Aftermarket PARTS Act saves insurers money, but savings to consumers dubious

By onBusiness Practices | Insurance | Legal | Technology

Calling it a consumer-focused piece of legislation, the Quality Parts Coalition is backing the latest version of a bill to lower design patent lifespans for automakers so aftermarket manufacturers could copy parts sooner.

The bill was introduced in February by sponsors U.S. Sen. Orrin Hatch, R-Utah, and Sheldon Whitehouse, D-R.I. A companion bill was introduced in the House by U.S. Reps Darrell Issa, R-Calif., and Zoe Lofgren, D-Calif. The QPC kicked off its publicity push in support Tuesday.

“It’s clear that independent auto parts are driving competition in the auto repair parts market and that consumers are reaping the benefits,” QPC Executive Director Ed Salamy said in a statement Tuesday. “That’s why it’s important to ensure the industry stays competitive and continues to pass along savings to consumers.”

“Having to replace a car part is frustrating enough; drivers shouldn’t have to pay artificially high prices set by car manufacturers,” Whitehouse said in a February statement. “This bill will preserve competition in the car-parts market and ultimately allow consumers to get safe replacement parts at lower prices.”

But the actual savings to real drivers — as well as whose wallets would really benefit from the move — may not be nearly as clear-cut as the QPC and bill sponsors make it out to be.

$19-$24 a year

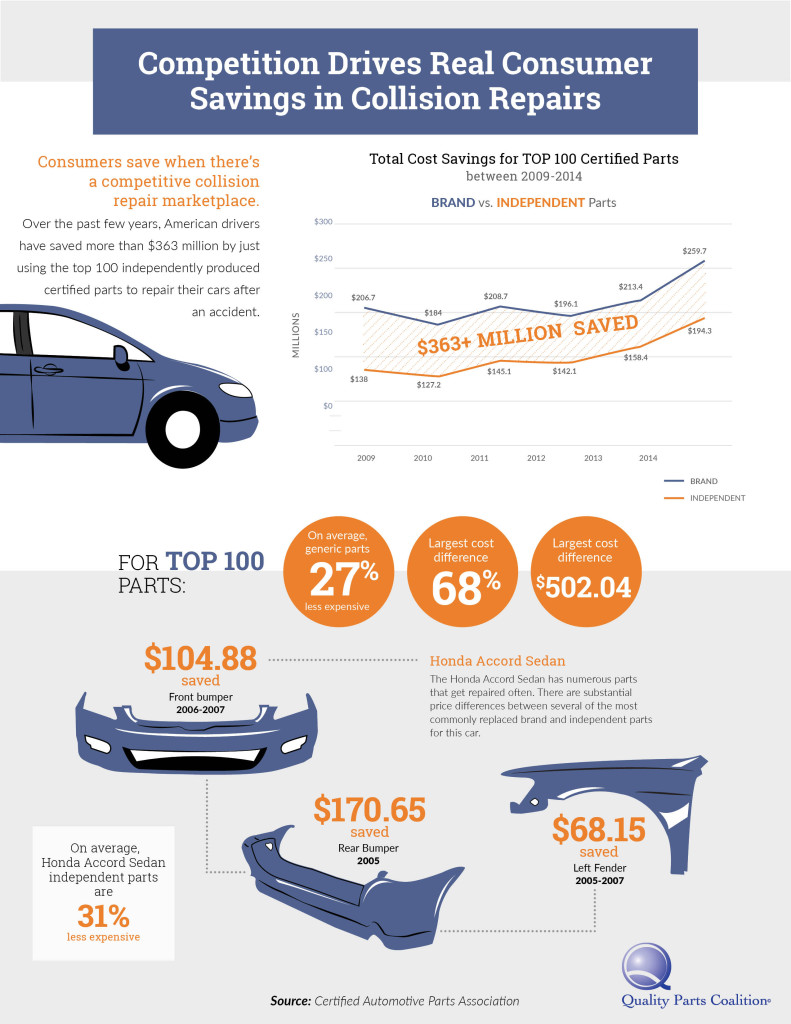

The QPC cites CAPA price comparisons to estimate that “American drivers” have saved more than $363 million by using aftermarket parts. But that’s misleading, as insurers pay for at least 70 percent of auto body work, based on estimates in court documents — because consumers gave them money all those years in case such a wreck happened. If the customer doesn’t get in a wreck, the insurer gets to keep and invest the money.

So that’s a nonstarter. But let’s look at the savings insurers say actually could be passed on to policyholders — or not.

The QPC cites January 2013 Property Casualty Insurers Association of America data that loss costs could rise by $1.5 billion if aftermarket imitation parts were banned overnight.

