Mitchell: Expect tariffs to disrupt supply chains, increase repair costs beginning this summer

By onBusiness Practices | Collision Repair

New tariffs on assembled vehicles and some automotive parts are expected to disrupt supply chains and increase repair costs. However, Mitchell International says the impact likely won’t hit until mid- to late summer.

A 25% tariff on assembled vehicles imported into the U.S. went into effect on April 3, and a 25% tariff on some parts is set to begin May 3.

During an April 17 CIECA webinar, Ryan Mandel, Mitchell’s auto physical damage solutions claims performance director, noted that the scope of the tariffs has changed dramatically over the last month and could change again, including the addition of more parts.

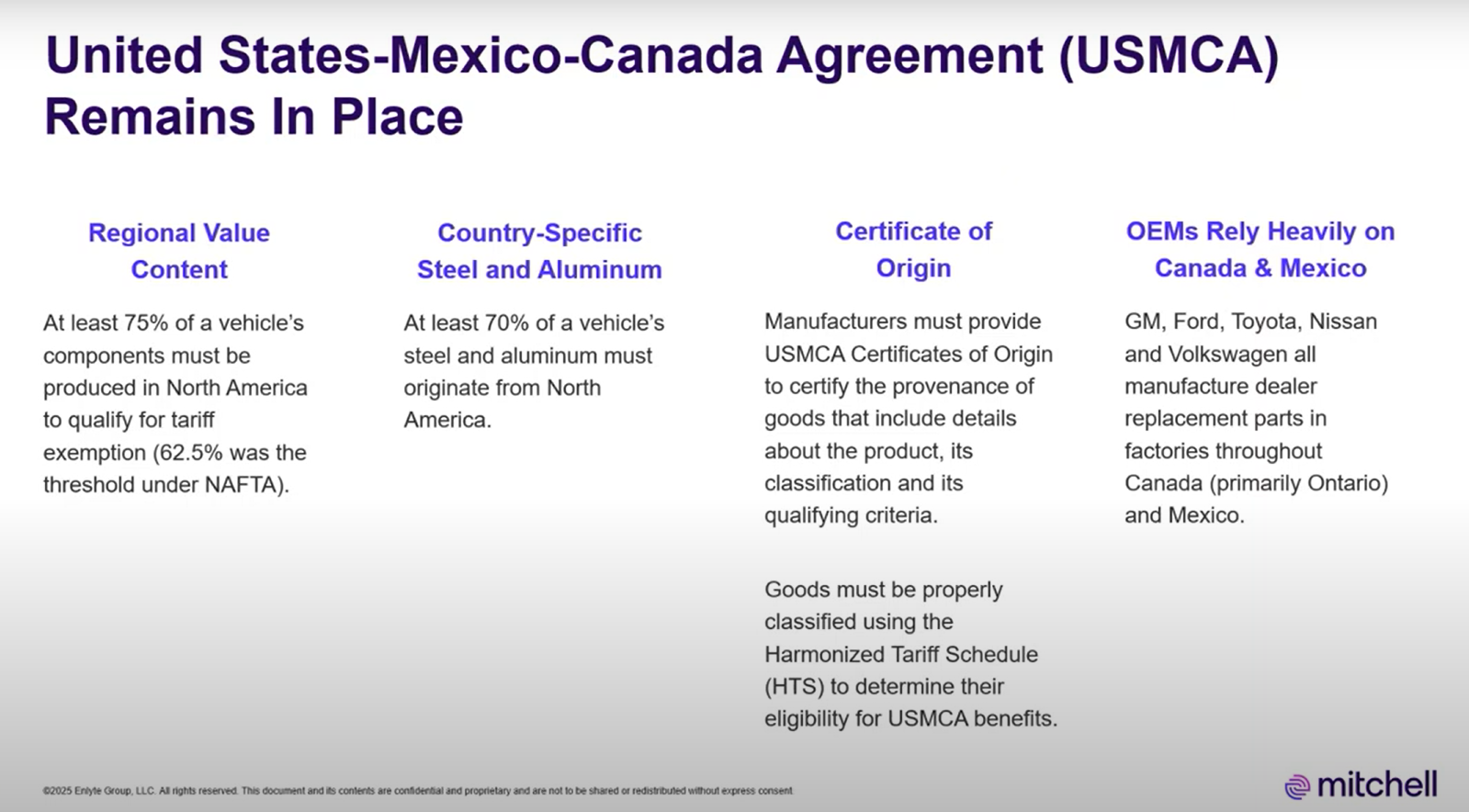

Fifty percent of auto part imports are compliant with the United States-Mexico-Canada (USMCA) agreement, meaning they aren’t subject to the tariffs that have already been announced, Mandell said.

