MEMA: ADAS aftermarket and calibrations on growth trend, AEB rising most

By onMarket Trends | Technology

In its latest advanced driver assistance system (ADAS) aftermarket forecast, the MEMA Vehicle Suppliers Association says that technology, market share, calibrations, and replacement components are growing and expanding.

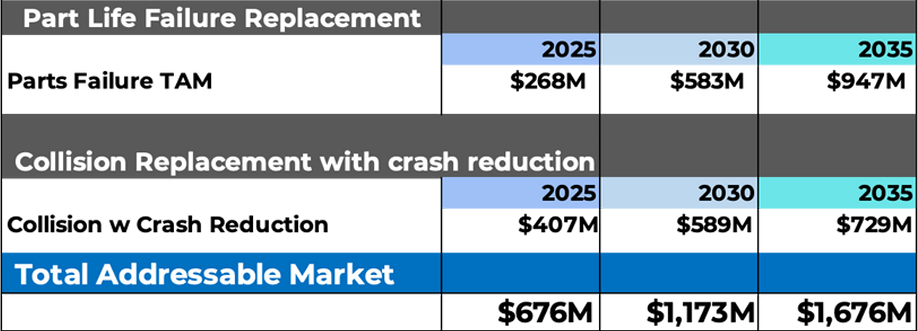

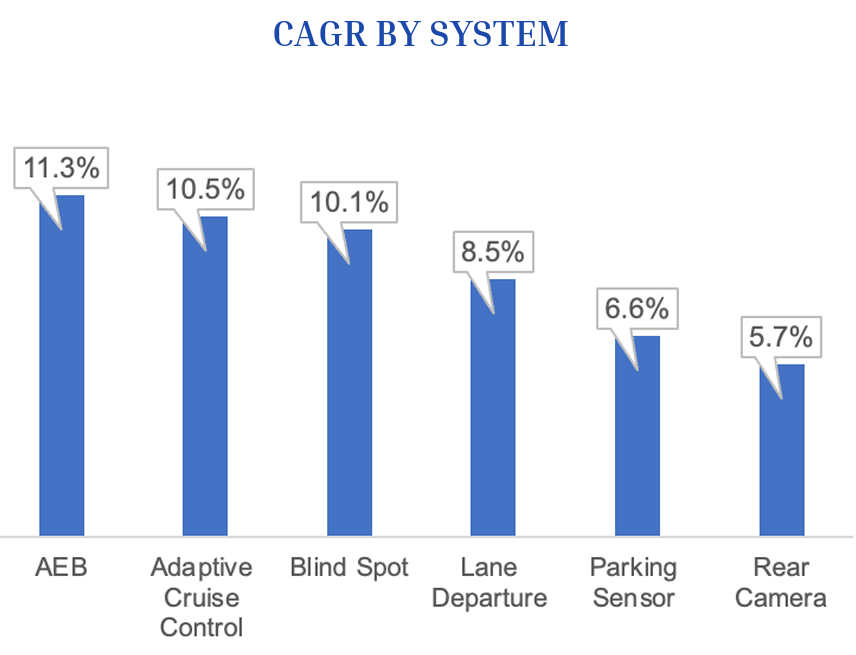

Updated from its first study in 2022, the total compound annual growth rate (CAGR) for parts is forecast to be 9.5% through 2035, with the collision sector forecast to experience a 6% CAGR and mechanical a 13.5% CAGR during that time.

Aftermarket ADAS parts are forecast to reach $676 million this year, reaching more than $1 billion in 2029 and then $1.7 billion in 2035, according to MEMA’s data.