That PCI report is a toned-down version of an earlier January 2013 report which states that without aftermarket parts, you could pay $24 more a year in premiums. The new version deletes that $24 statistic and scales down the “benefit to consumers” by nearly $1 billion.

Which means that you’d save even less. Since the PCI didn’t want to do the math a second time, we’ll try to do it ourselves using the same criteria as both versions of the report.

“This translates into a 2.0 percent increase in the combined liability and physical damage premium per insured car if non-OEM parts could no longer be used,” the PCI writes in the new report. The old one indicated it would be a 2.6 percent increase producing the $24 savings.

Using the most recent data from the National Association of Insurance Commissioners, which involve 2012 premiums, the average combined liability/property damage bill (Americans who bought liability, comprehensive, and collision) was $927.58.

So your bill would rise $18.55 a year if insurers quit requiring aftermarket parts tomorrow. Man, with that savings, you could trick out your car with an … oil change.

Asked about the $24 saving estimated by the PCI, Salamy said other studies put that tally higher and mentioned offhand the $1.5 billion number from the PCI.

This of course assumes that insurance companies will pass savings to customers.

“Additionally, at the latest hearing held on this issue/bill, when asked directly if insurance premiums would be lowered as a result of this legislation, the insurance industry representative replied, ‘I would not expect premiums to go down as a result’,” a letter from the Alliance of Automotive Manufacturers and other organizations opposing the bill states.

In fairness, insurers can’t completely predict the future, as good as their actuaries may be. A year with wildfires in the West, icy conditions across the Midwest and Northeast and hurricanes hitting the Southeast could be justification to raise rates, though that’s also just a risk of being in the insurance business.

But when we listen to Progressive and Allstate earnings calls and read GEICO’s financial documents, nobody is complaining specifically about the cost of parts as a reason to raise rates, though higher crash frequency is certainly a concern as gas prices stay low and miles driven increase, and parts bills do affect overall repair cost for each crash.

Progressive even estimates severity will decrease long-term for its book. As cars get safer, there’s also the potential for bodily injury claims — the really expensive area for insurers — to decrease, freeing up more savings for consumers.

Who benefits?

Though the QPC is painting the PARTS Act as a victory for average Americans, it clearly benefits coalition members with a huge financial stake in the outcome — and not just insurance companies.

“Consumers save big when there’s a competitive marketplace,” Consumer Federation of America public affairs director Jack Gillis said in a statement. “Major car companies are trying to disrupt the status quo by limiting competition in order to grow their profits at the expense of the average American.”

Gillis’ company Gillis and Associates, however, manages the parts certification organization CAPA, whose existence requires aftermarket parts. Other QPC members include figures from the aftermarket and insurance industry, including the PCI and American Insurance Association, as well as the Consumer Federation of America. No body shops are in the QPC, Salamy said.

Of course, bill opponents (see list here) — the OEMs, other manufacturers and those with intellectual property — also have a big financial stake in the matter and play the average American card, citing safety even though theoretically we’re discussing purely aesthetic patents. (The lines do blur somewhat, though. More on this and the form-function patent distinction in another article. Stay tuned.)

Still, that’s a more legitimate concern than whether or not consumers will pay $18-$24 more a year, and their counterargument is more honest about discussing their own self-interest in protecting their intellectual property and brands rather than just crying “Main Street.”

As for a lack of competition (recycled and Opt-OE would still be in play, of course) driving up parts prices for consumers, Dan Gage, director of communications and public affairs for the Alliance of Automotive Manufacturers, said other car companies keep things from getting too out of hand. (Of course, insurers’ insistence on aftermarket did seem to spur the entire auto industry towards “conquest” programs.)

If a car has a reputation for high repair costs, customers won’t buy it, Gage said.

“Why does government have to get into the business of winners and losers,” he said. “… It should be the free market that does that.”

More information:

“REPORT: COMPETITION DRIVES REAL CONSUMER SAVINGS IN COLLISION REPAIR”

Quality Parts Coalition, Dec. 1, 2015

Quality Parts Coalition via PRNewsweb, Dec. 1, 2015

Alliance of Automotive Manufacturers, March 23, 2015

“Aftermarket Parts: A $1.5 Billion Benefit for Consumers”

Property Casualty Insurers Association of America, January 2013

Images:

Auto parts are shown in this graphic. (1971yes/iStock/Thinkstock)

This Quality Parts Coalition graphic citing CAPA data estimates differences in parts costs. (Provided by QPC)

A display at the 2015 NACE touts General Motors “Plug-n-Play” bumper sets. (John Huetter/Repairer Driven News)