Absence of luxury repairers, 2005 ‘Class A’ definition could be concerns with Calif. labor rate effort

By onAnnouncements | Business Practices | Insurance | Legal

The California Department of Insurance’s effort to spell out precisely how insurers must study labor rates notably treats luxury and exotic collision repairers the same as shops working on the mainstream fleet.

Actually, for the purposes of the survey, it treats them like an odd amalgam of the Bureau of Automotive Repair’s shop requirements and the Collision Industry Conference’s 2005 minimum recommended requirements for a “Class A” shop.

Following hundreds of complaints about insurers refusing to pay an auto body shop’s rate — often because of outdated collision repair surveys or questionable definitions of market areas, Democratic Insurance Commissioner Dave Jones’ administration has proposed telling insurers precisely how they must survey shops and what counts as a market.

“The complaints all allege similar allegations,” the DOI wrote. “When the consumer took their vehicle for repair, the auto body shop billed the consumer based on the work that was done on their vehicle. When insurance covered auto body repair work, the auto body repair shop on the behalf of the consumer engaged with the insurer to settle the labor rate component of automobile insurance claim. However, the complaints alleged that the prevailing rates for many geographic areas fell well below the shop’s actual cost, as the result of unreliable geographic areas that do not accurately reflect the actual labor market, or using outdated surveys. Thus, consumers were forced to pay the difference between the prevailing rates and the actual labor rate charged by the shop or shops were deprived of their reasonably charged rates.

More California regulation proposals

- California thinks an auto body labor rate market should be six shops. Here’s why.

- Here’s what California says auto body labor rate surveys should look like

- California seeks to give insurers, repairers clear auto body labor rate survey rules

- Proposed Calif. DOI antisteering rules demand proof of ‘deceptive statements’, define ‘reasonable’ distances, time for non-DRP inspection

“Not adopting the proposed regulations will result in the continued existence of no standards for how insurers may conduct a reliable survey used to pay or adjust automobile insurance claims. … There would be no standards for the number and types of repair shops suitable for creating a reliable benchmark for paying claims. There would be no standards for what constitutes a reasonable market area for collision repairs. Insurers would continue to pay claims based upon these unsupported and unreliable surveys, resulting in unreasonably and artificially low settlement offers to claimants. Claimants and small business would continue to be financially harmed by these reduced payments. Claimants would not be paid the full costs to repair their damaged automobiles, and small businesses would be forced to accept reduced payments for the repair services they deliver or take collection action against the claimants to recover these reduced payments by insurers.”

Under the proposal, an insurer can’t pay less than either a collision repairer’s posted rate or the higher of the average or “rate at or below which a simple majority of surveyed shops charge” of the shop’s rate and the nearest five surveyed shops (assuming the insurer conducts labor rate surveys). Shops can still negotiate lower — or higher — rates and direct repair program agreement discounts, but those rates can’t be the ones reported in the surveys.

The surveys are optional; if the shop in question doesn’t respond to it, the market area becomes the nearest six shops which did. Only direct survey responses will be considered — the insurer can’t use rate data from an estimating service such as AudaExplore, CCC or Mitchell. (Shops have accused insurers of manipulating that data to get answers they want.)

