Allstate to increase Virtual Assist usage during COVID-19 issue; APCIA asks DOIs for flexibility

By onAnnouncements | Business Practices | Insurance | Legal | Market Trends

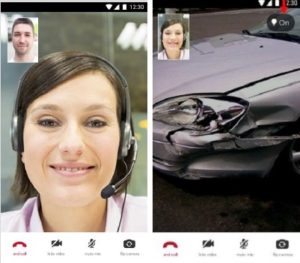

Allstate on Wednesday said it would use Virtual Assist more frequently for initial estimates to minimize the threat of the COVID-19 coronavirus.

“With the world’s attention on COVID-19, our focus is on the health and safety of our customers and partners,” Justin Herndon, a spokesman for the nation’s No. 4 insurer, wrote in an email.

“We are taking precautions to prevent the spread of COVID-19 and following guidance and recommendations from municipal public health officials and the Centers for Disease Control and Prevention (CDC).

“Out of an abundance of caution, we will increase the use of Virtual Assist for initial estimates. If shops have an Allstate or Encompass customer or claimant’s vehicle in their shop, we are asking them to contact us through the app for the initial estimate and continue to use the app for supplements. You can visit our website for more information on how to download the app.

“In situations where it’s not possible to handle a scheduled inspection virtually, we will work with shops to follow the CDC’s safety guidelines and recommendations.”

Allstate was the only one of the Top 4 insurers to respond to our inquiries on what coronavirus-related claims changes repairers and customers could expect, so kudos to them. No. 5 USAA on Monday said it would be in touch, but ultimately said Friday it couldn’t make our deadline.

Here’s some details we could glean from the other four carriers’ comments elsewhere.

No. 1 State Farm did issue a press release Wednesday noting “State Farm Claims is working on safety protocols specifically for those who are meeting face-to-face with customers.”

It also said hold times might be longer for customers, “while our team works to serve them in multiple ways.”

No. 2 GEICO said on its website that call wait times might be longer than usual.

“To protect your health and safety, as well as ours, we’ll be limiting in-person claims interactions as much as possible,” No. 3 Progressive’s website stated Friday. It also told customers call hold times might be longer.

No. 5 USAA said “our claims department is experiencing longer than normal wait times.” It was the only one of the four to specifically tie longer hold times to claims.

The other carriers also suggested customers use their app, but didn’t describe a specific change like Allstate did.

Flexibility offered, sought by APCIA

“During this unprecedented era, we remain focused on our promise to our customers — paying claims for motorists, injured workers, homeowners, renters, and businessowners,” American Property Casualty Insurance Association CEO David Sampson said in a statement Friday. “Many insurers are implementing contingency and continuity plans for pandemics to protect their employees and reduce interrupted service to consumers. Some insurers also are implementing new flexible payment solutions for policyholders, ensuring their homes, businesses, and properties remain protected during times of financial stress.”

The National Association of Insurance Commissioners hasn’t yet responded to a Friday inquiry on if insurance commissioners were altering or suspending any laws or regulations over the coronavirus.

However, the APCIA on Friday did ask the nation’s departments of insurance for greater flexibility.

“We recognize that all of us — regulators, carriers, and the trades — are going through tremendous change as we revamp our operations, transition to remote working arrangements, and implement contingency and continuity plans to protect our employees from potential pandemic exposure,” Sampson told a special NAIC COVID-19 session, according to remarks shared by his organization.

“… Undoubtedly, all of our systems are experiencing many stress points. As a result, on behalf of our customers, we are committed to working closely with the NAIC and state regulators to ensure a smooth, successful and coordinated response to the current COVID-19 environment.

“With these unprecedented conditions, there are several important issues that warrant immediate consideration by the NAIC and state regulators.”

Among them: “It will be increasingly important that insurers are allowed to deploy new technologies such as drones, mobile applications, and telemedicine for workers’ compensation claims without running afoul of regulatory barriers,” Sampson said in the remarks shared by APCIA.

He also asked for some slack on deadlines related to claims.

“We are urging states to be flexible in administering and enforcing statutory time restrictions related to claims handling, notification obligations, third-party administrator audits, and regulatory filings, for example,” Sampson said, according to the APCIA copy of his remarks.

Sampson also asked the NAIC to relax first-class mail rules and let all communications to customers and state insurance departments be electronic.

“Finally, and most importantly, it is vitally important to discourage efforts to impose retroactive coverage on insurance policies,” he said, according to the remarks shared by APCIA. “If policymakers force insurers to cover losses that do not exist under current insurance contracts, the stability of the sector could be impacted.”

According to Sampson, event cancellation and business interruption policies often don’t cover diseases.

“Insurers recognize that American businesses are facing unprecedented disruption,” he said in the other Friday statement. “Many standard event cancellation, business interruption, and travel insurance policies do not include coverage for communicable diseases such as COVID-19. Although, some businesses have purchased broader protections through specialized coverage.”

He said the APCIA supported helping small businesses with the “federal assistance programs that the Administration and Congress are proposing to deliver aid directly to vulnerable business communities.”

More information:

“APCIA Special Report to NAIC: Insurers Committed to Serving Consumers During COVID-19”

American Property Casualty Insurance Association, March 20, 2020

“Insurers Focused on Solutions, Assisting Consumers Impacted by COVID-19”

APCIA, March 20, 2020

Images:

Allstate has launched Virtual Assist, an Android and iPhone app which allows a collision repairer to video-chat with a remote Allstate adjuster. (Provided by Allstate; flashlight emphasis added by Allstate)