“GM Ford, Toyota, Nissan, and Volkswagen all do a significant amount of manufacturing work, not only in the United States but in Canada and Mexico as well, so in that regard, those goods will continue to move across those borders tariff-free, with the caveat that the percentage of content not from North America will now be subject to a tariff, ” Mandell said.

According to Mandell, the base tariff value is determined by the wholesale value of a product, which is set by the manufacturer and, for the automotive industry, applies to parts and whole vehicles.

“There’s not a lot of clarity around which tariffs are stacked on top of each other,” he said.

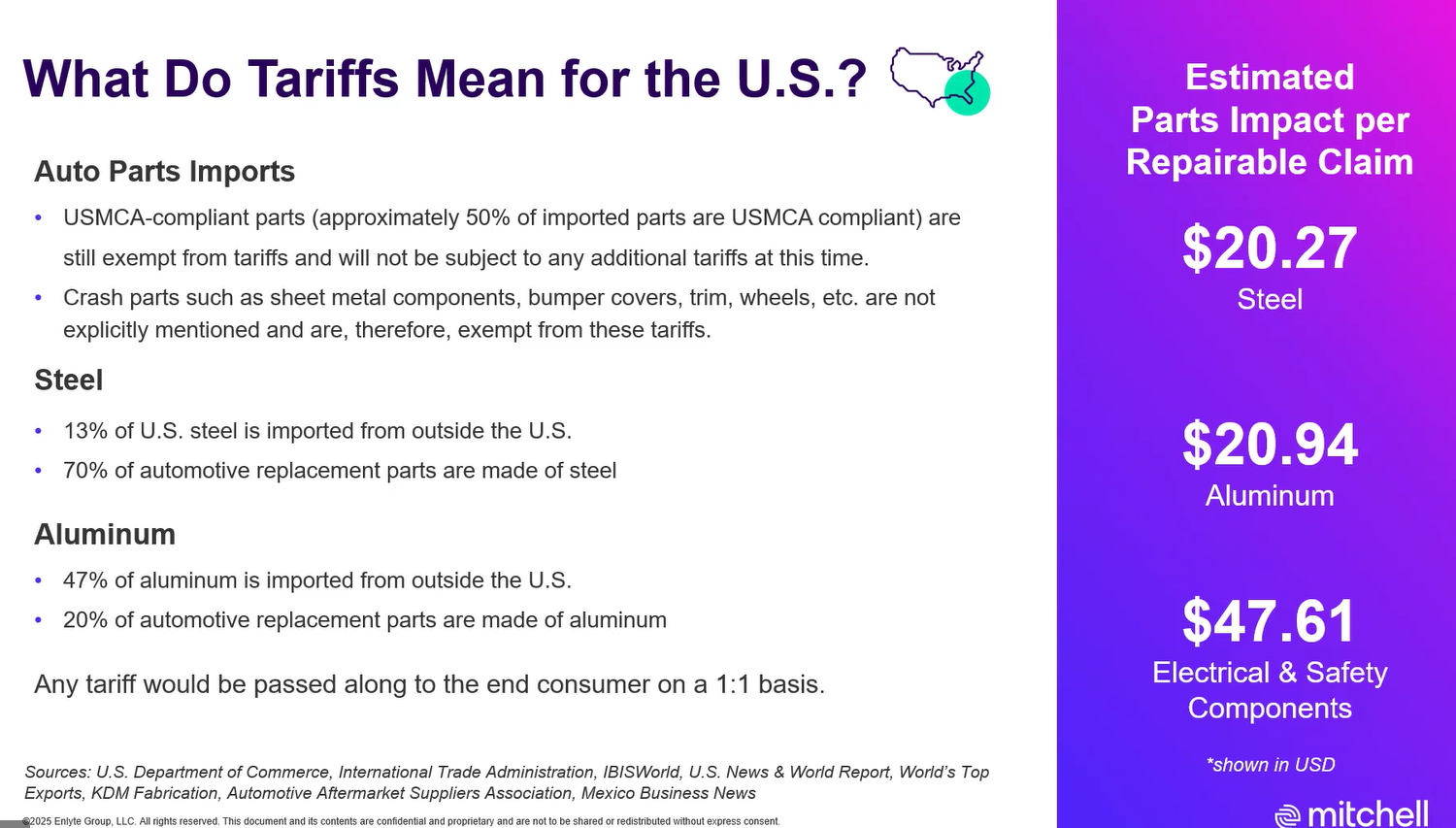

For example, steel and aluminum raw materials already tariffed at 25% won’t go up to 50% when the new 25% is instituted — the main reason being that sheet metal components don’t appear to fall under one of the categories that is being tariffed, according to Mandell.

“The major parts that are not subject to these 25% tariffs are essentially sheet metal, outer closure components, and structural sheet metal, things like hoods, fenders, quarter panels, doors, even bumpers, do not fall under that category at this time.”

However, other parts like ADAS sensors contain a variety of materials — copper, ceramics, glass, and composite plastics — from several locations around the world, making them subject to tariffs, Mandell said.

“We definitely expect the cost of repair to increase… when you look at all this, about $20 per raw material increase in the cost of repair, this really just goes to the increase in manufacturing those collision replacement parts that will trickle down to the part itself,” Mandell said. “As the input costs increase, the final product cost would increase as well. And then looking at those electrical and safety components and quantifying that, we see almost a $50 increase based on the increase in costs for those specific parts.

Parts supply chain issues similar to those that occurred during the COVID-19 pandemic could also occur because of OEM production and importation reductions, potentially resulting in longer-term impacts over the coming years due to changes in manufacturing locations, he said.

