CCC: Longer vehicle life, more expensive and complex repairs, more total losses trends continue

By onAnnouncements | Collision Repair | Market Trends

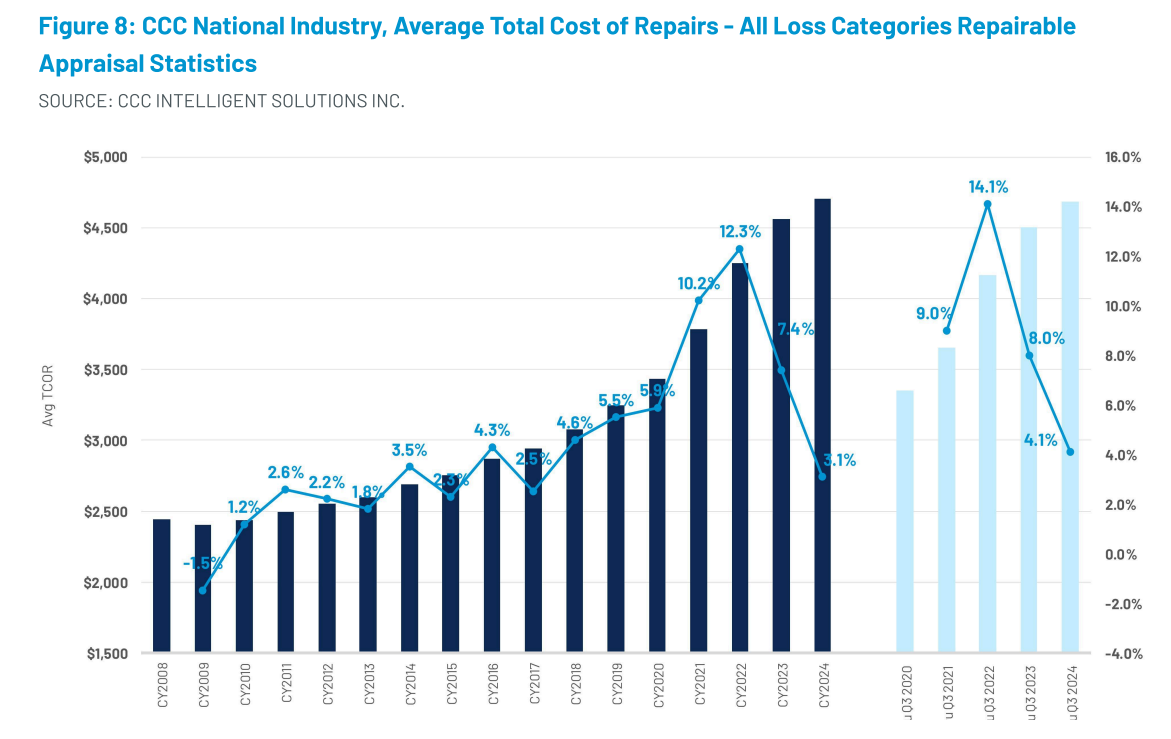

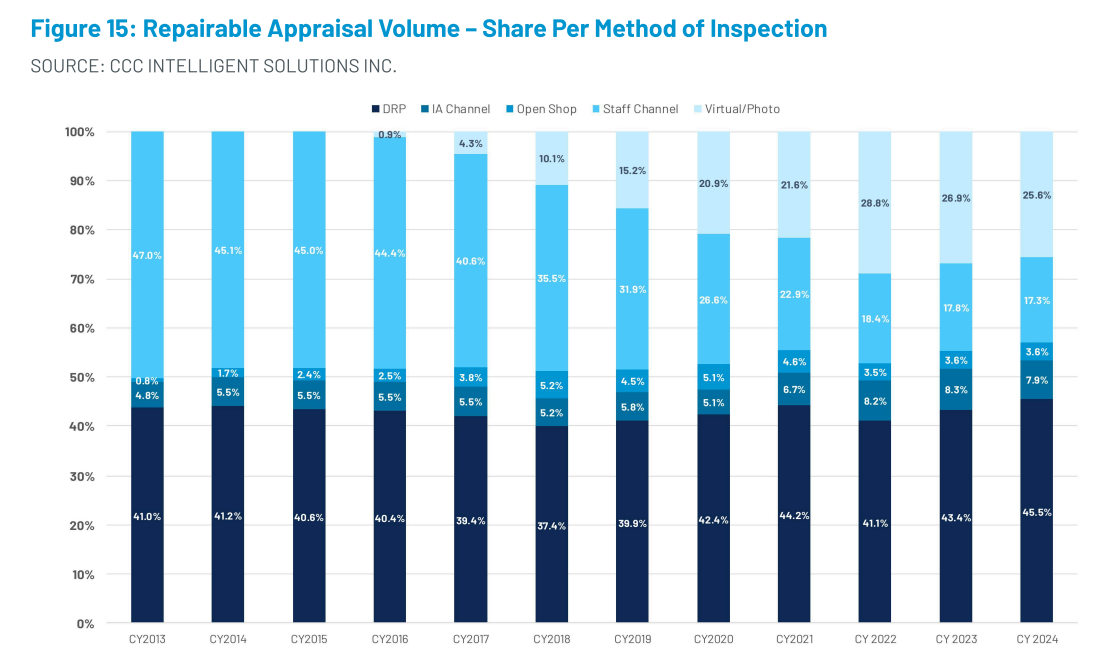

Research provided in CCC Intelligent Solutions’ Crash Course Q1 2025 report shows that changes in the U.S. vehicle car parc are causing longer vehicle life; increasingly complex, costlier, and tech-driven repairs; more total losses, and cost inflation.

Kyle Krumlauf, director of industry analytics at CCC and co-author of Crash Course, called the transformation “anything but cyclical.”

“It’s this intersection — not any single trend — that marks a true inflection point for the auto claims and repair economy,” he said, in a CCC press release. “Our Q1 report helps the industry understand these forces and plan accordingly.”

Crash Course is based on information from 300 million claims-related transactions and millions of bodily injury and personal injury protection/medical payment casualty claims processed by CCC customers.

