Pega: Independent repairers part of ‘moments that matter’ for OEM brand

By onBusiness Practices | Education | Market Trends | Repair Operations

OEMs have in recent years reported that a crucial reason for developing certified auto body networks was the realization that a poor repair in the aftermarket can jeopardize their brand, a sentiment Customer Relationship Management provider Pegasystems supported in an interview and research released this month.

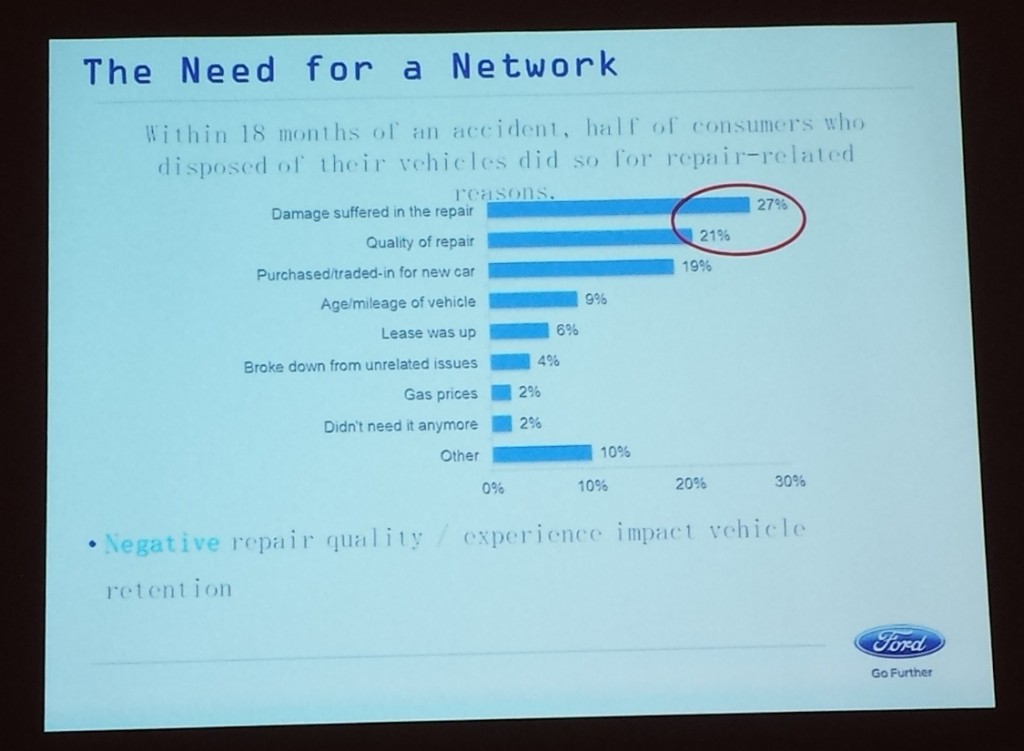

In 2015, then-Ford collision marketing manager Mark Mandl and FCA collision marketing manager Erica Schaefer cited data then holding that a bad repair at a body shop could cost an auto brand a customer’s loyalty.

“We have to take care of our customers,” Schaefer said then, citing FCA research that half of customers dropping a brand did so because of a bad repair.

FCA has found that 60 percent of customers which received an incomplete or inadequate repair sold or traded that car within a year, Sean Carey of SCG Management Consultants said in 2016. The OEM found 63 percent of those dissatisfied customers switch brands, he said.

Every percentage point of the overall auto market an automaker controls is worth $5 billion, Carey said then, and OEMs have realized that a bad repair or a total loss costs them some of that share — while they’re releasing vehicles that are growing harder to repair. Compared to that, any new OEM parts revenue generated by the network was insignificant, a mere $140 million market per point of retention, Carey said then.

Pegasystems’ research and “Pega” industry market leader-manufacturing Vice President Steven Silver this month demonstrated this brand blowback theory. Their information reinforces the need for dealerships and independent collision repairers to deliver proper repairs and an easy customer experience.

Pega reported Dec. 10 that a survey of more than 1,000 consumers found dealerships have a highly significant impact on the automaker brand — one more important than the cost or performance of the car itself.

“When it comes to loyalty, 54 percent of those surveyed are loyal based on a past experience with an auto brand, and 47 percent are loyal because of a positive experience with a dealership,” Pega wrote in a news release. “Only 28 percent answered they are loyal because of price or vehicle performance, revealing just how much rides on the combined experience the manufacturer and dealership provide. A strong product combined with a quality in-person dealership experience are almost equally responsible for a customer coming back.”

