PartsTrader business development Vice President Dale Sailer wouldn’t release many details about the fee change in an email interview, but he did give a little more insight on the new Premier Supplier designation.

“The Premier Supplier program identifies and rewards those suppliers who consistently act in their customers’ best interest based on their actions on the PartsTrader platform,” he wrote. The majority of those who qualified will see subscription prices fall Aug. 1, according to Sailer.

Cooper said that the combination of lowered subscriptions and new 1.75-3.5 percent fees would on the whole be “less than 1% of total orders on the platform (using Q1 2015 sales data).”

“We believe PartsTrader as a sales channel represents good value to suppliers,” he continued.

Repairers, “as committed to you when we entered the market,” still wouldn’t pay to use the system, which continues to be a sore subject for some shops because of No. 1 auto insurer State Farm’s reliance on it.

But PartsTrader acknowledged that some suppliers would pass costs to repairers, and would therefore “significantly” sweeten PartsTrader Rewards incentives Aug. 1

Sailer wouldn’t elaborate heavily on the new rewards, except to write in an email that “Just as hotel chains commonly offer double point or triple point specials to guests who stay at a newly-opened property, PartsTrader will be offering similar specials starting on July 1.”

According to Sailer, the company didn’t expect that the “vast majority” of suppliers would return the fees to repairers.

“Many suppliers have acknowledged that our value to their business is greater than the fees we are introducing,” Sailer wrote. “However, we recognize that in a competitive marketplace, how businesses absorb fees, just as how they address cost savings (keep them for themselves or share them with customers), is up to each individual business.”

As for the existing subscription costs, Sailer said “no data-oriented evidence or anecdotal evidence” indicated those had been passed to repairers.

“Solving the industry’s parts sourcing challenges continues to be PartsTrader’s primary mission,” Cooper wrote. ” We recognize that the introduction of any fees in the marketplace have the potential to create challenges and we are prepared to ease any possible impact on you. Rest assured that these fees enable us to continue to invest in making PartsTrader the highest value, most efficient, and most effective parts sourcing tool in the industry.”

Sailer also defended charging dealerships to sell to their own body shops.

“There is a long list of benefits that PartsTrader provides to OE dealers and the collision repair businesses they own via the platform,” he wrote. “We recognize that on internal sales, only a subset of these benefits are realized by each distinct business (such as fully documented work files and consolidated reporting), so we have appropriately reduced the rate.”

As stated above, State Farm sales were excluded from the 1.75-3.5 percent charge. PartsTrader has a partnership with the insurer, which mandates its use for all direct repair program shops.

But given that PartsTrader’s new 3.0 platform will tell suppliers which insurer is involved in the parts sale, it seemed as though suppliers would only fill State Farm orders and do an end-run around PartsTrader for all other insurers.

Asked about this scenario, Sailer said such a vendor would be leaving tens of millions of dollars on the table by spurning the thousands of repairers working on a car for a State Farm competitor. And more practically:

“Additionally, those repairers who use the platform to source the parts they need are required by our Terms of Service to subsequently order those parts via the platform,” Sailer wrote. “PartsTrader cannot solely be used as a sourcing tool.”

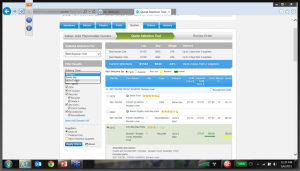

Featured image: A screenshot from PartsTrader’s Wednesday webinar gives an example of its revamed Quote Selection Tool with PartsTrader 3.0. (Provided by PartsTrader)