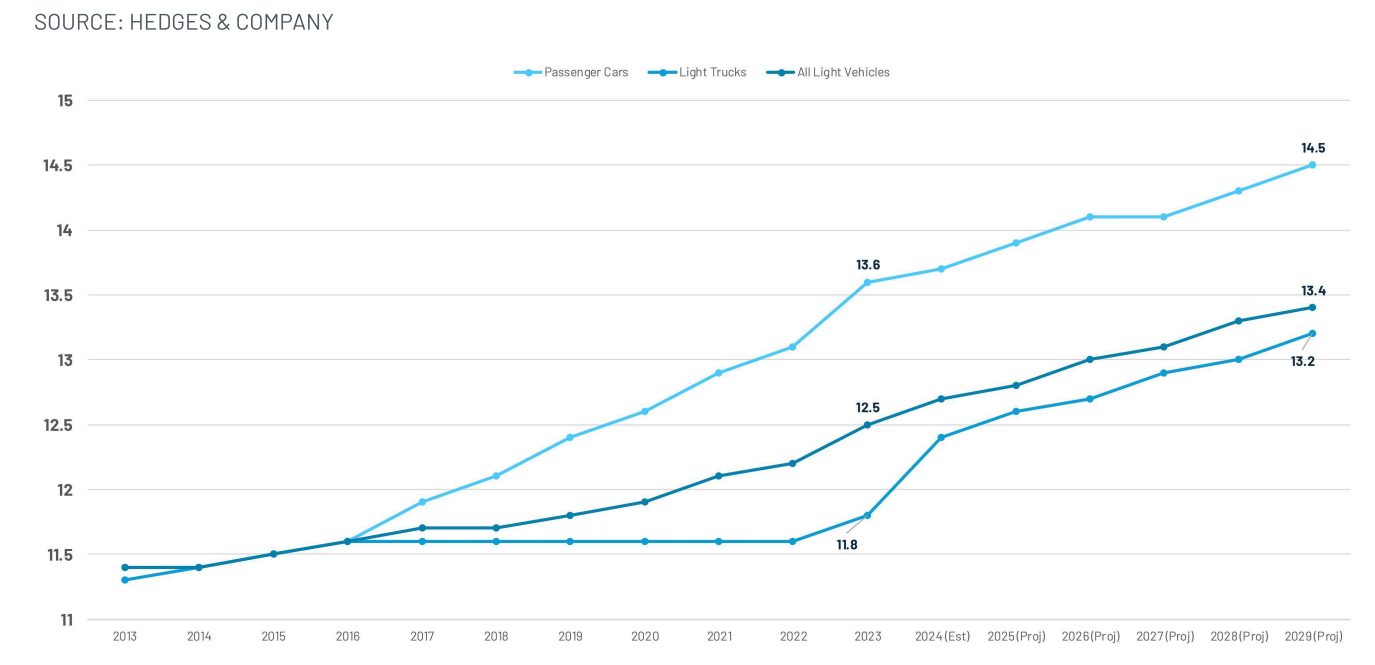

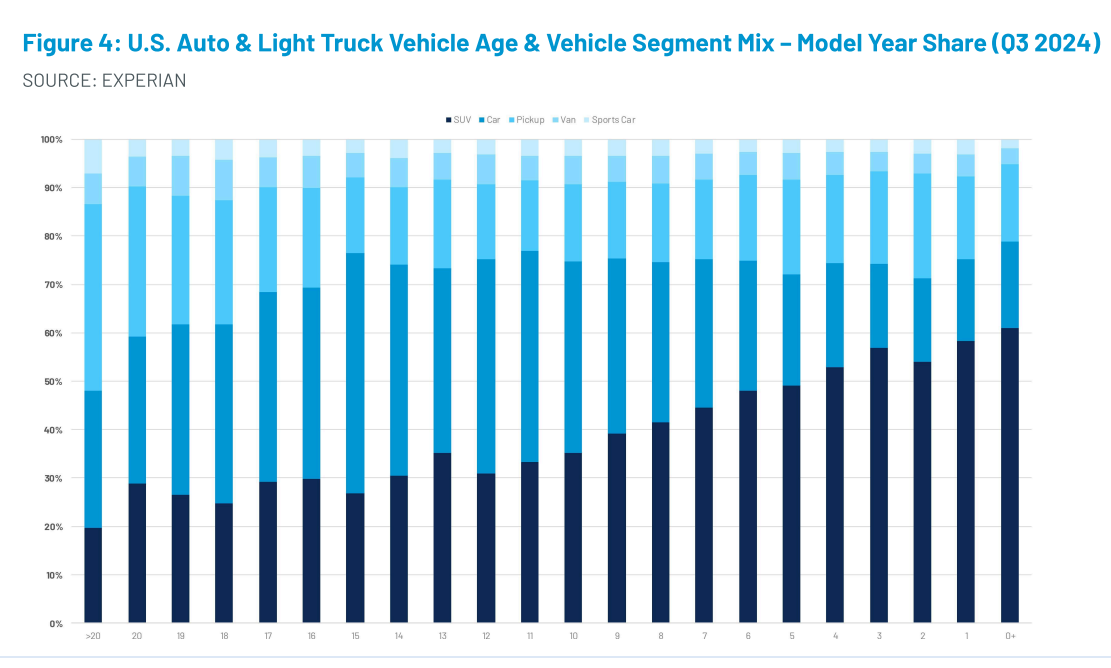

The average vehicle age is now 12.7 years old, on point with the average age trending upward over the last few years. CCC projects the average age to reach 13 by 2026.

