South Coast Air Quality Management District proposes phase-out of some paint solvents by 2028

By onAnnouncements

Southern California Collision repair shops and their customers could see an extra rise in liquid material costs in the coming years on top of already-increasing repair costs.

On Friday, the South Coast Air Quality Management District held a virtual workshop about its proposal to phase out two components used to manufacture paint.

Proposed changes to Rule 1151 would apply to all motor vehicle and mobile equipment non-assembly line coating operations and would require product reformulations.

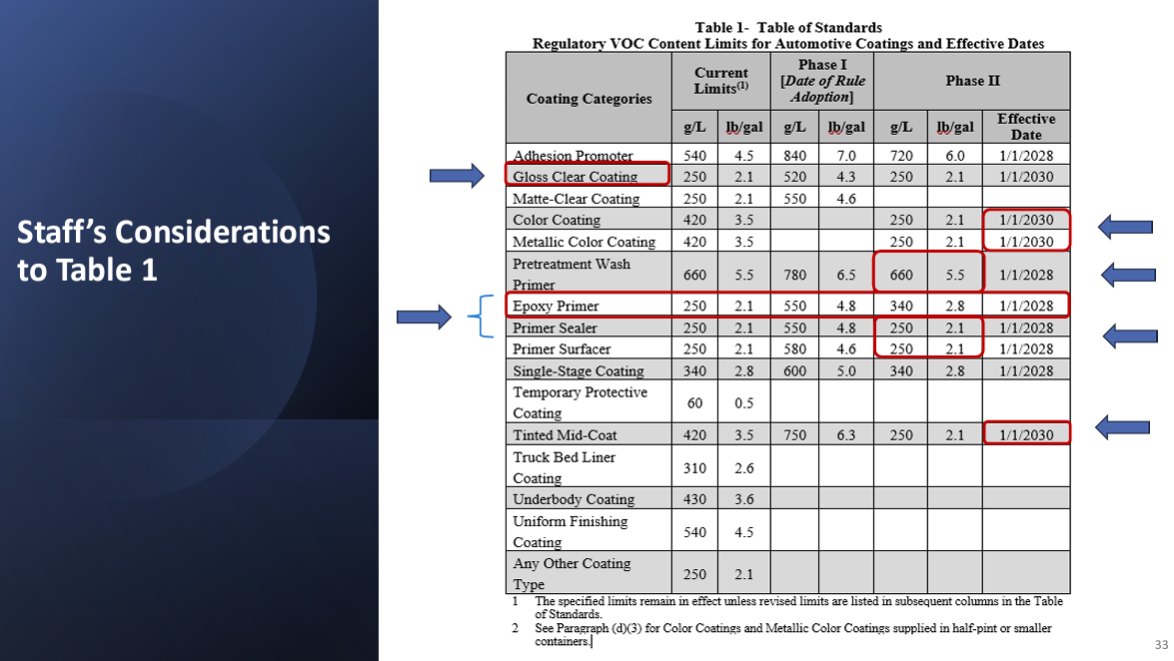

It would establish volatile organic compound (VOC) content limits for coatings as well as coating application restrictions and recordkeeping requirements.

