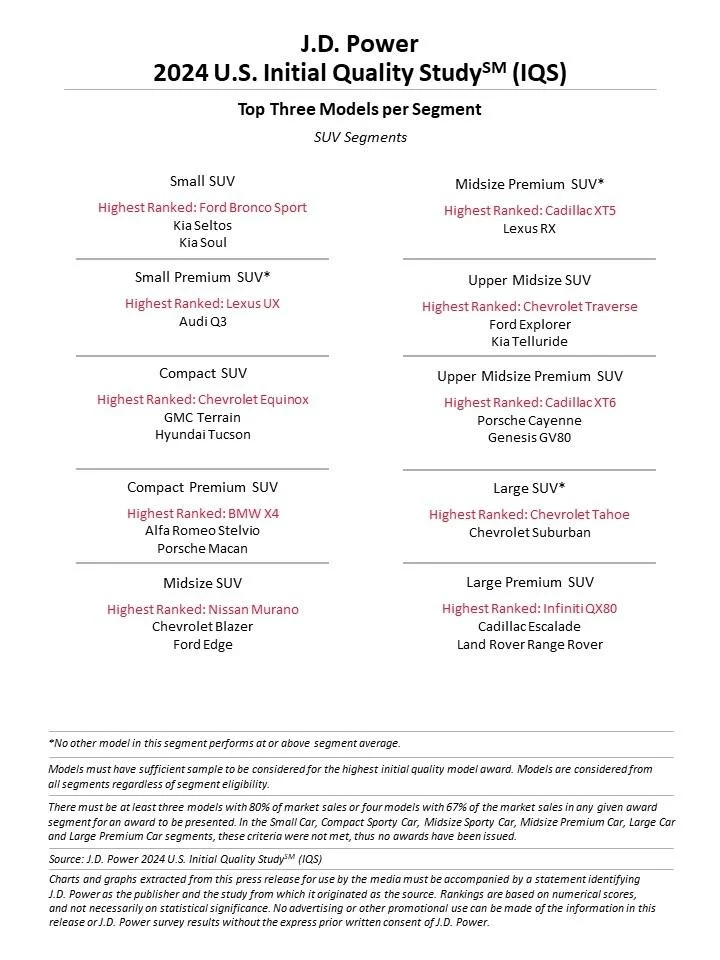

Highest-Ranking Brands and Models

Ram is the highest-ranking brand overall in initial quality with a score of 149 PP100. Among mass-market brands, Chevrolet (160 PP100) ranks second, and Hyundai (162 PP100) ranks third.

Among premium brands, Porsche ranks highest with a score of 172 PP100. Lexus (174 PP100) ranks second and Genesis (184 PP100) ranks third.

The parent corporation receiving the most model-level awards is General Motors (six awards) followed by Hyundai Motor Group and Toyota Motor Corp., each with four awards. Among brands, Chevrolet received the most segment awards (four) followed by Lexus (three).

GM models that rank highest in their respective segments are Cadillac XT5, Cadillac XT6, Chevrolet Equinox, Chevrolet Silverado HD, Chevrolet Tahoe, and Chevrolet Traverse.

Hyundai Motor Group models ranked highest in their respective segments are Genesis G80, Hyundai Santa Cruz, Kia Carnival, and Kia Forte.

Toyota models ranked highest are Lexus IS, Lexus LC, Lexus UX, and Toyota Camry.

The highest-ranking model overall is the Lexus LC with 106 PP100.

