More than a third of drivers say they’d rather not file claims with their insurance company

By onInsurance

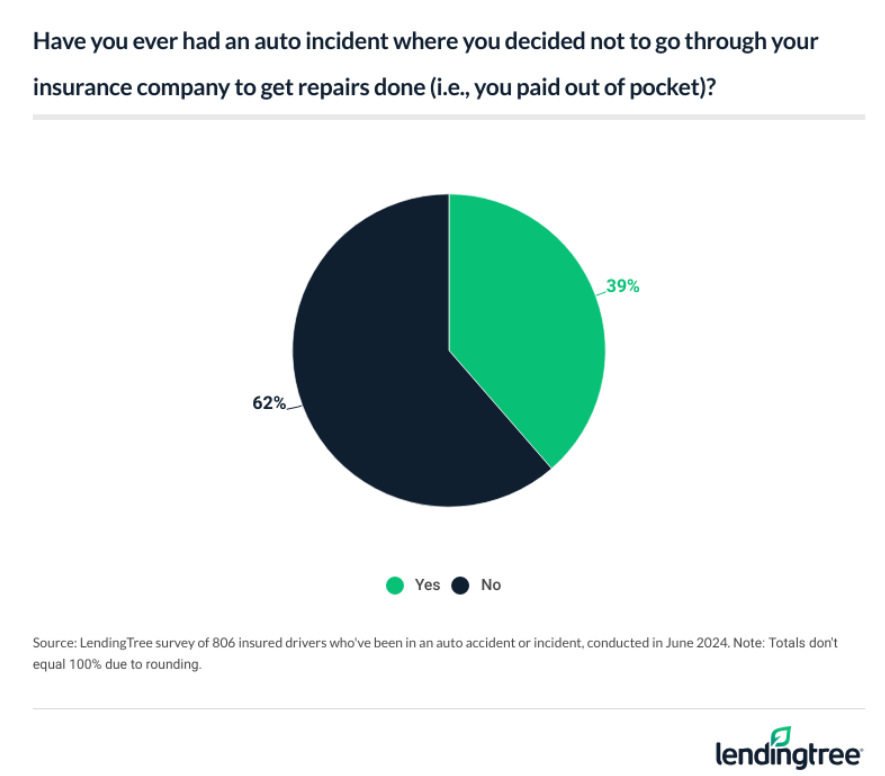

Based on a survey of 2,000 U.S. consumers, LendingTree recently found that 39% of those who have been in an accident or incident didn’t use their insurance for repairs. And 24% who did file a claim regretted it, more commonly among younger drivers.

Fifty-nine percent said they didn’t use their insurance because the damage was minimal. Forty-four percent said their deductible was higher than the cost. Forty-two percent said they didn’t want their insurance rates to increase.

Seventy-six percent had a deductible of less than $1,000 when they paid out of pocket, and 65% spent less than $1,000 on repairs.

Men and younger drivers are less likely to file an insurance claim. Overall, 39% of the survey respondents have, at some point, chosen not to use their insurance for repairs.

“A claim for an at-fault accident almost always increases your rates,” said Rob Bhatt, licensed insurance agent and LendingTree auto insurance staff member. “If someone else causes the damage, their policy’s liability coverage is supposed to cover your repairs with no deductible. If the at-fault driver is uninsured, your policy’s uninsured motorist or collision coverage kicks in — if you have either. These coverages can also pay for repairs after a hit-and-run.”

However, he added that while a claim doesn’t have to be filed, it could be illegal for policyholders to not notify law enforcement of an incident or collision that causes injury or significant property damage.

Those who regretted filing a claim said they did because of:

-

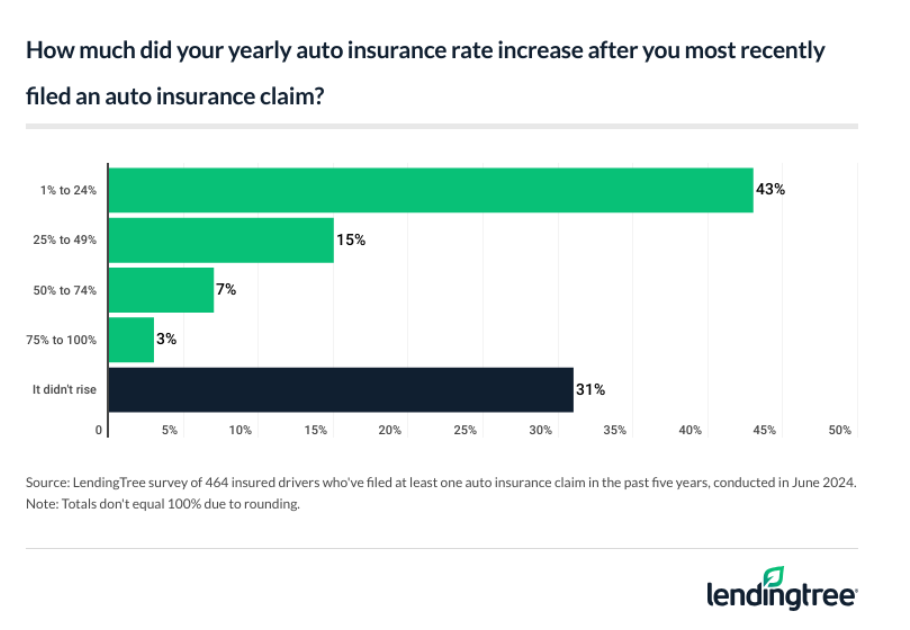

- Significantly higher insurance rates after filing (59%)

- Lessened vehicle value (36%)

- Expensive deductible (33%)

- View filing a claim as a hassle (22%)

- Lost their “no claims” bonus (5%)

Regardless of whether they filed for their most recent incident, drivers said they would generally like to avoid insurance when possible. Among insured drivers, 73% of those in an incident generally prefer to pay out of pocket for a small issue than involve their insurance, LendingTree said.

That rises to 77% among men. Sixty-eight percent of women felt the same.

The survey was conducted in June and quotas were used to ensure the sample base represented the overall population.

A new report from Insurify states that in the first half of this year, full-coverage annual insurance premiums were hiked another 15% to $2,329 on top of post-COVID increases over the past couple of years.

Insurify’s data science team projects a total 22% increase by the end of the year.

Bankrate found in its new “Hidden Cost of Car Ownership Study” that Americans are also struggling to pay the hidden costs of vehicle ownership, which are, on average, $6,684 annually.

Images

Featured image credit: CHRISsadowski/iStock