Webinar: Lower fees in pooled SCRS plans add up big for employees over time

By onAnnouncements | Associations | Business Practices | Education | Market Trends

Both the “miracle of compound interest” and economies of scale might make the Society of Collision Repair Specialists’ association retirement plan a better deal for employees than a small-business’ existing benefit, according to an SCRS webinar Thursday.

Compound interest can be hard to wrap your brain around, but it’s awesome if you’re the one getting it.

It’s why taking out a $130,000 loan at 4 percent to buy a house in 30 years means a homeowner really pays $130,000 plus an extra $86,000 over the life of the loan. The bank charges interest not just on the principal but all the interest that’s racked up and now owed until the bill is paid off.

The same thing applies in your favor when you invest for your retirement, though in this case the principal is whatever you and/or your employer contributed to the retirement plan, and the “interest” is the return — the amount of money you made off your investment. (For example, the stock you bought went up in price.)

If you never read a Wall Street Journal or conducted any stock research and just blindly bought the 500 stocks on the Standard & Poor’s 500, you’d average about an 8 percent return each year. (Ironically, for all the work professional stock pickers do, they’re often unable to outperform that return long-term.) This can easily be done with an index fund, which does the the legwork of buying full or partial shares of those 500 individual stocks for investors.

The median auto body repairer made $42,730 in May 2018. Let’s say he at age 35 saves $6,410 for retirement, around 15 percent of the paycheck, and just buys $6,410 worth of S&P 500 shares. The stocks collectively go up the average 8 percent. Our repairer’s stock is now worth another $513.

Our repairer decides to quit saving for retirement but leaves the $6,923 worth of stock sitting in the 401(k) to keep cooking. The S&P 500 goes up another 8 percent. Our repairer is now worth an additional $553 — his investments compounded, making a return on their return, or interest on interest, without him putting any more money in at all.

This seems small, but over time, the compounding of 8 percent makes his portfolio worth around $64,502 thirty years later without him paying anything else into the fund. His 65-year-old self has nearly an extra $60K if he sells the stock.

That’s the magic of compound interest.

However, the people who manage your money take a percentage of it for their troubles and to keep their lights on. For example, let’s say they charge enough to knock down the return on investment to 7 percent.

Our repairer only would bring in around $449 extra the first year. His second year’s 7 percent return on what would be a $6,859 portfolio only brings in about $480 more. At age 65, he only has about $48,795 in the account.

That teeny 1 percent difference cost him nearly $16,000. Knock it down to 0.5, and he’s back up to around $56,119. He’s only out $8,383 from paying his finance guy.

Obviously, none of these amounts spread over another 20 years of life is enough to live on comfortably, which is why people or employers tend to consistently contribute to such funds. And doing so really lets the employee’s money take off.