EV Sales Q1 2024

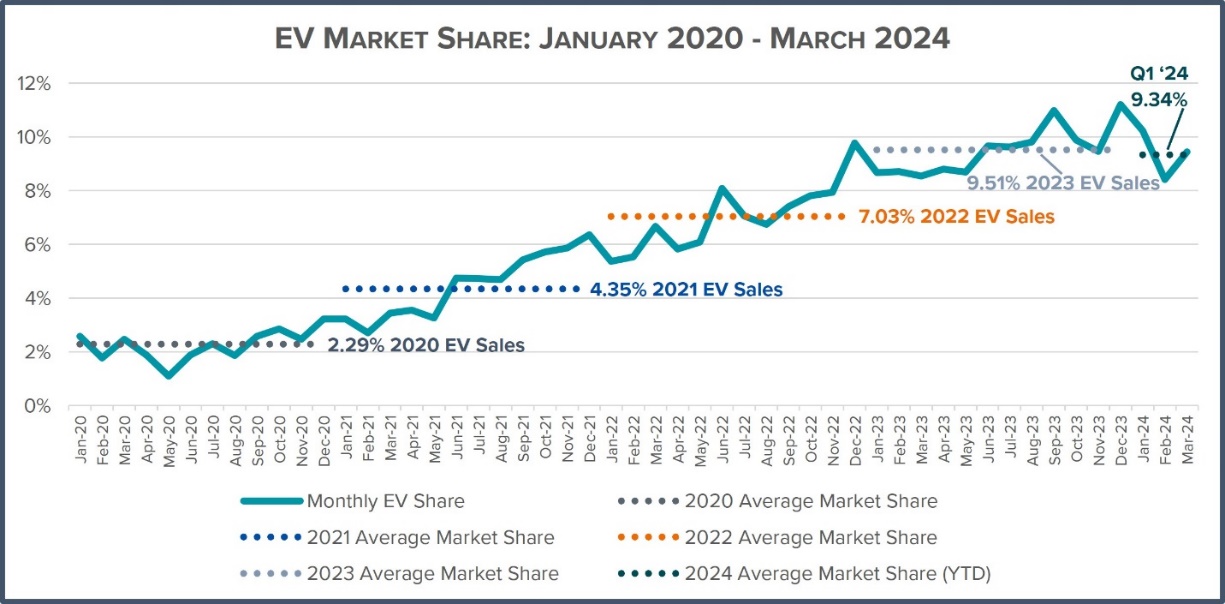

The Alliance for Automotive Innovation (Auto Innovators) also found in its Q1 2024 Get Connected Electric Vehicle report that EV sales are up year-over-year but are down sequentially.

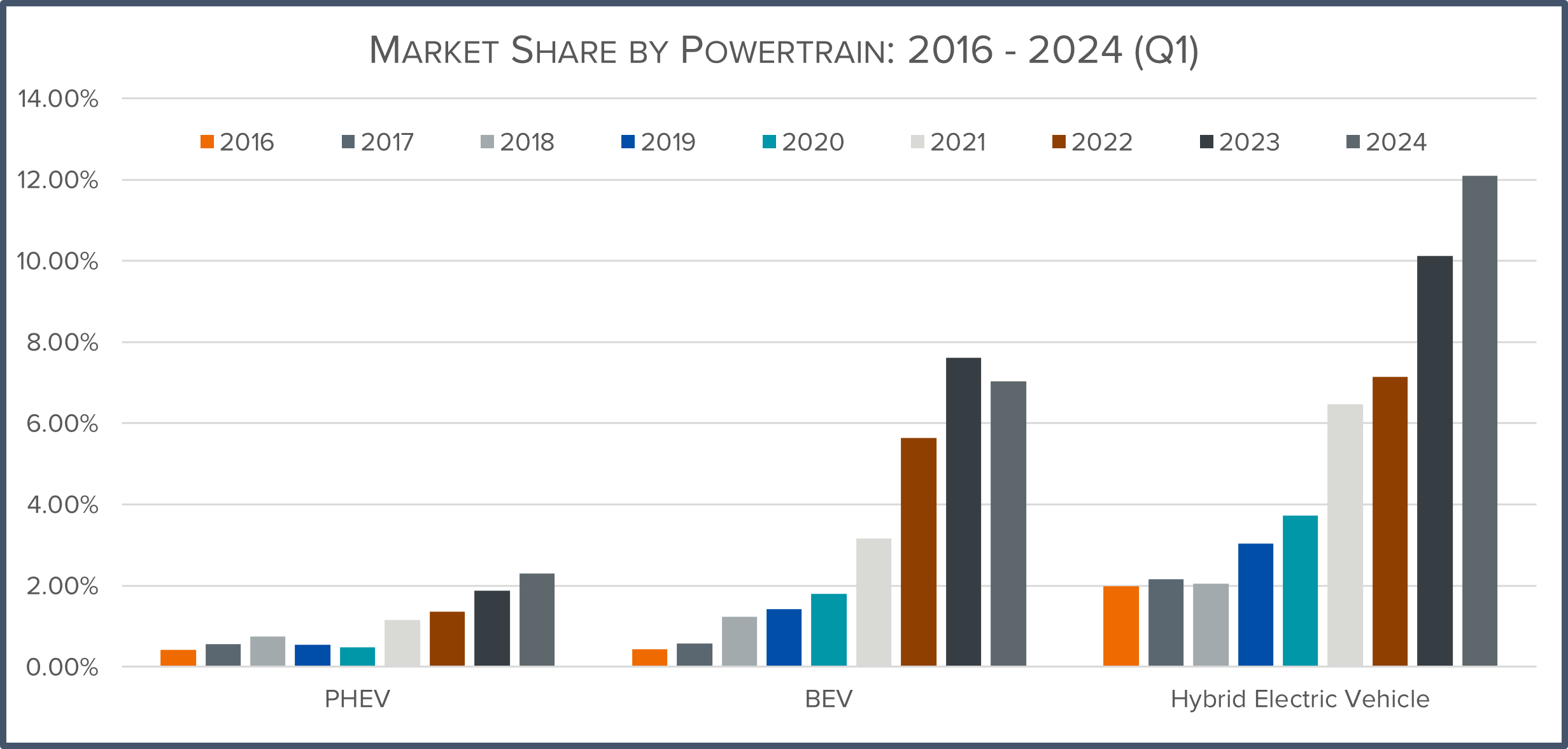

The state-by-state analysis of the U.S. EV market includes a breakdown of light-duty market share by powertrain (2016-2024) and an update on EVs eligible for the federal 30D EV tax credit.