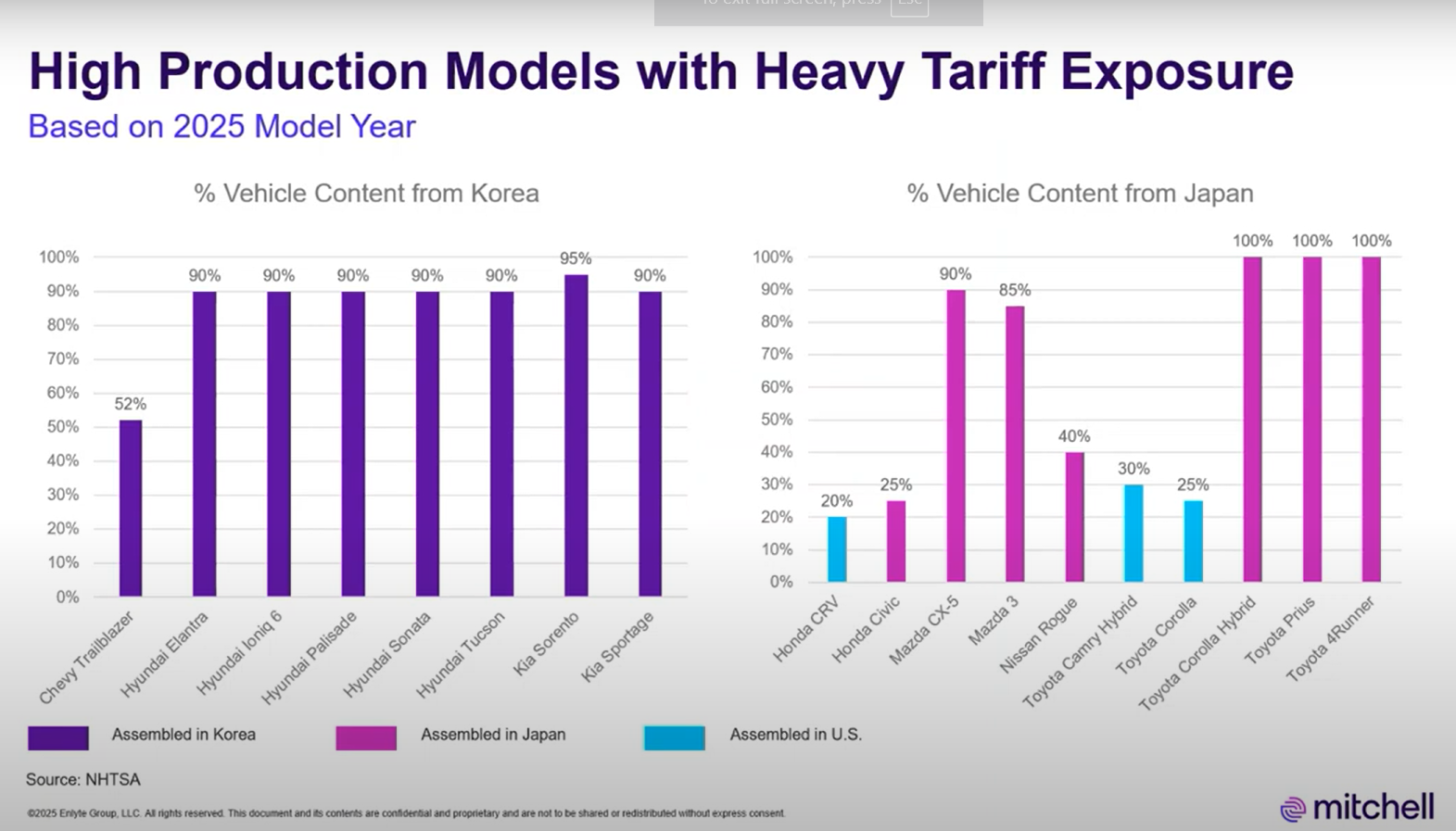

Mandell noted that, according to NHTSA data, a lot of vehicle manufacturing takes place in Korea and Japan. For example, the Chevy Trailblazer and Hyundai Elantra.