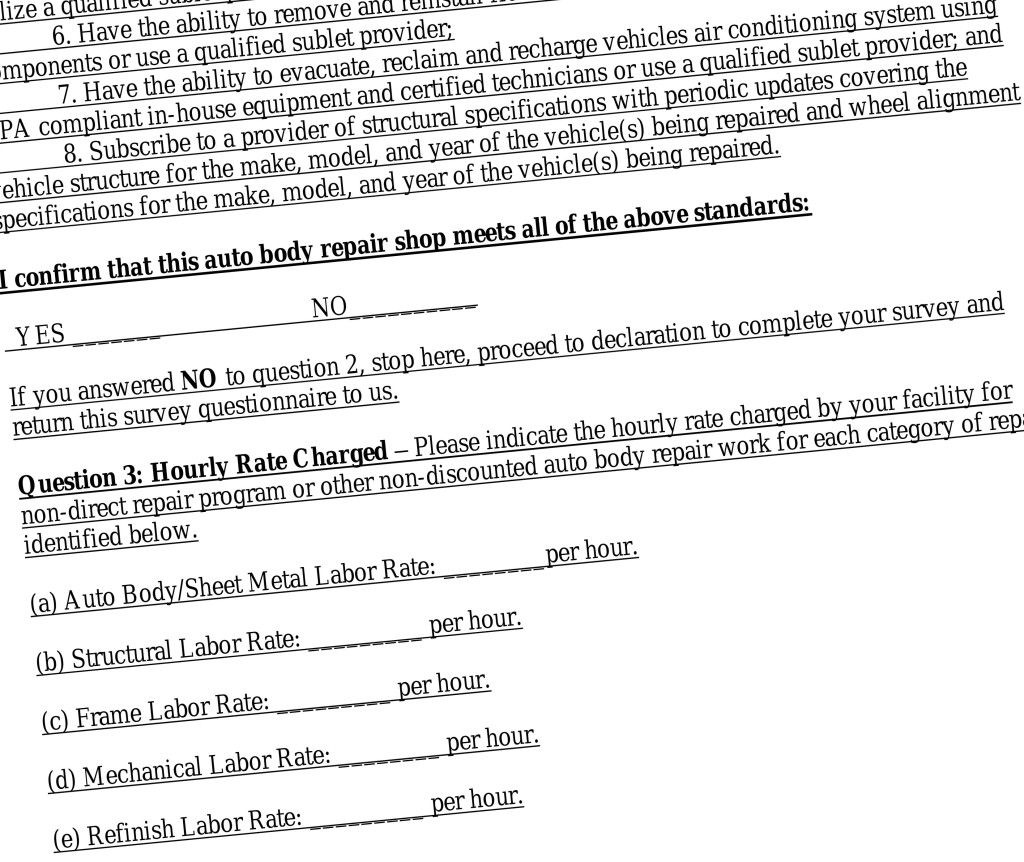

Under the DOI’s proposal, insurers would survey shops on five factors — but not distinguish between luxury/exotic or mainstream work on any of them:

- Auto body/sheet metal labor

- Structural labor

- Frame labor

- Mechanical labor

- Refinish labor

- Aluminum labor

The agency doesn’t distinguish between aluminum structural and aluminum panel work, and it omits carbon fiber. Nor does it wade into the issue of an hourly paint and materials rate versus just itemizing what supplies were used.

As noted before, nothing prevents a repairer or insurer from negotiating a higher rate. And if luxury OEMs restrict components to their certified shops, the shop would presumably have leverage in that discussion. Would an insurer really want to irritate an affluent customer by forcing them to pay the difference? (On the other hand, one lawsuit filed by shops alleges an insurer unwilling to pay a higher rate to repair a Porsche.)

Still, it’s a starting point, and aluminum gets its own rate — a big win for collision repairers in an era of aluminum F-150s and potentially all hoods and panels moving towards the substrate. There are signs insurers don’t want to pay more for aluminum work despite the amount of training and equipment necessary to properly repair a vehicle like the F-150.

“Drawing a distinction for each type of rate is reasonably necessary to ensure claims are equitably settled based on similar types of labor, which varies depending on the complexity of repair,” the DOI wrote.

What is a shop?

While better than a system which theoretically lets an insurer call whatever it wants a shop, the DOI might not have gone far enough in defining what types of shops deserve to be counted in the survey.

“An insurer may only use labor rates in a survey reported by shops that meet the enumerated specific standards,” the DOI states. “The proposed adoption is reasonably necessary to make clear that not all shops that exist should be surveyed because it may result in artificially low rates due to not having all the required equipment.”

The DOI in its rationale for its regulations said it used both the Bureau of Automotive Repair standards for collision repairers and the 2005 CIC minimum “Class A” requirements for a shop. (The CIC isn’t referenced by name in the proposed regulations themselves.)

“Including both standards is necessary since the BAR requirements outlined in section 3351.5 does not list all required equipment, the Department felt it was necessary to include the CIC recommended requirements as well,” the DOI wrote. “The CIC is a reliable authority which lists accepted industry standards for minimum equipment requirements for auto body repair shops.”

By incorporating both, the pool of qualified shops drops from 5,000 (those passing the BAR requirements) to less than 4,000 (those meeting the proposed survey inclusion threshold), according to the DOI.

Insurers aren’t required to verify these items under the proposal, as the DOI felt that’d be an unfair burden. Shops completing the survey would sign off that that they meet this criteria.

Here’s what is necessary to meet the BAR requirements; this would evolve with California Code 3351.5:

An auto body repair shop that performs automotive painting shall have all equipment and current reference manuals necessary to paint and repair non-structural damage, including but not limited to:

(1) corrosion protection application equipment, and

(2) equipment capable of applying exterior corrosion resistant primers, anticorrosion compounds and topcoats.