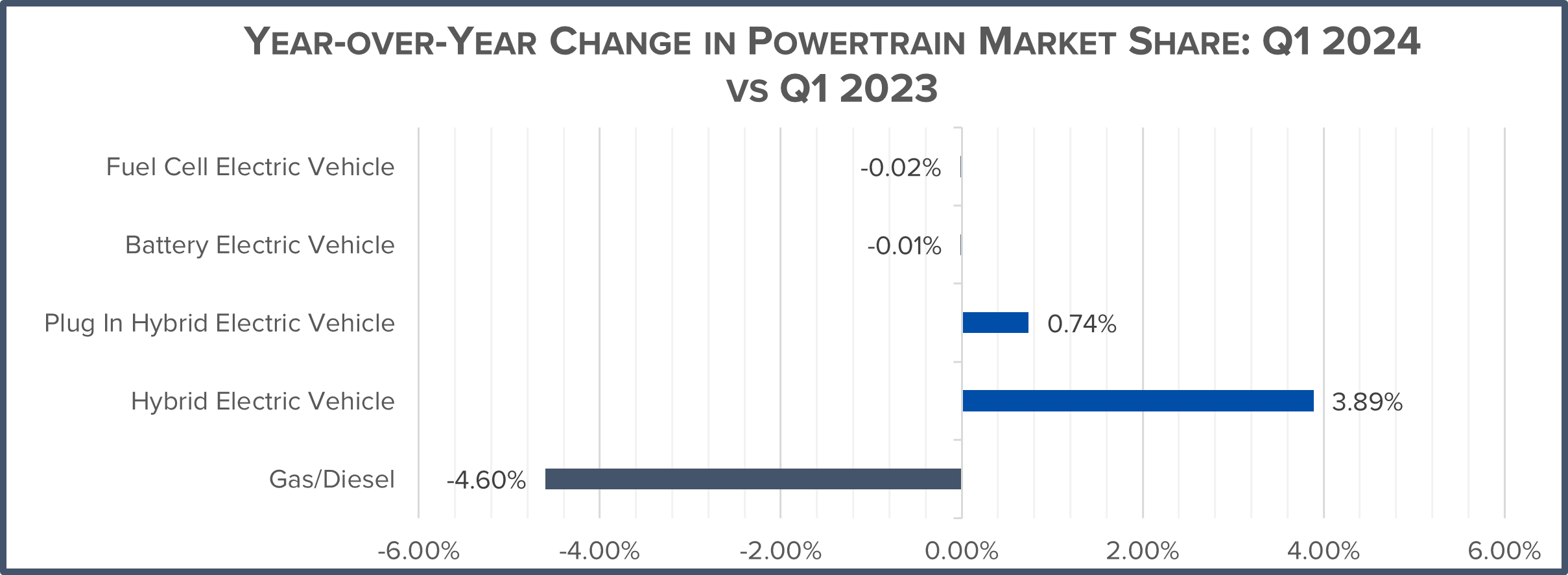

EVs represented 9.3% of new light-duty vehicle sales in Q1 2024, down from 10.2% in Q4 2023 and up from 8.6% in Q1 2023. There are now 113 EV cars, utility vehicles, pickup trucks, and van models for sale.

The report also found:

-

- Light truck sales represent 84% of the EV market;

- EV market share increased in 37 states during Q1 compared to Q1 2023;

- The top five states for EV sales during the quarter are California (24.8%); Washington (20.2%); District of Columbia (19.5%); Colorado (18.3%), and Hawaii (16%);

- More than 344,000 EVs were sold during the quarter, 13% increase over Q1 2023;

- Total light-duty sales (all powertrains) increased 4.2%; and

- Internal combustion engine (ICE) vehicle market share contracted 4.6%.

The number of publicly available EV chargers increased 5% from the previous quarter while total EVs on the road increased 8%, according to the report.

Nationwide, 344,533 EVs were registered in Q1 2024 but only 7,247 new public chargers were added which is a ratio of 48 new EVs for every new public port. In total, there are 4.7 million EVs on the road and 167,213 public charging outlets which is a ratio of 28 EVs for every public port.

Over 1 million more public chargers (940,370 Level 2 and 141,417 DC Fast) are required to meet the National Renewable Energy Laboratory’s necessary infrastructure estimate for 2030, according to Auto Innovators. That means 438 chargers will need to be installed every day, or nearly three chargers every 10 minutes, through the end of 2030, the report states.

Of the 113 EV models available for sale in Q1 2024, 19 percent (22 models) are eligible for all or part of the $7500 federal EV tax credit.

Images

Featured image credit: kckate16/iStock

Graphs provided by J.D. Power and Auto Innovators