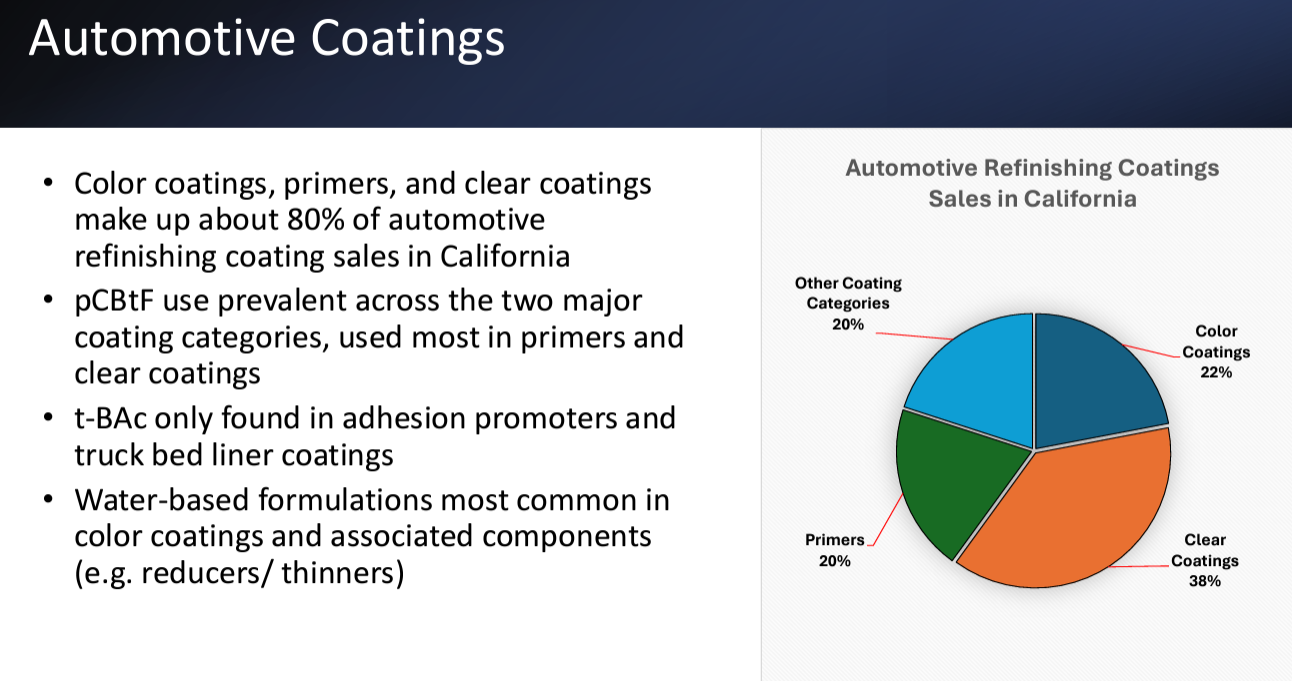

Nearly all automotive coating categories used in the South Coast AQMD contain both solvents, which the California Office of Environmental Health Hazard Assessment has deemed potential carcinogens, according to the AQMD.

The AQMD said Friday there are two ways to control VOC emission from automotive coatings: transition to water-based systems or formulate them with exempt solvents, such as tert-butyl acetate (t-BAC) and para-chlorobenzotrifuloride (pCBtF). t-BAC, however, is a limited exemption.

AQMD officials stressed during Friday’s workshop that there will be further opportunities for the public to comment on the proposed rule.

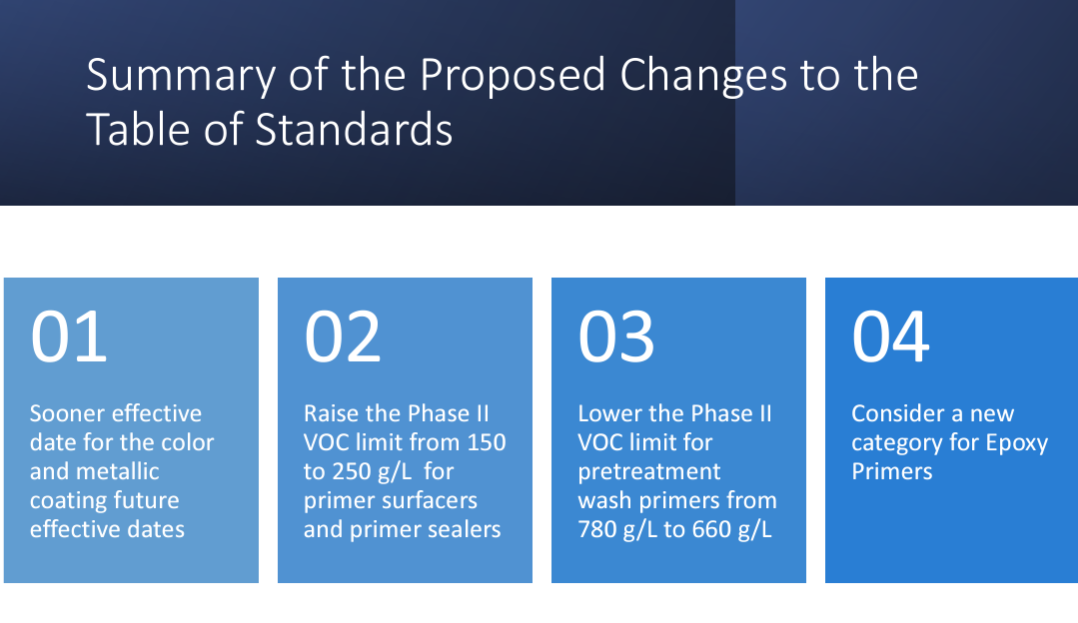

The proposal included a two-phase plan to phase out pCBtF and t-BAC:

