CCC: Customers see repair process as ‘single cohesive experience’ between repairers, insurers

By onBusiness Practices | Collision Repair | Insurance

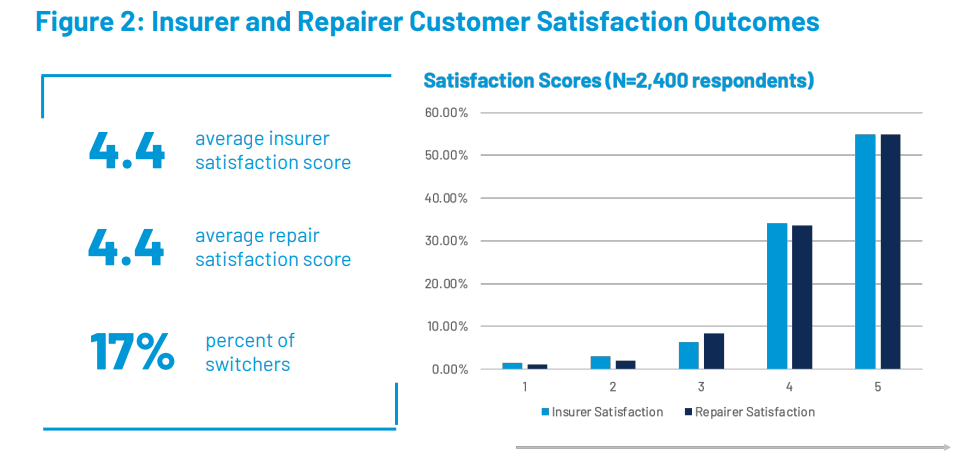

CCC Intelligent Solutions released the findings of its “Moments of Truth” study today, which the IP says show customer satisfaction with the repair process isn’t solely on the repairer or the insurer but instead, are intertwined.

Consumer satisfaction with insurers and repairers in a claims experience are closely linked, and that collaboration plays a pivotal role in each other’s satisfaction scores, according to a news release from CCC.

The study defines “moments of truth” as “critical points in time in which carriers and repairers must perform well to achieve a good outcome for customer satisfaction, and for carriers, customer retention.”

CCC said the findings also indicate that satisfaction with the claims process may not impact insurer loyalty.