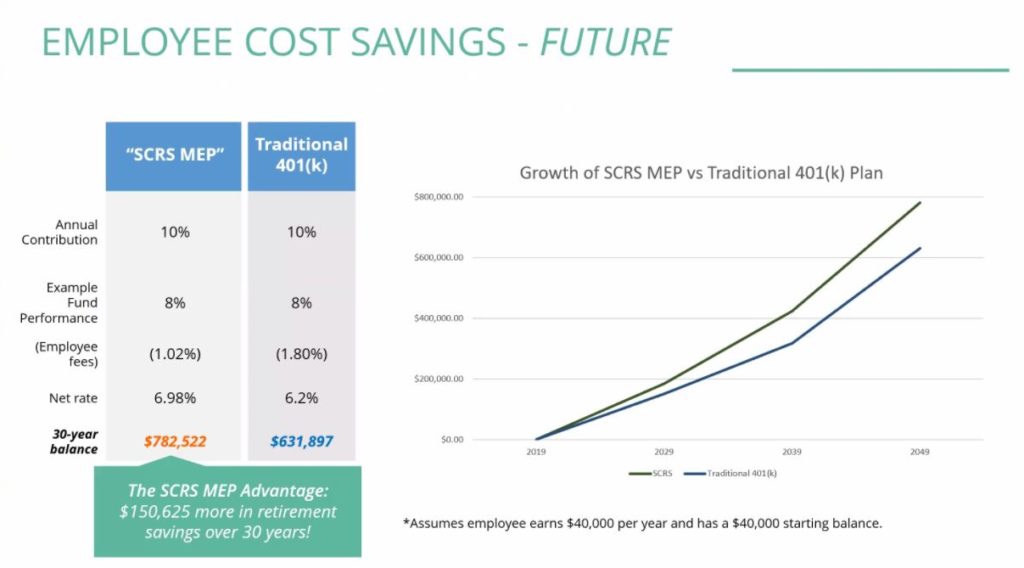

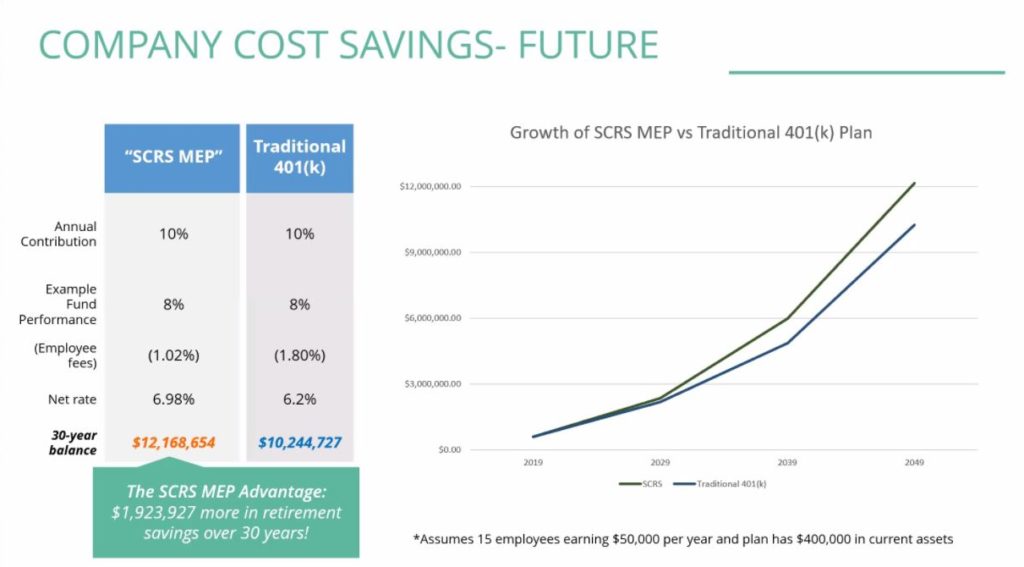

Virginia Asset Management partner Scott Broaddus, the investment advisor on the SCRS retirement plans, demonstrated on the Thursday webinar how both compounded returns and investment fees could play out over time for a shop trying to go it alone versus using the SCRS option.

Broaddus presented a slide of a shop employee making $40,000 a year and with $40,000 already saved in a retirement plan paying in 10 percent a year. The plan earns 8 percent a year, but the employee gets charged 1.8 percentage points in fees for a net return of 6.2 percent.

That employee has $631,897 at the end of those 30 years. But the SCRS multiple-employer plan leverages the clout of multiple member shops participating to demand a better deal from their plan’s financial management.

The employee is only charged 1.02 percent in fees and earns $150,625 more, retiring with $782,522, according to the slide.

“Having a 401(k) plan drives the best employees and the best technicians into your shop,” Broaddus said.

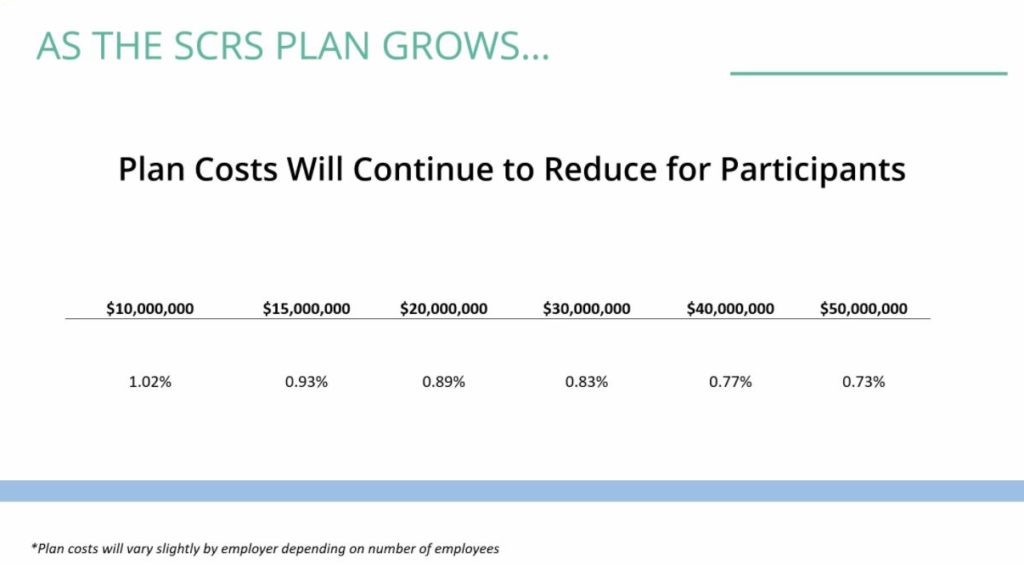

As more SCRS members take advantage of the retirement plan, the financial fees will drop further thanks to a deal the association has negotiated, according to Broaddus.