-

- Phase I: Temporarily allow higher limits at rule adoption

- Phase II: Future effective date of lower limits pCBtF and t-BAc

A presentation on the proposal by AQMD says that it “allows time for manufacturers to reformulate and develop products to meet lower future limits with longer timelines allowed for categories that are challenging to reformulate to meet performance requirements and address color matching concerns and are heavily reliant on exempt compounds to comply with VOC limits.”

Sell-through and use-through dates are also included to allow time for use of current products that contain pCBtF and t-BAc.

Ahead of the meeting, the California Auto Body Association said in an email to its members that the “legislation is likely to lead to a significant increase in the costs to produce new compliant coating products used by almost all collision repairers. The initiative is purportedly to reduce the usage a newly categorized component as a hazardous chemical.”

“This change is likely to dramatically affect the cost of manufacturing paint products and those costs will likely be passed on to the end users of those products through higher production costs,” the email states.

While commenters told AQMD officials they understand the need for environmental protections, the proposed changes will have negative economic impacts.

Andrew Batenhorst, a body shop manager and CAA Glendale Foothill Chapter president, pointed out to the board that, ultimately, the costs paint manufacturers will take on to reformulate their products to be in compliance with the rule will be passed on to consumers.

“Typically, we face increases in materials every quarter that gets passed on to us as it is. Beyond that, in our environment, we’re probably dealing with insurance companies paying for almost 70% of all the repairable vehicles in my shop. I don’t give labor rate increases every quarter; I’m lucky if I get it once a year from an insurance company, maybe twice a year, and that varies wildly across the state.

Ultimately, with the increase in cost that’s going to come from the paint manufacturers having to revise formulas, that gets passed on to me — that’s going to get passed straight on to all the consumers that need to get their vehicles repaired. And that also is going to drive insurance premiums that we already are facing in this market.”

Ryan Brown, AkzoNobel western technical manager, said the timelines are somewhat tight for companies to meet.

“It takes a lot of resources to do these things and color codings especially,” he said. “It’s not like there’s a way to just modify an existing product line. You have to redesign something and within a color coding system, there’s over 100 components to go into that. It’s a large task.

“The cost to do that is really significant and the ongoing costs are very high because the color system has to be maintained every year. It’s not like it’s a one-time cost. You’re looking at a color coding system that’s only going to be used in one state and [for] all the manufacturers, it’s more of a global platform… The time to develop that stuff is sometimes a five to seven-year or even longer process.”

Mike Krause, South Coast AQMD Planning, Rule Development and Implementation assistant deputy executive officer, responded that the implementation timeframes aren’t taken lightly. However, the agency has to acknowledge and address that body shops and other businesses are releasing emissions from the components within the district’s neighborhoods.

“Some people have already made great advances and strides in that.. but we also recognize that other folks need that need that time,” he said. “We do think the ones we’re proposing are reasonable ones that we feel create that balance in order to achieve them… We do have unique challenges down here in Southern California. Extreme non-attainment of our ozone means that we have to put more and more reductions in areas like our volatile organic compounds, which come of course, from our coatings, our solvents, our adhesives, our fugitive petroleum gasses, things like that.”

Krause added that timeframes can be revisited and that the district faces sanctions for non-attainment.

“The reality is — even if there may be some solvent savings and an individual product may be slightly cheaper — the inventory cost, the unique label, the packaging, everything is going to be unique specifically for one market,” said Tim Ronak, AkzoNobel senior services consultant. “The average repair cost right now is almost $6,000 as reported in national publications for collision repair vehicles paid for by an insurance company. The typical liquid material cost of this product that we manufacture averages about 5% of that.

“Any increase that we have on that liquid material portion is absolutely going to be passed on as part of the business of being able to be competitive in the marketplace. That’s going to wind up driving up that $5,900 or $6,000 average repair cost, which in turn will impact consumers directly through raised insurance premiums.”

The webcast will be uploaded here. To view the PowerPoint presentation referenced during the workshop, click here.

Images

Photo courtesy of Featured image credit: Ruslan malysh/iStock

Graphs provided by the South Coast Air Quality Management District.