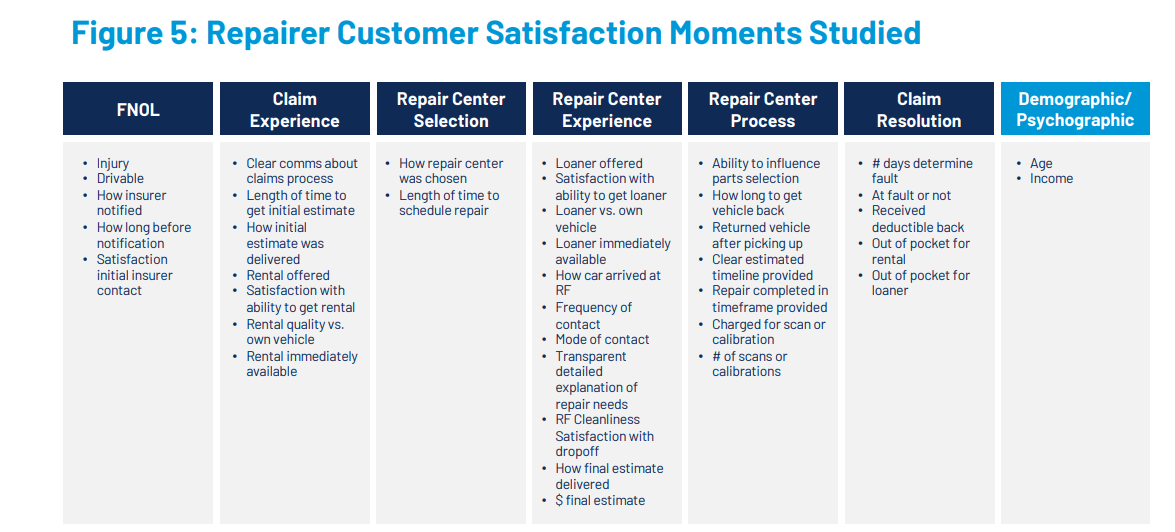

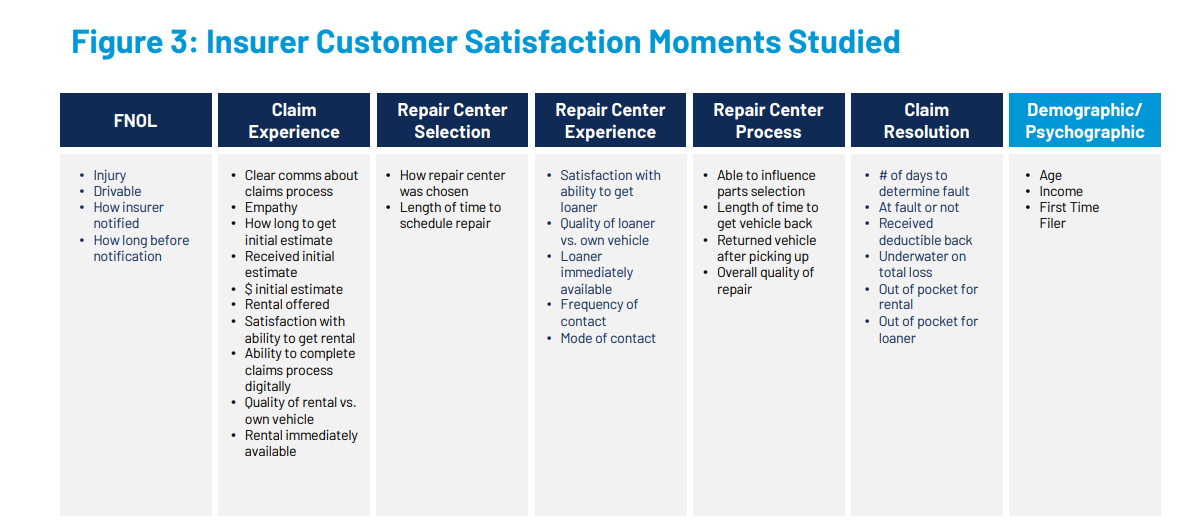

The study is based on responses from 2,400 policyholders involved in an accident between August 2021 and December 2023 who filed a first-party claim and went through the repair process. Forty-seven moments in the first-party auto claims and repair process were analyzed.

“[R]epairers help insurers score satisfaction points by offering high-quality repairs and minimizing the time to schedule and complete repairs, and conversely, insurers bolster repair satisfaction scores with clear communication about the claims process and a satisfying first contact with the consumer,” CCC said.

“These insights suggest that many consumers view their interactions with insurers and repairers as a single cohesive experience and do not differentiate between their experiences with insurers and repairers.”

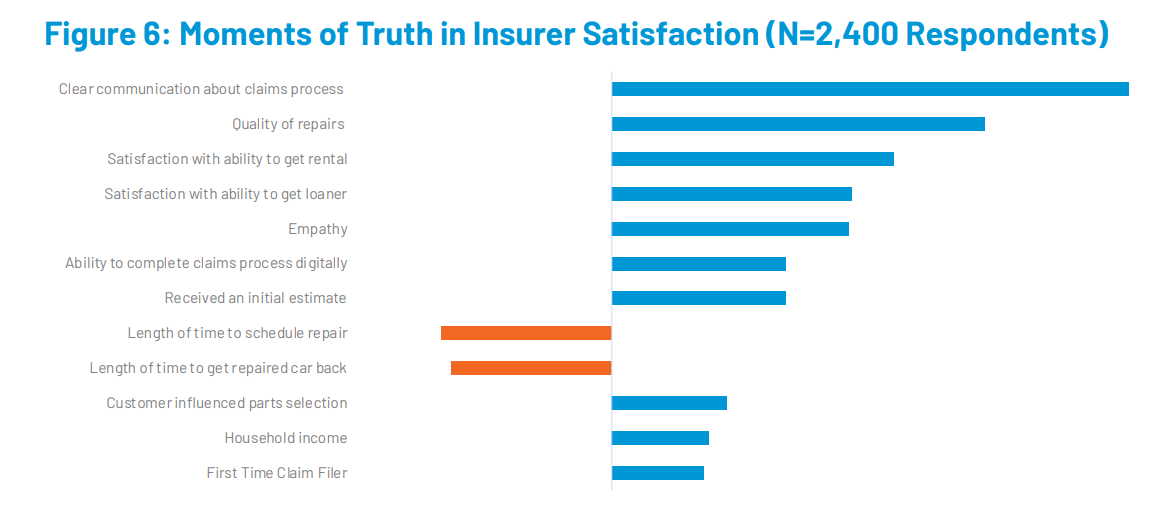

Overall moments with repairers that had a negative impact are shown below in orange while positive are shown in blue.

CCC found that customers’ No. 1 moment for repairer satisfaction is getting a transparent and detailed explanation of repair needs despite the repair bills being paid by the insurers.

“This goes against the industry’s age-old wisdom that speed is what matters, [and that] ‘The consumer is not paying for the repair, so they don’t need or care to know how their vehicle needs to be repaired,'” CCC said.

“It turns out that the length of time required to repair the vehicle is also a moment of truth but is outweighed by the need to know the details of how the vehicle will be repaired. This suggests that customers want to ensure the safety and reliability of their vehicle when they return to the road.”

Apart from repair process transparency, detail, and speed CCC found through its study that there are also moments that reflect on repairer satisfaction but are actually in the control of insurers, such as when they receive clear communication about how the claims process will work and when they are satisfied with their first contact with the insurer.

“For example, insurers greatly influence where consumers go to get their vehicles repaired… Nearly one-third of consumers, the largest cohort, said that the determining factor that informed where they took their vehicle for repair was a recommendation from their insurer.”