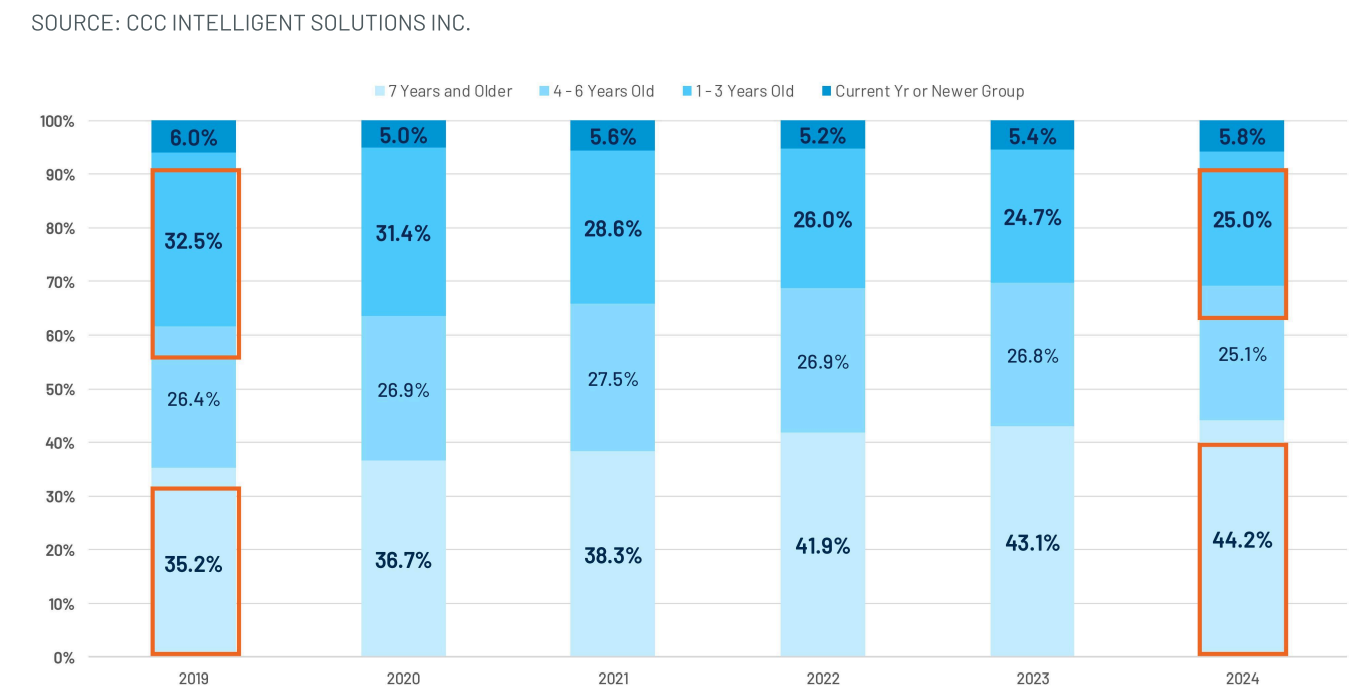

The share of repairable vehicles seven years or older has increased 9 percentage points since 2019. High vehicle costs, interest rates, and supply constraints have driven longer ownership cycles, delayed upgrades, and increased repair needs, according to CCC.

More than 70% of total loss valuations in 2024 were for vehicles seven years or older, and continued depreciation of used vehicles plus the growing cost of repairs, especially for EVs and ADAS-equipped cars, are driving carriers to declare more total losses, CCC wrote.

EVs require nearly four additional labor hours than their ICE counterparts per repair and labor costs are averaging 30% higher. According to CCC’s research, hybrids require the most expensive parts, on average, while EVs have fewer but costlier parts. EVs averaged 22 replacement parts per repair last year compared to 16 for ICE vehicles.

