Ohio repairer prevails in American Family lawsuit seeking car insurer already received

By onInsurance | Legal

Three-C Body Shop announced last week an Ohio court ruling that American Family had erred in suing to recover a vehicle the Ohio repairer had already given it more than a year and a half prior.

Oops.

Franklin County, Ohio, Magistrate Judge Timothy McCarthy, who’d ruled in favor of American Family in January, reversed that decision in April after being petitioned by Three-C to reconsider. Franklin County Judge Julie Lynch backed McCarthy’s decision over Three-C’s requests for time to file objections. However, Lynch didn’t grant Three-C ‘s request for American Family to pay the shop’s attorneys fees and costs.

A Wednesday Three-C/Auto Damage Experts news release said American Family didn’t appeal the decision in time, apparently referring to Lynch’s June ruling.

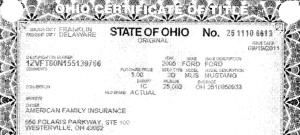

The case revolved around a 2005 Ford Mustang (with only 25,003 miles, according to American Family’s title document) which had been brought to Three-C after a wreck. American Family appraised the damage at $5,045 and cut a check to Three-C and the owner for repairs, according to the court.

Three-C took the full amount, and American Family shortly after declared the vehicle a total loss and requested part of the money back. An estimator in 2013 swore in an affidavit that the vehicle was only worth $4,000. (Of course, he also incorrectly wrote that Three-C still had the Mustang.)

After Three-C wouldn’t refund what American Family sought, the insurer sued in 2013 alleging Three-C had unfairly retained the car and violated the Ohio Consumer Protection Act — even though the insurer had already been given the car in 2011.

After considering a higher and lower estimate — he threw out a third which seemed “contrived,” something Three C disputes — McCarthy originally ruled in January that Three-C owed American Family $2,532.50. However, he found that it didn’t violate the Ohio Consumer Protection Act.

But once Three-C pointed out in February that writs of replevin are meant to recover property — the car — not address contract disputes, McCarthy agreed and ruled in the shop’s favor.

In its motion to reconsider, Three C also noted that the case was just a billing dispute — the insurer didn’t want to pay Three-C’s rates. As the two parties didn’t have a contract and the lawsuit wasn’t for relief on contract law terms, it was unfair for McCarthy to widen the scope of the lawsuit and accept insurer arguments on that unincluded point without letting Three-C defend itself.

Three-C owner Bob Juniper alleged in a news release the case might have been an example of an insurer using the legal system to pressure repairers for concessions.

“Some insurers have used and abused the legal system and employed a Replevin in an effort to dare the repairer into filing a lawsuit against their customer to recover their billing,” Juniper said in a statement. “This generally results in a lengthy legal battle (as was ours) which the insurer will make as costly as possible. The insurer’s know that most shop owners are ill prepared and don’t want to file a lawsuit against their own customers and incur the legal costs, and as a result, the repairers often cave to the insurer’s pressures and reduce their billings. This often times results in the shop merely accepting what they can for their billing and foregoing or ‘eating’ the rest to avoid a Replevin. … At Three-C We don’t play that game, we charge what’s competitive and reasonable and will do what is necessary to collect it and stop such behavior.”

American Family did not return an email request for comment to its media address last week or phone messages Monday.