Two of the moments of truth for repairer satisfaction were actually insurer responsibilities while four of the moments of truth for insurer satisfaction were repairers’ responsibilities, according to the study.

The second most influential reason was respondents had been to the repair facility before and trust the repairers there.

Other reasons, in order of most influential, include:

-

- Recommended by friends or family;

- Offered best price;

- Proximity to home or work;

- Based on online reviews; and

- Remembered the facility from advertisements;

Frequency of contact from repairers being “just right” is key: 88% of respondents wanted at least weekly updates, with nearly half expecting communication every two to three days, CCC said.

The study also found that customers’ interactions with repair facilities influenced their perception of insurers; 42.5% of consumers surveyed said that made a difference.

When the study model was conducted with only respondents who indicated that they lived in “urban” (52%) or “suburban” areas (36%), the empathy moment went from the fifth most important to the third most important. The “used text to communicate with repair facility” moment also showed up as statistically significance compared with not showing up at all in the model for the overall sample.

For lower income households, receiving a deductible back from insurers was also significant. Based on this finding, CCC wrote in the study results, “Insurers should consider ways to generate the highest number of optimal outcomes for every customer, and at lower income levels, receiving their deductible back can be an important determinant in how satisfied a consumer will be with their carrier.”

“[R]espondents are more satisfied with their carriers when they perceive overall vehicle repair quality to be high, and they’re also more satisfied with their repairer when they receive clear communications about how the claims process will work,” the study results state. “This suggests that, in a consumer’s mind, the entire post-accident journey from ‘crash to keys’ is one unified experience in which the providers are, in some instances, indistinguishable from one another.”

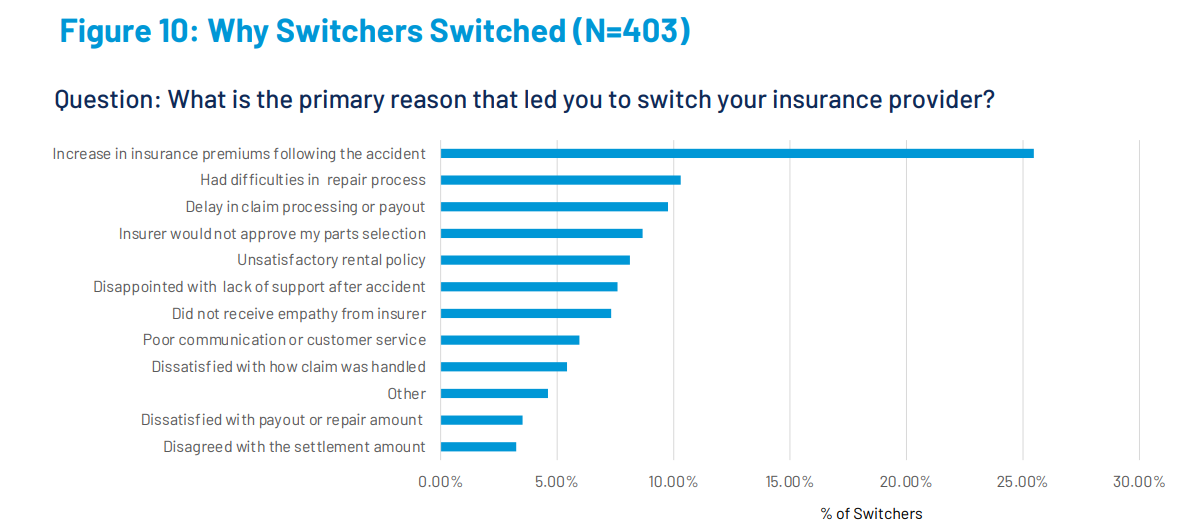

CCC found most of the moments that helped the carrier achieve a positive customer satisfaction score were relatively statistically insignificant in helping to determine carrier defection.

Overall, 17% of the sample said they switched carriers after the claim.

Three moments were found to be the most powerful predictors of switching behavior:

Three moments were found to be the most powerful predictors of switching behavior:

-

- In a total loss, the policyholder was upside down in their outstanding loan and was able to cover the gap;

- An injury occurred in the accident; and

- Being a first-time claim filer (with any insurer).

When all three are present, policyholders are more than three times likely to leave their carrier, CCC said.

“Policyholders with total loss vehicles that were sent to repair facilities were 5x more likely to switch than their repairable counterparts, while the presence of an injury made them 1.7x more likely to switch,” the study findings state. “Being a first-time claim filer also increased their likelihood to switch, albeit moderately.”

Maryling Yu, vice president of marketing at CCC, added in the release, “Our findings suggest that while speed has long been prioritized, transparency and clear communication about the claims process and repair needs play an even more significant role in consumer satisfaction.

“The study found that even when a consumer has indicated high satisfaction with their insurer, it may not tell the insurer much about whether they will ultimately switch. We hope these insights will help the industry in navigating today’s challenges and delivering better outcomes.”

The full report can be downloaded at cccis.com/reports/moments-of-truth.

Images

Featured image credit: Hispanolistic/iStock

All graphs/charts provided by CCC in “Moments of Truth” report