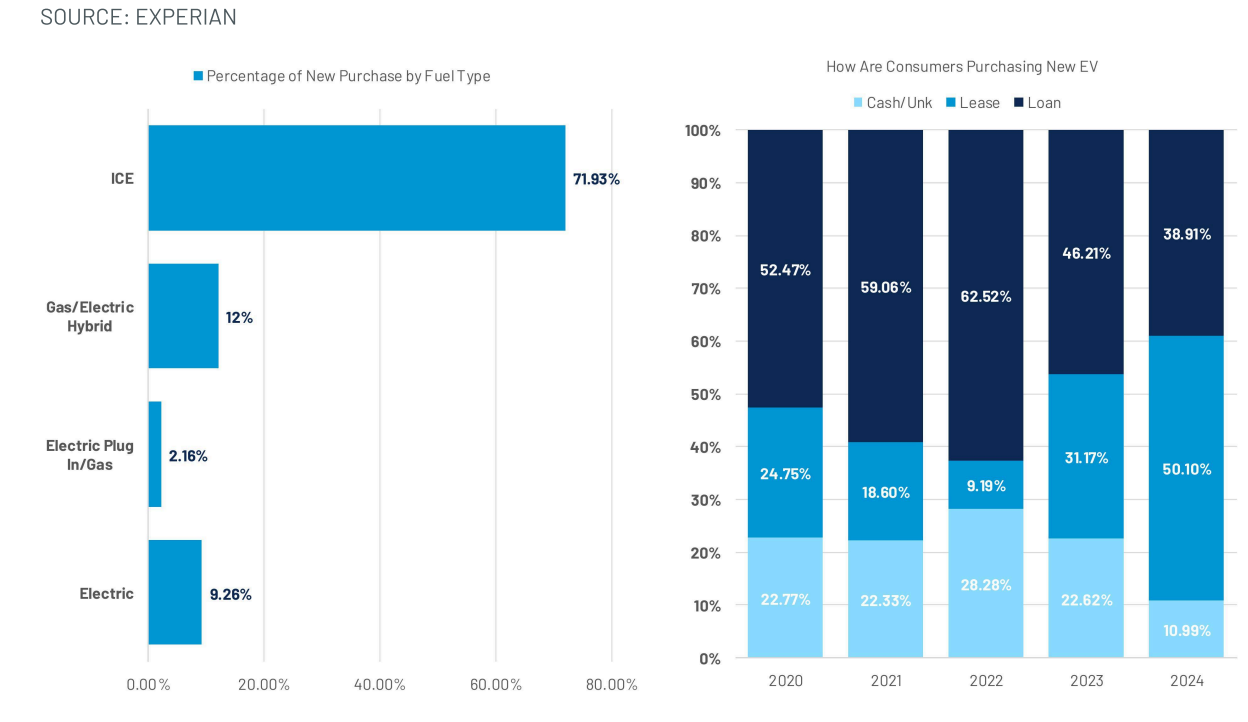

The report also shows that 95% of the U.S. car parc are ICE vehicles including nearly 72% of new purchases during Q3 2024. Consumers continue to buy larger vehicles.

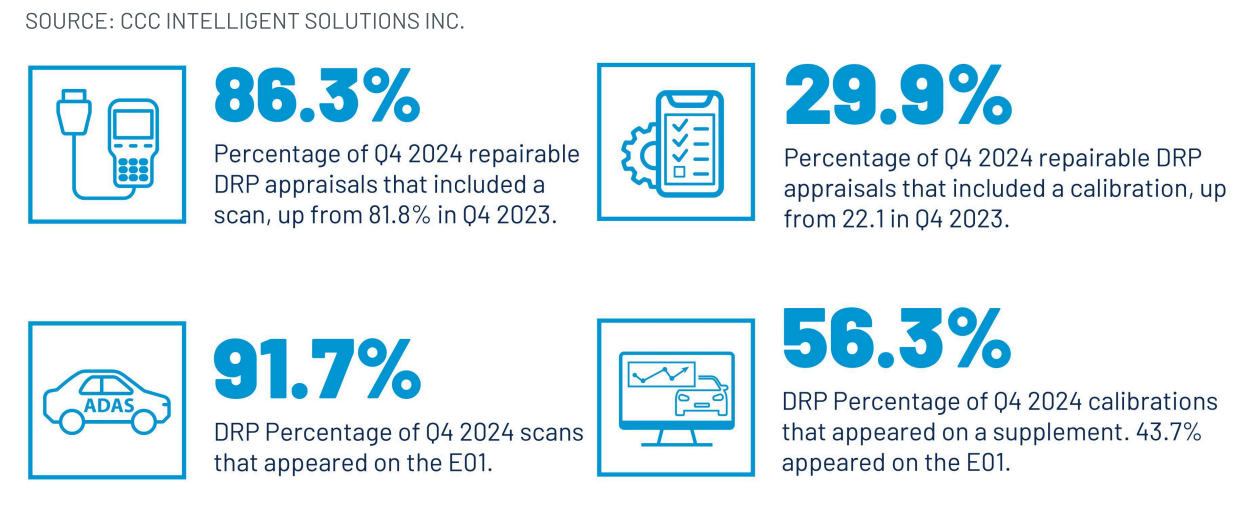

Vehicles equipped with advanced driver assistance systems (ADAS) demand more frequent and complex diagnostics. Hybrids had the highest calibration frequency and cost, with features like front automatic emergency braking and blind spot monitoring now found in more than half of vehicles.

To download the full report, visit cccis.com/crash-course.

Images

Featured image credit: LukaTDB/iStock

All graphs and charts provided in CCC’s latest Crash Course report