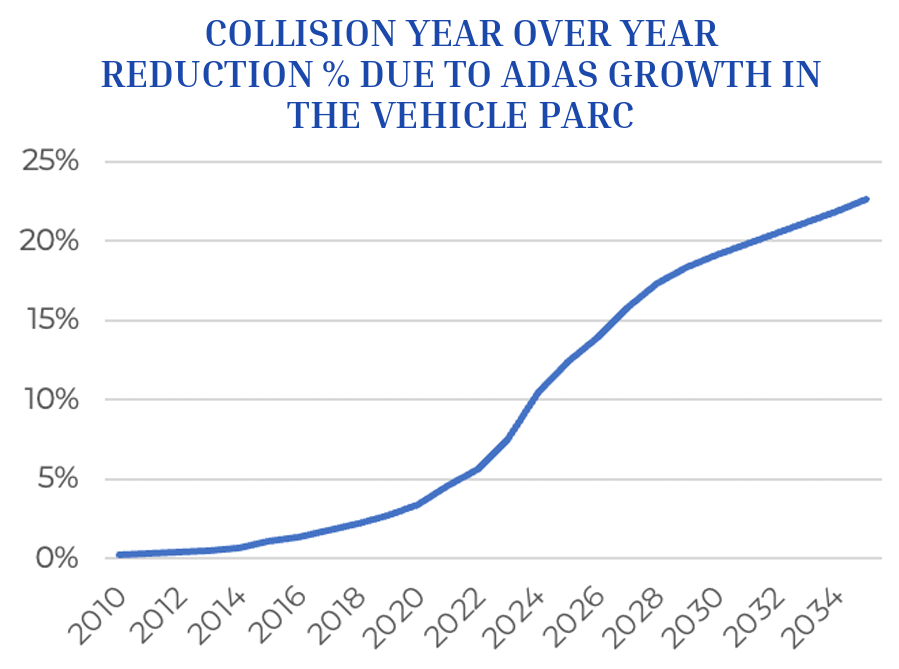

“ADAS features have the ability to reduce crashes by between 20% and 46%, depending upon ADAS feature,” the report states. “We are seeing a reduction in collision claims that exceeds 1% per year, but the factors of COVID recovery and the rapidly rising average claims cost are also contributors to claims reductions.

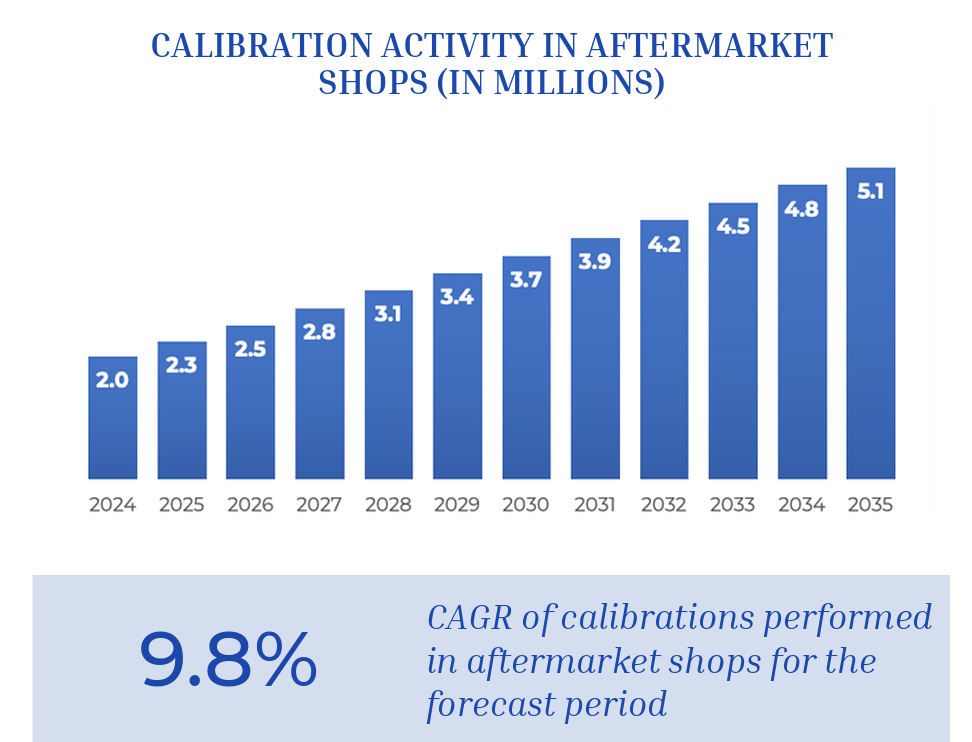

“The aggregate classic ‘S-curve’ of technology adoption is currently at peak growth rates, with year-over-year growth now tapering from 12.8% in 2025 to 6% in 2035. ADAS calibrations now exceed 2 million per year in the aftermarket, excluding glass replacement calibrations, which currently exceed 1 million per year.”

MEMA notes that the aftereffects of the COVID-19 pandemic were more pronounced than anticipated, leading to both headwinds and tailwinds in its forecast, with the service ecosystem now in the later stages of reversion to mean level activities in sales of new vehicles and repair activity.

“While acceptance of ADAS technology is improving, there is a rising concern that a portion of vehicles in the parc do not have systems operating as designed and are thus not delivering the anticipated safety improvements,” the report states. “More collaborative industry work is needed to quantify and deliver a strategy appropriate for the aftermarket ecosystem and vehicle owners.”