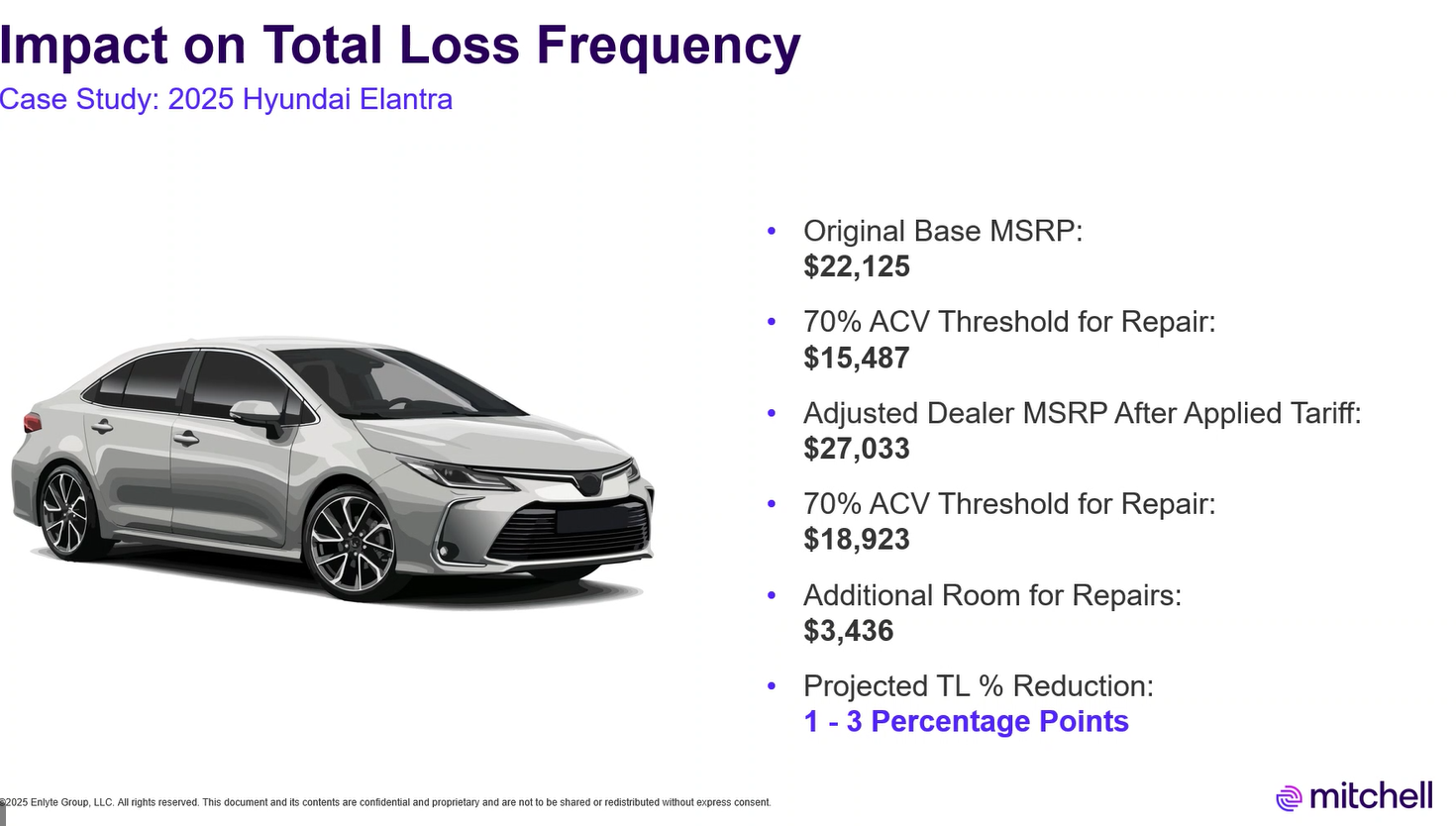

Fifty-two percent of the components that make up the Trailblazer are manufactured in Korea. The model is also assembled in Korea, so there would be a 25% tariff on the whole vehicle; the same for Kia and Hyundai vehicles. Over 90% of the Elantra is manufactured in Korea, plus assembly, adding up to a nearly 21% price increase on the base model.

Honda, Mazda, Nissan, and Toyota vehicle tariffs coming out of Japan will vary more, depending on the model and trim level, he said.

“Some have a relatively low percentage. The Honda CRV, 20% of that vehicle content is coming from Japan, but it’s assembled in the United States… The rest of that content appears to be coming from North America and so that vehicle would actually be a USMCA-compliant vehicle, and only that 20% of content that’s coming from Japan would be tariffed.”

The Toyota Prius and Corolla hybrid are 100% produced and assembled in Japan, while the Camry and Corolla include less content from Japan and are assembled in the U.S.

Mandell’s research also found that used vehicle prices will likely increase 5-10% throughout the next year.

“What we’re already seeing is that right now, people are flocking to the new vehicle market to try to take advantage of vehicle pricing that does not have tariffs already applied,” he said. “What we can expect to see is that as the new vehicle prices increase, people are being priced out of that market for specific vehicles, and so it will create more demand for the used vehicle market. What we’re also seeing is that a lot of manufacturers have announced that they’re going to be producing less vehicles for importation into the United States.”

Mandell added that the effect on total loss market values will likely lag behind a bit, in mid-late summer, because most insurance carriers look at historical data from the past 30-90 days to find comparable vehicles and inventory already onshore will be worked through first.

Shops will also face increases in paint, materials, and other consumables, such as abrasives because mainland China is one of the primary suppliers of many abrasives, plastic body fillers, and isocyanides found in paint formulations, Mandell said.

To mitigate detrimental impacts, Mandell recommends increasing parts and consumables supply chain transparency.

He suggests asking vendors:

-

- How are goods moved around me?

- Where are the goods moving to?

- How do you direct import parts or materials?

- Where are you sourcing parts and materials from?

Mandell also said it could be helpful to find out if there are alternatives that could be sourced domestically or from the USMCA region, and to consider repairing versus replacing parts or using recycled parts.

Images

Featured image credit: FilippoBacci/iStock

All slides from Mandell’s April 17, 2025 CIECA webinar presentation