(b) An auto body repair shop that is performing structural repairs shall have all repair, measuring, and testing equipment and current reference manuals necessary to diagnose, section, replace or repair structural damage, including but not limited to:

(1) A three dimensional measuring system that can locate points with the dimensions of length, width, and height, relative to three defined reference planes.

(2) A four-point anchoring system capable of holding a vehicle in a stationary position during structural and body pulls which is suitable for the types of vehicles being repaired.

(3) Equipment capable of making multiple body and structural pulls.

(4) A Metal Inert Gas (MIG) welder with an output of at least 110 amps for unibody repairs and an output of 200 amps for conventional frame repairs or capable of meeting trade standards for the work being performed.

(5) Corrosion protection equipment for treating enclosed areas on unibodies and frame assemblies including pressurized spray equipment, flexible and rigid wands capable of reaching full length inside enclosed areas, spray heads capable of 360 degree spray application and spray heads capable of a fan-shaped pattern.

Here’s what else you’d need, apparently drawn from the CIC document:

2. Have proof of garage keeper’s liability and workers’ compensation insurance or equivalent;

3. Have electrical or hydraulic equipment capable of making simultaneous multiple body or structural pulls;

4. Have a spray booth that meets current federal, state and local requirements;

5. Have the ability to complete and verify four-wheel alignment through computer printout either from an in-house alignment system with at least one technician that is certified or qualified or utilize a qualified sublet provider;

6. Have the ability to remove and reinstall frame, suspension, engine and drive train components or use a qualified sublet provider;

7. Have the ability to evacuate, reclaim and recharge vehicles’ air conditioning systems using EPA compliant in-house equipment and certified technicians or use a qualified sublet provider; and

8. Subscribe to a provider of structural specifications with periodic updates covering the vehicle structure for the make, model, and year of the vehicle(s) being repaired and wheel alignment specifications for the make, model, and year of the vehicle(s) being repaired.

The 2005 CIC standards — and the state didn’t even include all of them — are a decade out of date. The CIC last updated its recommendations in 2013, and CIC Chairman Randy Stabler, a Californian, has called even those “woefully outdated.”

Here’s what’s being discussed today — and some in the industry have argued these are too lenient or the CIC should get out of the minimum requirements business altogether precisely because regulators and other parties might use them in unintended ways. (Take the CIC’s survey and share your thoughts ahead of the April conference.)

Not only does the DOI rely on an absurdly old document (Don’t these guys have Google?), its criteria has a few other issues.