Co-authors of the study, Matt Ballard and Jim Fish, added that the extent of damaged ADAS or those that have failed and no longer work is unknown.

“The industry needs to work together to validate the size of this problem, then determine the best way to solve what could be a contributor to unnecessary accidents and injuries that would occur when an ADAS system doesn’t deliver the safety benefits for which it was designed,” Ballard wrote in the report.

Fish added, “Absolutely, that’s really our primary recommendation… get the key industry stakeholders together and find a way to validate and quantify what is happening out there on the roads.”

According to the report, the number of collisions will be reduced by more than 20% by 2035, as projected in a recent study conducted by the University of Michigan’s Transportation Research Institute.

AEB systems will see the highest growth factors, from 20.7% of the forecast total this year to 24.1% in 2035, MEMA wrote.

“Coincidentally, these also contribute the most to collision reduction claims,” the report states. “The increase in parts price has been significantly volatile in the last few years, with prices starting to hold steady in the most recent past.”

At the system level, the later introduction of AEB, and then the agreement to make it standard equipment by the OEMs, led to AEB contributing to the greatest growth in the forecast period, MEMA wrote.

The Insurance Institute for Highway Safety (IIHS) and the National Highway Traffic Safety Administration (NHTSA) worked together in 2016 to broker a commitment by 20 manufacturers to equip passenger cars and light-duty trucks with AEB that prevents front-into-rear collisions with other vehicles.

Last year, NHTSA finalized a new Federal Motor Vehicle Safety Standard (FMVSS) to mandate that AEB and pedestrian AEB (PAEB) come standard on all passenger cars and light trucks by September 2029.

Calibration activity in the aftermarket has grown strongly, primarily driven by the collision segment, according to the report. The estimates in the report don’t include glass replacement calibrations.

MEMA estimates that just over 2 million calibrations were performed in aftermarket shops last year, predominantly in the collision space.

MEMA states in the report that the cost of ADAS repairs “remains a thorny problem in the aftermarket, and it is beginning to produce second-order effects due to the average collision claim costs rising considerably faster than GDP.”

“This is part of the explanation for the volume of claims reduced approaching 10% in 2024 versus 2023,” MEMA wrote. “The fundamental areas of cost are the tooling and software, as well as the components themselves. This is seen in the ‘claims severity’ data — the average cost of a collision repair is rising simply due to the presence of ADAS systems on vehicles and the cost to service them. The industry has struggled to standardize the equipment necessary for performing calibrations, and aftermarket alternatives for most ADAS components remain unavailable when these systems are damaged or require replacement.”

MEMA wraps up the report by recommending that the “industry initiate action from several perspectives and possibilities for value creation for the automotive aftermarket stakeholders” via:

-

- “Methodology to prohibit deactivation of ADAS safety systems;

- “In-vehicle notification of ADAS malfunction;

- “Field work to identify magnitude; and

- “Vehicle inspection and regulations to ensure that vehicle users, whatever the vehicle age or owner’s income group, can operate a safe vehicle.”

While MEMA’s data shows that business is growing, statements made on its website by its advocacy team suggest that business is dwindling, and will continue to, unless specific legislation is passed.

“Motor vehicle manufacturers and dealers are unfairly restricting access to vehicle-generated data and repair and replacement components,” MEMA wrote under a “vehicle right to repair” section of its advocacy webpage.

“This is shrinking the market and driving up costs. Without legislation, the aftermarket’s service and repair market share could drop from 70% to 54% by 2035, costing $92 billion. Urge your members of Congress to support the REPAIR Act.”

The April Senate version and the REPAIR Act reintroduced February in the House have stark differences and show misalignment between the houses on the “right to repair” debate.

An overview of the most recent versions of the House and Senate Right to Equitable and Professional Auto Industry Repair (REPAIR) Act bills can be found here in a previous Repairer Driven News article.

The Alliance for Automotive Innovation (Auto Innovators), which represents most automakers, the Society of Collision Repair Specialists (SCRS), and the Automotive Service Association (ASA) believe that their federal framework, the Safety as First Emphasis (SAFE) Repair Act, would be a better alternative to both of the current versions of the REPAIR Act.

The SAFE Repair Act was written in response to consumer safety provisions that the groups say are missing from the REPAIR Act. They and others have argued that repair information and tool access are already available to owners and repairers for safe and proper repairs.

Images

Featured image and graphs provided by MEMA