Silver, whose purview includes automotive, on Dec. 18 said independent collision repairers also affect consumer loyalty to the OEM. While not as close as the dealership to the OEM bullseye in a metaphorical target of brand influencers, independent repairers aren’t “eight rings out” either, Silver said.

“Those are moments that matter,” he said.

Silver said consumers “notoriously and historically” do not appreciate the “fine distinctions” between OEMs, dealers and the extended ecosystem supporting an automotive brand. A bad experience at the dealership is viewed as a bad experience with the automotive brand, he said.

He said that when an independent repairer proclaims a particular car difficult to fix or declares “‘Hey, it’s not my fault'” that a part is troublesome or not warrantied or that a technician has little experience, it “gets lost in the wash.” The customer blames the OEM.

This blowback on the OEM brand might occur even if the facility doesn’t badmouth the automaker to the customer, according to Silver.

OEMs driving consumers to a branded dealership using genuine branded parts with certified technicians can aid their brand, Silver said. The customer also sees the showroom and gets exposed to the brand and dealership “in a positive light” during the visit.

But the aftermarket matters too. Silver said marketing theory views interactions with brands as a “series as journeys,” which some refer to as “‘moments that matter.'”

Theoretically, every time you ride in your branded vehicle is a moment that matters, but it’s not as significant as other moments, such as a “servicing event,” according to Silver.

“Those moments matter a lot,” he said.

Silver said customers have an emotional and rationale response. A repair that takes too long or has difficulty fixing a vehicle is “associated with the vehicle” and therefore the OEM brand, he said. Such moments add up.

While those in the industry might classify and draw distinctions between an OEM and different tiers related to it, consumers don’t think that way, according to Silver.

He said he felt that if he were to break an iPhone’s glass and take it to a kiosk to the mall, it would be part of what he described as the “Apple experience.” He speculated that fi the part was expensive to repair or done with low-quality glass, he would “certainly” blame the kiosk repairer. However, he felt “still a part of me” would blame Apple: “‘It shouldn’t be so easy to break this glass.'”

Silver likened it to football. The automaker was like a quarterback or coach, taking the bulk of the credit or blame for whatever happens, he said. Customer brand sensitivity was “heightened” during a repair, and so the aftermarket’s actions would be associated with the brand, according to Silver.

Silver said Pega has historically been critical of the lack of “very fine instruments” used to measure moments that matter. It felt the larger dealer and repairer groups should use such science to design experiences for customers.

An OEM or captive OEM lender had the deep pockets, advertising partners and expertise to create services that smart dealers lacking those resources could consume, he said. But medium- to large-size companies in the ecosystem can use that tactic as well, he said.

“It’s not a science experiment anymore,” Silver said. “… It’s done all the time.” He cited fields like politics, consumer products, retail and banking as examples.

“You don’t get a Mulligan in this game,” he said. If, say, a roadside event isn’t handled in a way that matters and is personalized to the individual, reflecting knowledge you should have had about them specifically or about their consumer type, the customer will say “‘Shame on you,'” according to Silver.

That “shame” rolls up to everyone, including the OEM,” he said.

Pega’s research also found 54 percent of customers agreeing or strongly agreeing that there would be value in vehicle data enhancing their time inside their cars. But 45 percent were concerned about how their data would be used, and Pega said dealerships, OEM captive finance companies and automakers “must use this data in the right way.”

In this vein, Pega wrote that “a key element consumers look for in aftermarket experiences is transparency – whether it’s transparency from a dealer on what a warranty covers or how to purchase one, or transparency about how their data is used for better in-vehicle experiences.”

“When it comes to aftermarket owner and user experiences, there is an urgency for auto manufacturers, their captive finance divisions, and dealer partners to intelligently orchestrate the fragmented channels, processes, decisions, and data necessary to cultivate more loyal customers – whether it’s helping consumers with extended warranty purchases or providing more seamlessly-connected ownership and user experiences,” Silver said in a statement Dec. 10. “By understanding buyers’ experiences on a deeper level, the industry can provide more personalized recommendations and effortless interactions that protect customers’ automotive purchases long-term, as well as better experiences every time consumers use their vehicles and dealers service them.”

More information:

Pegasystems, Dec. 10, 2018

Images:

Ford data in this NACE 2015 slide shows that a bad repair at a body shop could cost an auto brand a customer’s loyalty. (Ford slide; photo by John Huetter/Repairer Driven News)

A Pegasystems marketing expert said independent aftermarket repairers’ work can blow back on the OEM brand. (kzenon/iStock)

Work done in the aftermarket can still reflect upon the OEM brand, even at a non-dealership. (kali9/iStock)