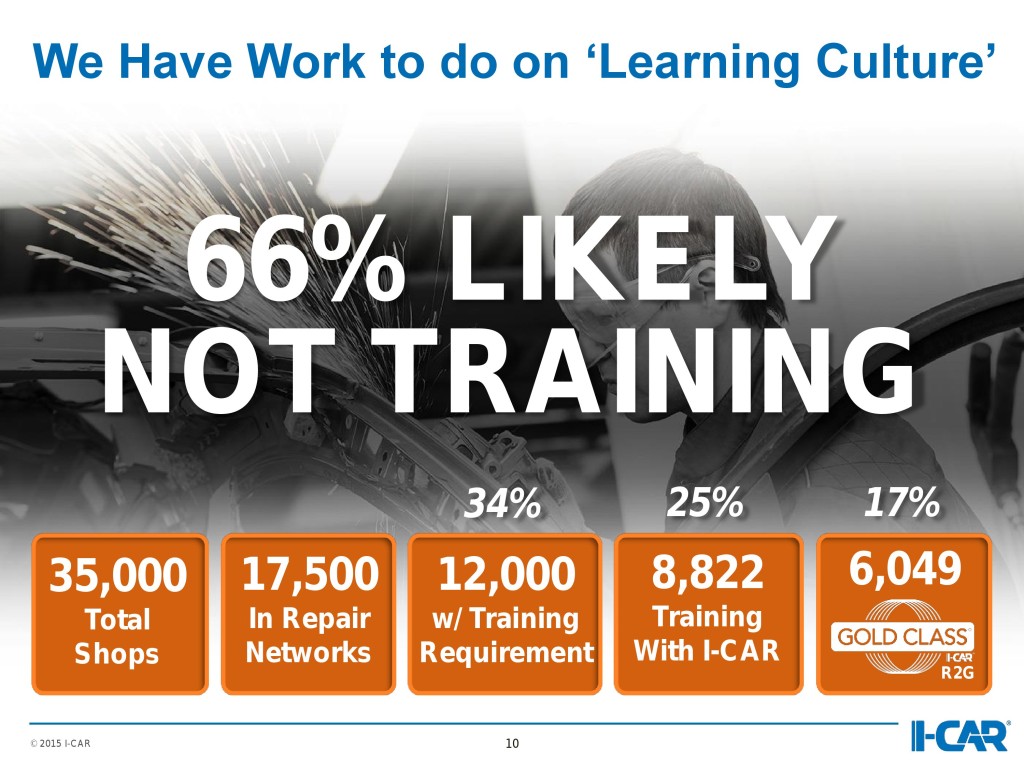

- There’s no training requirements or certification included in here at all. For example, you can have a MIG welder to make the BAR happy, but not know how to use it. Based on I-CAR data, most collision repairers nationally aren’t certified in even basic welding — not to mention aluminum.

- A shop can charge aluminum rates, but not even have the gear or training to properly fix aluminum without corrosion issues.

- There’s also little attention paid to the evolving procedures — less straightening, more adhesives, rivets, etc. — needed in even mainstream vehicles.

- And you don’t need to know how to scan or calibrate anything.

There’s a lot to like in what California’s planning — the California Autobody Association supports the regulations and has urged members to watch out for a possible legislative end-run — but its assumption that all of those 4,000 cited repairers are qualified to perform all six categories of rate-worthy work seems flawed.

At the very least, the shop should be given a “not applicable” option for some of these rates or tighten the OEM data requirement to indicate the repairer will follow the OEM specifications or outsource the work if it can’t — not just subscribe to them.

Be heard: The DOI will take comments on the idea through April 21 and hold a public hearing that day — which is ironically Day 2 of the Collision Industry Conference which will vote on the proposed Class A document.

Submit comments — email is preferred, the DOI said — by 5 p.m. April 21 to Kara.Potts@insurance.ca.gov or Edward.Wu@insurance.ca.gov. You can also fax 415-904-5490, or contact:

- Kara Boonsirisermsook Potts, California Department of Insurance, 45 Fremont Street, 21st Floor, San Francisco, CA 94105. Phone: 415-538-4174.

- Edward Wu, California Department of Insurance, 300 South Spring Street, South Tower, Los Angeles, CA 90013. Phone: 213-346-6635.

The public hearing will be held April 21 from 10 a.m. to no later than 2 p.m., at the first floor auditorium of the Employment Development Department, 722 Capitol Mall in Sacramento, Calif.

Correction: An earlier version mischaracterized one prevailing rate calculation as the median of six surveyed shops. It’s actually the “rate at or below which a simple majority of surveyed shops charge,” which is close but not necessarily the arithmetic median. The story has since been corrected.

Here’s how the California DOI describes it: “Assuming there are six (6) repair shops in a specific geographic area, with surveyed labor rates of $62, $64, $64, $67, $68, and $70. The arithmetic mean or average labor rate of the six repair shops is $65.83 ($62 + $64 + $64 + $67 + $68 +$70 / 6). The rate at or below which a simple majority of surveyed shops charge is $67, since four of the six shops (the simple majority) charge a rate of $67 or less. Since $67 is greater than $65.83, the prevailing rate would be $67.”

More information:

Auto body labor rate surveys: Initial statement of reasons

California Department of Insurance, March 4, 2016

Auto body labor rate surveys: Text of regulation

California Department of Insurance, March 4, 2016

Auto body labor rate surveys: Notice of proposed regulatory action

California Department of Insurance, March 4, 2016

Images:

A Maserati GranTurismo MC sits near Mercedes and Infiniti displays on Nov. 19, 2015, at the Los Angeles Auto Show. (br-photo/iStock Editorial/Thinkstock file)

An unspecified Jaguar XK aluminum body is shown. (Jaguar Land Rover via International Aluminum Institute)

The Collision Industry Conference Class A definition panel is shown Tuesday, Nov. 3, 2015, at SEMA. (John Huetter/Repairer Driven News)

Part of the proposed California labor rate survey text is shown. (Provided by California Department of Insurance)

This bold slide from I-CAR CEO John Van Alstyne was presented at the Collision Industry Conference in Atlanta on April 8, 2015. (Provided by I-CAR)