With $10 million in retirement assets being managed, SCRS member companies’ employees will see those 1.02 percent fees, according to a slide from the webinar. But if a few more companies come on board and bring the combined asset pool to $15 million, the fees will drop to 0.93 percent. At $50 million in assets, the fees will fall to 0.73 percent, according to the slide.

The employer also might save money on a required audit of a retirement plan, for such a bill would be spread among all the SCRS members participating rather than absorbed completely by one company, Payroll Company retirement services Vice President Anglea Pickel said on the webinar. Her company serves as liaison to SCRS members on the plan.

Broaddus also said one of the things that “jumped out” during a review of six SCRS member companies about a year ago was that most owners didn’t realize the true cost of the 401(k).

As part of Virginia Asset Management’s relationship with SCRS, it has offered to provide a free comparision in “hard dollars” between a company’s current retirement plan and the SCRS plan.

The review is completely free; all that’s needed is a list of plan investments and balance and a 408(b)2 annual plan expense statement, Broaddus said. (He said those could be found through your plan’s website or by asking your plan provider.) Visit www.scrsbenefitscenter.com or email Broaddus at Scott.Broaddus@vamllc.com to get started.

Society of Collision Repair Specialists Executive Director Aaron Schulenburg said non-members could take advantage of this as well, allowing them to see if the SCRS plan would be a good fit before committing to membership.

If the SCRS program would represent a savings, the employer will have that information and can consider being a member and participating in the association plan. If the owner is shown to be getting a better deal under their current benefits program, they can keep doing what they’re doing and just use the review as documentation for a fiduciary file, Broaddus said. (According to Pickel, the SCRS plan can minimize fiduciary responsibility too.)

SCRS membership starts at $475 a year, less than what Broaddus said was the $17,000 annual savings seen by one business with just more than $2 million worth of retirement benefits.

Pickel said an employer switching plans might encounter a one-time charge from their current provider to move assets to the SCRS plan, as well as a few hundred in document fees from SCRS’ provider associated with the changeover.

An employer without an existing retirement plan can establish an SCRS one in about a month, and a change of plans takes about 60 days, Pickel said. The conversion can occur basically behind the scenes, without any signatures or reenrollment needed from employees, under the transition Broaddus described.

Though the Payroll Company is helping facilitate the SCRS plan, it’s “absolutely not required” for a business owner to switch payroll providers, Pickel said. She said the company can work with another payroll company to handle the retirement contributions or even an in-house payroll staffer.

Pickel said the SCRS plan offers flexibility, including customizable features like employer matching, Roth deferrals, vesting, profit sharing, according to a slide.

However, the flexibility doesn’t extend to employees being able to self-direct investments (for example, put all their money into shares of a stock they think is hot), according to Broaddus.

Employees must pick from what he thought were around 16 fund options plus additional target date fund choices, he said. (Target date funds adjust investment risk depending how close a person is to an anticipated retirement year. For example, a 20-year-old starting work in 2020 might pick a 2065 target date fund.)

The lineup consists of primarily low-cost index funds from Vanguard, according to Broaddus, who mentioned money market, fixed-income and international investments also were available. He said index options exist in every category except for money-market and short-term bonds.

A finite number of investment options allowed the fiduciaries to keep an eye on what was being offered, he said.

Broaddus also said a “very common question” during discussions of the SCRS plan is the idea that a body shop has a local retirement broker with a relationship to their company. However, many options exist under the SCRS plan for employees to seek information about their retirement even without a local provider, according to Broaddus.

A website will have tools and calculators for employees, and regular scheduled webinars and calls would be scheduled for employees, Broaddus said.

Hotlines exist for employers and employees, according to Pickel, and employees also can call or email Broaddus to set up a one-on-one meeting.

Broaddus said he’s able to provide individual investment advice to employees, which has “been a big differentiator” in recent years. New regulations prohibit some other brokers from doing so, he said.

Details: www.scrsbenefitscenter.com or Scott.Broaddus@vamllc.com or info@scrs.com.

More information:

“Understanding the Benefit of Retirement Solutions for your Business”

Society of Collision Repair Specialists, July 18, 2019

Images:

The “miracle of compound interest” can be bolstered with lower retirement plan fees. (rzarek/iStock)

Virginia Asset Management partner Scott Broaddus, the investment advisor on the SCRS retirement plans, demonstrated on the Thursday webinar how both compounded returns and investment fees could play out over time for a shop trying to go it alone versus using an SCRS plan. (Provided by SCRS)

As more SCRS members take advantage of its retirement plans, the financial fees will drop further thanks to a deal the association has negotiated, according to Virginia Asset Management partner Scott Broaddus, the investment advisor on the plans. (Provided by SCRS)