TU-Automotive poll finds predictions of connected car claims

By onBusiness Practices | Education | Insurance | Market Trends | Technology

A poll of 150 auto insurance and connected car professionals released in July ahead of TU-Automotive’s Wednesday Connected Car Insurance USA conference found predictions of the kind of telematics-based claims that could disrupt the collision repair industry.

Connected claims would use data from the car itself (for example, a sharp change in speed and direction of travel, or perhaps something more basic like the triggering of an airbag) to realize the vehicle had been in an accident and perform a estimate of severity.

According to CCC, which has developed such a product, it’s possible to obtain decent collision information with a smartphone (which has an accelerometer and gyroscope), but the quality of the data grows even better with an OBD-II plugin and better still with internal information actively disseminated by the car’s AI. Given cellular data and Wi-Fi availability, all three of these sources could easily transmit the data to parties like insurers instantaneously.

This will affect collision repairers in a variety of ways as the technology develops. For example, a shop might see fewer total losses, as predictive analytics and vehicle sensor data advise an insurer to send the vehicle straight to salvage. Or the car itself might send a customer’s preferred shop a list of parts likely needing to be replaced.

But the biggest near-term question remains who receives word of the crash at the moment of impact — and which collision repair facilities they’ll be promoting to the customer. Will it be DRP shops? OEM certified locations? Third-party shops verified through some other criteria?

Collision repairers will need to consider all of these connected car issues over the next couple of decades — and best sooner, rather than later. Those daunted by the prospect can take some comfort that other industries like insurers and automakers are also trying to wrap their brains around this technology.

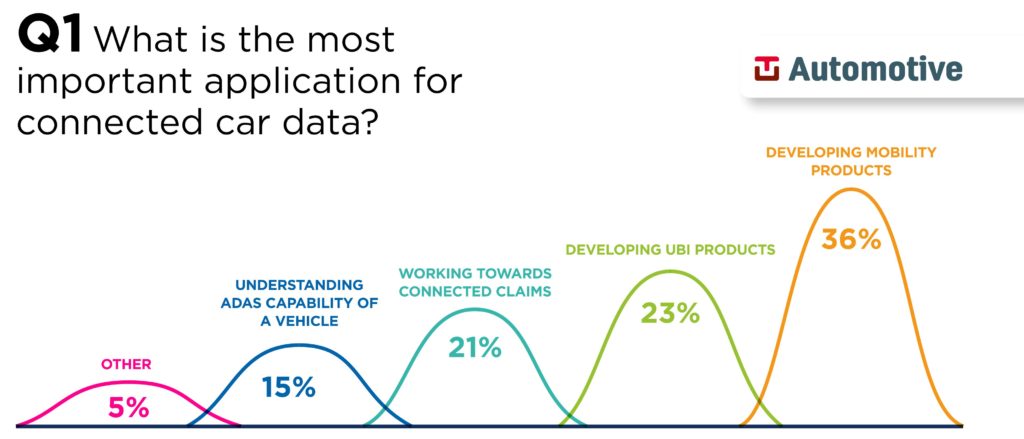

Most important application?

Asked by TU-Automotive what the most important application for connected car data would be, 21 percent of the 150 respondents picked claims. However, a combined 59 percent felt developing mobility and usage-based insurance products would be even more important.

“If you think of our core business that we have, it’s really just a bunch of driving data and we can give you the best score that is possible, the best predictor of risk, and not only does an insurer want that, but the ride share, car sharing companies want that too,” said Gary Hallgren, president of Allstate telematics spinoff Arity, whom TU-Automotive asked to comment on the responses. “I personally want to know that my Lyft driver got four stars because he’s a great driver, and not because his car didn’t smell and he usually gives people a mint. I think that as we start thinking about how to apply these technologies for those technologists in the audience that are working with insurers, I think there’s a lot of applicability to mobility. I think that there’s a lot of-, for the insurers to just embrace it, and don’t put your head in the sand and think ‘I’m going to ride out this wave and it’s going to change.’ As a community, embrace it, and let’s bring about the efficiency and systems that really can help these households save that money.”

Understanding the advanced driver assistance systems capability ranked fourth, at 15 percent. That might have been a reference to how much of a reduction in frequency and severity — and subsequently, premiums — insurers can expect.

Asked to comment by TU-Automotive about the responses, Plug and Play Tech Center ventures principal and insurtech director Ali Safavi agreed “100%.”

“I mean, exciting trend right now for me in mobility is, in general, vehicle to X, or V to X kind of applications in terms of cars being able to share their information with objects on the side of roads, with other cars on the road,” he continued.

Biggest change?

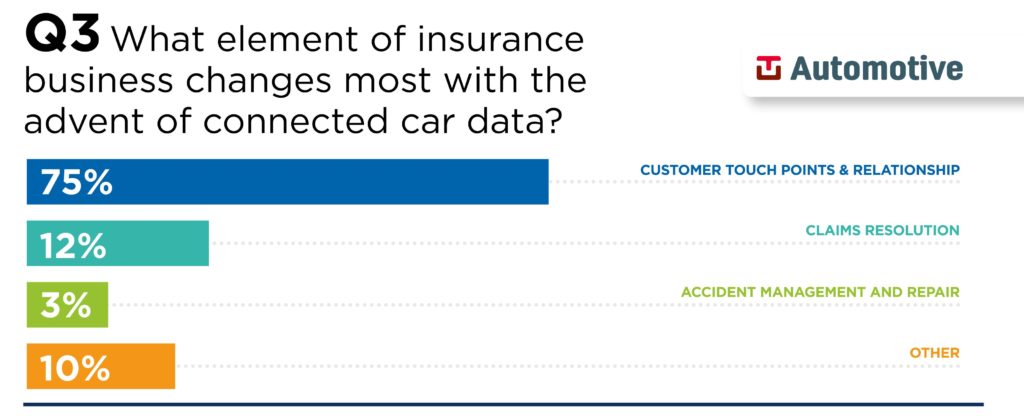

Asked what part of insurance changes the most with connected cars, 12 percent said claims resolution — and 3 percent said accident management and repair.

“It’s interesting that the accidents side, and the claims side, looks so low,” Hallgren told TU-Automotive. “I do think there are opportunities there, especially with continuously connected type solutions, that there’s going to be some amazing innovations that are going to come out of that. When you look at the overall expense structure of insurance companies, there’s some really big opportunities inside of that bucket, so I wouldn’t be surprised if we look back at this in a year or two that these results might change a little bit.”

10 percent said other, and 75 percent said customer relationship.

“I think that, as far as the data that comes in, what happens with the customer is equally important on-, it will change how they buy insurance, potentially,” Mariel Devesa, Farmers head of innovation, told TU-Automotive. “On accessing, having it be less steps that one needs to take, using data that’s available, being smarter, simplifying the process. So, I think that definitely the personalisation side of it, and simplifying, can be very impactful moving forward.”

Connected Car Insurance USA 2017 runs Wednesday and Thursday at the Chicago Magnificent Mile Marriott. Register here. For information on the 2018 event, email Andy Pym at andy@tu-auto.com.

More information:

“Exclusive Poll Results: Carriers Cast Their Vote On The Connected Car”

TU-Automotive, July 2017

Connected Car Insurance USA website

Images:

Connected cars could send collision data to OEMs, insurers, or even auto body shops. (a-image/iStock)

A poll of 150 auto insurance and connected car professionals released in July ahead of TU-Automotive’s Wednesday Connected Car Insurance USA conference found predictions of the kind of telematics-based claims that could disrupt the collision repair industry. (Provided by TU-Automotive)